As we step into 2026, the copper market is at a pivotal juncture. Production growth is projected to be flat to modest, with refined output expanding by just 0.9% compared to 3.4% in 2025, largely due to constraints on concentrate availability and operational challenges.

This slowdown is flipping the market from surplus to a projected deficit of around 150,000 tonnes this year.

For investors tuning into the Energy News Beat Channel, this shift signals both risks and opportunities. Copper’s role in electrification, AI infrastructure, and defense spending is driving demand higher, but supply bottlenecks could push prices up in the medium term—even as some forecasts predict a slight dip to $10,000-$11,000 per tonne in 2026 before rebounding.

In this article, we’ll break down global demand versus supply, spotlight key miners and smelters, and highlight investment plays to consider.

Global Copper Demand vs. Supply: A Widening Gap

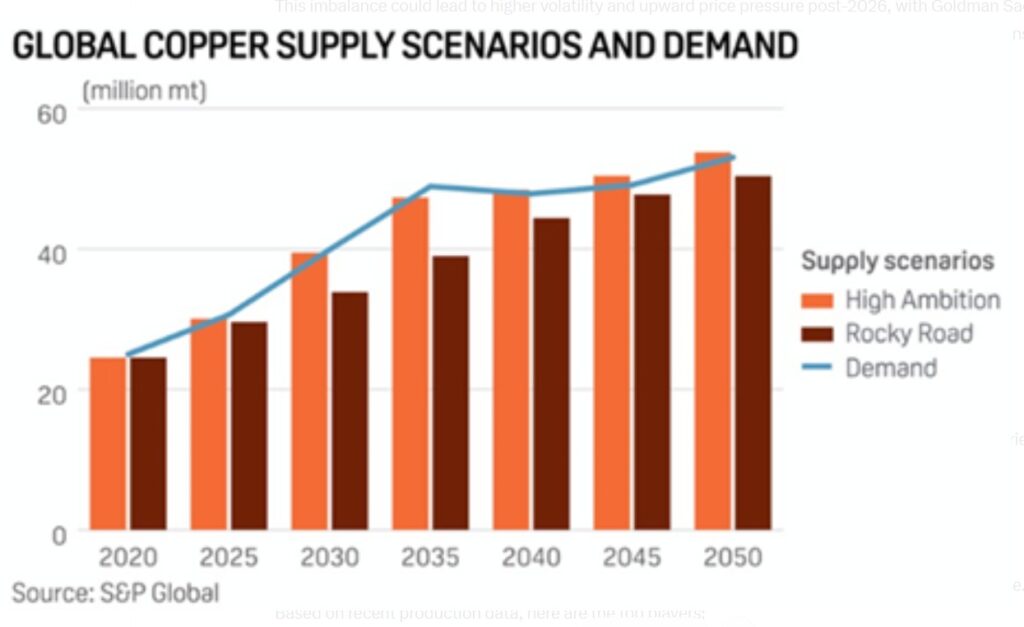

Copper demand is surging, fueled by the energy transition, AI data centers, and growing defense needs. Analysts at S&P Global forecast a 50% jump in demand to 42 million metric tons by 2040, with AI alone adding up to 2 million tons between 2025 and 2040.

For 2026 specifically, the International Copper Study Group (ICSG) anticipates a refined copper shortfall of 150,000 tonnes, reversing recent surpluses as production growth stalls.

J.P. Morgan estimates mine supply growth at only 1.4% this year, far below what’s needed to match consumption.

On the supply side, global production is expected to peak around 33 million metric tons by 2030, creating a “substantial shortfall” that could reach 10 million tons by 2040 without major new investments.

Factors like declining ore grades, rising capital costs, and regulatory hurdles are hamstringing output. In China, which dominates refining, smelters are planning cuts of over 10% in 2026 due to low margins and concentrate shortages.

crugroup.com

This imbalance could lead to higher volatility and upward price pressure post-2026, with Goldman Sachs eyeing demand outpacing supply from 2029 onward.

recyclingtoday.com

Investors should watch for signs of accelerated mine development or recycling boosts to ease the crunch.

The chart above illustrates the projected copper supply shortage, highlighting how demand trajectories are outstripping production forecasts.

Key Copper Miners: The Heavy Hitters

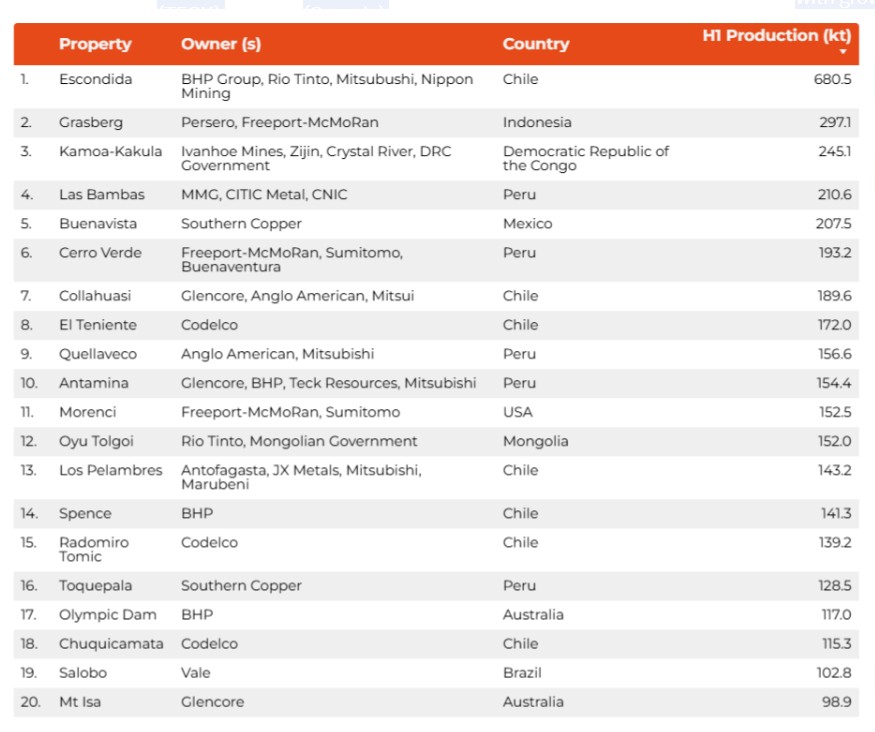

The copper mining landscape is dominated by a handful of giants with operations spanning the globe. Based on recent production data, here are the top players:

|

Company

|

Key Operations

|

2025 Production (est. kt)

|

Notes

|

|---|---|---|---|

|

Codelco

|

Chile (multiple mines)

|

~1,700

|

State-owned; world’s largest producer, facing grade declines. investingnews.com

|

|

BHP Group (BHP)

|

Escondida (Chile), Olympic Dam (Australia)

|

~1,200

|

Diversified miner; strong copper portfolio amid energy transition focus. investingnews.com

|

|

Freeport-McMoRan (FCX)

|

Grasberg (Indonesia), Morenci (USA)

|

~1,800

|

Recovering from disruptions; eyeing EBITDA growth to $12B at $5/lb copper. fool.com

|

|

Glencore

|

Collahuasi (Chile), Mount Isa (Australia)

|

~1,000

|

Cut 2026 targets but plans long-term expansion to top producer status. goldmansachs.com

|

|

Rio Tinto (RIO)

|

Oyu Tolgoi (Mongolia), Bingham Canyon (USA)

|

~800

|

Balanced with iron ore; investing in green copper tech.

|

|

Southern Copper (SCCO)

|

Peru/Mexico mines

|

~1,000

|

Low-cost producer; positioned for demand surge. seekingalpha.com

|

|

Teck Resources (TECK)

|

Quebrada Blanca (Chile), Highland Valley (Canada)

|

~500

|

World-class assets; undervalued with growth potential. fool.com

|

These companies control the bulk of output, with Chile, Peru, and the DRC as key regions. Production challenges like water scarcity and labor issues could further constrain supply.

This chart ranks the top copper mines as of 2025, providing a snapshot of where major production is concentrated heading into 2026.Key Smelters and Processors: Refining the Red MetalSmelting and processing are critical bottlenecks, with China accounting for over 50% of global capacity.

The China Smelter Purchasing Team (CSPT) has announced over 10% capacity cuts for 2026, impacting nickel, lead, and zinc as well—potentially tightening refined supply.

Japanese smelters are negotiating separate TC/RCs (treatment and refining charges) to avoid benchmark ties to China.

Leading smelters include:Codelco (Chile): Integrated mining and smelting; focusing on sustainability.

Glencore (Switzerland): Operates smelters in Canada, Australia, and Africa.

BHP Group: Smelting tied to mining ops, emphasizing low-emissions tech.

Freeport-McMoRan: Processes output from its mines.

Jiangxi Copper (China): World’s largest refined copper producer; part of CSPT.

Aurubis (Germany): Europe’s top recycler and processor.

Grupo México (via Southern Copper): Major in the Americas.

These entities face tougher challenges in 2026, including supply-demand imbalances and higher energy costs.

Investors may see margin squeezes but also opportunities in efficient, green-focused operators.Which Companies to Invest In? Navigating the OpportunitiesWith flat production growth amplifying supply risks, copper-exposed stocks could rally if deficits materialize. Analysts are bullish on the sector for 2026, citing undervalued assets and long-term demand tailwinds.

Here are top picks based on growth potential, valuations, and market positioning:Freeport-McMoRan (FCX): Undervalued with earnings set to soar; production rebounding in Indonesia. Analysts predict strong EBITDA growth.

Buy for exposure to pure-play copper.

Southern Copper (SCCO): Low-cost operations in Peru and Mexico; staging a comeback with solid dividends.

Ideal for income-focused investors.

Teck Resources (TECK): Diversified but copper-heavy; world-class assets and undervalued stock.

Growth from Quebrada Blanca expansion.

BHP Group (BHP): Broad commodity exposure but leading in copper; benefits from energy transition.

Rio Tinto (RIO): Strong balance sheet; investing in sustainable mining.

Ero Copper (ERO): Smaller cap with high growth; Brazil-focused efficiency.

Lundin Mining (LUNMF): Expanding portfolio; attractive valuation.

Diversify via ETFs like the Global X Copper Miners ETF (COPX) for broader exposure. Risks include economic slowdowns curbing demand or unexpected supply boosts, but the structural deficit favors upside.

Wrapping Up: A Bullish Outlook Amid Constraints

Flat to modest copper production growth in 2026 underscores a market tipping toward scarcity, impacting investors through potential price spikes and stock gains for well-positioned companies.

As demand from AI and green tech accelerates, keeping an eye on supply chain dynamics— from miners like Freeport-McMoRan to smelters in China—will be key.

For Energy News Beat listeners, this could be a prime time to position portfolios for the red metal’s resurgence. Stay tuned for updates as the year unfolds. I will be writing additional articles on the companies listed and their earnings reports.

While we do not give investment advice, we love talking about the finacials and looking at prices. As always please check with your Certified Public Accountant or proffesional finacial planner.

Check out theenergynewsbeat.substack.com.

Be the first to comment