In the volatile world of energy markets, oil prices have stabilized around $60 to $65 per barrel throughout much of 2025 and into early 2026, a level that might typically pressure major oil companies’ stock performance.

Yet, industry giants Chevron (CVX) and ExxonMobil (XOM) have demonstrated remarkable resilience, with their shares holding steady or even edging up amid these conditions.

This stability stems from a combination of strategic global expansions, geopolitical advantages in key regions like Venezuela and Guyana, and a broader U.S. push toward energy dominance through exports and expertise—echoing the Trump Administration’s mantra.

As Stu Turley, host of the Energy News Beat podcast, aptly puts it: “Energy Security starts at home, but Energy Dominance is through your exports.” This article explores how Chevron and Exxon are leveraging these factors to weather low oil prices, while also touching on industry shifts exemplified by Harold Hamm’s decision to pause drilling in the Bakken and pivot to South America.

Chevron’s Mediterranean Momentum: The Leviathan Gas Expansion

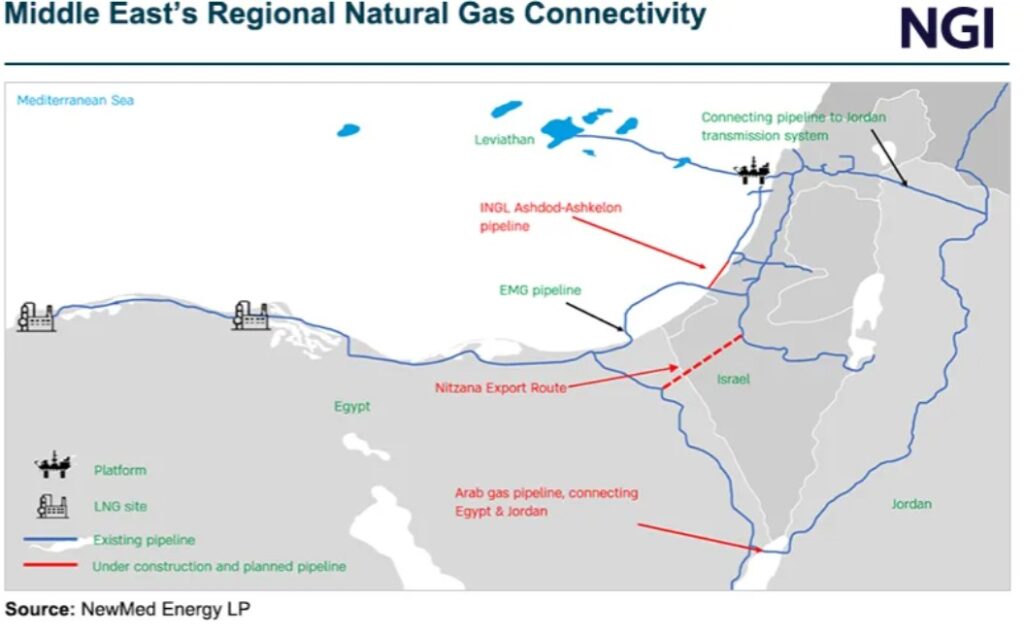

Chevron’s recent approval of the Leviathan gas field expansion in the Mediterranean Sea off Israel’s coast is a prime example of how the company is diversifying beyond oil to bolster its portfolio.

In January 2026, Chevron and its partners reached a Final Investment Decision (FID) on a $2.36 billion project to boost production capacity from the current 12 billion cubic meters (BCM) annually to 21 BCM by 2029.

This involves drilling three new wells, adding subsea infrastructure, and upgrading platform facilities, with gas primarily destined for Israel, Egypt, and Jordan—potentially extending to Europe as liquefied natural gas (LNG). The expansion underscores Chevron’s confidence in regional energy demand, especially as Egypt’s domestic production declines.

In 2025, Leviathan generated about $2.23 billion in sales from 10.9 BCM, and the upgrade could add billions more in revenue, helping offset softer oil prices.

This move not only diversifies Chevron’s revenue streams but also positions it as a key player in the energy geopolitics of the Eastern Mediterranean.

For context on Leviathan’s growth, here’s a production chart illustrating its output trajectory:

Exxon’s Guyana Gains and the Venezuela Factor

ExxonMobil’s fortunes are closely tied to its massive discoveries in Guyana’s Stabroek Block, where production has skyrocketed from near zero in 2020 to over 900,000 barrels per day (bpd) by late 2025.

The U.S. intervention in Venezuela in early 2026 has removed a longstanding threat: former President Nicolás Maduro’s territorial claims over Guyana’s oil-rich Essequibo region.

With Maduro ousted, Exxon can accelerate development without fear of disruption, targeting up to 1.7 million bpd by 2030.

Guyana’s high-quality crude has transformed the small nation into South America’s third-largest producer, surpassing Venezuela, and Exxon holds the lion’s share.

This boom provides Exxon with low-cost production that remains profitable even at $60 oil, cushioning its stock against price dips.

Here’s a chart showing Guyana’s oil production surge from 2020 to projections for 2026:

The Bakken Pivot: Harold Hamm’s Shift to South America

Not all U.S. producers are faring as well. Harold Hamm, founder of Continental Resources, announced in January 2026 that his company would halt all drilling in North Dakota’s Bakken shale for the first time in over 30 years, citing vanishing margins at $58 oil.

“There’s no need to drill it when margins are basically gone,” Hamm stated, emphasizing that U.S. shale needs around $80 per barrel for viability in higher-cost areas like the Bakken.

Instead, Continental is redirecting efforts to Argentina’s Vaca Muerta shale, acquiring assets from Pluspetrol in November 2025 and non-operating interests in four blocks from Pan American Energy in January 2026.

This pivot exemplifies how U.S. companies are exporting expertise to achieve global energy dominance, applying shale innovations to unlock Vaca Muerta’s estimated 16 billion barrels of oil and 308 trillion cubic feet of gas.

U.S. Energy Dominance: Exports and Expertise as a Service

The Trump Administration’s emphasis on energy dominance through exports aligns with these strategies.

In 2025, the U.S. achieved record oil production of over 13.8 million bpd and LNG exports, supplying 55% of Europe’s needs and reducing reliance on Russian gas.

By lifting LNG export pauses and streamlining permits, the U.S. is projecting to double LNG capacity to 30 billion cubic feet per day by 2029.

Chevron and Exxon are at the forefront, exporting not just commodities but also technological know-how to regions like South America and the Mediterranean. This “expertise as a service” model enhances global production while securing U.S. influence, helping their stocks remain buoyant despite low oil prices.

Conclusion: Resilience Through Diversification and Geopolitics

Chevron and Exxon’s ability to maintain stock prices amid $60-$65 oil reflects their strategic foresight: expanding into gas (Leviathan), securing low-cost oil frontiers (Guyana), and capitalizing on U.S.-led opportunities in Venezuela. While figures like Hamm shift from domestic shale to international plays, the broader U.S. energy sector’s export-driven dominance provides a buffer.

Investors should watch for oil price rebounds or further geopolitical wins, as these could propel CVX and XOM higher in 2026.

Stu Turley on the Energy News Beat podcast has said, “Energy Security Starts at home, and Energy Dominance is with your Exports,” which really hits the point. As drillers in the US face higher regulatory and environmental costs, basins and recovery prices differ in other countries. So Venezuela was selling to China at a deep discount below market, and after President Trump said we are open for business and will sell to China, China responded with new contracts to Canada. This will be a major issue soon. If President Trump is looking at the new and revised “Donroe Doctrine,” the new statements from Premier Carney of Canada should spark some huge concerns in the White House.

We are seeing the new trading bloc alignments roll out in real time. And they are falling into the patterns we have talked about on the Energy News Beat Podcast.

And compare Exxon and Chevron to BP and Shell. They jumped into the Green Energy, and BP just took a $5 billion write-down. I would be surprised if BP is still in business by the end of 2026. They look like prime targets for breaking apart and selling off to survive as a much smaller company. As Michael Tanner and Stu Turley have always said on the Energy News Beat podcast, “Good Management – Good Numbers.”

Remember, we do not give investment advice, and please always consult your CPA or a certified professional. We want to provide tools and information to help you ask the right questions and maximise your portfolio.

Sources: finance.yahoo.com, reuters.com, drilled.media, npr.org, energyindepth.org, energynewsbeat.co

Be the first to comment