In an era where trillions of dollars have poured into wind and solar energy projects worldwide, one might expect coal to fade into obscurity. Yet, the International Energy Agency’s (IEA) latest Coal 2025 report paints a different picture: coal remains a stubborn cornerstone of global energy systems, essential for reliability and security even as renewables surge ahead.

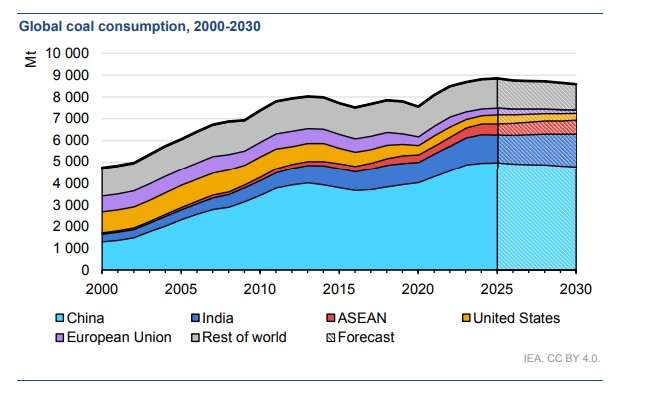

Global coal demand is set to hit a record 8.85 billion tonnes in 2025 before a modest decline to 8.58 billion tonnes by 2030, underscoring that the transition away from fossil fuels is far from complete.

Key Insights from the IEA Coal 2025 Report

The IEA report highlights several critical trends shaping coal’s trajectory. Demand plateaued in 2024 at 8.81 billion tonnes and is projected to edge up slightly in 2025, driven largely by offsets in regions like the United States, where a 37 million tonne increase counters declines in powerhouses such as China and India.

By 2030, overall demand dips by about 3%, but this masks stark regional contrasts. Asia continues to fuel growth—China’s demand stabilizes around 4.95 billion tonnes in 2025, while India’s rises at 3% annually to 1.52 billion tonnes by 2030, and ASEAN countries expand by over 4% per year.

In contrast, developed economies like the EU and US see sharp drops, with US demand falling 6% annually on average through 2030.

Why does coal endure despite enormous renewable investments? The report points to its role in energy security and system flexibility. Renewables like wind and solar are variable, influenced by weather—weak hydro or wind performance can displace up to 248 million tonnes of coal equivalent in backup needs.

In China, coal-fired plants are retrofitted for low-load operations to backstop renewables, with capacity reaching 1,400 GW by 2030. India relies on coal for baseload amid industrial growth, and in the US, policies like emergency powers and $625 million in funding extend plant lifespans to meet rising demand from data centers and electrification.

Non-power uses, such as coal-to-chemicals in Asia, also keep demand resilient, growing by nearly 50 million tonnes by 2030.

Coal’s persistence extends to trade and production. Global trade peaks at 1.54 billion tonnes in 2024 before dropping 5% in 2025, with Asia dominating imports.

Production follows suit, with US output at 473 million tonnes in 2025, declining to 386 million tonnes by 2030.

Yet, unabated coal—without carbon capture—remains the norm, contributing over 40% of energy-related CO₂ emissions in 2024.

What This Means for the Energy Sector

The IEA’s findings signal a nuanced energy future. While renewables are projected to drive most electricity growth—pushing global output to 38,000 TWh by 2030 and slashing coal’s share from 35% to 27%—coal’s decline is gradual.

This has profound implications:Energy Security First: Coal acts as a hedge against renewables’ intermittency and supply chain vulnerabilities. In tight markets, like the EU’s brief lignite rebound in early 2025 due to low wind and hydro, coal ensures grid stability.

For the US, this means prolonged reliance amid AI-driven power demands, potentially boosting domestic production.

Regional Shifts: The “eastward shift” concentrates coal in Asia, where policy support (e.g., India’s $1 billion for gasification) sustains it for industry and power.

Developed nations accelerate phase-outs, but global emissions linger without widespread carbon capture (currently just 10 Mtpa for coal).

Investment Opportunities: With coal trade revenues at $140 billion in 2025 and met coal (for steel) holding steady, the sector offers resilience.

However, risks abound: LNG gluts could displace coal in some regions, and stricter emissions policies loom.

Overall, the report underscores that trillions in renewables haven’t eliminated coal’s utility—it’s evolving from baseload to flexibility provider, buying time for a fuller transition.

US Coal Companies Investors Should Watch

For investors eyeing the US coal rebound—projected at 8% in power generation for 2025—focus on leading producers.

Based on market data, here are the top five US coal companies, ranked by prominence in production and market cap.

We’ve analyzed their latest Q3 2025 earnings to gauge performance amid these trends.

|

Company

|

Ticker

|

Key Business

|

Q3 2025 Earnings Highlights

|

|---|---|---|---|

|

Peabody Energy

|

BTU

|

Largest US coal producer, focusing on thermal and met coal

|

Reported a GAAP net loss of $70.1 million, driven by $54 million in costs, but beat revenue estimates by 4.17% with an earnings surprise of -205.26%. Challenges from operational expenses offset strong demand signals. |

|

Core Natural Resources

|

CNR

|

Merged entity of Arch Resources and CONSOL Energy, specializing in thermal and met coal

|

Generated $87.9 million in net cash from operations and $38.9 million in free cash flow; EPS of $0.61 beat estimates by 156.48%. Post-merger synergies position it well for export markets. |

|

Alliance Resource Partners

|

ARLP

|

Diversified coal and royalties, with oil & gas exposure

|

Revenue of $571.4 million, net income of $95.1 million, and Adjusted EBITDA of $185.8 million—up 4.4% sequentially despite lower year-over-year prices. Declared $0.60/unit distribution, signaling stability. |

|

Warrior Met Coal

|

HCC

|

Premium met coal for steelmaking

|

Adjusted EBITDA of $71 million (up 32% QoQ) on record sales volumes; revenues at $239.5 million, up from $231.6 million prior year. Strong export demand bolsters outlook. |

|

Alpha Metallurgical Resources

|

AMR

|

High-quality met coal exporter

|

Net loss of $5.5 million but Adjusted EBITDA of $41.7 million; liquidity at $568.5 million supports resilience in volatile met coal markets. prnewswire.com

Domestic prices at $152.25/ton highlight premium positioning. |

These companies benefit from US coal’s short-term uptick, but long-term investors should monitor regulatory risks and the global shift east. As the IEA notes, coal’s story is one of endurance, not extinction—making it a contrarian play in the energy transition. As you have heard Stu Turley say on the Energy News Beat Channel, “We are not in an Energy Transition, we are in an Energy Addition,” and coal will be here to stay for the next several decades until technology changes. Clean coal is a term that should be reevaluated, and accepted as coal is one of the best energy sources on the planet, as we try to make energy affordable and available to everyone. We have to take care of the environment along the way, but do so through science, not emotion.

Future Coal organization is a great resource, and they have posted some great information on the report:

The findings reinforce the reality that coal remains a critical pillar of energy security, industrial competitiveness, and economic development. At a time of increasing volatility and strain across global energy systems, the report underscores the need for pragmatic, inclusive energy policies that recognise coal’s continued role alongside efforts to reduce emissions and advance climate objectives.

Key findings from the report include:

- Global coal demand is forecast to increase by 0.5% in 2025, reaching a record 8.85 billion tonnes.

- Global coal production is expected to hit a new all-time high of 9.11 billion tonnes in 2025, surpassing the 2024 record.

- Total global electricity generation is projected to rise from approximately 31,100 TWh in 2024 to around 32,200 TWh in 2025, representing an increase of about 3.5% year on year.

“These findings confirm what energy systems around the world are now confronting openly,” said Michelle Manook, Chief Executive of FutureCoal. “Coal remains essential to keeping the lights on, industries operating, and economies stable. After years of being sidelined for political reasons, energy security, affordability, and reliability are firmly back on the table.”

Regionally, coal demand growth reflects the choices of developing and emerging economies that are prioritising industrialisation, population growth, and energy security, often with greater strategic realism than is currently evident in current European policymaking.

The IEA emphasises that India’s coal consumption is poised for the most significant growth worldwide through 2030, with demand expected to increase by approximately 3% annually, adding over 200 million tonnes (Mt). Southeast Asia is projected to see the fastest global growth, with coal demand rising by more than 4% each year amid expanding manufacturing and electricity needs. China remains central, representing over half of global coal consumption, with demand highly dependent on electricity growth, renewable adoption, and investments in coal gasification and advanced coal technologies.

This reassessment extends beyond emerging economies. In the United States, coal demand is set to increase by 8% in 2025, driven by higher gas prices, slower plant retirements and a US$625 million commitment by the Department of Energy to modernise the coal fleet, reflecting coal’s vital role in energy security and industrial strength.

“Across the developing world, coal has never been ideological; it has been about delivering power, supporting jobs and enabling economic growth,” said Mike Teke, Chairman of FutureCoal and CEO of Seriti Resources Group. “What we are now seeing is advanced economies beginning to confront the same reality — that reliable and affordable energy cannot be delivered without firm generation alongside renewables. A balanced energy mix underpins resilience, development and credible climate outcomes, in line with the Paris Agreement’s original intent.”

The global financial system is adjusting to these realities. Over the past year, net-zero finance alliances have dissolved or been paused as investors acknowledge the limitations of exclusionary strategies, with capital increasingly allocated to performance-driven investments focused on reliability, affordability, and measurable outcomes.

FutureCoal’s Sustainable Coal Stewardship (SCS) framework provides a practical pathway for this transition, emphasising proven and emerging technologies across the coal value chain that can reduce emissions by up to 99% while boosting the economic value derived from each tonne of coal. These include high-efficiency, low-emissions power/heat generation, carbon capture and storage, coal-to-liquids innovations, chemicals, waste reuse, and the extraction of critical minerals from coal.

“The question for policymakers and investors is no longer when coal will be phased out, but whether it will be modernised responsibly,” said Ms Manook. “Sustainable Coal Stewardship aligns energy security, emissions reduction and economic development. The world is moving in this direction, and those who fail to adapt risk being left behind.”

We are in 100% agreement with Michelle Manook, and will reach out to have her on the Energy News Beat Podcast. The numbers from the IEA do not math up as Stu Turley would say. He has pointed out that even in California’s energy mix, coal use was still high because of the industry, cement, and other uses. While they show a decline, at least they are not saying that renewables will support the global grid in 5 years without coal, natural gas, and oil.