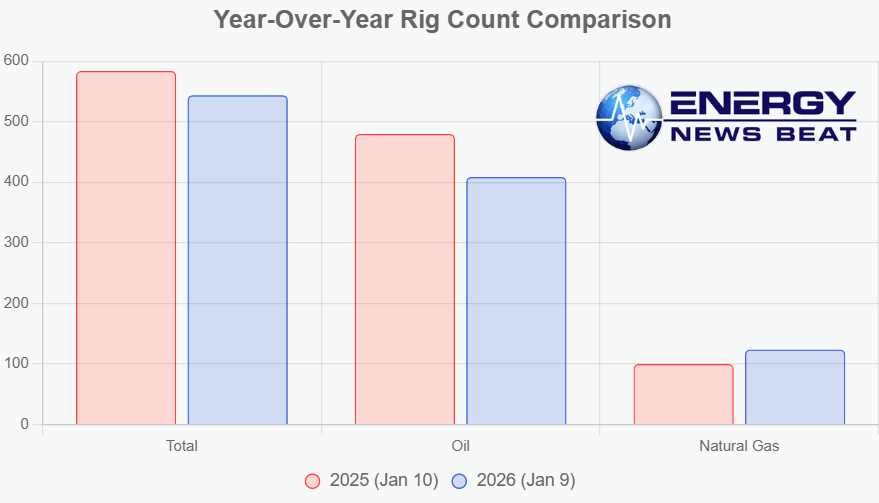

As we kick off 2026, the U.S. oil and gas industry is signaling caution, with the latest rig count data showing a slight decline to start the year. According to the weekly report from Baker Hughes released on January 9, 2026, the total number of active drilling rigs in the United States fell by 2 from the previous week, landing at 544.

This marks the first drop in three weeks and sets a subdued tone for energy exploration activities amid fluctuating commodity prices and economic uncertainties.

Year-Over-Year Comparison: A Notable DeclineComparing the current figures to the same period in 2025 reveals a more pronounced downturn. The total rig count is down by 40 rigs, or approximately 7%, from 584 a year ago.

This decline reflects broader industry trends, including efficiency gains in drilling operations that allow producers to maintain output with fewer rigs, as well as ongoing volatility in global energy markets.

Breaking it down further:

Oil Rigs: Down significantly year-over-year, with a drop of 71 rigs to 409.

This represents a roughly 15% reduction, highlighting reduced activity in oil-focused plays amid concerns over demand and inventory levels.

Natural Gas Rigs: Bucking the trend, gas rigs are up by 24 from last year, now totaling 124.

This increase suggests growing interest in natural gas development, possibly driven by export demands and cleaner energy transitions.

Miscellaneous Rigs: These stood at 11, up 2 from the prior week, but their small share means they have minimal impact on overall trends.

These shifts underscore a pivot within the industry, where natural gas exploration is gaining ground while oil activity contracts.

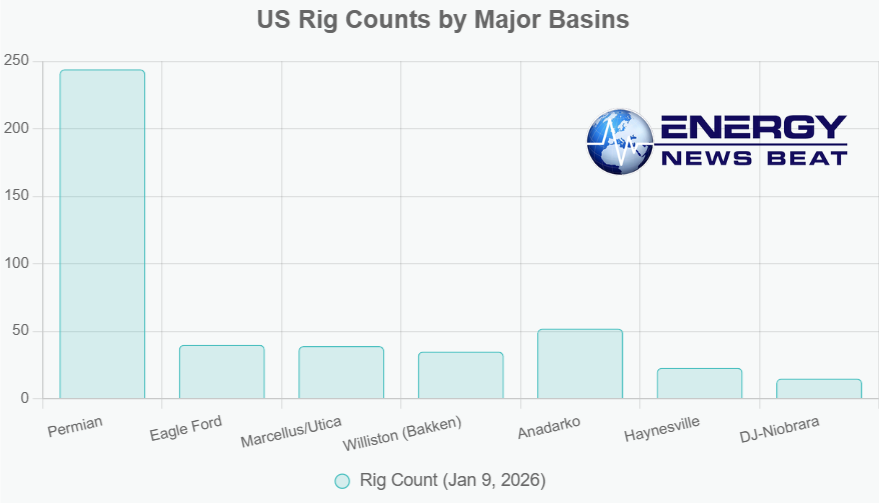

Rig Counts by Major Basins: Permian Leads the Pack but Sees Pullback

The Permian Basin, the powerhouse of U.S. oil production spanning West Texas and New Mexico, continues to dominate but started 2026 on a softer note. The rig count there dropped by 3 from the previous week to 244, and it’s down a substantial 60 rigs year-over-year.

Despite the decline, the Permian accounts for nearly half of all U.S. rigs, emphasizing its critical role in national output.

Other key basins show mixed results based on recent data:

Eagle Ford (South Texas): Held steady at 40 rigs week-over-week but is down 3 from last year.

This shale play has seen relatively stable activity, focused on both oil and gas.

Marcellus/Utica (Appalachia region): Remained flat at 39 rigs in recent weeks, indicating steady but unremarkable operations in this gas-heavy area.

Bakken/Williston (North Dakota/Montana): Recent estimates place activity around 35 rigs, with no major changes reported, though exact Baker Hughes figures for January 9 show stability in oil-focused drilling.

Haynesville (Louisiana/Texas): Activity appears unchanged in the low double-digits, focused on natural gas, aligning with the overall gas rig uptick.

Anadarko (Oklahoma/Kansas): Around 52 rigs based on parallel industry trackers, with minimal fluctuations.

DJ-Niobrara (Colorado/Wyoming): Stable at approximately 15 rigs, reflecting cautious investment in this mixed-play basin.

enverus.com

These basin-level insights highlight how regional dynamics—such as infrastructure access, commodity prices, and regulatory environments—are influencing drilling decisions.

|

Basin

|

Current Rig Count (Jan 9, 2026)

|

Weekly Change

|

Year-Over-Year Change

|

|---|---|---|---|

|

Permian

|

244

|

-3

|

-60

|

|

Eagle Ford

|

40

|

0

|

-3

|

|

Marcellus/Utica

|

39

|

0

|

N/A

|

|

Williston (Bakken)

|

~35

|

0

|

N/A

|

|

Anadarko

|

~52

|

0

|

N/A

|

|

Haynesville

|

~20-25 (est.)

|

0

|

N/A

|

|

DJ-Niobrara

|

~15

|

0

|

N/A

|

(Note: Estimates for some basins are derived from complementary industry sources like Enverus, as they align closely with Baker Hughes trends.)

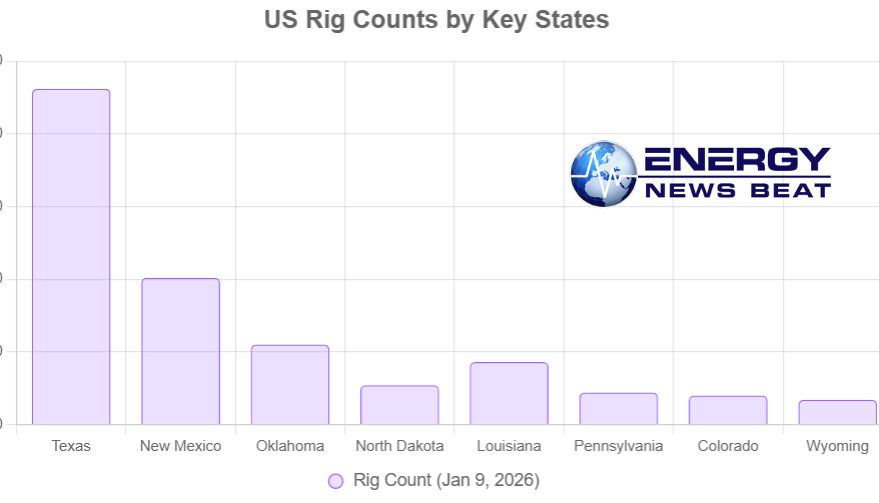

Rig Counts by State: Key Producers Feel the PinchDrilling activity varies widely by state, with Texas and New Mexico leading due to their overlap with the Permian Basin. Recent reports indicate:Texas: Approximately 231 rigs (based on late December data, with a -1 weekly change noted recently), down from higher levels last year.

As the top state, it hosts the bulk of Permian and Eagle Ford activity.

New Mexico: Steady at 101 rigs, a significant portion of Permian operations.

Oklahoma: Stable, with around 50-60 rigs primarily in the Anadarko Basin.

North Dakota: Unchanged at 27 rigs, centered on the Bakken formation.

Louisiana: Holding at 43 rigs, with focus on Haynesville gas plays.

Pennsylvania: Part of the Marcellus/Utica, contributing to the 39-rig regional count, with state-level activity around 20-25.

Colorado: Stable but lower, estimated at 20 rigs in the DJ Basin.

Wyoming: Around 15-20 rigs, tied to Niobrara and other plays.

Smaller states like Alaska, California, and Utah contribute minimally, often in the single digits.

Outlook: What This Means for Energy Markets

The down note to start 2026 isn’t entirely unexpected, given the industry’s push toward capital discipline and higher productivity per rig. While oil rigs continue to slide, the uptick in gas rigs could support increased LNG exports and domestic supply stability. Investors and producers will be watching upcoming reports closely, as any sustained decline could impact future production forecasts.

For more details, check out the full Baker Hughes report.

Stay tuned to Energy News Beat for ongoing updates on rig trends and their implications for the energy sector.

Sources: Bakerhuges.com, oilprice.com, worldpopulationreview.com, enverus.com