In a move that could reshape the global energy landscape, Russian oil giant Lukoil has agreed to sell its vast international assets to Swiss-based commodity trader Gunvor Group, led by Swedish billionaire Torbjörn Törnqvist. The deal, valued at up to $20 billion, comes in direct response to fresh U.S. sanctions imposed by the Trump administration in October 2025, which have severely hampered Lukoil’s ability to operate abroad. If approved by U.S. and U.K. regulators, this transaction would allow Russia to liquidate these assets, converting them into much-needed hard currency while sidestepping the full brunt of Western restrictions.

Background on the Sanctions and the DealLukoil, Russia’s second-largest oil producer and responsible for about 2% of global crude output, announced on October 27, 2025, its intention to divest its foreign holdings due to the escalating sanctions.

These measures, enacted by the Trump administration last month alongside sanctions on state-owned Rosneft, aim to deprive Moscow of revenue streams funding its ongoing conflict in Ukraine.

The sanctions prohibit U.S. entities from dealing with Lukoil and restrict its access to international financial systems, making overseas operations untenable.Just days later, on October 30, Lukoil revealed it had accepted an offer from Gunvor, excluding its Dubai-based Litasco unit.

The assets span over 30 countries and include refineries in Europe (such as in Italy, Romania, and Bulgaria), oil fields in Iraq (notably the massive West Qurna 2 field), Central Asia, the Middle East, and even retail gas stations from the U.S. (Bronx) to Sicily.

African stakes are also part of the package, further broadening Gunvor’s footprint.

This sale marks the end of Lukoil’s three-decade global expansion, effectively retreating to domestic operations.

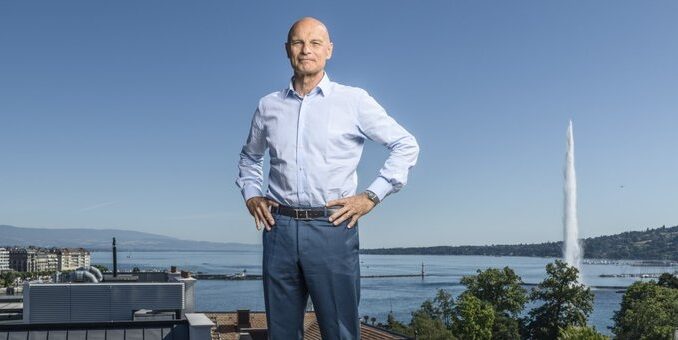

Gunvor, founded by Törnqvist and a former Putin associate, has grown into a trading powerhouse with $136 billion in annual revenues in 2024.

Törnqvist, a 71-year-old commodity veteran, described the acquisition as a “clean break” for Lukoil, emphasizing its strategic fit for Gunvor’s expansion into upstream production and refining.

Revenue Potential from Lukoil’s Foreign Assets

Lukoil’s international portfolio represents about 5% of its total oil production, equating to roughly 100,000 barrels per day based on the company’s overall output.

These assets have been a significant source of hard-currency earnings, with foreign retail and storage networks generating steady revenues. Analysts estimate that losing these operations could create a cash shortfall for Lukoil of up to $4 billion annually.

This figure underscores the value of the assets, which include high-margin downstream businesses like European refineries and global retail outlets.The deal’s total valuation could reach $20 billion, providing a substantial one-time influx if completed.

However, exact purchase terms remain undisclosed, with bankers seeking clarity on funding and assurances given to Lukoil.

Trump Administration’s Stance on Approval

The Trump administration, which imposed the sanctions, has not publicly detailed discussions on approving the sale. However, the transaction is proceeding under a U.S. Treasury Office of Foreign Assets Control (OFAC) wind-down license, which permits the orderly divestment of sanctioned assets to avoid abrupt disruptions.

This mechanism suggests implicit allowance for the deal, as it enables buyers to acquire assets without directly benefiting sanctioned entities long-term.While no explicit statements from Trump officials have emerged on this specific transaction, the administration’s broader policy emphasizes pressuring Russia economically while allowing controlled wind-downs to minimize global energy market volatility.

Approval from Washington and London is still required, and sources indicate the process is underway, with Gunvor confident in securing clearances.

How This Benefits Russia’s Revenues

For Russia, the sale represents a pragmatic escape hatch from sanctions’ grip. By divesting these assets, Lukoil can repatriate billions in proceeds, bolstering domestic revenues at a time when export earnings are under siege.

The sanctions have already made foreign operations “impossible,” freezing potential earnings and risking asset seizures.

Converting these into cash—potentially $20 billion—provides immediate liquidity to offset losses, fund operations, or even support the war effort indirectly.

Moreover, it prevents the total loss of value from immobilized assets, turning a liability into an asset. Russia avoids ongoing operational costs and compliance headaches, while the hard currency inflow helps stabilize the ruble and replenish state coffers, which rely heavily on oil exports (Lukoil and Rosneft account for two-thirds of Russia’s 4.4 million barrels daily).

Critics argue this circumvents sanctions’ intent, but proponents see it as a necessary market adjustment.

Implications for Global Energy Markets

If greenlit, the deal would hand Gunvor control over key infrastructure, potentially stabilizing supply chains disrupted by sanctions. For energy consumers, it could mean continued access to refined products from former Lukoil facilities. However, it highlights the ongoing geopolitical chess game, where sanctions force asset reshuffles but don’t fully halt Russian economic maneuvering.As the approval process unfolds, the energy sector watches closely. This transaction could set a precedent for other sanctioned entities, signaling that strategic sales remain a viable path amid escalating tensions.

Got Questions on investing in oil and gas? Or do you have a Tax Burden in 2025?

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack

Be the first to comment