In a surprising turn of events amid ongoing geopolitical tensions, ExxonMobil has taken a bold step toward reclaiming billions in losses from its forced exit from Russia’s Sakhalin-1 oil project. According to recent reports, the U.S. energy giant signed a non-binding agreement with Russia’s state-owned Rosneft in late August or early September 2025, paving the way for discussions on recovering the $4.6 billion write-down it incurred back in 2022.

This move comes as ExxonMobil continues to grapple with the fallout from Russia’s invasion of Ukraine, which prompted Western sanctions and the company’s abrupt departure from one of its key international ventures.

The Sakhalin-1 Saga: A Costly Exit

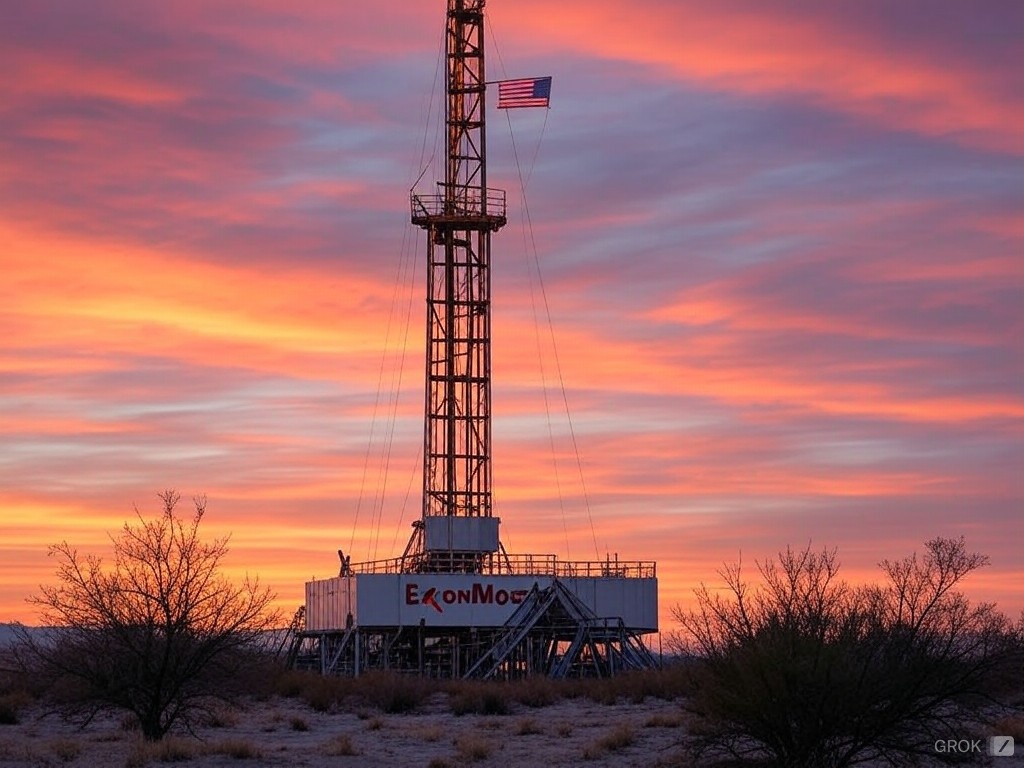

To recap, ExxonMobil held a 30% operating stake in the Sakhalin-1 project, a massive oil and gas development off Russia’s Far East coast. Pre-war production hovered around 220,000 barrels per day, contributing significantly to global energy supplies.

However, following Moscow’s military actions in Ukraine in February 2022, Exxon declared force majeure, halted new investments, and ultimately exited the project. The decision led to a staggering $4.6 billion impairment charge and the loss of access to approximately 150 million barrels of proven reserves.

Russia didn’t take this lying down. Moscow expropriated Western stakes in Sakhalin-1, transferring them to a new domestic entity and effectively sidelining foreign operators. Production plummeted in the aftermath but has since been restored under Russian management. For Exxon, the exit wasn’t just a financial hit—it symbolized the broader rupture in energy ties between the West and Russia, fueled by sanctions that targeted entities like Rosneft and its CEO, Igor Sechin.

Now, three years later, Exxon CEO Darren Woods has confirmed ongoing talks with Russian officials, emphasizing that the focus is strictly on recouping losses from the expropriated assets.

Woods has been clear: “We have no plans to re-enter Russia.”

Yet, the non-binding pact with Rosneft represents the first concrete framework for negotiations, signaling Exxon’s determination to claw back its stranded billions.

Rosneft, for its part, has denied signing any cooperation deal but hasn’t commented directly on the preliminary agreement.

A Broader Geopolitical Shift?

This development doesn’t exist in a vacuum. Russian President Vladimir Putin has recently shown openness to foreign investors reclaiming stakes in Sakhalin-1. In August 2025, Putin signed a decree that could allow companies like Exxon to regain their shares, extending a previous sales window into 2026.

The Sakhalin region’s governor has even publicly stated that Exxon’s return would be “beneficial” for Russia, highlighting the project’s importance to local energy infrastructure.

But here’s where it gets intriguing for those of us at Energy News Beat: Could this be the first crack in the ice leading to a resolution in the Ukraine conflict? For years, we’ve argued that the path to peace doesn’t run through endless military aid or sanctions alone—it’s through pragmatic business deals that give Putin a stake in stability. The ongoing war has drained resources on all sides, with energy markets caught in the crossfire. Exxon’s overture, timed amid reports of U.S.-Russian discussions on economic cooperation tied to a potential Ukraine peace framework, feels like a calculated probe.

Recall the August 2025 meeting between President Trump and Putin in Alaska—no major breakthroughs, but whispers of backchannel talks on energy projects like Sakhalin-1 as olive branches.

If Exxon can navigate the sanctions maze and secure compensation, it might normalize limited economic engagement, pulling Putin toward negotiations. After all, Russia’s economy relies heavily on energy exports, and reintegrating Western expertise could boost output without conceding ground militarily.

Skeptics point out the hurdles: U.S. sanctions remain in place, and Exxon’s stated goal is recovery, not re-entry.

Yet, history shows that business often precedes diplomacy. Think of how energy deals thawed U.S.-China relations in the 1970s or stabilized post-Cold War Europe. If this sparks a chain of similar agreements—perhaps involving other majors like Shell or TotalEnergies—it could pressure both sides to de-escalate.

What’s Next for Energy Markets?

For investors and energy watchers, Exxon’s move underscores the enduring allure of Russian reserves despite the risks. Global oil demand isn’t slowing, and Sakhalin-1’s potential remains untapped under full Western operation. Shares in Exxon rose modestly on the news, reflecting market optimism about asset recovery.

At Energy News Beat, we’re watching closely. If business can indeed bridge the divide where politics has failed, this could mark the beginning of the end for the Ukraine stalemate. Putin has long signaled that economic incentives are key to talks—Exxon might just be the catalyst. Stay tuned as we track developments in this high-stakes energy chess game.

Investing in U.S. oil and gas companies does not seem like a bad idea. Also, President Putin would be money ahead to pay ExxonMobil back damages, and plans on having help from the United States as Energy as a Service. Russia has a limited amount of capacity, but it is increasing its oil and gas production. So if they paid ExxonMobil payments over time, they could cashflow the improvement and get U.S. oil and gas producers to increase Russian oil and gas production.

Avoid Paying Taxes in 2025

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack