The explosive growth of artificial intelligence (AI) and cloud computing has ignited a datacenter boom across the United States, pushing the energy sector to innovate at breakneck speed. As tech giants like Google, Amazon, and Microsoft pour billions into massive facilities to handle the computational demands of AI, the power grid is being forced to adapt. This surge is driving rapid advancements in grid management and energy sourcing, but it also raises questions about sustainability, economic risks, and whether the hype could lead to a market bubble.

Hot Spots for Datacenter Development: A Nationwide Surge

Data Center construction is booming in key regions, with the U.S. leading the global charge. Northern Virginia remains the epicenter, hosting over 300 facilities and commanding nearly 4,000 MW of power capacity, thanks to its robust connectivity and low energy costs.

This area, often called “Data Center Alley” in Ashburn, accounts for a significant portion of the world’s datacenter infrastructure but is grappling with land shortages and power constraints.

Other hotspots include Dallas-Fort Worth, Texas, projected to see a staggering 355% capacity growth by requiring up to 4,396 MW—enough to power millions of homes.

Phoenix, Arizona; Atlanta, Georgia; and Chicago, Illinois, are also seeing rapid expansion, with primary market supply hitting a record 8,155 MW in the first half of 2025, up 43% year-over-year.

Emerging markets like Las Vegas, Nevada; Salt Lake City, Utah; Columbus, Ohio; and rural areas beyond Ashburn in Virginia are attracting investments due to available land and incentives.

A key factor in site selection is proximity to reliable energy sources, particularly natural gas. Texas stands out as a prime location, benefiting from its abundant natural gas reserves, which make it ideal for powering energy-hungry data centers.

Similarly, states like Oklahoma and Pennsylvania—major natural gas producers—are drawing developers.

Natural gas has emerged as the go-to fuel for new installations, with utilities advancing deals to connect datacenters directly to gas infrastructure amid power bottlenecks.

In regions like Virginia, coal- and gas-fired plants are being revived or expanded to meet demand, highlighting how fossil fuels are fueling the AI revolution.

Companies like Chevron are tapping natural gas to power datacenters, with new pipelines and plants coming online nationwide.

Power Grid Innovations: Adapting to the Strain

The data center surge is spurring innovation in the power grid. Utilities are revising rate structures to curb speculative projects, introducing longer contracts, ramp rates, and stricter credit requirements.

For instance, AEP Ohio’s new data center tariff adds nearly $10 million in first-year costs for a 100 MW facility, which has halved connection requests.

Developers are turning to behind-the-meter distributed generation, using smaller sub-100 MW units like aeroderivative turbines and fuel cells to bypass grid delays.

Production of these small-scale systems is expected to rise from 24 GW in 2024 to 27.4 GW by 2027.

In the PJM grid covering the Northeast, wholesale power prices have doubled in cities like Baltimore and Buffalo since 2020 due to datacenter demand.

These adaptations underscore America’s history of innovation in crises, turning challenges into opportunities.

Is the Demand Real? Occupancy vs. Forecasts

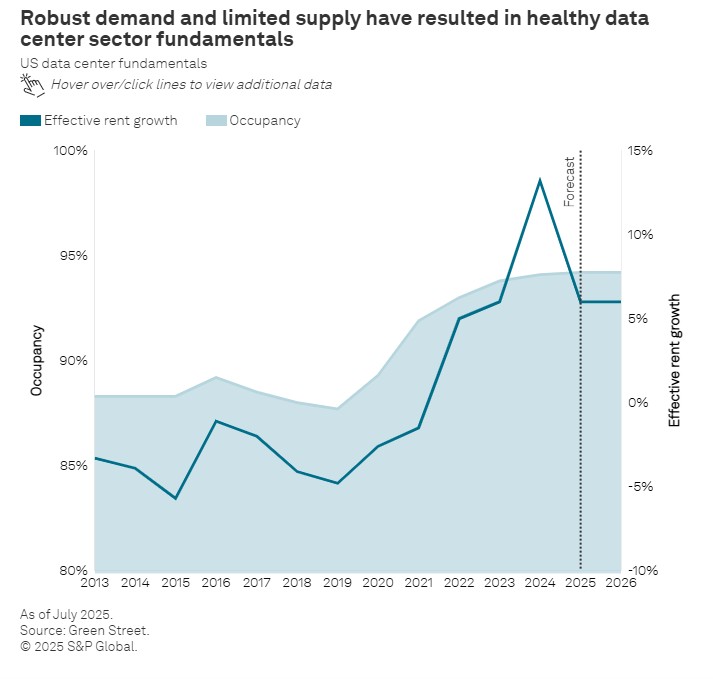

The demand for data centers appears robust, driven by AI’s early-stage transformation and the need for cloud computing, data storage, and enterprise applications.

Current occupancy rates are soaring, with major markets like Northern Virginia and Dallas-Fort Worth reporting colocation vacancy below 1%.

Effective rents are rising rapidly, and most projects are pre-leased or built to meet existing commitments.

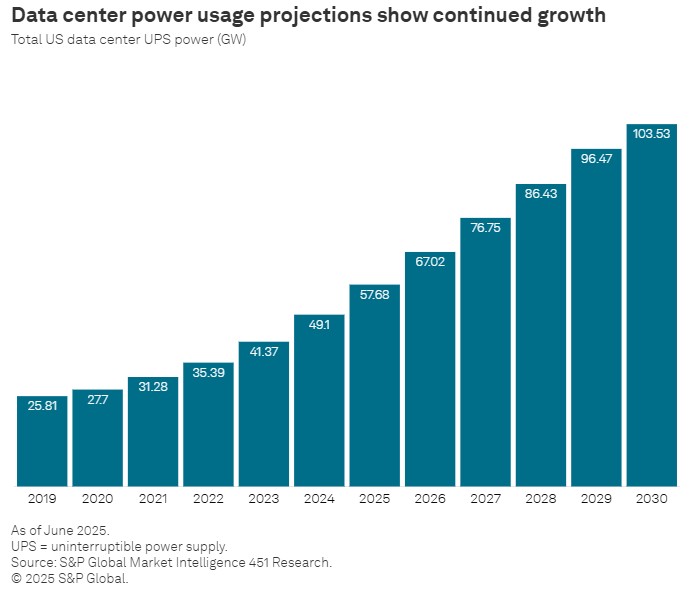

Forecasts paint an even brighter picture: Global data center capacity is projected to grow 15% annually, but demand is expected to outpace supply for years due to constraints like power availability and land scarcity.

AI-specific growth could hit 13-20% annually through 2030, with U.S. demand potentially adding 120 GW of peak summer load— a fivefold increase.

However, while market fundamentals are healthy now, slower AI adoption could disrupt this trajectory.

The Bubble Question: Risks if AI Underperforms

Optimism abounds, with investments totaling $450 billion over five years, including $300 billion in debt, and trillions more forecasted.

But what if AI promises fade?

Experts warn of a potential bubble, akin to the dot-com bust, where overbuilding leads to high vacancies and crashing valuations.

Tech companies are relying on debt for chips and infrastructure, with risks of defaults if revenues don’t materialize within 10 years.

If investors don’t see quick returns, aggressive financing and high leverage could backfire, especially for unprofitable firms.

Obsolescence from tech advancements, regulatory hurdles on sustainability, and concentrated tenant risks amplify the threat.

Some predict a “debt bomb” if AI pilots fail at rates as high as 95%.

While not imminent, the bubble could burst if AI growth stalls, leaving stranded assets.

Will Consumers Foot the Bill?

U.S. consumers are already feeling the pinch. Datacenter demand is driving up electricity rates, with wholesale prices near facilities rising up to 267% since 2020.

In Virginia, bills could increase 25%, while Texas expects a 70% demand surge, half from datacenters, pushing costs higher.

Utilities pass on construction and subsidy costs, leading to regional hikes.

Hyperscalers are seeking off-grid solutions, but overall grid strain and regulatory penalties for inefficiency could exacerbate rate increases.

While some argue new loads could lower rates in the medium term by spreading fixed costs, the short-term reality is higher bills for households.

In conclusion, the data center boom is a double-edged sword: fostering grid innovation and economic growth while teetering on the edge of overinvestment. As AI evolves, stakeholders must balance ambition with caution to avoid a costly bust.

Sources: spglobal.com, seekingalpha.com, builtin.com, noahpinion.blog, jll.com, utilitydive.com

Want to get your story in front of our massive audience? Get a media Kit Here. Please help us help you grow your business in Energy.