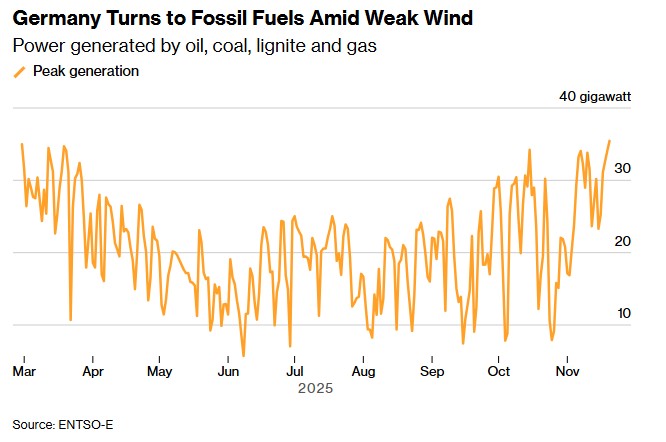

In the chill of late 2025, Germany is grappling with a stark reminder of its energy vulnerabilities. Power prices have surged amid a spike in fossil fuel generation, reaching the highest levels in nearly nine months due to cold weather and subdued wind output.

This development underscores the nation’s ongoing struggle to balance ambitious climate goals with reliable energy supply, as natural gas consumption climbs and the broader energy mix shifts in unexpected ways.

Germany’s Evolving Energy Mix in 2025

Germany’s energy landscape in 2025 reflects a mix of progress and setbacks. Renewable sources supplied nearly half (46.9%) of the country’s electricity in the first quarter, but overall low-carbon generation has dipped, accounting for around 57% in recent data—still above the global average but signaling a reversal in the energy transition.

The electricity generation breakdown includes approximately 26% from wind, 21% from coal, and 17% from solar, with low-carbon output having peaked back in 2019.

Primary energy consumption rose slightly by about 2.3% in the first half of the year, driven by colder temperatures, reaching levels that have pushed emissions higher despite ongoing decarbonization efforts.

Fossil fuels still dominate, comprising over 77% of primary energy, with natural gas and oil seeing modest increases in share to 25% and 38.1%, respectively.

This year has seen clean energy sources generate the smallest share of electricity in over a decade during the early months, highlighting how weather-dependent renewables can strain the grid when conditions falter.

Net Zero Policies and the Path to Deindustrialization

Germany’s pursuit of net zero emissions by 2045—five years ahead of most wealthy nations—has been both a beacon of ambition and a source of economic friction.

The Energiewende, the country’s flagship energy transition policy, has accelerated renewable deployment but at a cost. Critics argue that aggressive decarbonization measures, including phasing out nuclear power and imposing strict emissions limits, have contributed to deindustrialization by driving up energy costs and eroding competitiveness.

High electricity prices, now averaging just under $100/MWh in the first half of 2025 (a 37% increase year-over-year), have squeezed energy-intensive industries like chemicals and steel, leading to plant closures and relocations abroad.

The government’s recent move to cap power prices at €0.05 per kWh for heavy industry starting in 2026 aims to stem the tide, but it comes amid warnings that “deindustrialization” could devastate the economy if not managed carefully.

Policy inconsistencies under the new coalition risk further derailing climate targets, with emissions reductions projected to fall short without bolder action.

Surging Reliance on Natural Gas

As renewables falter in adverse weather, natural gas has become a critical crutch for Germany’s energy security. Consumption rose by 3.7% in the first half of 2025, fueled by higher demand for heating and power generation.

This uptick, coupled with soaring global gas prices—tripling generation costs to €150/MWh in some periods—has directly contributed to the electricity price spike across Europe.

Industrial gas use remains elevated at around 514 TWh, representing 61% of total consumption, even as overall imports dipped 11% in 2024.

Germany has pivoted from Russian piped gas to liquefied natural gas (LNG) imports, a strategic shift accelerated by geopolitical tensions.

Key suppliers in 2025 include Norway (48% of imports via pipeline), the Netherlands (25%), and the United States (nearly half of LNG volumes).

Total imports hit 309,049 terajoules in October, underscoring continued dependence on foreign sources despite efforts to diversify.

For the EU as a whole, Norway remains the top provider of gaseous natural gas.

Coal Use: A Declining but Persistent Player

Contrary to Germany’s coal phase-out ambitions, usage has shown mixed trends in 2025. Overall consumption declined, with hard coal down 2.6% and lignite (brown coal) dropping 3.8%, continuing a long-term retreat.

However, coal-fired power generation surged 11% in the first half, and inputs rose 23% to compensate for low renewable output.

By June, though, coal hit an all-time low amid record renewable highs, suggesting seasonal variability rather than a reversal.

Coal still holds a 21% share in the electricity mix, but projections indicate further reductions as renewables expand.

Wind Generation: Expansion Amid Challenges

Wind power, a cornerstone of Germany’s renewables push, has faced headwinds in 2025. Slow wind speeds reduced the renewable share to 54.5% in the first half, down 2.7 percentage points year-over-year.

Despite this, onshore wind expansion accelerated, with 409 new turbines (2,202 MW) commissioned in the first six months—the strongest growth since 2017.

Total onshore capacity stands at 63,461 MW from 28,766 turbines, with offshore adding to a national total of 72.75 GW.

Recent completions mark a record in construction, but inconsistent winds have highlighted the need for storage and grid upgrades to stabilize output.

Wind contributed 26% to electricity generation, yet experts call for faster deployment of proven technologies like wind and solar to meet net zero goals.

Economic Outlook in 2025 and Bankruptcy Trends

Germany’s economy is limping through 2025, with growth forecasts hovering between 0.2% and 0.4%, signaling stagnation amid high energy costs, weak exports, and geopolitical uncertainty.

The outlook remains sluggish into 2026, with employment growing modestly at 0.5% and unemployment stable.

Competitiveness has eroded, and government investment stalls have compounded the issues.

Corporate bankruptcies have soared, reflecting the toll of economic pressures. In 2024, insolvencies rose 23.1% to 21,964 cases, the highest since the financial crisis.

This followed around 17,840 in 2023 (calculated from the percentage increase). In the first half of 2025 alone, 11,900 companies filed, a ten-year high, with projections for a further 10% rise to about 24,300 by year-end.

Over the last two years (2023-2024), approximately 39,804 firms went bankrupt, with 2025 adding thousands more amid rising costs in sectors like automotive suppliers.

As Germany navigates these challenges, the surge in power prices serves as a cautionary tale: achieving energy security and climate ambitions requires not just policy ambition, but resilient infrastructure and economic safeguards.

Got Questions on investing in oil and gas?

If you would like to advertise on Energy News Beat, we offer ad programs starting at $500 per month, and we use a program that gets around ad blockers. When you go to Energynewsbeat.co on your phone, or even on Brave, our ads are still seen. The traffic ranges from 50K to 210K daily visitors, and 5 to 7K or more pull the RSS feeds daily.