In the evolving landscape of American automotive manufacturing, a notable pivot is underway: away from aggressive adoption of electric vehicles (EVs) toward hybrid technologies. This shift, accelerated by the Trump administration’s removal of federal EV mandates, reflects a pragmatic response to market realities, consumer preferences, and economic pressures. As of late 2025, U.S. automakers are recalibrating their strategies, with Ford’s potential discontinuation of its F-150 Lightning electric pickup serving as a high-profile example. This article explores the drivers behind this transition, its implications for consumers and investors, and whether it’s tied to evolving views on climate change or the limitations of subsidy-driven sustainability.

The Rollback of EV Mandates and Its Impact on Manufacturers

The Trump administration, upon taking office in January 2025, swiftly moved to dismantle policies perceived as forcing EV adoption. On his first day, President Trump signed an executive order to eliminate the “electric vehicle mandate,” which had aimed for 56% of new vehicles sold to be electric by 2032 under the previous administration.

Michael Tanner and Stu Turley have been talking about the hybrids on the Energy News Beat Stand Up Podcast as the future of automotive production and reducing gasoline demand. It seems that economics are forcing this move, and Stu and Michael were just early to the dance.

This included halting unspent funds for EV charging infrastructure and revoking California’s nation-leading emissions standards, which had set a template for phasing out gas-powered cars.

The Environmental Protection Agency (EPA) also proposed rescinding Obama-era endangerment findings that paved the way for greenhouse gas regulations on vehicles.

These changes have freed automakers from stringent requirements that previously incentivized EVs through credits and penalties. Without these mandates, companies like Ford, General Motors (GM), and Toyota are redirecting resources. GM, for instance, announced plans to reintroduce plug-in hybrids to North America by 2027, reversing its earlier all-EV stance.

Toyota, which has long emphasized hybrids, is doubling down on this approach, positioning itself to benefit from the policy shift.

Industry analysts note that as EV mandates ease, traditional automakers can prioritize profitable mixes of gasoline, hybrid, and limited EV models, rather than subsidizing loss-making EVs with higher gas vehicle prices.

This isn’t a complete abandonment of electrification—hybrids, which combine internal combustion engines with electric motors, offer a bridge technology. They address range anxiety and infrastructure limitations while improving fuel efficiency. The shift aligns with consumer demand: hybrids are seeing renewed interest as EV sales slow amid high costs and charging challenges.

Ford’s Lightning: A Case Study in EV Challenges

Ford’s F-150 Lightning, launched in 2022 as an electric version of America’s best-selling truck, exemplifies the hurdles facing pure EVs. Reports from November 2025 indicate Ford executives are seriously considering scrapping the model due to mounting losses—estimated at $13 billion across Ford’s EV division—and plummeting sales.

Sales dropped 24% year-over-year in October 2025 after the federal $7,500 EV tax credit expired, with only 1,500 units sold that month—far below the targeted 150,000 annually.

Ford has already halted production temporarily to focus on more profitable gas and hybrid variants, which require less aluminum and align better with current market dynamics.

The decision stems from the loss of indirect incentives, such as fuel economy credits under EPA regulations, which were worth tens of thousands per vehicle—more than the consumer tax credit.

CEO Jim Farley has highlighted a preference among Americans for smaller, affordable EVs or hybrids over large, expensive trucks like the Lightning.

Instead, Ford is pivoting to compact $30,000 EV pickups and expanding hybrid offerings.

Implications for Consumers

For everyday buyers, this could mean relief from upward pressure on vehicle prices. Previously, automakers hiked gas vehicle costs to offset EV losses, but with mandates lifted, prices for traditional and hybrid models may stabilize or drop.

Hybrids provide a practical alternative: better mileage, lower emissions than pure gas cars, and no need for extensive charging infrastructure. Consumers gain more choices, including commuter-friendly hybrids that bridge the gap to full electrification as battery tech improves.

However, those committed to zero-emission driving might face fewer high-end EV options, potentially slowing the national transition to greener transport.

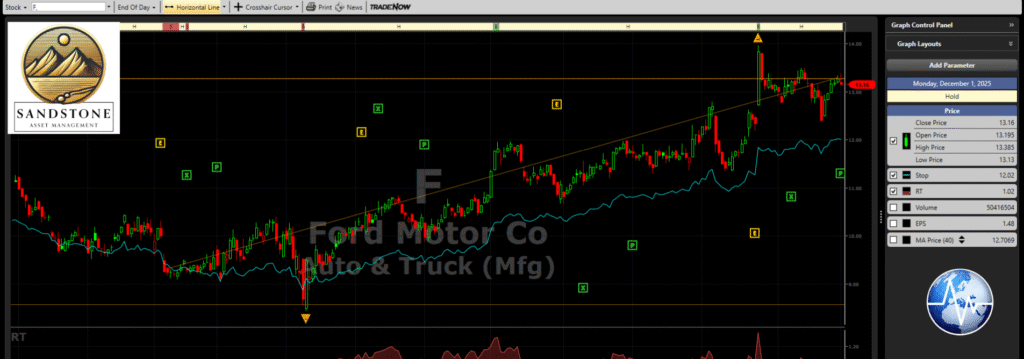

Implications for Investors

Investors in Ford (and similar firms) could see improved profitability as the company sheds unprofitable EV lines. Scrapping the Lightning frees up resources for hybrids, which have proven margins and demand.

This pivot might boost stock performance by reducing exposure to EV market volatility, though it signals caution on rapid electrification bets. Broader market sentiment favors hybrids as a safer investment amid policy uncertainty, with companies like Toyota poised for gains.

Risks remain if global EV adoption accelerates elsewhere, leaving U.S. firms behind.

Climate Narratives and Subsidy Realities: What’s Driving the Shift?

Is this automotive realignment linked to Bill Gates’ recent comments on climate change? In October 2025, Gates stated that while climate change is a serious problem, it “will not lead to humanity’s demise” and criticized “doomsday views” that exaggerate its existential threat.

He argued that warming won’t exceed 2.9°C above pre-industrial levels, aligning with revised projections showing less than 3°C by 2100 under current policies—down from earlier fears of 4-6°C.

This echoes analyses like Roger Pielke Jr.’s, who argues that declining emissions projections have prompted advocates to amplify fear around lower warming thresholds, maintaining apocalyptic rhetoric despite progress.

Pielke notes that what was once seen as a policy success (e.g., ~2.8°C under mitigated scenarios) is now framed as catastrophic, potentially eroding public trust.

Yet, the shift to hybrids appears more directly tied to economic realities than climate reassessments. Subsidies and mandates artificially propped up EVs, but their removal exposes unsustainable models: high production costs, consumer resistance to premiums, and inadequate infrastructure.

As one analysis puts it, “sanity is rapidly returning” to the market without federal distortions.

Gates’ views may contribute to a broader cultural shift, questioning the urgency of forced EV transitions, but the core driver is financial: subsidies can’t indefinitely sustain unprofitable tech.

Looking Ahead

The U.S. auto industry’s embrace of hybrids signals a balanced path forward—one that prioritizes affordability and practicality over ideological mandates. For consumers, it promises diverse options; for investors, potential stability. Whether fueled by tempered climate fears or subsidy fatigue, this shift underscores that true sustainability emerges from market viability, not government fiat. As battery advancements continue, hybrids may pave the way for eventual EVs, but on consumers’ terms.

Got Questions on investing in oil and gas?

If you would like to advertise on Energy News Beat, we offer ad programs starting at $500 per month, and we use a program that gets around ad blockers. When you go to Energynewsbeat.co on your phone, or even on Brave, our ads are still seen. The traffic ranges from 50K to 210K daily visitors, and 5 to 7K or more pull the RSS feeds daily.