In a move that underscores the ongoing tension between fossil fuel revival efforts and the push for clean energy, the Trump administration issued an emergency order on December 30, 2025, requiring the Craig Station Unit 1 coal-fired generator in northwestern Colorado to remain operational beyond its planned retirement date.

This 446-megawatt unit, part of a 45-year-old facility, was set to close at the end of 2025 due to economic pressures and compliance with state and federal environmental regulations. The Department of Energy (DOE), led by Secretary Chris Wright, cited electricity shortages in the northwestern U.S. as the primary reason, emphasizing the need to maintain grid reliability during winter months.

The order, issued under the Federal Power Act, mandates that Tri-State Generation and Transmission Association—along with other owners—repair a broken valve that caused a shutdown on December 19 and keep the unit available for at least 90 days, with potential for renewal.

This action aligns with President Trump’s broader agenda to bolster the coal industry, which has seen similar interventions in states like Indiana, Washington, and Michigan to prevent plant closures.

However, it has sparked immediate backlash from environmental groups, state officials, and ratepayer advocates, who argue it imposes unnecessary costs and delays Colorado’s transition to renewables.

Colorado’s Evolving Energy Mix and Demand Outlook

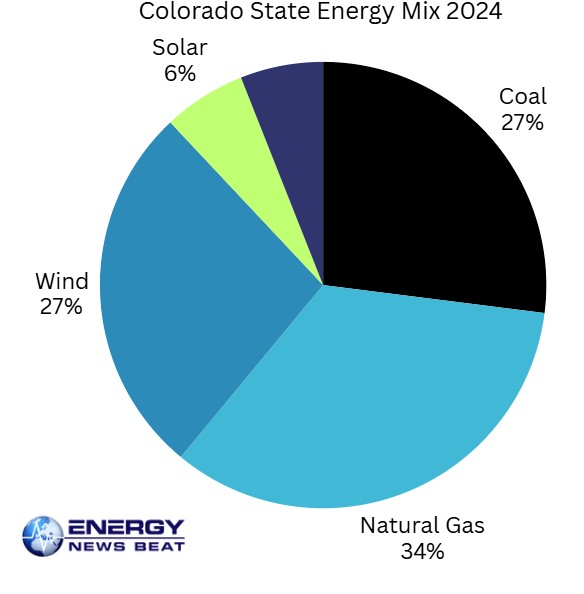

Colorado’s electricity sector is in the midst of a significant shift away from coal toward cleaner sources. In 2024, coal accounted for 27% of the state’s in-state electricity generation, a sharp decline from 60% a decade earlier.

Natural gas led with 34%, followed closely by wind at 27%, solar at 6%, and hydroelectric at 3%.

Renewables, particularly wind and solar, have surged, providing 43% of electricity needs in 2024—up from 15% in 2014.

By mid-2025, the state boasted approximately 8,455 MW of renewable capacity, representing about 2.2% of the U.S. total.

This transition is accelerating as coal plants retire: Colorado plans to decommission most coal capacity between 2025 and 2031. But at what cost to consumers?

Craig Station’s other units (2 and 3) are slated for closure in 2028, and the nearby Trapper Mine, which supplies its coal, is also shutting down.

In 2025, renewables produced around 22.4 million MWh, highlighting the state’s growing reliance on wind, solar, and other clean sources.

Demand for electricity in Colorado is rising rapidly, driven by population growth, electrification of vehicles and buildings, and the boom in data centers.

Forecasts indicate a national uptick in usage, with average annual growth of 5.7% over the next five years, but Colorado faces unique pressures.

Xcel Energy, a major utility, projects needing $22 billion in investments to meet data center demands alone over the next 15 years.

Peak demand is expected to grow 40% by 2040 from 2023 levels, reaching about 14,791 MW, though 2025 projections suggest a more modest increase of 3-5% year-over-year from 2024’s approximately 10,500 MW peak.

Total annual consumption could approach 35-40 TWh in 2025, up from 2024’s roughly 32 TWh, as the state balances retiring coal with new renewable and gas capacity.

Opposition, Orders, and Emerging Lawsuits

The DOE’s emergency order has drawn sharp criticism. Colorado Governor Jared Polis called it a “sham” that would “pass tens of millions in costs to Colorado ratepayers” for a plant that’s “broken and not needed.”

Democratic U.S. Senator Michael Bennet echoed this, labeling it “unacceptable” to burden consumers with unnecessary expenses.

Environmental groups like Earthjustice have condemned the move as illegal, arguing it harms communities and ignores economic realities.

They estimate that keeping Unit 1 operational for 90 days could cost at least $20 million, with annual operating expenses reaching $85 million—largely from coal fuel. Which was an expense in the past, and they were ok with it, as it was cheaper than the grid updates that have driven costs higher.

While no lawsuits have been filed as of January 2, 2026, Earthjustice and other NGOs have signaled intent to challenge the order, drawing parallels to past interventions where similar mandates cost ratepayers over $100 million in other states.

Earlier in 2025, the EPA ruled that Colorado cannot mandate coal plant closures by specific dates, potentially opening doors for delays, but this federal order overrides state plans.

Green groups, including those focused on air quality, have a history of suing over coal emissions in Colorado, and this could lead to litigation under environmental laws.

Implications for Investors and Consumers

For consumers in Colorado, the order means short-term relief from potential power shortages but at a price. Residential electric rates have already risen 24% since 2015, and keeping Craig Unit 1 open could add to this burden.

coloradopolitics.com

Tri-State, a not-for-profit cooperative, warns that compliance costs—unless shared regionally—will fall on its members, potentially hiking bills by 4-6 cents per kWh above inflation trends by 2030.

If lawsuits ensue, legal fees and delays could further inflate rates, though successful challenges might force a quicker closure and shift to cheaper renewables.

For investors, the decision signals volatility in the energy sector. Coal-related stocks might see a temporary bump from pro-fossil fuel policies, but the long-term outlook remains dim as Colorado aims for near-zero fossil fuel generation by 2040.

Renewable energy firms could face delays in grid connections, but rising demand from data centers offers growth opportunities—Xcel’s $22 billion plan alone highlights investment potential in solar, wind, and storage.

Utility investors should monitor rate cases, as higher costs from coal mandates could pressure margins.

Grid Stability and Future Scenarios

If Craig Unit 1 shuts down as originally planned, grid stability could be at risk, particularly in the rural northwest, where the plant provides baseload power.

The DOE argues it’s essential to prevent blackouts during high-demand winter periods, as closures could cause interruptions to homes and businesses.

Colorado’s increasing reliance on intermittent renewables exacerbates this, though new gas and storage capacity is being added to mitigate.

Conversely, if it stays open amid lawsuits, rates are likely to rise due to operational costs ($85 million annually) and potential legal battles.

Environmental compliance issues could add fines or retrofits, further burdening consumers. Ultimately, this order buys time but doesn’t reverse the economic tide against coal—Colorado’s clean energy trajectory suggests that renewables will dominate at a higher cost to consumers. As Energy News Beat has reported, Democratic states pay on average 37% more for electricity due to Net Zero, Green Energy policies, lawsuits, and additional carbon taxes. Colorado is following a path blazed by the UK, Germany, California, and New York. I would not own a business in Colorado due to the long-term energy outlook.

You can’t just shut 27% of a coal-fired turbine off a grid running in AC mode and expect things to keep running just fine. The grid requires obeying the laws of physics and fiscal responsibility, and it appears that Colorado leadership does not read technical manuals but governs based on input from green-funded NGOs.

This development highlights the clash between federal energy priorities and state-level transitions, with Colorado’s ratepayers caught in the middle. As the state grapples with growing demand, the path forward will depend on balancing reliability, costs, and environmental goals.

Sources: utilitydive.com, energynewsbeat.co, coloradosun.com, denverpost.com, earthjustice.org, washingtonexaminer.com, coloradopolitics.com

Be the first to comment