In a rapidly evolving energy landscape, major oil companies are shedding weight to stay competitive amid fluctuating crude prices, mergers and acquisitions, and technological disruptions. As highlighted in a recent Wall Street Journal piece, giants like ExxonMobil are leading the charge with significant workforce reductions—Exxon alone is cutting 2,000 jobs globally, about 3% of its staff, building on a 19% headcount drop since 2014. This trend toward leanness isn’t just about survival; it’s increasingly driven by artificial intelligence (AI), which is automating processes and reshaping how the industry operates. But what does this mean for jobs, investors, and everyday consumers? Let’s dive into the latest announcements from the top oil players and explore the broader implications.

Layoffs and Cost-Cutting in the Top 10 Oil Companies

Based on 2025 market capitalization rankings from sources like CompaniesMarketCap and Straits Research, the world’s largest oil and gas firms include Saudi Aramco, ExxonMobil, Chevron, Shell, PetroChina, TotalEnergies, ConocoPhillips, BP, Eni, and Petrobras. Over the last 60 days (August to September 2025), several of these companies have announced aggressive cost-saving measures, often tied to weaker oil prices hovering around $70-80 per barrel and a wave of industry consolidation.

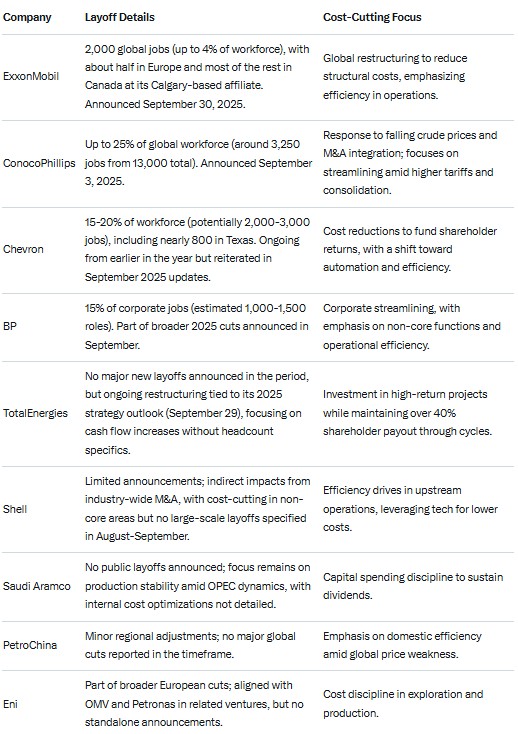

Here’s a snapshot of key announcements:

These moves align with a Reuters report from September 30, 2025, noting that global energy majors plan deeper job cuts in 2025 after thousands were slashed last year. U.S.-focused reductions, like those from ConocoPhillips and Chevron, threaten output growth, with capital expenditures already trimmed by $2 billion across top producers.

Office vs. Field Jobs: Is AI the Culprit?

A key question is where these cuts are landing—corporate offices or the rugged oil fields? Data from announcements points to a heavier toll on white-collar roles. For instance, BP’s cuts target “corporate jobs,” while Exxon’s restructuring emphasizes office-based functions in Canada and Europe. ConocoPhillips and Chevron’s plans also lean toward administrative and support roles, with field operations (drilling, extraction) seeing fewer direct hits.

This skew suggests AI is playing a starring role. According to a BCG report from August 2025, AI adoption in oil and gas could boost profits by 30-70% through smarter drilling, real-time monitoring, and predictive maintenance—tasks traditionally handled by office-based analysts and engineers. Forbes highlighted in July 2025 how AI reduces costs by automating data analysis and optimization, potentially replacing “corporate nerds” as one Reddit thread from May 2025 bluntly put it, while field engineers remain essential for hands-on work.

World Economic Forum’s Future of Jobs Report 2025 echoes this, predicting AI will drive both job growth (in tech integration) and declines (in routine analytics). In the oil patch, this means office jobs in planning, forecasting, and logistics are more vulnerable, allowing companies to produce more with fewer people. Direct jobs per barrel in Canada fell 43% from 2013 to 2023, per Pembina Institute analysis, underscoring this efficiency shift.

Why This Could Be Good News for Investors and Consumers

For investors, these leaner operations spell higher returns—if CEOs stick to their pledges. Exxon, Chevron, and TotalEnergies have reiterated commitments to robust shareholder payouts. Chevron, for example, returned $27 billion to shareholders in 2024 and is using 2025 cuts to sustain that. TotalEnergies’ September 29 strategy update promised over 40% payouts through market cycles, while Imperial Oil (Exxon affiliate) emphasized “industry-leading shareholder returns” in its restructuring announcement.

Reuters noted on May 2, 2025, that Big Oil’s Q1 earnings showed a focus on production strategy and returns, even amid price slumps. If maintained, cost savings from AI and layoffs could fuel dividends and buybacks, potentially offsetting threats from prolonged low prices as flagged by CNBC in May 2025.

Consumers stand to benefit too. Lower operational costs could help stabilize or reduce energy prices, though global markets dictate much of that. AI-driven efficiency means faster, cheaper production—Reuters reported in March 2025 that AI is enabling quicker drilling and reevaluation of marginal fields. This could ease supply pressures, benefiting drivers at the pump and households with heating bills, especially if OPEC+ holds steady.

Looking Ahead: Commitment to Returns in a Volatile World

Big Oil’s pivot to leanness, accelerated by AI, marks a departure from boom-and-bust hiring cycles. As PwC’s 2025 AI Jobs Barometer suggests, AI-exposed industries like energy are seeing wages rise for remaining roles, but overall headcounts are shrinking. If CEOs like Exxon’s Darren Woods or Chevron’s Mike Wirth honor their high-return vows—amid M&A like Conoco’s ongoing integrations—the sector could emerge more resilient.

Smaller private oil field service companies are in a different boat, and they will have to cut to the bone and work miracles with less to survive.

Yet risks loom: prolonged weak prices or regulatory shifts could test these strategies. For now, though, the message is clear—Big Oil is betting on tech to thrive, potentially rewarding investors and keeping energy affordable while navigating a greener future.

Got A Tax Burden in 2025?

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack