European coal futures extended their rally for a fourth straight day on Monday, propelled by a Ukrainian drone strike on Russia’s key Black Sea coal export hub and fresh supply constraints from Indonesia, the world’s largest thermal coal shipper. The attack on the Taman seaport—handling over 1 million tons of coal monthly—has raised fears of near-term disruptions in Russian exports, injecting volatility into an already strained global market.

The Taman port, located in Russia’s Krasnodar region, was hit over the weekend, damaging oil storage tanks, warehouses, and terminals in the nearby Volna village. Fires raged into Sunday, injuring two people, though authorities reported them extinguished by Monday. While the port also moves oil products and grain, its coal role is critical for Russian shipments to Europe and beyond.

This geopolitical flashpoint comes as coal markets grapple with broader pressures: a projected 5% decline in global seaborne trade to 1.47 billion tons in 2025, the first back-to-back drops in over two decades.

Yet, supply shocks like this underscore coal’s enduring role as a bridge fuel amid energy security concerns.

The Global Coal Market: Exporters, Importers, and Shifting Dynamics

Coal remains a cornerstone of the global energy mix, powering ~35% of electricity worldwide despite decarbonization pushes. Seaborne trade hit a record 1.54 billion tons in 2024 but is set to contract amid softer demand in key Asian markets.Top Exporters (2024-2025 estimates, in million tons):Indonesia: 505-555 Mt (thermal coal dominant; Asia’s swing supplier).

Australia: 363 Mt (high-quality metallurgical and thermal; ~$45B revenue in 2025).

Russia: 198 Mt (75% to Asia; now vulnerable to Black Sea disruptions).

Others: South Africa (up slightly), Colombia (down 11 Mt), US (steady but smaller player).

Top Importers (2025 estimates, in million tons):China: 305-548 Mt (largest; down 12% YoY due to domestic output).

India: 157-237 Mt (steel-driven met coal growth; thermal imports flat).

Japan: 100-162 Mt (declining structurally).

South Korea, Vietnam: 76 Mt and 45-64 Mt (Vietnam up 4%).

Asia absorbs ~60% of imports, with China and India accounting for nearly half of thermal volumes. Europe’s demand is rebounding modestly on low renewables, but overall trade is tilting toward contraction as domestic production ramps in importers.

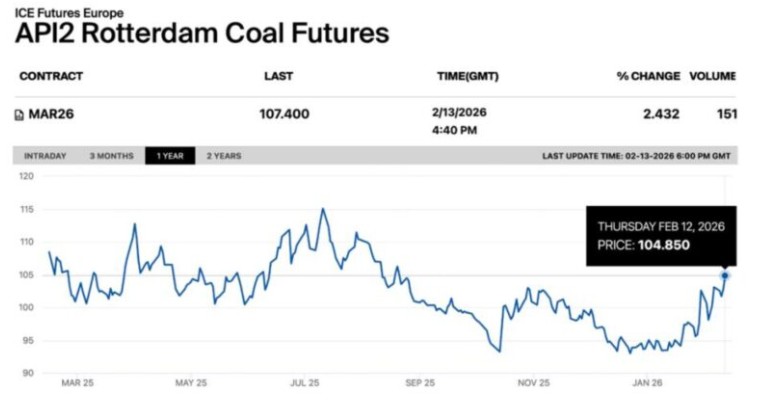

Prices reflect the tension: Rotterdam API2 futures hovered around $104-116/ton mid-February, up ~7% in a month, while Newcastle climbed to $116/ton.

The US Coal Sector: A Resilient Exporter in a Volatile World

The United States ranks as the world’s fourth-largest coal exporter, shipping ~104-108 million short tons (MMst) in 2025—down slightly from 2024’s ~108 MMst but supported by policy tailwinds under the Trump administration.

Exports averaged 22.3 MMst in Q3 2025, with full-year thermal coal volumes hitting multi-year highs through late 2024.

Key destinations: India (23%), China (12%), Japan (8%), Brazil (8%), Netherlands (7%). Ports like Norfolk, VA (41 MMst in 2024), Baltimore, and New Orleans dominate outflows.

|

Rank

|

Company

|

Production (MMst)

|

Focus

|

Key Strength

|

|---|---|---|---|---|

|

1

|

Peabody Energy (BTU)

|

95.8

|

Thermal & Met

|

Largest US producer; strong exports to Asia.

|

|

2

|

Core Natural Resources (Arch)

|

84.3

|

Met & Thermal

|

Metallurgical focus; export growth.

|

|

3

|

Navajo Transitional Energy

|

37.1

|

Thermal

|

Western operations.

|

|

4

|

Alliance Resource Partners (ARLP)

|

32.2

|

Thermal

|

Efficient, export-oriented.

|

|

5

|

Consol Energy (CEIX)

|

~26

|

High-BTU

|

Asia/Europe exports; robust infrastructure.

|

US output is projected at 530 MMst for 2025, up 3.4% YoY, buoyed by higher gas prices and policy support.

Investment Opportunities: US Coal Stocks Poised for Gains

Amid global disruptions, US producers with export exposure—especially metallurgical (met) coal for steel—stand out. Met coal demand is resilient, with global steel output up 1.2% in 2025.

Top Picks for 2026:Warrior Met Coal (HCC): Alabama-based met coal specialist; 100% exported. Low-cost longwall mines; Blue Creek expansion boosts volumes. Premium product suits Asian steelmakers. Stock up ~14% recently.

Peabody Energy (BTU): Diversified giant; thermal and met. Export focus to India/Asia; Zacks rank #3. Dividend yield ~1%.

Ramaco Resources (METC): High-quality met coal; growth via acquisitions. Benefits from steel demand.

Consol Energy (CEIX): High-BTU thermal; strong Asia exports. Stable amid volatility.

Alpha Metallurgical (AMR): Met coal pure-play; export upside.

These names trade at attractive valuations, with export margins insulated from domestic declines. Risks include China tariffs or oversupply, but strikes like Taman’s highlight upside from supply tightness.

Outlook: Geopolitics Meets Energy Reality

The Taman strike is a reminder: Coal’s “peak” is elusive. While trade contracts, events like this—coupled with Indonesia’s curbs—keep prices supported. For US firms, it’s a tailwind in a Trump-era energy push. Watch for Russian export reroutes and Q1 earnings from the majors. In a world hungry for reliable power, American coal’s global reach could shine brighter. We don’t give investment advice; we enjoy sharing what we have learned about market indices. As always, ask your CPA or certified professional and check back for updates.

Energy News Beat: Powering Informed Decisions.

Sources: bloomberg.com,reuters.com, thecoalhub.comspglobal.com, nasdaq.com, tradingeconomics.com

Be the first to comment