In a bold and unprecedented move, President Donald Trump has reshaped the global oil landscape by orchestrating the U.S. takeover of Venezuela’s oil sector following the capture of former President Nicolás Maduro. This January 2026 intervention not only marked the end of Maduro’s regime but also positioned the United States as the direct manager of the world’s largest proven oil reserves—over 303 billion barrels. By selling Venezuelan crude on the international market and strategically routing proceeds through Qatar, Trump has bypassed traditional legal and financial hurdles, potentially flooding the market with additional supply and challenging the dominance of OPEC and OPEC+. Yet, this strategy comes at a crossroads: Venezuela’s oil industry requires prices around $75 per barrel to thrive, while Trump has publicly aimed for $55 oil or lower to benefit American consumers and industry. Here’s how this dramatic shift unfolded and what it means for global energy dynamics.

The Swift Takeover: From Capture to Control

The sequence began on January 3, 2026, with U.S. special forces capturing Maduro amid political turmoil in Caracas. Just three days later, on January 6, Trump announced that the U.S. would “run” Venezuela’s oil sector indefinitely, framing it as a means to stabilize the country and monetize its vast resources. This was followed by an executive order on January 9 that shielded Venezuelan oil revenues from creditor claims, effectively nullifying $170 billion in outstanding debts to bondholders, oil companies, and nations like China. By January 14, the U.S. had completed its first sale of Venezuelan oil, valued at $500 million, as part of a broader $2 billion deal.

This rapid timeline—12 days from military action to revenue capture—represents a new model of resource management. Unlike past interventions in Iraq or Libya, where revenues flowed through local channels under international oversight, the U.S. now directly markets and sells the oil….

In Shanaka Anslem Perera’s Substack article, The Privatized Seigniorage Pivot: America’s Quiet Monetary Regime Change, he outlines some incredible points and how the real oil markets are changing.

The thesis is precise: The United States has begun outsourcing dollar hegemony maintenance to private stablecoin issuers while simultaneously abandoning the rules-based international order it created, not as coordinated grand strategy but as emergent behavior of an overstretched empire under fiscal pressure reaching for any mechanism that might work. The stablecoin-Treasury nexus, mandated by the GENIUS Act signed in July 2025, represents the only scalable mechanism for creating captive Treasury demand without Federal Reserve balance sheet expansion or foreign central bank cooperation. Venezuelan oil, by contrast, generates approximately three percent of annual interest payments at maximum theoretical extraction. The intervention is geopolitical theater dressed in fiscal language. The actual fiscal innovation is happening in plain sight, in regulatory filings and attestation reports and Congressional testimony, where private corporations now hold more Treasury bills than most sovereign nations.

What follows is the complete mechanism, the timing, the positioning, the evidence, the trade, and the framework for understanding every subsequent iteration of this dynamic. The positions are already being built.

The Arithmetic That Exposes the Contradiction

Begin with the numbers that no one disputes.

The United States national debt stands at $38.5 trillion as of the first week of January 2026. This figure grows by approximately $6.12 billion every twenty-four hours, a rate that would have seemed pathological a decade ago but now registers as baseline. The acceleration is the story: crossing from $35 trillion to $36 trillion required 133 days, then $36 trillion to $37 trillion in 96 days, then $37 trillion to $38 trillion in just 90 days. The debt is not merely growing. It is growing at an increasing rate, a second derivative that fiscal projections consistently underestimate because they assume mean reversion that never arrives.

The Mechanism Hidden in Plain Sight

While the media dissected Venezuelan oil reserves and debated the legality of extraterritorial regime change, a different kind of intervention was finalizing in Washington. On July 18, 2025, the GENIUS Act became law. The legislation’s full title is the Guiding and Ensuring National Innovation for U.S. Stablecoins Act, a name so anodyne it practically begs to be ignored. Do not ignore it.The GENIUS Act establishes a comprehensive federal framework for payment stablecoins, those digital tokens pegged to the dollar and backed by reserves. The critical provision is the reserve requirement: stablecoin issuers must maintain one-to-one backing exclusively in United States coins and currency, demand deposits at insured depository institutions, Treasury bills with remaining maturity of 93 days or less, repurchase agreements backed by Treasury bills, and government money market funds. No rehypothecation is permitted. No fractional reserve games. Every dollar of stablecoin in circulation must have a corresponding dollar of specified reserve assets.

Read that list again. Treasury bills with 93 days or less maturity. This is not incidental technical language. It is the entire point.

Treasury Secretary Scott Bessent stated the implications explicitly in his July press release on the legislation: “This groundbreaking technology will buttress the dollar’s status as the global reserve currency in the evolving digital asset space and lead to a surge in demand for US Treasuries.” He was not being subtle. In subsequent interviews, Bessent elaborated that Treasury is “in discussions with Tether and Circle about how the government might tailor short-term debt issuance to meet rising demand from the sector.”

The New Financial System Can Change the Entire Oil Market

So the new financial mechanisms put in place are now accelerated through the use of Qatar’s banking and the funding of Venezuelan oil money to bypass the old system, royalties, and ownership claims, all through a veil of legal protections.

As President Trump says things may calm down in Iran, oil markets drop 4.19% in early trading. We can now see that a conflict in Iran, Iraq, and the Strait of Hormuz can still impact geopolitical dynamics, but the 711 million barrels from Venezuela, while important, have been sold on the dark fleet to China at a huge discount and did not impact the markets when Maduro was captured.

What will the longer-term issues and impacts be?

Overview of US Sanctions on Iran’s Oil Sector

US sanctions on Iran, primarily reimposed in 2018 under the Trump administration and tightened further in subsequent years, target the country’s oil exports as a key revenue source for its government and military. These measures aim to curb Iran’s nuclear ambitions, regional influence, and support for proxy groups by restricting access to global markets, banking, and technology. As of January 2026, Iran’s oil industry remains under pressure amid ongoing protests, geopolitical tensions, and renewed US enforcement threats. The sanctions have significantly hampered Iran’s economy while influencing global oil prices, though evasion tactics like shadow fleets have allowed partial recovery in exports.

Impact on Iran’s Oil Exports and Production

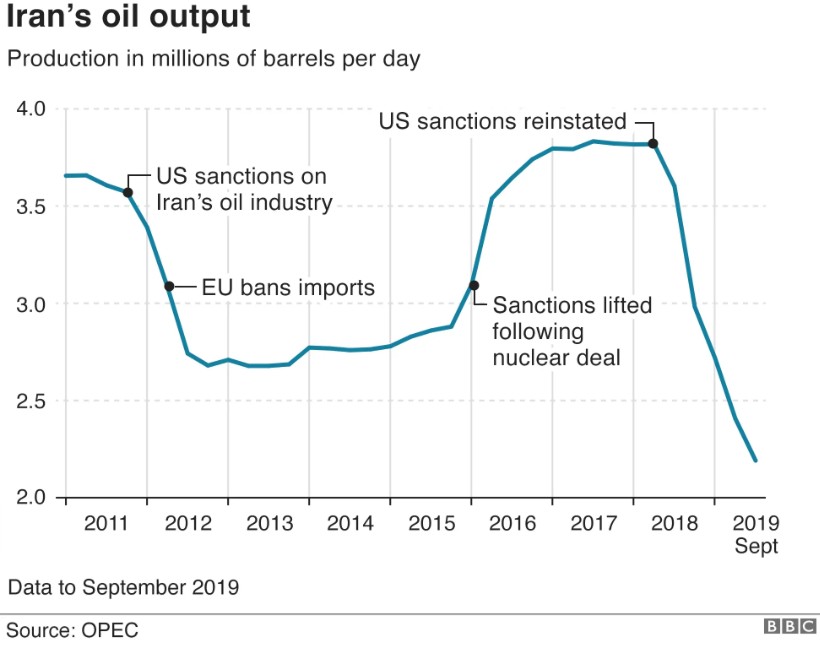

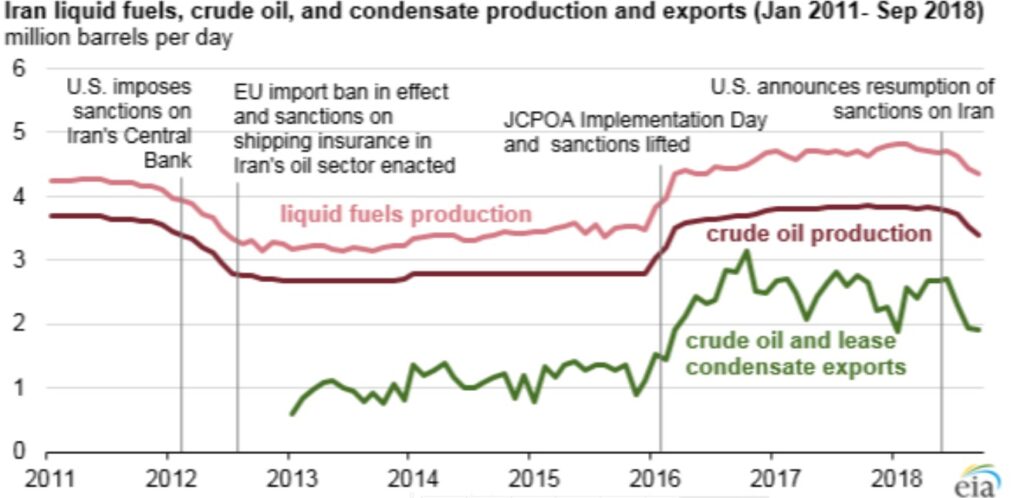

Iran holds the world’s third-largest proven oil reserves (over 200 billion barrels) and produces more than 3 million barrels per day (bpd), but sanctions have drastically reduced its ability to monetize this resource.

Key effects include:

Export Decline: Prior to intensified sanctions, Iran exported about 2.2 million bpd in 2011. Exports plummeted 60-80% after 2018, hitting a low of around 400,000 bpd in 2020 due to restrictions on buyers and shipping.

By 2025, exports recovered to approximately 1.5 million bpd, largely through discounted sales to China via a “shadow fleet” of over 170 sanctioned vessels, which evade detection by rerouting and rebranding oil.

However, late 2025 saw a further drop of 100,000 bpd in output, exacerbating revenue shortfalls.

Production Challenges: Sanctions limit access to foreign investment and technology, leading to aging infrastructure and reduced efficiency. Iran’s heavy reliance on oil (10-15% of GDP) means these curbs have stripped tens of billions in annual revenue.

Recent US actions, including sanctions on front companies like Sepehr Energy Jahan, force steeper discounts (up to $17 per barrel) to attract buyers.

To illustrate the historical trend:

Economic Impacts on Iran

The oil sanctions have rippled through Iran’s broader economy, compounding issues from mismanagement and corruption:

Currency and Inflation: The Iranian rial has depreciated dramatically, losing over 90% of its value since 2018, fueling hyperinflation (rates exceeding 40% annually).

This has led to soaring prices for essentials, with cooking oil up 200% and poultry/eggs over 120% in recent spikes.

Budget and Revenue Shortfalls: Oil revenues fund about 30-40% of the government budget. Sanctions have created deficits addressed through money printing, tax hikes, and delayed repatriation of export earnings (e.g., only $13 billion of $21 billion in 2025 oil sales returned home).

Overall exports (oil and non-oil) fell 16% to $100 billion in 2025, while imports dropped 10% to $98 billion.

Human and Social Costs: Shortages of medicine, food, and fuel have worsened living standards, with increased mortality among vulnerable groups.

Unemployment hovers around 10-15%, and protests—fueled by economic grievances—have intensified, risking further instability.

Despite diversification efforts (e.g., non-oil exports to neighbors), Iran remains vulnerable, with GDP growth stagnant or negative in sanction-heavy years.

Impact on the Global Oil Market

Iran’s situation influences global supply dynamics, given its role in OPEC and proximity to key chokepoints:

Supply and Price Volatility: Removing Iranian oil tightens markets; exports of 1.3-1.5 million bpd (mostly to China) represent about 1.5% of global supply.

Recent tensions, including US threats of 25% tariffs on countries trading with Iran, have pushed Brent crude up 3-7% in short bursts (e.g., from $69 to $74 per barrel in one day).

If fully enforced, tariffs could curb flows to Asia, potentially raising prices to $120 per barrel if disruptions escalate.

Strait of Hormuz Risk: Iran controls this strait, through which 25% of global seaborne oil (20 million bpd) passes. Any blockade could cause severe shortages and price spikes, far outpacing Venezuela’s impact.

Broader Geopolitical Effects: Sanctions on Iran, Russia, and Venezuela have collectively removed millions of bpd from markets since 2014, but enforcement gaps (e.g., via China) limit volatility.

Hypothetically, lifting sanctions could drop global prices by 13%, benefiting importers like the EU and US while hurting exporters like OPEC members (e.g., 3.9% welfare loss for GCC countries).

However, some analysts argue Trump’s 2025-2026 enforcement may have minimal impact compared to 2019, as evasion networks are entrenched and global demand is soft.

|

Aspect

|

Pre-2018

|

Post-Sanctions Low (2020)

|

2025 Levels

|

Potential 2026 Impact

|

|---|---|---|---|---|

|

Oil Exports (mbpd)

|

2.2

|

0.4

|

1.5

|

Could drop if tariffs enforced, tightening global supply

|

|

Production (mbpd)

|

~4.0

|

~2.0

|

~3.0+

|

Stagnant due to tech limits; recent 0.1 mbpd decline

|

|

Revenue Loss

|

N/A

|

Tens of billions annually

|

~$50-60B (discounted)

|

Further erosion from discounts ($15-17/bbl)

|

|

Global Price Effect

|

Stable

|

Minor upward pressure

|

Volatility from tensions

|

Risk of $10-50/bbl spikes if escalation

|

Outlook for 2026

With President Trump escalating rhetoric—including potential military options and tariffs—Iran’s exports face renewed risks, potentially benefiting US shale producers but straining allies like China and India.

Protests could disrupt output further, adding a geopolitical premium to prices.

Yet, Iran’s resilience through evasion suggests limited long-term market disruption unless broader regional conflict ensues. Other key focal points will be how OPEC (aka Saudi Arabia) handles the new oil finance and payment systems implemented, the enforcement of sanctions, and the disruption of the dark fleet. All of these align with OPEC’s stated goal of realigning pricing matrices to output and demand by 2027.

If the United States eliminates the Dark Fleet’s capabilities, it would keep OPEC’s pricing power in line. Kind of not obvious, but also impactful, is Saudi Arabia’s need for $85 oil to meet its budget. They have been shifting their economies away from 100% oil dependence, which may just show the resilience of Saudi Arabia’s plans. As they move to natural gas for electricity rather than oil, it will help, but their cost of oil is so low that they need the other business lines for cash flow.

For energy markets, monitoring the Strait of Hormuz and US-China trade dynamics will be key. Following that will be seeing how the royalty questions on Venezuelan oil roll out. We will be covering this on the Energy News Beat Stand-up today.

Be the first to comment