In the evolving landscape of global energy, natural gas is experiencing a remarkable resurgence. Once overshadowed by oil and renewables, this versatile fuel is now at the forefront of meeting surging energy needs, particularly through an unexpected partnership with artificial intelligence (AI). As data centers powering AI technologies proliferate, they are driving unprecedented demand for reliable, scalable power sources—often fulfilled by natural gas-fired generation. This shift is not only boosting consumption but also reshaping drilling strategies among exploration companies, with rig counts reflecting a pivot toward gas amid fluctuating oil markets. Drawing on data from the U.S. Energy Information Administration (EIA), International Energy Agency (IEA), and other sources, this article explores the historical growth of natural gas demand, future forecasts, impacts on drilling plans, and key insights for investors.

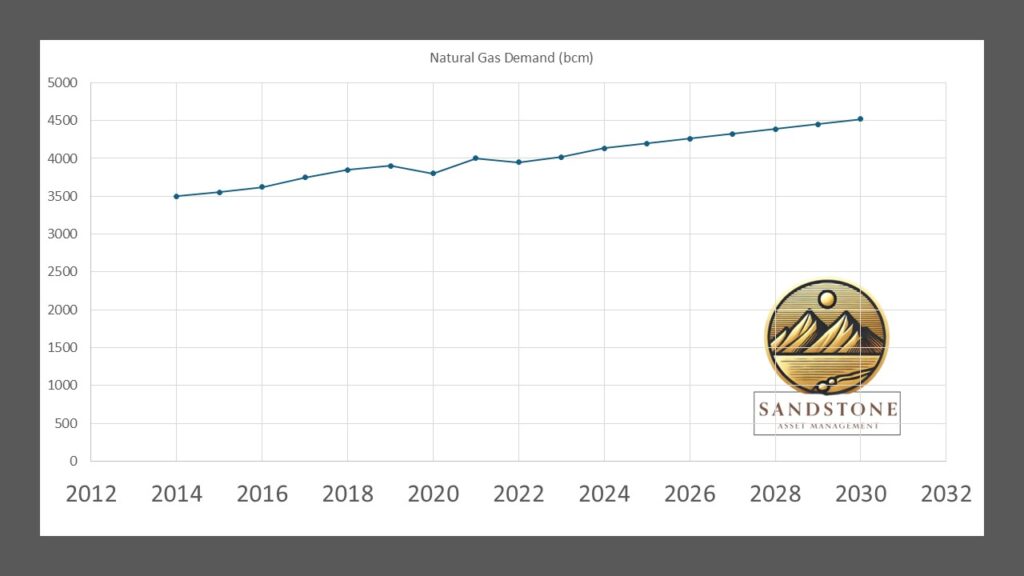

Historical Growth of Natural Gas Demand: A Decade of Steady ExpansionOver the past decade, global natural gas demand has shown consistent growth, driven by industrialization in emerging economies, the transition from coal in power generation, and increasing use in residential and commercial sectors. According to IEA data, world natural gas demand averaged around 2% annual growth between 2010 and 2019, accelerating to 2.7% in 2024 compared to 2023.

This equates to an increase of approximately 115 billion cubic meters (bcm) in 2024 alone.

To illustrate, here’s a table summarizing estimated global natural gas demand from 2014 to 2023, based on IEA and EIA historical trends (figures in bcm, approximated from aggregated reports as exact year-over-year data varies by source):

|

Year

|

Global Demand (bcm)

|

Annual Growth (%)

|

|---|---|---|

|

2014

|

3,500

|

–

|

|

2015

|

3,550

|

1.4

|

|

2016

|

3,620

|

2.0

|

|

2017

|

3,750

|

3.6

|

|

2018

|

3,850

|

2.7

|

|

2019

|

3,900

|

1.3

|

|

2020

|

3,800

|

-2.6 (COVID impact)

|

|

2021

|

4,000

|

5.3

|

|

2022

|

3,950

|

-1.3

|

|

2023

|

4,019

|

1.7

|

Sources indicate a rebound post-2020, with demand recovering from pandemic disruptions.

Forecasts: AI and Emerging Markets Fuel Future Demand

Looking ahead, projections paint an optimistic picture for natural gas. The IEA forecasts global demand (excluding bunkers) to grow at an average annual rate of nearly 1.5% between 2024 and 2030, reaching new highs amid expanding liquefied natural gas (LNG) trade and power sector needs.

BP’s Energy Outlook echoes this, highlighting strong growth in emerging Asian economies as they industrialize, offset by slower gains in mature markets.

A key driver is the AI boom. Data centers, essential for AI training and operations, are projected to add significant electricity demand—potentially 120 gigawatts (GW) by 2030 in the U.S. alone, according to Grid Strategies.

Goldman Sachs estimates this could translate to 3.3 billion cubic feet per day (bcf/d) of new natural gas demand by 2030.

Globally, IEA predicts electricity demand from data centers could more than double to 945 terawatt-hours (TWh) by 2030, with natural gas playing a pivotal role in providing baseload power alongside renewables.

Here’s a forecasted table for global natural gas demand from 2024 to 2030 (in bcm, based on IEA base case and BP scenarios):

|

Year

|

Projected Demand (bcm)

|

Key Drivers

|

|---|---|---|

|

2024

|

4,134

|

Post-2023 rebound, Asia growth

|

|

2025

|

4,196

|

AI data centers, LNG exports

|

|

2026

|

4,259

|

Industrial expansion

|

|

2027

|

4,323

|

Power sector shift from coal

|

|

2028

|

4,388

|

Emerging market demand

|

|

2029

|

4,453

|

Global energy transition

|

|

2030

|

4,519

|

Cumulative 1.5% annual growth

|

These figures assume moderate scenarios; more aggressive AI adoption could push demand higher.

Shifting Drilling Plans: From Oil to Gas Exploration

The surge in natural gas demand is influencing exploration and production (E&P) strategies. Many companies traditionally focused on oil are pivoting toward gas-rich plays to capitalize on higher prices and demand stability. For instance, EOG Resources, a leading U.S. driller, is expanding into gas-prone regions like the UAE and Bahrain while maintaining top-tier drilling activity in the U.S.

Chevron is ramping up exploration in gas-heavy areas such as Suriname, Brazil, and Angola.

ExxonMobil continues investing in both oil and gas to offset natural declines in existing fields, emphasizing the need for sustained capital in gas assets.

Globally, rig counts underscore this trend. Baker Hughes data shows U.S. natural gas rigs rising to 128 in early November 2025—the highest since August 2023—up from 102 a year prior.

In contrast, oil rigs have remained flat or declined, holding at 414 amid a broader slowdown in U.S. drilling activity in 2024-2025.

This stability in gas rigs reflects confidence in long-term demand, while oil faces headwinds from OPEC+ production and weaker global appetite.

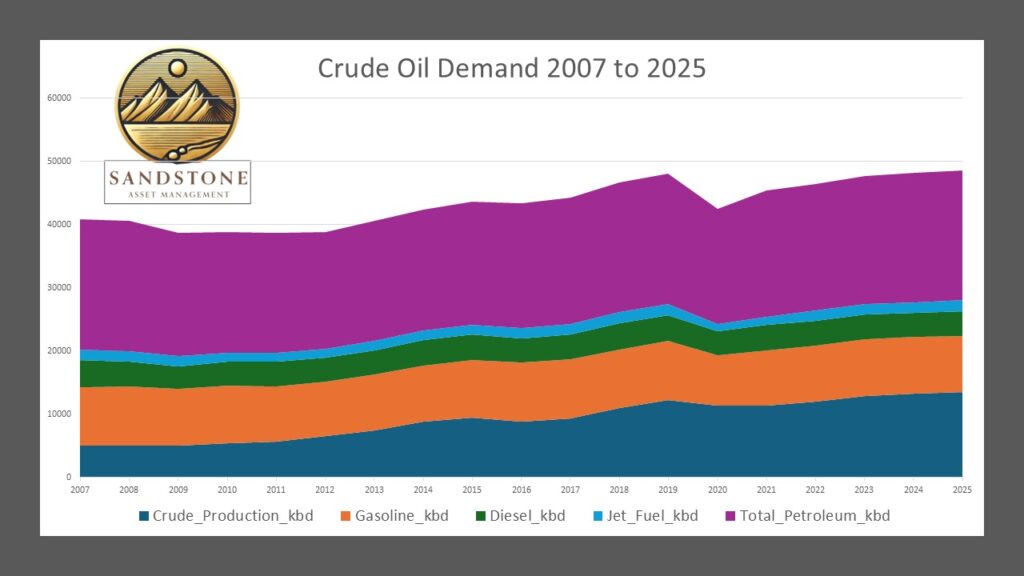

Just for Comparison, here is the Crude Oil Demand 2007 to 20025 YTD.

Investor Insights: Opportunities in a Gas-Driven Future

As outlined in the OilPrice.com article, natural gas’s rise positions it as a “bridge fuel” in the energy transition, with lower emissions than coal and flexibility for renewables integration.

Investors should focus on upstream producers benefiting from direct demand, midstream infrastructure (pipelines and storage) for increased throughput, and companies advancing carbon capture or hydrogen blending for sustainability.

Key risks include price volatility from weather, geopolitics, and regulations, but affordability and reliability make gas resilient.

Companies to watch in 2025 include:

Cheniere Energy: Leading LNG exporter poised for export growth.

EQT Corporation: Largest U.S. natural gas producer, capitalizing on AI-driven demand.

Kinder Morgan: Midstream giant with extensive pipeline networks.

Antero Resources (AR): Focused on Appalachian gas, benefiting from higher prices.

ExxonMobil and Chevron: Integrated majors shifting resources toward gas exploration.

Other sources recommend diversified exposure via ETFs for hedging risks.

With U.S. production forecasted at 118 bcf/d by 2026 and prices averaging $3.80/MMBtu in 2025, the sector offers compelling growth potential.

In conclusion, the synergy between AI and natural gas is accelerating a demand boom that’s recalibrating the energy industry. As companies adapt drilling plans and investors eye resilient stocks, natural gas stands as a cornerstone of the global energy mix—bridging today’s needs with tomorrow’s sustainable goals.

Got Questions on investing in oil and gas?

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack