ENB Pub Note: This article is from the Energy Bad Boys themselves, Mitch Rolling and Isaac Orr. I have reached out to them to get them on a podcast, as this is a huge topic, as electricity prices are rising around the country. We highly recommend subscribing to the Energy Bad Boys Substack. As AI data centers grow, we will need storage to buffer the electricity to the data centers, and storage can be justified, but we also have to look at safety from a lithium runaway fire problem in communities. I will be scheduling an interview with one of our advertising sponsors, Kight Fire Specialists, on this issue.

Rising electricity prices are a hot topic as of late.

Many people are looking in all the wrong places to pinpoint the blame, specifically Democrats and wind and solar advocates looking to place it at the feet of Donald Trump and Republicans for accelerating the phaseout of wind and solar subsidies in the One Big Beautiful Bill Act (OBBBA). Others are pointing fingers at demand growth for data centers and AI.

The truth is that today’s electricity price increases have been years in the making, fueled by massive spending for the so-called “energy transition”—and the spending is still ongoing with no signs of slowing down.

In regulated markets, rate increase requests filed by electric utility companies are very clear about why they are asking to raise prices on their customers, and they are primarily concerned with investments for “clean energy” initiatives, such as replacing thermal generators with less reliable wind and solar facilities and the transmission and distribution network to accommodate them.

These moves to radically alter the nation’s electricity system came during a time of little to no energy demand growth, which took away valuable resources that could’ve been used to meet the growing demand of today (in the form of capital spending and assets like reliable and affordable coal and nuclear power plants).

To borrow a recent quote about America’s growing debt, applying it to the energy grid, “We are guilty of spending our rainy-day fund in sunny weather.”

Explosion in Rate Increase Requests

In regulated markets, electric utility companies file rate increase requests (called rate cases) with state utility commissions to increase electricity prices for customers.

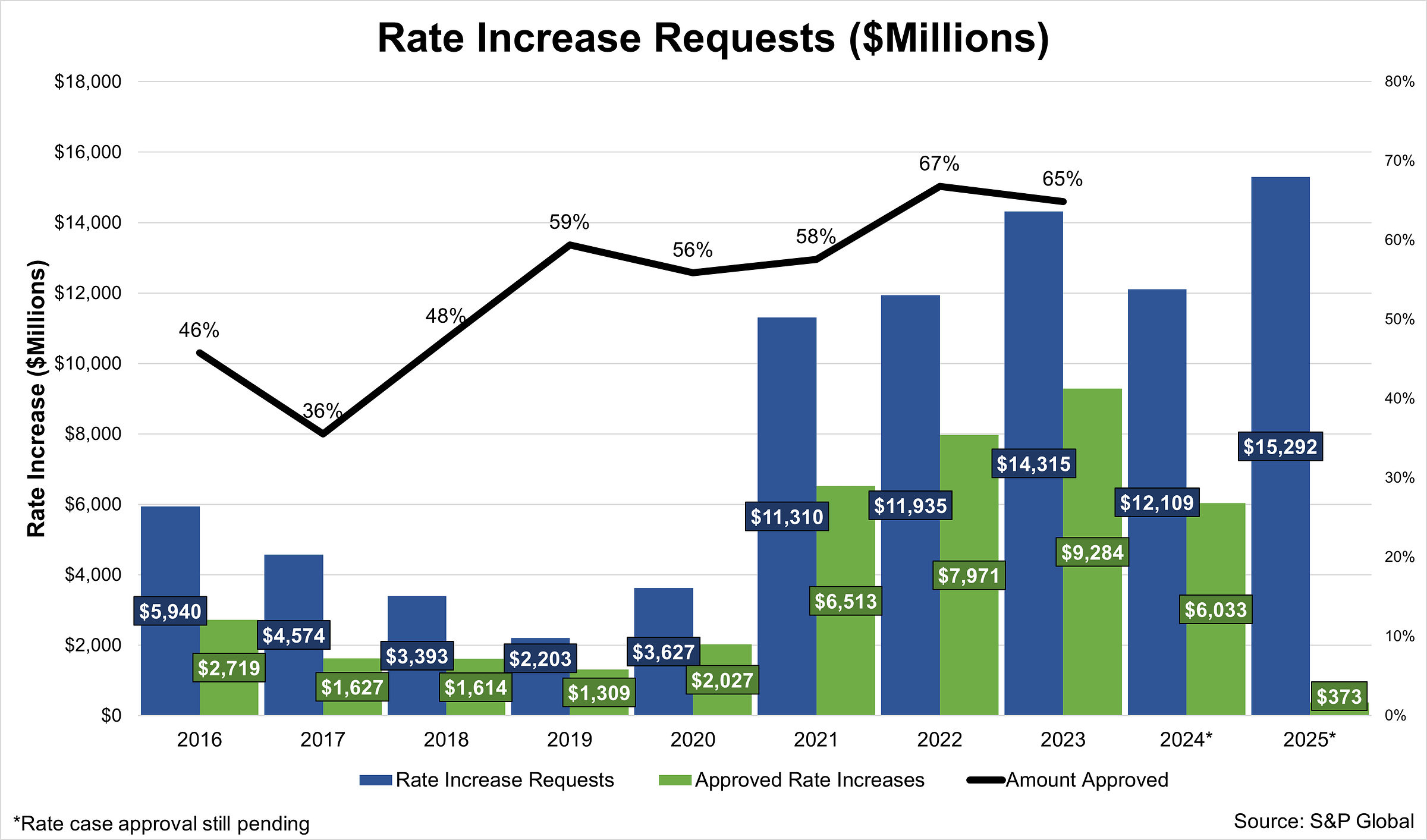

Rate increase requests from utility companies have exploded since 2020, jumping from $3.6 billion to $11.3 billion in one year, an increase of over 200 percent. While the jump from 2020 to 2021 can be explained by the delay of rate increases during COVID, the upward trend hasn’t gone away and is hard to ignore, with 2022, 2023, and 2025 all reaching new record highs.

The reasons behind these massive rate increases are plentiful, but many of them stem from the ongoing—and failing— “energy transition.” Mandates for wind and solar buildouts and the transmission and distribution networks to accommodate them, battery storage facilities, EV charging infrastructure, home heating electrification, thermal closures, wildfire prevention, and increasing natural gas prices all played a role.

However, there’s more.

As you can see, rate increase requests haven’t just skyrocketed, but the amount that utility commissions are approving is increasing, too.

Utility commissions approved only 46 percent, 36 percent, and 48 percent of the requested rate increases from 2016 through 2018, respectively. From 2019 through 2023, the approval rate has ranged from 56—67 percent.

This trend of ever-increasing electricity rate increases has directly resulted in higher electricity rates—duh.

Electricity Rate Increases Lead to Higher Rates

First, we were accused of cherry-picking a few paragraphs out of the huge rate case filings, but we assume our readers understand that we aren’t going to re-file rate cases in their entirety.

We were also told that rate cases don’t show the full picture and that we should look at wholesale power costs, but this misses the point about how regulated markets determine electricity prices, and that wholesale prices don’t reflect the full cost of retail prices.

However people choose to downplay the direct statements from utility companies affirming that they are raising rates due to “clean energy” investments, the simple fact is that electricity rates are rising, and the vast majority of investments are going toward wind, solar, and battery storage resources and the transmission and distribution infrastructure to accommodate them.

Electricity Prices are Increasing Dramatically

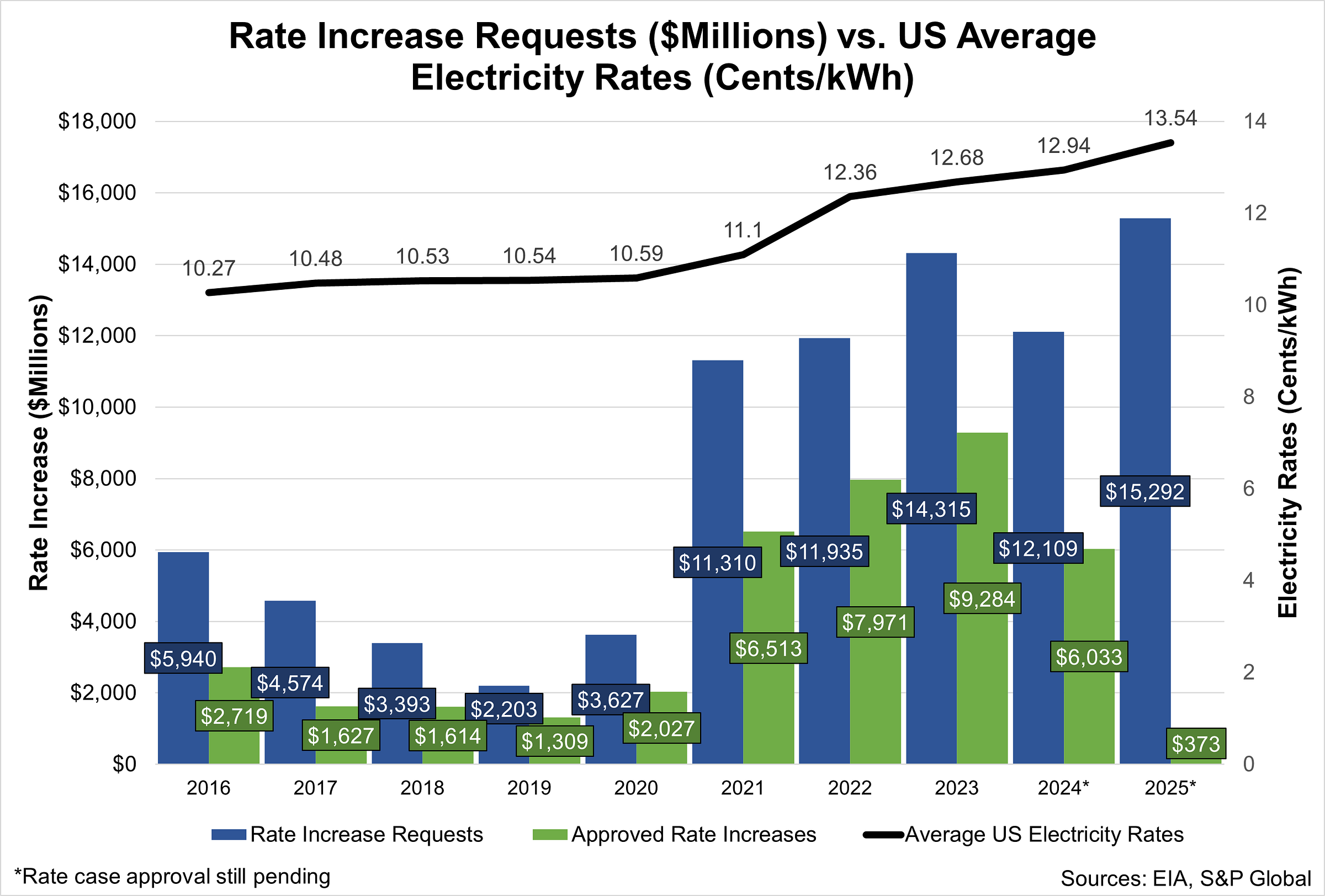

From 2016 to 2020, electricity prices increased modestly across the country. Average U.S. electricity prices rose from 10.27 cents per kilowatt-hour (kWh) in 2016 to 10.59 cents per kWh in 2020—an increase of only 3 percent across four years.

Since 2020, prices have increased to 13.54 cents per kWh—an increase of 28 percent in five years.

The graph below shows national electricity prices paired with data on electric rate increase requests from S&P Global. The causation is clear as day. Electricity rate increase requests and approvals exploded in 2021, and so did electricity prices.

It should go without saying, but rate increases from utility companies have a direct impact on the price consumers pay… obviously.

Therefore, rather than theorize about what is causing electricity prices to increase, we should pay close attention to the reasons for these rate increases in order to diagnose why electricity prices have become so unaffordable.

We looked at the largest rate increase requests filed by top 6 companies in 2025 to see what the primary reasons were requesting price increases. The results are below.

SPOILER ALERT: The ongoing energy transition is the primary suspect.

Primary Reasons for Rate Increases

- Florida Power & Light Company [FPL] ($2,472,100,000)

- Consolidated Edison Company in New York [Con Ed] ($1,608,400,000)

- Pacific Gas & Electric Company in California ($1,842,000,000 combined)

- Virginia Electric & Power Company [Dominion] ($1,169,000,000)

- Arizona Public Service Company [APS] ($662,400,000)

- DTE Electric Company in Michigan ($574,100,000)

Here are the primary reasons they stated for asking for such large rate increases on their customers.

Emphasis has been added to these quotes to highlight their relevance.

1. Clean Energy and Climate Goals

These investments reflect Con Edison’s commitment to our customers to continue to build a clean, reliable and resilient grid of the future while advancing New York State and New York City’s climate goals.

Further in testimonies, it makes it crystal clear again:

The expanding need for capital investment, much of which is related to resiliency and clean energy enablement… contributes to the increase in the carrying cost on rate base relative to current RY3 rate levels by approximately $370 million for electric…

DTE is no different. In it’s rate case, the company states it needs “continued infrastructure investments to improve the reliability of the grid and to sustain the reliability of its generation fleet while moving toward cleaner sources of generation, including the associated depreciation and property tax increases.”

DTE makes clear that investments included in the rate case, which are detailed below, support “the State’s Clean Energy Standard targets and demonstrates progress toward the Company’s and State’s energy storage target.”

Additionally, PG&E also affirms that it needs approval for massive funding to achieve the state’s decarbonization goals, stating the following:

[U]tilities need adequate funding to cover the cost of service to achieve the energization policies established in the Powering Up Californians act, including promptly connecting customers to meet decarbonization goals, serve housing developments and businesses, enable transportation electrification, and more.

Dominion Energy is also trying to comply with the Virgina Clean Economy Act (VCEA), which requires Dominion to be 100 percent carbon-free by 2045, but warns that clean energy legislation is complicating reliability in the state and PJM.

The company notes that while it has built several solar facilities and is completing its offshore wind facility to comply with the VCEA, the company has also retired over 2,500 MW of mostly coal-fired power plants—and additions haven’t kept up with retiring capacity. It continues, noting that:

Other utilities are taking similar actions, retiring fossil-fueled generators in compliance with clean energy legislation and environmental regulations. In PJM more generally, retirements are outpacing supply growth, which prompted a determination by the North American Electric Reliability Corporation (“NERC”) that the RTO is at an elevated risk of supply shortfalls. PJM projects resource shortfalls within the RTO as early as 2026 or 2027.

Today, the Company needs as much generation capacity as it can get.

As you can see, the trend of massive spending to satisfy clean energy legislation and climate goals doesn’t end with these utilities.

2. Investments for Wind, Solar, Batteries, and Coal-Conversions

For example, one of the largest capital investments being made by APS is the Agave Battery Energy Storage System (BESS) that will cost $264.3 million.

FPL is investing $624 million in solar and battery storage projects.

Additionally, DTE is investing to transition to “cleaner” energy sources, converting the coal-powered Belle River power facility to natural gas and building the Trenton Channel Battery Storage facility.

Also worthy of note is that not only is Con Ed investing in infrastructure to facilitate more wind, solar, and batteries in New York, detailed below, it is actively working to allow regulated utilities to own large wind and solar facilities, which they are currently not allowed to do. While our readers will understand that Con Ed is simply trying to get in on the Green Plating™ action to have more reasons to increase the company’s rate base and profits, it is couching this advocacy as a means of achieving New York’s renewable energy goals:

Currently, third-party developers receive subsidies for generating wind and solar energy, but the state recently acknowledged it is unlikely to meet the goal of 70% renewable energy by 2030. CECONY is advocating for an all-hands-on-deck approach to achieving renewable energy policy goals and energy system reliability that includes regulated large scale renewables, which would be owned and operated by regulated utilities like CECONY.

3. Transmission and Distribution to Support “Clean Energy,” Electrification, and Load Growth

Most of these utility companies are investing heavily in distribution and transmission infrastructure for expected integration of wind and solar, electrification efforts, anticipated load growth, or all of the above.

As Con Ed makes clear:

[T]he Core investments described in the Company’s Electric Infrastructure and Operations Panel (“EIOP”) direct testimony either facilitate interconnection of future renewable generation supply into the Company’s service territory or provide additional electric system capacity to accommodate increased load due to electrification of transportation and buildings.

In its Integrated Long-Range Plan that it includes in the rate case filing, Con Ed affirms that it’s “investing in transmission and storage projects within our service territory that can both deliver electricity supplied by remote intermittent renewables and balance increasing system demand in support of clean energy goals.”

DTE is in the same boat, stating that it’s “continuing its multi-year journey aimed at providing safe, reliable, and increasingly clean electric service by making necessary capital investments in its distribution grid and power generation and energy storage assets.”

DTE states that these investments are:

required to address generation and grid reliability needs, to support the transition to cleaner generation sources economically, to aid with transportation electrification, and to improve service quality for customers, consistent with the service quality and reliability standards set forth by the Michigan Public Service Commission (MPSC).

FPL is also investing heavily in distribution and transmission. Between 2024 and 2026, the company will end up investing over $6.4 billion in distribution and transmission infrastructure “to support system growth, including the addition of 352,000 new service accounts, upgrades to existing infrastructure and installation of new facilities.”

These new facilities will be solar and energy storage, as stated elsewhere in the rate case.

Similarly, Dominion notes that “New generation and distribution capital requirements are the largest driver of the revenue requirement outside of capacity expenses,” and these investments are intended to “serve our growing load.”

4. Electrification for Home Heating and Electric Vehicle Charging Infrastructure

While PG&E’s rate case includes wildfire mitigation expenses, it also tacks on funding for the state’s electrification and decarbonization policies.

As it states:

Our GRC requests funding for several programs supporting and advancing the state’s air emissions, electrification, and decarbonization policies. These programs include electrical vehicle charging infrastructure work and other modernization work to ready the grid for increased electrification that advances decarbonization. We are also continuing the alternative energy program adopted by this Commission that performs cost effective electrification of gas customers and retirement of gas infrastructure.

It’s interesting to note that PG&E has the 4th-highest electricity rates in the country among investor-owned utilities, and yet it still prioritizes increasing electricity rates on customers to pay for electrification and decarbonization efforts over affordability.

PG&E isn’t alone.

Con Ed, which has the 10th-highest electricity rates in the country among investor-owned utilities, is also prioritizing home heating electrification and EV infrastructure as one of its main reasons for requesting rate increases. As the company notes immediately in its filing as a justification for increasing prices:

Expanding programs to install services for new business, including supporting access to Electric Vehicle charging infrastructure. Additionally, we anticipate demand for heat electrification to grow, driven by an increase in new construction in our service territory combined with requirements for clean heat in new commercial and residential buildings.

5. Load Growth

Several rate increase requests focus on load growth expectations, especially in states with expected customer growth such as Virginia, Arizona, and Florida.

Dominion Energy in Virginia argues that its rate increase is necessary for meeting anticipated load growth from data centers and that the company is investing in the existing gas, nuclear, and coal fleet for uprates, life extensions, and resiliency measures.

While Dominion is still planning to invest in battery storage, which the company says “improves and facilitates the Company’s increasing integration of renewable generation resources,” its rate case reflects the fact that Dominion needs firm, reliable capacity to meet projected growth in demand, and uses recent reports for anticipated shortfalls in PJM to make the case for continued use of its thermal power facilities.

The same is true for FPL, which “projects to add 335,000 more customers through the end of 2029, and that “[to] meet this new growth and maintain operational reliability, FPL must invest in generation, transmission, and distribution.”

APS sings a similar tune, arguing that “the Company must continue to make substantial investments in expanding its generation resources and investing in the grid to modernize and harden the system to accommodate both APS’s continued load growth and changing customer energy usage trends.”

Conclusion

We should also note that several of these utility companies are continuing to use the IRA subsidies, which haven’t expired yet. This directly contradicts claims that OBBBA is responsible for recent rate hikes, as these subsidies will continue to offset costs applied to electricity rates, foisting them instead onto taxpayers, as several utilities make clear.

FPL, for example, notes that it will receive tens of millions of dollars from the production tax credit (PTC) and the investment tax credit (ITC), which will offset costs from their anticipated solar and storage facilities.

Electricity prices are increasing and have been for years because of state energy policies that prioritize emissions reductions and building wind and solar over energy affordability and reliability.

Americans are now literally paying the price of these misaligned priorities.

Got Questions on investing in oil and gas?

If you would like to advertise on Energy News Beat, we offer ad programs starting at $500 per month, and we use a program that gets around ad blockers. When you go to Energynewsbeat.co on your phone, or even on Brave, our ads are still seen. The traffic ranges from 50K to 210K daily visitors, and 5 to 7K or more pull the RSS feeds daily.