By Wolf Richter for WOLF STREET.

The sharply falling prices since mid-2022 of energy such as gasoline, and durable goods, such as motor vehicles, had contributed a lot to the cooling of inflation measures. But prices cannot fall forever – they can rise forever, but they cannot fall forever, and they stopped falling. And on top of it, services inflation has gotten stuck in mid-2024 at too high levels.

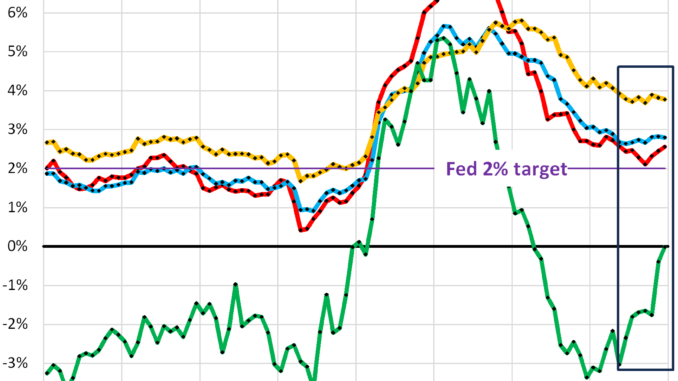

As a result, overall inflation indices, including the PCE price index released by the Bureau of Economic Analysis today, have started accelerating again on a year-over-year basis. The driver of inflation has been and still is in “core” services, which, at 3.8% year-over-year for the core services PCE price index, remains substantially higher than before the pandemic (yellow in the chart below).

In a broader sense, there hasn’t been any progress on inflation since May (black box in the chart below), with the Fed’s favored inflation measures well above its 2% target, confirming the Fed’s pivot this week to a wait-and-see strategy.

The PCE price index accelerated for the third month in a row, to 2.6% year-over-year in December, the worst increase since May 2024 (red in the chart above). The Fed’s target for this measure is 2%.

The “core” PCE price index, which excludes the volatile prices of food and energy products, remained at 2.8% for the third month in a row, and these three months have been the highest since April (red in the chart below). The Fed’s target for this measure is 2%.

The “core services” PCE price index has gotten stuck at around 3.8% with only minor fluctuations for the seventh month in a row (yellow in the chart above).

This year-over-year rate in the core services index is between 35% and 70% higher than before the pandemic (ranged between 2.2% and 2.8%).

As we’ll see in a moment, on a six-month basis, which reacts faster but is more volatile, there has been no progress at all for 12 months.

Core services are about 65% of consumer spending and include housing costs, insurance of all kinds, health care, education, subscriptions, transportation, broadband, personal care services, financial services, food services & accommodation, etc.

The durable goods PCE price index has ended its historic plunge, and on a year-over-year basis, the index is at the 0% line, meaning no change year-over-year (green in the chart above). In late 2023 and early in 2024, the big negative readings of about -3% contributed a lot to cooling the PCE price index as well as the core PCE Price index.

The durable goods category is dominated by new and used vehicles, which have seen huge price spikes in 2021 and 2022. Used vehicle prices then plunged through mid-2024, but in recent months started rising again. New vehicle prices have been sticky at very high levels and have barely come down. Durable goods also include appliances, furniture, computers, cellphones, other consumer electronics, sporting goods, such as bicycles, etc.

Month-to-month and six-month.

The PCE price index accelerated to +0.26% (+3.1% annualized) in December from November, the worst increase since April 2024 (blue in the chart below).

The six-month PCE price index, which irons out some of the month-to-month squiggles, started reaccelerating in November, and in December rose to +2.2% annualized (red):

The “core” PCE price index accelerated to +0.16% (+3.1% annualized) in December from November, the worst increase since April 2024 (blue in the chart below).

The six-month core PCE price index has been in the 2.3% annualized range for fourth month in a row (red):

Inflation is festering in “core services.” The core services PCE price index accelerated to +0.29% (3.5% annualized).

The six-month index has been accelerating slowly since the July low point and in December rose to +3.4% annualized, right back where it had been in December 2023, and despite some volatility, there has been no progress at all in a year (red):

The PCE price index for housing costs (rent), the largest component of the core services index, has been decelerating in a zigzag manner for two years.

But the six-month average, which irons out a lot of the zigzags, is now showing that the deceleration stalled. It accelerated a tad in December to 4.3%:

Food inflation has started to accelerate again. Food prices have been very high following the spike through 2022. Since then, the pace of increases of those prices (that’s what inflation measures) has slowed dramatically. But recently, food-price increases have started to accelerate again.

On a month-to-month basis, the PCE price index for food rose by 0.24% (2.9% annualized) in December from November.

The acceleration in recent month has caused the year-over-year index to accelerate again, and in December it rose to +1.6%, the biggest increase in 13 months.

Food is included in the overall PCE price index, and the sharp deceleration of food prices was a contributor to the deceleration of the overall PCE price index, and that may now be over as well.

Energy prices spiked in December from November by 38% annualized, the biggest increase since August 2022. So here we go again.

These are prices of energy goods and services that consumers buy directly, such as gasoline, natural gas piped to the home, electricity, propane, heating oil, etc.

Year-over-year, the PCE price index for energy is still negative, but barely at -1.1%. Energy prices weigh heavily in the overall PCE price index. They cannot and won’t drop forever, though they’re very volatile and can plunge for a long time, after a big spike. They were a big contributor to the deceleration of the overall PCE price index in 2023 and 2024, but that help may be fading out:

We give you energy news and help invest in energy projects too, click here to learn more