In the heart of Canada’s oil country, a simmering discontent is boiling over. Albertans, often affectionately dubbed “Snow Texans” by their southern counterparts due to shared rugged individualism, cowboy culture, and deep roots in the oil and gas industry, are increasingly vocal about charting their own path. This isn’t just barroom talk—recent developments, including a push for a 2026 independence referendum, have thrust the idea into the spotlight. Sparked by meetings with Trump administration officials, the separatist movement highlights frustrations with federal policies that many see as shackling Alberta’s energy sector. But what would independence really mean for energy markets? Could Alberta thrive on its existing pipeline infrastructure, keeping its oil and natural gas revenues instead of forking over billions in federal taxes? And would a trade deal with the U.S. be the golden ticket, or might statehood offer even more upside? Let’s break it down.

The Spark: Separatism Gains Momentum After Trump Talks

The push for Alberta’s independence isn’t new—roots trace back to the 1970s oil crisis and the infamous National Energy Program under Pierre Trudeau, which many Albertans viewed as a federal raid on their resources.

But recent events have supercharged the movement. A right-wing separatist group is hustling to collect 177,000 signatures—about 10% of registered voters—for a petition to trigger a 2026 referendum on secession.

This surge follows three meetings with Trump officials, including State Department reps, where topics like border security, adopting the U.S. dollar, and mutual benefits were on the table.

Some factions even float joining the U.S. as the 51st state, echoing the cultural kinship with Texas.

Polls show mixed support: 29% of Albertans might back leaving Canada, but only 8% are firmly committed, with 65% preferring to stay.

The core gripes? Federal carbon taxes, oil sands regulations, and climate policies that separatists argue cripple the industry.

Alberta, holding 97% of Canada’s oil reserves and dominating natural gas production, feels it’s propping up the nation while getting shortchanged—contributing more in taxes (17% of GDP despite just 10% of parliamentary seats) than it receives in services.

Equalization payments, where wealthier provinces subsidize others, are a particular sore spot.

Adding fuel to the fire is Enbridge’s recent decision to shelve a proposed Alberta pipeline project. Citing excessive development risks—likely regulatory hurdles, environmental pushback, and economic uncertainties—the CEO pulled the plug on what could have been a vital artery for oil sands exports.

This move underscores Alberta’s pipeline woes: blocked projects like Northern Gateway and Energy East have left the province overly reliant on U.S. markets.

Yet, separatists argue, even without new builds, existing infrastructure could sustain an independent Alberta, freeing it from Ottawa’s taxes and red tape.

Existing Pipeline Infrastructure: Enough to Go Solo?

Alberta’s oil sands are a global powerhouse, producing over 3.7 million barrels per day (bpd) of crude, plus billions of cubic feet of natural gas.

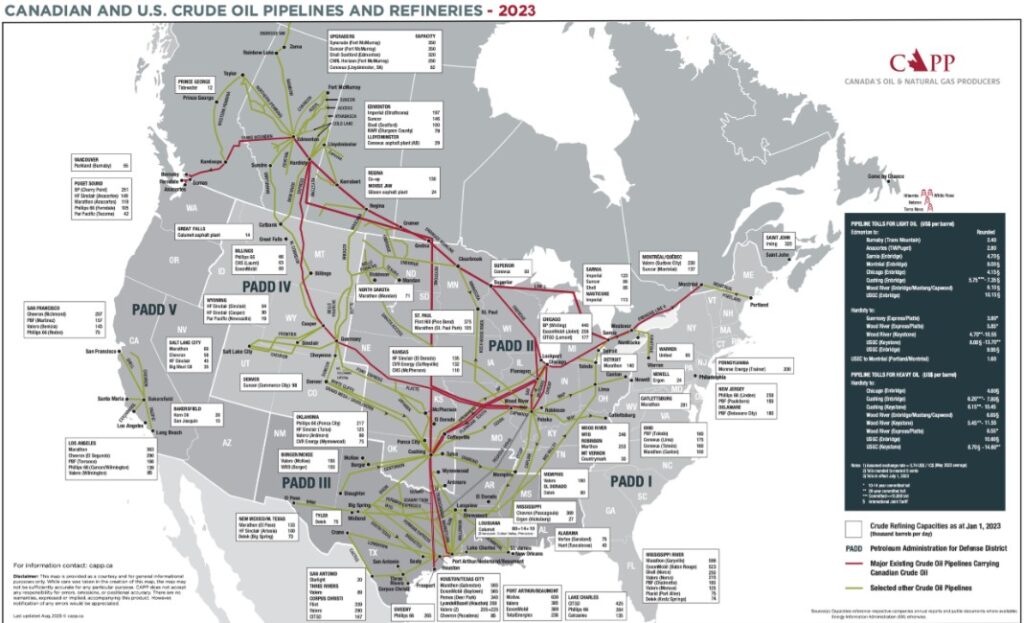

But getting it to market has been a bottleneck, with federal opposition to new pipelines forcing reliance on rail and trucks at times. The good news for independence advocates? The province’s export capacity is robust, clocking in at around 5.3 million bpd in design terms, though actual available capacity hovers near 4.7 million bpd after adjustments.

Key players include:Trans Mountain Pipeline (TMX): Expanded in 2024, this line runs from Edmonton to Vancouver, with a capacity of 890,000 bpd. It serves B.C., Washington State, California, and even Asian markets via marine terminals.

Long-term contracts lock in 708,000 bpd, providing steady egress to the Pacific.

Enbridge Mainline System: The workhorse, with over 3 million bpd capacity from Edmonton to the U.S. Midwest and beyond. It connects to refineries in Chicago, Patoka, and Cushing, Oklahoma.

Enbridge is eyeing a 150,000 bpd expansion, though the shelved Alberta project highlights ongoing risks.

Keystone Pipeline: Operated by TC Energy (formerly TransCanada), it carries up to 830,000 bpd from Hardisty, Alberta, to Steele City, Nebraska, feeding into U.S. Gulf Coast refineries.

Express and Platte Pipelines: Adding 280,000 bpd from Hardisty to the Rockies and Midwest.

Other Lines: Milk River (97,900 bpd) and Rangeland (20,000 bpd) provide additional southbound routes.

In total, Western Canada’s pipelines can move about 4.3 million bpd to external markets, with Alberta dominating the flow.

Independence wouldn’t magically add capacity, but it could streamline approvals for optimizations or small expansions without federal oversight. Natural gas infrastructure, including the Nova Gas Transmission system, similarly supports exports, primarily to the U.S.

Critics warn that as a landlocked nation, Alberta risks losing access to Canadian ports and pipelines transiting other provinces, potentially depressing prices and investment.

But with 80-90% of exports already heading south to the U.S., a tight trade deal could mitigate that.

Ditching Federal Taxes: A Revenue Windfall or Fiscal Fantasy?

Alberta’s energy sector is a cash cow, generating $21.9 billion in non-renewable resource revenue in 2025-26 alone, alongside $28.6 billion in taxes.

But the province is Canada’s biggest net contributor to federal coffers. From 2007-2022, Albertans paid $244.6 billion more in taxes and payments than they received in spending—five times more than B.C. or Ontario.

The oil and gas industry alone chipped in at least $53 billion from 2007-2019, representing 19% of Alberta’s net fiscal contribution.

In 2020, amid the pandemic, Alberta flipped to a net receiver for the first time in decades, pulling in $10.9 billion more than it paid—but that’s deficit-financed spending, not sustainable.

Independence would let Alberta pocket all this: no more $20-27 billion annual outflows to Ottawa.

Separatists like the Alberta Prosperity Project envision surpluses of $23-45 billion, enough to scrap income taxes, sales taxes, and GST.

With oil royalties at $14 per barrel in federal revenue contributions, and production humming, that’s real money.

Natural gas adds billions more. Free from federal carbon taxes (which hit the sector hard) and regulations, growth could accelerate—potentially to 10 million bpd in two decades.

But reality bites. Independence means assuming $71 billion in federal debt, higher borrowing costs, capital flight, and setup costs for new institutions like a currency or military.

Oil companies might bail, as seen in Quebec’s separation debates.

Post-oil cleanup? Hundreds of billions, with no federal bailout.

Trade barriers could widen differentials, hurting royalties. Economists like Trevor Tombe argue separation would shrink productivity via reduced interprovincial trade, leaving Alberta poorer overall.

macdonaldlaurier.ca

|

Revenue Source

|

2025-26 Forecast (Billion CAD)

|

Post-Independence Potential

|

|---|---|---|

|

Non-Renewable Resources (Oil/Gas)

|

15.4

|

Retained fully; potential growth without federal caps

|

|

Personal Income Tax

|

15.1

|

Could eliminate; attract talent/investment

|

|

Corporate Income Tax

|

7.0

|

Lower rates to compete globally

|

|

Other Taxes

|

6.5

|

Scrap GST/fuel taxes for domestic relief

|

|

Total

|

44.0

|

Surplus potential: $23-45B (per separatist estimates)

|

Data sourced from Alberta government forecasts; independence projections speculative.

Trade Deal with the U.S. or 51st State? Weighing the Options

As a sovereign nation, Alberta could negotiate directly with the U.S., leveraging its heavy sour crude—vital for Midwest refineries.

Pros: Full resource control, easier pipeline builds, and alignment with U.S. energy policies.

A gold/oil/Bitcoin-backed “Alberta Dollar” is even floated.

But cons loom: Landlocked status means begging for access through B.C. or Saskatchewan, prolonged negotiations with Canada/Indigenous nations, and no automatic USMCA entry.

Legal hurdles? Secession is virtually impossible under Canadian and international law without negotiation.

Statehood? It offers U.S. dollar stability, massive market access, and pro-energy regs—potentially boosting oil exports without federal interference.

Alberta would be the largest state by economy (second to California), with outsized influence.

Cultural fit with Texas is a plus, but polls show Albertans want to stay Canadian, not become American.

Downsides: Loss of sovereignty, U.S. taxes/regulations, and no guaranteed representation—could end up as a territory like Puerto Rico.

Trump-era tariffs or politics could backfire.

From an energy lens, a U.S. trade deal edges out statehood: It preserves autonomy while securing markets. But neither is a slam dunk—existing ties under USMCA already work well, and disruption could spike differentials or curtail production.

As one X user noted, separation might reduce egress, not expand it.

The Bottom Line: High Stakes for Energy Markets

Alberta’s independence push is a bold bet on energy self-reliance. With solid pipelines and revenue streams, it could emerge stronger, especially with U.S. alignment. But the risks—economic isolation, debt, and market access fights—could hobble the sector. For global energy markets, a split Alberta means potential supply shifts, price volatility, and a reconfiguration of North American trade. As “Snow Texans,” Albertans share Texas’s grit, but going solo might prove colder than expected. The 2026 referendum, if it happens, will be a watershed. Stay tuned—energy’s future hangs in the balance.

Stu Turley and Michael Tanner will be covering this story on the next Energy News Beat Stand-Up.

Sources: csis.org, albertaprosperityproject.com, policyoptions.irpp.org, macdonaldlaurier.ca, oilprice.com

Get your CEO on the podcast: https://sandstoneassetmgmt.com/media/

Is oil and gas right for your portfolio? https://sandstoneassetmgmt.com/invest-in-oil-and-gas/

Be the first to comment