In the global race toward a sustainable future, China stands out as a powerhouse in renewable energy deployment. With record-breaking installations of solar panels and wind turbines, the nation has positioned itself as a leader in the “clean energy” revolution. However, beneath this green facade lies a stark reality: China’s renewable sector is heavily reliant on fossil fuels like oil and coal—not just for energy supply, but for the very manufacturing processes that build these technologies. This dependency raises questions about the true sustainability of the transition, especially as global oil producers like OPEC highlight the intertwined nature of fossils and renewables. Meanwhile, in the United States, the incoming Trump administration is taking bold steps to revive coal, underscoring a broader recognition of fossil fuels’ enduring role in energy security.

The Fossil Fuel Backbone of Renewable Manufacturing

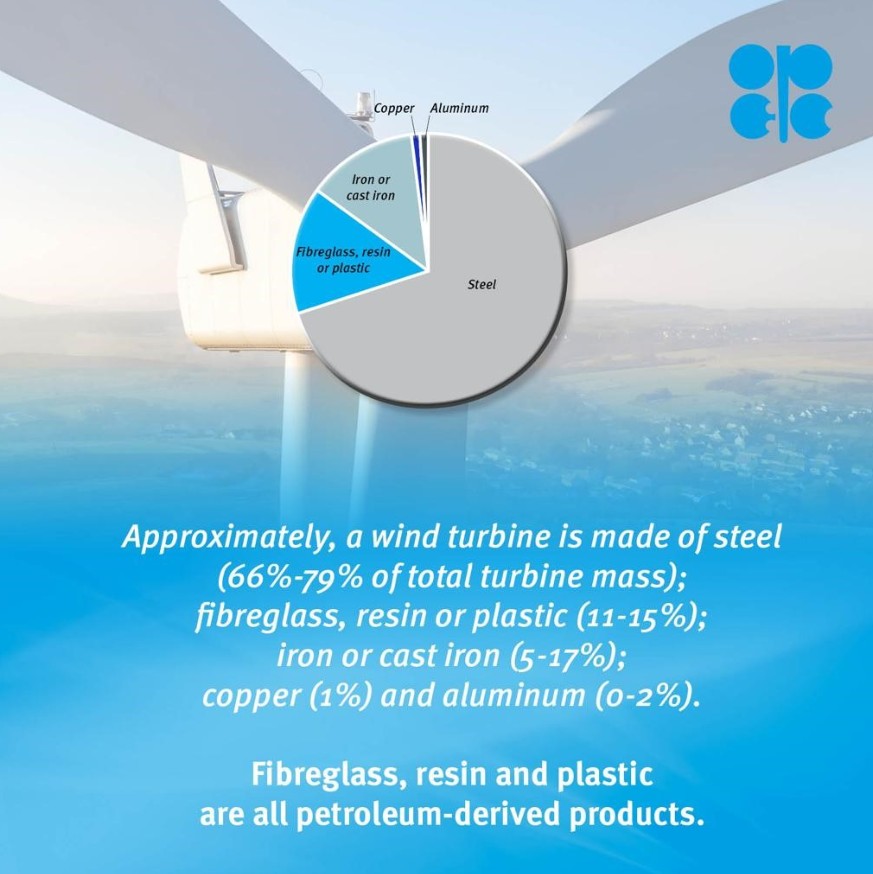

Producing wind turbines and solar panels is an energy-intensive endeavor that demands significant inputs from fossil fuels. According to insights from OPEC, oil products and other fossil fuels are integral to the fabrication of these components, from mining raw materials to processing and assembly.

For instance, the extraction and refinement of silicon for solar panels, or the steel and rare earth magnets for wind turbines, often rely on coal-powered electricity and oil-derived petrochemicals. OPEC’s World Oil Outlook emphasizes how economies of scale in manufacturing solar panels, wind turbines, and batteries have driven down costs, but this progress is underpinned by fossil energy sources.

OPEC Secretary General Haitham Al Ghais has been vocal on this point, stating that “the oil industry, renewables and EVs are not separate from each other. They do not work in silos.”

This perspective challenges the narrative of a clean break from fossils, as hydrocarbons remain essential feedstocks for materials in renewable tech. Without coal and oil, the supply chain for these “green” technologies would grind to a halt, illustrating how the clean energy machine is, in essence, powered by the very fuels it aims to displace.

China’s Energy Paradox: Green Growth Fueled by Black Gold

China’s clean energy investments hit a staggering 7.2 trillion yuan ($1 trillion) last year, representing over 11% of GDP and driving growth three times faster than the broader economy.

The “new three” sectors—solar, batteries, and electric vehicles—accounted for more than 90% of this investment surge. In terms of capacity, China installed 315 GW of solar and 119 GW of wind power, outpacing the rest of the world combined.

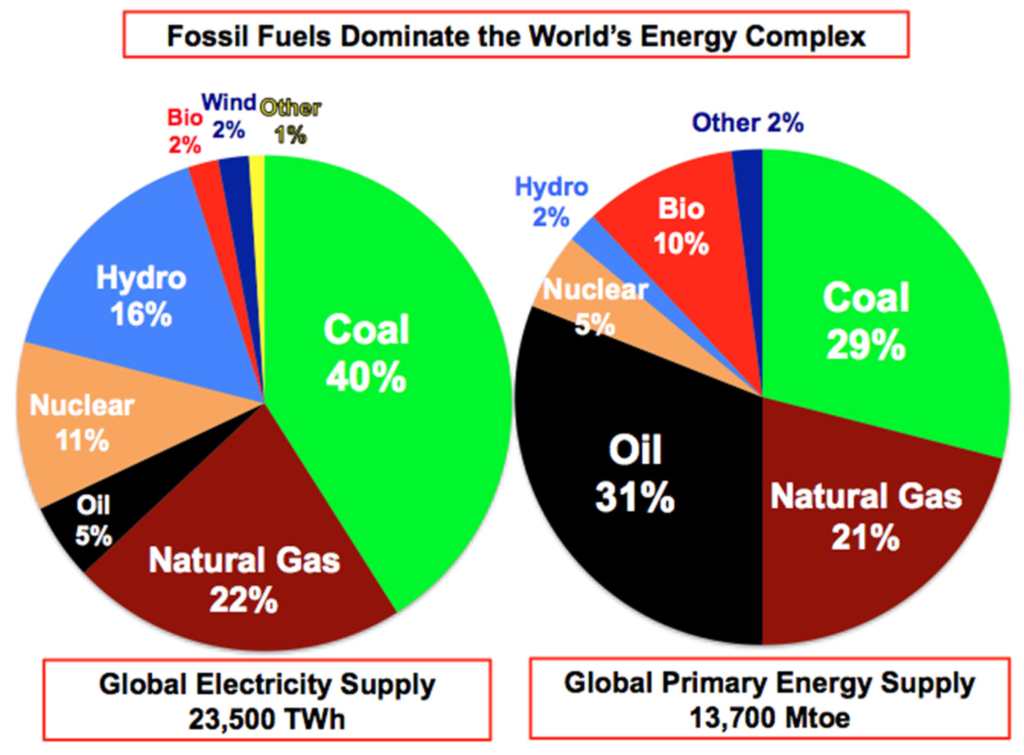

Yet, fossil fuels remain the bedrock of China’s energy system, supplying over 80% of primary energy and more than 60% of electricity.

Coal, in particular, is the linchpin, generating over 50% of electricity and comprising 60-70% of total primary energy consumption. China consumes more than 4 billion tons of coal annually—over half of global usage—with imports reaching a record 474 million tons in 2023.

Despite pledges from President Xi Jinping to “strictly control” coal expansion and “phase down” consumption, 2023 saw a rise in coal use, and 2024 marked a 10-year high in new coal-fired projects, with 94.5 GW initiated and 3.3 GW resumed.

Oil plays a crucial role too, making up about one-fifth of the energy mix and fueling transport and petrochemicals. Current consumption hovers at 16.3-16.4 million barrels per day (b/d), with projections for 2025 averaging 16.74 million b/d.

Imports account for 74% of this, or 11.1 million b/d, sourced primarily from Russia (over 2 million bpd via shadow fleets), Saudi Arabia, and Iraq.

Domestic production reached a record 4.3 million b/d in 2025, up from 3.8 million b/d in 2020, but the gap is filled by imports under the 2019-2025 “Seven-Year Action Plan” for energy security.

Natural gas acts as a “bridge fuel,” helping to curb coal’s environmental impact while balancing intermittent renewables. Consumption hit approximately 428 billion cubic meters (bcm) in 2024, up from 330 bcm in 2020.

As the world’s largest LNG importer, China is projected to import up to 76 million metric tons this year—a 10% increase following a 10% dip in 2025—from suppliers like Australia, Qatar, and Russia.

Adding to this, China’s dominance in rare earths—60-70% of mining and over 90% of processing—bolsters its clean energy manufacturing edge. Elements like neodymium and dysprosium are vital for wind turbine magnets, while yttrium enhances solar components.

This control ensures supply chain advantages but also ties back to energy-intensive, often coal-dependent mining processes.

U.S. Response: Trump’s Push to Revive Coal

Across the Pacific, the Trump administration is charting a course to bolster coal as a pillar of national security. President Trump plans to issue an executive order mandating the Pentagon to purchase electricity directly from coal-fired plants, invoking the Defense Production Act to prioritize coal for military needs.

This move aims to avert plant closures amid competition from cheaper natural gas and renewables, while delaying retirements and supporting the industry.

The policy’s rationale is rooted in energy independence and grid resilience, using federal procurement to inject demand into struggling coal operations.

It could benefit major producers like Peabody Energy, Arch Resources, and CONSOL Energy by stabilizing jobs in coal-reliant areas.

However, the sector faces headwinds: an aging workforce (with 80% of utility employees over 55 in some companies), a halving of mining jobs from 92,000 to 45,000, and projected production drops to 520 million short tons in 2026.

Coal’s electricity share is slated to fall to 16%, with some sites eyed for repurposing into data centers rather than sustained coal use.

This initiative highlights broader energy security concerns, such as reducing foreign dependency and addressing infrastructure bottlenecks like long lead times for power transformers.

In a world where renewables like those in China still lean on fossils, Trump’s strategy underscores the pragmatic need to keep coal “alive” for reliable power.

Conclusion: A Symbiotic Energy Future

China’s clean energy ascent is impressive, but its foundation on oil, coal, and gas reveals the complexities of the global transition. As OPEC notes, fossils are not adversaries to renewables but enablers.

The Trump administration’s coal revival efforts in the U.S. further emphasize that energy security demands a balanced approach, not a hasty abandonment of proven resources. For true sustainability, the world must acknowledge this interdependence and innovate ways to minimize environmental impacts while ensuring reliable supply. As the Energy News Beat continues to track these developments, one thing is clear: the path to green energy is paved with black coal and liquid gold.

Sources: oilprice.com, energynewsbeat.co, OPEC.com

Get your CEO on the podcast: https://sandstoneassetmgmt.com/media/

Is oil and gas right for your portfolio? https://sandstoneassetmgmt.com/invest-in-oil-and-gas/