You can’t buy this kind of entertainment. When President Trump throws out a mean Truth Social post, he can move the markets, but when an Aircraft Carrier Strike group shows up near Iran and Iraq, the oil traders panic. It is quite possible that the Glut Narative may just roll off into the sunset, as Stu Turley has said on the podcast “Where’s the Glut?” much like the “Where’s the Beef” Wendy’s commercial.

We are seeing a commodities Supercycle surge, and did oil just make it to the Commodities Homecoming Dance? We cover critical investment issues and factors that will impact consumers in the oil and gas markets.

The main topics discussed in this Energy News Beat Stand-UP are:

1. Geopolitical tensions and their impact on oil prices:

– President Trump’s threats of military action against Iran and the resulting spike in Brent crude oil prices

– Concerns about potential supply disruptions from Iran and Iraq, which could further impact oil markets

2. Declining oil and gas exploration and investment:

– The plunge in global conventional oil and gas discovery volumes in recent years

– The decline in overall oil and gas capital expenditures, focused on short-cycle, low-cost projects

– The high percentage of production coming from post-peak oil and gas fields raising concerns about future supply

3. The changing dynamics in the oil and gas industry:

– The dichotomy between “drill, baby, drill” and “grow, baby, grow” approaches to production

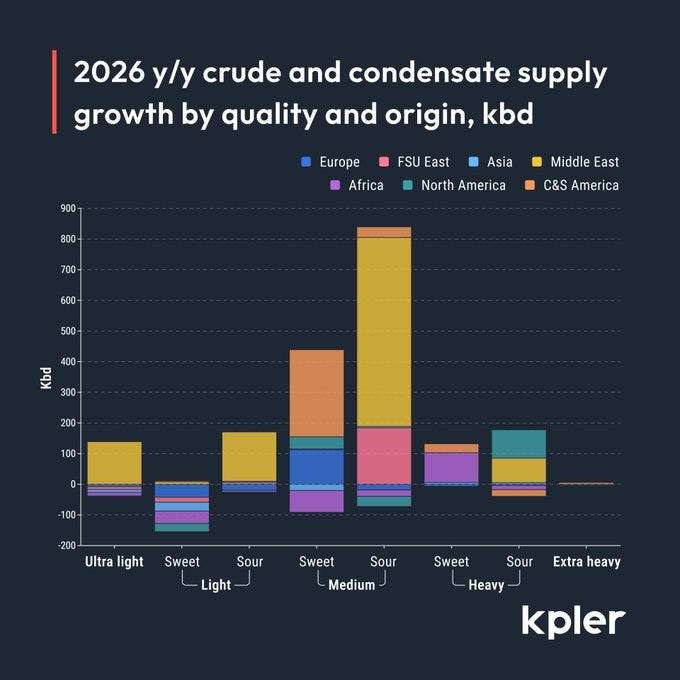

– The role of refinery demand in determining the pricing and trading of different crude oil grades

– Saudi Aramco’s efforts to change how OPEC monitors and prices oil, moving towards a more refinery-driven model

4. Potential mergers and acquisitions in the sector:

– The ongoing discussions around a potential merger between Coterra Energy and Devon Energy

– The involvement of activist investor Kimmeridge in pushing for this merger, including the potential nomination of Scott Sheffield to Coterra’s board

5. Performance and outlook for oil and gas companies:

– The strong stock price performance of major oil companies like ExxonMobil and Chevron

– The potential opportunities in the mining and gold/silver sectors as a hedge against oil and gas market volatility

Stories Covered in today’s Energy News Beat Stand-Up

1.Brent Breaks $70 After Trump Threatens Iran With Military Force

January 29, 2026 – Truth Social posts from President Trump can certainly rattle markets, but when U.S. aircraft carrier task forces deploy to the Persian Gulf, that’s when traders sit up and take notice. This morning, Brent crude surged past the $70 per barrel mark for the first time in over five months, driven by escalating U.S.-Iran tensions. As President Trump ramps up rhetoric against Tehran, the oil market is injecting a hefty geopolitical risk premium, pushing prices higher amid already strained global supply dynamics. But this isn’t just a short-term blip—it’s potentially the spark for a perfect storm that could see oil prices joining the rally in commodities like gold, copper, and platinum.

2.Oil Options on Longest Bullish Run Since 2024 as Iran Risk Looms

In the volatile world of energy markets, oil traders are increasingly betting on upward price movements, driven by escalating geopolitical tensions in the Middle East. The global Brent benchmark has shown a call skew—a premium for bullish call options—for 14 consecutive sessions, while the U.S. crude marker has followed suit for 13 days, marking the longest such streaks since late 2024.

For years, Stu Turley has sounded the alarm on the chronic underinvestment in global oil and gas exploration and production (E&P). The writing has been on the wall: without sufficient capital flowing into new discoveries and field developments, it’s only a matter of time before supply shortages hit hard, driving up prices and threatening energy security. As the host of the Energy News Beat podcast, I’ve discussed this repeatedly—pointing out how short-term thinking, investor pressures, and the rush toward renewables have left the industry vulnerable. Now, the latest data from Rystad Energy and analyses incorporating their insights, such as those from the International Energy Agency (IEA), confirm what I’ve been saying. Oil exploration is in a steep decline, investments are flattening or dropping, and we’re relying far too heavily on aging fields with high depletion rates. Let’s dive into the details, backed by recent reports, and explore what this means for the future.

The Shrinking Discovery Curve: Rystad’s Wake-Up Call

Rystad Energy’s October 2025 insight, “The Shrinking Discovery Curve: Why Exploration Still Matters,” paints a stark picture of dwindling new finds. Global conventional discovered volumes have plummeted from an average of over 20 billion barrels of oil equivalent (boe) per year in the early 2010s to just over 8 billion boe annually since 2020. The trend has worsened, averaging about 5.5 billion boe per year from 2023 through September 2025. This isn’t just a blip; it’s a structural shift driven by reduced exploration expenditure (expex), which has hovered between $50 billion and $60 billion annually—down from a peak of $115 billion in 2013.

These discoveries are increasingly concentrated in a handful of hotspots, like Namibia’s Orange Basin, Suriname’s deepwater plays, Guyana’s Stabroek Block (with an estimated 13 billion boe recoverable), and Brazil’s pre-salt basins. Supermajors like ExxonMobil, TotalEnergies, and Shell are leading the charge, accounting for about 22% of discovered volumes since 2015, while national oil companies (NOCs) like Petrobras dominate in their home turf. But overall, the industry is shifting away from broad exploration toward high-impact, targeted drilling in proven areas.

The Bottom Line: Time to Act

As mentioned above, Stu Turley has warned on Energy News Beat that the lack of investment in oil and gas E&P is setting us up for a supply crunch. Rystad’s data shows discoveries and expex at historic lows, while investments stall below levels needed to combat declines. With 80-90% of production from high-depletion fields, we can’t afford complacency. Policymakers, investors, and industry leaders must prioritize balanced energy strategies—boosting exploration while advancing transitions—to avoid volatility. The clock is ticking; let’s ensure supply keeps pace with demand before it’s too late.

So “Drill, baby, drill” sounds like a great political rally for lower prices for consumers, but the real impact on consumers could backfire if we do not invest in new exploration and the current price does not support new discoveries. There is a balance between Drill baby Drill, and Grow baby Grow. As Saudi leaders have stated, it is better to set a higher price that supports new drilling but is low enough to keep consumers satisfied.

4.Trinidad & Tobago: The $4 Billion Nat Gas Play

In the ever-evolving landscape of global energy, Trinidad & Tobago (T&T) is emerging as a pivotal player in the Caribbean natural gas sector. With declining domestic production threatening the viability of its Atlantic LNG facility—one of the world’s key export hubs—a potential $4 billion opportunity is on the horizon. This stems from cross-border gas fields shared with Venezuela, where major energy giants like BP and Shell are pushing for U.S. sanctions clearances to unlock trillions of cubic feet of reserves. Drawing from recent insights by commodity trader Jack Prandelli and ongoing developments, this article explores the play, the companies positioned to capitalize, and key considerations for investors eyeing this high-stakes arena.

The Geopolitical and Energy Backdrop

T&T’s natural gas production has been in a structural decline, dropping from peak levels and straining feedstock for Atlantic LNG, which supplies around 10% of global LNG to markets in Europe and Asia.

Without fresh supplies by 2026–2027, the facility risks further curtailments, potentially costing billions in export revenue.

5.Gas Turbines Suffer Economic Hardships Due to Stress Placed on Them by Wind and Solar

In the evolving landscape of the U.S. energy grid, natural gas turbines have long served as a reliable backbone for electricity generation. However, the rapid integration of intermittent renewable sources like wind and solar has introduced new challenges. These renewables, while questionably contributing to decarbonization goals, fluctuate based on weather conditions, forcing gas turbines to cycle more frequently—ramping up and down or idling—to maintain grid stability. This operational stress not only accelerates wear and tear on turbines but also drives up maintenance costs, increases downtime, and ultimately raises expenses for consumers. Drawing on data from the U.S. Energy Information Administration (EIA) and other sources, this article explores the scale of gas turbines on the grid, the impacts of intermittency, and the hidden economic burdens.

We have also listed the three main sources for natural gas turbines, and we will cover their stock performance on the next Energy News Beat Stand Up.

The Scale of Gas Turbines on the U.S. Grid

Natural gas-fired power plants are the dominant force in U.S. electricity generation, accounting for about 43% of utility-scale production in recent years.

6.Saudi Aramco Raises $4 Billion as Oil Prices Remain Under the Oil Glut Threat

The Purpose Behind the $4 Billion Raise

Aramco’s bond sale is primarily aimed at funding its ambitious capital investments and maintaining hefty dividend payouts to shareholders, including the Saudi government, which owns the majority stake.

The company has been ramping up borrowing to support these commitments, following previous issuances like a $3 billion sukuk in September 2025 and a $5 billion bond in May 2025.

So if you ever wondered if Saudi Arabia really needs the $80 to $90 oil, they do, just look at the debt that Saudi Aramco took on to pay their part of the Saudi Arabia budget.

But make no mistake, Doug Sandridge was spot on, and Saudi Arabian leadership would rather have a lower stable price than wild swings. We are about to see a new oil pricing matrix roll out in the next year, and it will mean not counting oil on the water. Michael and I covered that, but refineries determine which oil is needed based on the products in demand at their refinery. Not all oil is created equal.

A shout-out to Reese Energy Consulting for sponsoring the Podcast:

https://reeseenergyconsulting.com/

Check out: theenergynewsbeat.substack.com,

Get your CEO on the podcast: https://sandstoneassetmgmt.com/media/

Is oil and gas right for your portfolio? https://sandstoneassetmgmt.com/invest-in-oil-and-gas/

Stay safe, and I hope everyone has a great day. More news on the way.

Be the first to comment