As Europe grapples with the aftermath of its coldest winter since the 2022 energy crisis, Germany’s natural gas storage situation is raising alarms. A recent post by energy analyst Tracy Shuchart (@chigrl) highlights the challenges ahead, noting that storage levels are critically low and operators are facing profitability issues.

With refill season approaching in the spring and summer, the lack of economic incentives could leave the country vulnerable to shortages by next fall. Let’s dive into the numbers, verify the claims, and explore potential outcomes if storage isn’t replenished or more facilities close.

Current Storage Levels: A Verified Low Point

Germany’s gas storage facilities, the largest in Europe, are currently sitting at just over 26% capacity. Data from the Gas Infrastructure Europe (GIE) Aggregated Gas Storage Inventory (AGSI) confirms this figure: as of February 10, 2026, levels stood at 26.21%, with 65.83 TWh of gas in stock.

This is well below the seasonal average, driven by heavy withdrawals amid cold weather and reduced hydropower due to low snow cover in key regions.

For context, at the start of 2026, levels were around 57%, but they’ve plummeted due to increased demand.

Recent X posts echo this, with one automated update reporting 26.23% for the February 9-10 period.

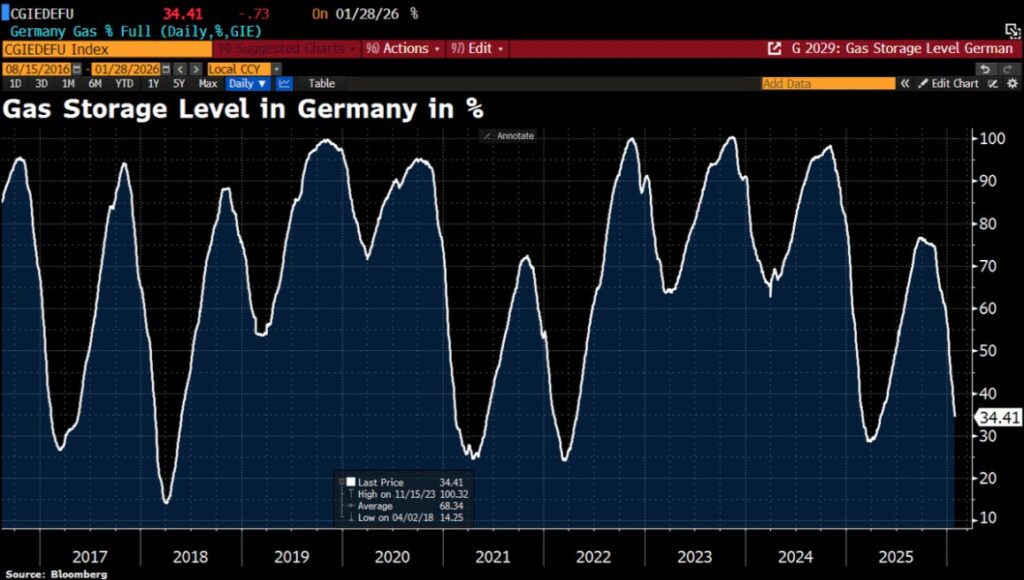

To illustrate the downward trend:

This chart shows Germany’s storage levels over recent years, highlighting the unusually low position in early 2026 compared to historical norms.

The Closure Threat: Two Facilities on the Brink

The post mentions two German gas storage operators planning to shut down facilities due to waning profitability: Uniper SE’s Breitbrunn and Bayernugs GmbH’s Wolfersberg.

Verification from multiple sources confirms these plans. Uniper applied for decommissioning Breitbrunn (11.5 TWh capacity) in October 2025, aiming for closure by March 31, 2027, after failing to sell capacity effectively.

Similarly, Bayernugs announced intentions to close Wolfersberg (4.1 TWh capacity) in late 2025, citing zero capacity sales over the past year.

These sites represent about 6% of Germany’s total storage capacity (roughly 250 TWh). While the German economy ministry states that Breitbrunn’s closure wouldn’t jeopardize supply, losing them could reduce flexibility, especially for slower-cycling storage that provides long-term buffering.

|

Facility

|

Operator

|

Capacity (TWh)

|

Churn Rate

|

Status

|

|---|---|---|---|---|

|

Breitbrunn

|

Uniper SE

|

11.5

|

1.48

|

Application for closure by 2027 pending

|

|

Wolfersberg

|

Bayernugs GmbH

|

4.1

|

2.36

|

Intention to close announced; no sales in recent years

|

Refill Challenges: Economic Hurdles Ahead

The upcoming injection season (typically April to October) looks particularly tough. As Torsten Frank, managing director of Trading Hub Europe, explained, summer gas prices are high while winter 2026/27 prices remain flat, eliminating the profit margin for storing gas.

This “bad spread” discourages operators from refilling, as noted in recent analyses.

Without incentives, storage could enter the next winter underfilled, exacerbating vulnerabilities.

Broader factors compound this: Europe’s low snow cover has boosted gas use for power generation, tightening supplies further.

Natural gas prices have already risen in 2026, averaging 34 euros per MWh compared to 27 euros in late 2025.

Predictions: A Potential Crunch Next Fall and Winter

If Germany fails to refill storage adequately or sees more closures, the impacts could be severe by fall 2026, when withdrawal season begins. Analysts predict:Supply Shortages and Price Spikes: Low storage could lead to a supply gap, with prices potentially reaching two-year highs as seen in early 2025.

In worst-case scenarios, tightness might persist until 2027, with reliance on LNG imports from the US and elsewhere driving costs up.

Energy Security Risks: The EU is prepared for the current winter, but future ones depend on summer storage.

Germany is pushing to replace expiring EU storage targets post-2027 with national strategic reserves, signaling long-term concerns.

Economic and Social Impacts: A repeat of the 2022 crisis could mean rolling blackouts, industrial curtailments, and higher inflation.

One X commenter speculated on blackouts akin to those in developing nations.

Studies warn of unviable projections for supply security in the mid-term, with potential gaps in 28 of 30 scenarios through 2030.

However, mitigation is possible through increased LNG diversification, demand reduction, and policy tweaks. The EU’s growing dependence on US imports offers a buffer, but weather and global demand spikes remain wild cards.

In summary, while the numbers in Shuchart’s post check out, the bigger picture is one of caution. Germany must incentivize refills and prevent further closures to avoid a significant energy crunch next winter. As one analyst put it, the market is signaling trouble ahead—ignoring it could prove costly.

One thing is certain: businesses and manufacturing will not survive in the EU or Germany with their prolonged war on natural gas.

Source: Bloomberg, agsi.gie.eu, @gasinfo_bot on X, reuters.com, @chigrl on X, argusmedia.com

Get your CEO on the podcast: https://sandstoneassetmgmt.com/media/

Is oil and gas right for your portfolio? https://sandstoneassetmgmt.com/invest-in-oil-and-gas/