In the ever-evolving landscape of global energy markets and finance, few concepts have sparked as much debate as the “petrodollar.” Coined to describe the system where oil is predominantly priced and traded in U.S. dollars, this arrangement has underpinned American economic dominance for decades. But recent shifts—ranging from Saudi Arabia’s geopolitical realignments to surging gold purchases by central banks—have led many to question its viability. A provocative article from The Merchants News on Substack declares the petrodollar outright “dead,” citing the expiration of a 50-year U.S.-Saudi deal and broader de-dollarization trends.

Giacomo Prandelli and Stu Turley have a podcast scheduled to cover this very issue. It is worth a review, and we will post the link here when it rolls out. We recommend The Merchant News Substack here.

Is this the end, or merely a setback?

Let’s dive into the data, trends, and hypotheses to assess whether the petrodollar is truly deceased or simply nursing wounds in a multipolar world.

The Petrodollar’s Origins and Alleged Demise

The petrodollar system traces back to 1974, when the U.S. struck a deal with Saudi Arabia: In exchange for military protection, the Kingdom would price its oil exports in dollars and reinvest proceeds into U.S. Treasuries. This followed President Nixon’s 1971 decision to end the dollar’s gold convertibility, creating a fiat currency backed by global oil demand. The arrangement fueled U.S. trade deficits, debt accumulation, and monetary expansion without immediate inflation spikes, as dollars flooded back into American assets.

According to the Substack analysis, this era ended in 2023 with the deal’s expiration. By September 2025, Saudi Arabia signed a Strategic Mutual Defense Agreement with Pakistan, effectively swapping U.S. security guarantees for Pakistan’s nuclear umbrella.

This move, the article argues, eliminates the need for dollar recycling. Adding fuel to the fire, Saudi Arabia has begun settling oil trades in yuan—such as a 2023 deal with China—and frozen its BRICS membership bid in late 2024, signaling a hedging strategy rather than full allegiance to any bloc.

The piece predicts profound implications, including vulnerability for U.S. finances and a surge in gold as an alternative store of value. Yet, claims of the petrodollar’s outright death may be premature. While Saudi Arabia now allows oil sales in other currencies, around 80% of global oil trade still occurs in dollars, with Saudi exports defaulting to USD settlements.

No formal U.S.-Saudi petrodollar pact ever mandated exclusive dollar use; it’s been a market convention.

If anything, these changes reflect gradual erosion rather than a sudden collapse.

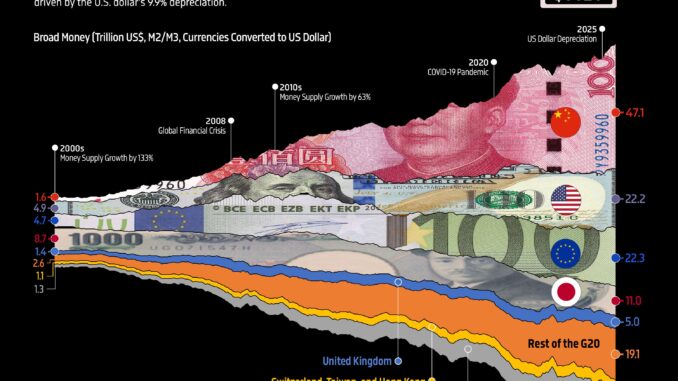

The USD’s Share in Global Reserves: A Slow Bleed?A key metric for the petrodollar’s health is the U.S. dollar’s dominance in global foreign exchange reserves. As of Q2 2025, the dollar holds about 56.32% of allocated reserves, down from 57.79% in Q1 2025 and a peak of 73% in 2000.

Other estimates peg it at 58% for 2024 overall.

This 20% decline since 2000 is the steepest since World War II, accelerated by geopolitical tensions post-2020.

The euro has gained ground, rising to 20.1%, while the yuan sits at a modest 2.5%.

Total global reserves are massive, with top holders including:

|

Rank

|

Country

|

Reserves (USD Billion)

|

|---|---|---|

|

1

|

China

|

3,380

|

|

2

|

Japan

|

1,160

|

|

3

|

Switzerland

|

865

|

|

4

|

India

|

588

|

|

5

|

Taiwan

|

544

|

|

6

|

Russia

|

643 (including gold)

|

|

7

|

United States

|

910

|

|

8

|

Saudi Arabia

|

~500 (estimated)

|

(Data compiled from 2025 sources; note: Figures vary slightly by reporting methodology.

Countries like Russia have dumped dollars post-sanctions, with gold now comprising half its reserves.

This diversification hints at waning confidence in the dollar’s invincibility.

Gold Rush: Central Banks’ Hedge Against Dollar Uncertainty

Over the last decade, central banks have ramped up gold purchases, signaling a shift away from dollar reliance. From 2015 to 2025, trends show:

Annual average: 400-500 tons from 2010-2021, surging to over 1,000 tons annually in 2022-2024.

- 2014-2016 total: 1,576 tons.

2022-2024 total: 3,220 tons (doubling prior periods). - H1 2025: 415 tons, down 21% from H1 2024 but still robust.

- Q2 2025: 167 tons purchased.

Key buyers include China, Russia, India, Turkey, and Poland, accumulating 2,082 tons in 2023-2024 alone—the fastest pace since World War I.

Gold’s appeal lies in its neutrality: unsanctionable and inflation-resistant amid dollar volatility. This “gold rush” underscores efforts to insulate reserves from U.S.-centric risks.

Has U.S. Weaponization of Oil and Sanctions Hurt the Dollar?

Absolutely, and here’s why. The U.S. has increasingly “weaponized” the dollar through sanctions, tariffs, and exclusions from systems like SWIFT, targeting oil producers like Russia, Iran, and Venezuela.

This leverages the petrodollar’s infrastructure but erodes global trust. Sanctions cause commercial losses and prompt alternatives, as seen in Russia’s pivot to yuan and gold post-2014.

Hypothetically, this backfires by accelerating de-dollarization. Countries wary of U.S. leverage seek bilateral deals in local currencies, reducing dollar demand.

While short-term political gains accrue, long-term reliability suffers, potentially weakening the dollar’s reserve status.

In energy terms, sanctioning oil flows disrupts markets, pushing buyers toward non-dollar trades and hurting U.S. exporters indirectly.

Echoes of the British Pound: A Slow Fade or Resilient Revival?

The British pound’s decline offers a cautionary tale. Once dominant, it fell from over 50% of reserves in the early 20th century to just 4.78% by 2021, amid empire collapse and economic shifts.

The dollar overtook sterling as the leading reserve currency by the mid-1920s, solidified post-WWII.

Could the USD follow suit? Likely a gradual diversification rather than an abrupt fall, as no single alternative (like the yuan) is ready to dominate.

Factors like U.S. economic size and financial depth provide buffers, unlike Britain’s rapid imperial decline.

New Trading Blocs: Balancing Act or Dollar Disruptor?

Emerging trading blocs among countries eschewing strict net-zero policies—think BRICS (Brazil, Russia, India, China, South Africa) and the “Global South”—could either wound or stabilize the dollar.

These nations, prioritizing growth over emissions targets, are forging alliances that bypass Western sanctions, using local currencies for oil and trade.

A potential BRICS currency could challenge USD hegemony, especially if tied to commodities like oil.

On the flip side, these shifts might attract new investments to the U.S., as “neutral” countries (over 100 nations) balance between U.S.-led and China-Russia blocs.

U.S. energy independence and innovation could draw capital, offsetting losses.

However, the West’s fossil fuel phase-out creates vulnerabilities that these blocs exploit, potentially fragmenting global trade further.

Regarding Saudi Arabia’s Pakistan pact: This September 2025 agreement extends Pakistan’s nuclear deterrence to the Kingdom, viewing attacks on one as attacks on both.

By securing an alternative to U.S. protection, Saudi Arabia gains the flexibility to ditch its reliance on the petrodollar, hastening reserve currency diversification.

It doesn’t “ensure” the USD’s demise but certainly contributes, as Saudi hedges against U.S. unreliability.

Conclusion: Wounded, But Not Yet Buried

The petrodollar isn’t dead—it’s wounded. Declining reserve shares, gold hoarding, and sanction backlash signal erosion, amplified by Saudi’s pivot to Pakistan. Like the pound’s slow fade, the USD faces a multipolar challenge, but its entrenched role in energy and finance provides resilience. New blocs may balance losses through U.S. investments, yet ongoing weaponization risks are accelerating the bleed. For energy markets, this means volatility: Watch for more yuan-oil deals and gold-backed trades. The dollar’s supremacy endures, but its monopoly? That’s increasingly in question.

Is Oil and Gas Right for your Portfolio?

If you would like to advertise on Energy News Beat, we offer ad programs starting at $500 per month, and we use a program that gets around ad blockers. When you go to Energynewsbeat.co on your phone, or even on Brave, our ads are still seen. The traffic ranges from 50K to 210K daily visitors, and 5 to 7K or more pull the RSS feeds daily.

Be the first to comment