The artificial intelligence revolution is reshaping industries worldwide, and nowhere is this more evident than in Texas, where a flood of data center projects is straining the state’s energy infrastructure. With requests for over 220 gigawatts (GW) of new electricity connections by 2030—more than twice the grid’s current peak demand—Texas is at the epicenter of a high-stakes gamble.

Driven by cheap land, abundant energy resources, and favorable policies, this buildout promises economic growth and technological advancement. But amid the hype, questions loom: Is this a home run for investors and consumers, or a speculative bubble poised to burst? Let’s dive into the numbers, the grid’s realities, and the potential outcomes.

Understanding Texas’s Energy Landscape: ERCOT’s Capacity and Demand

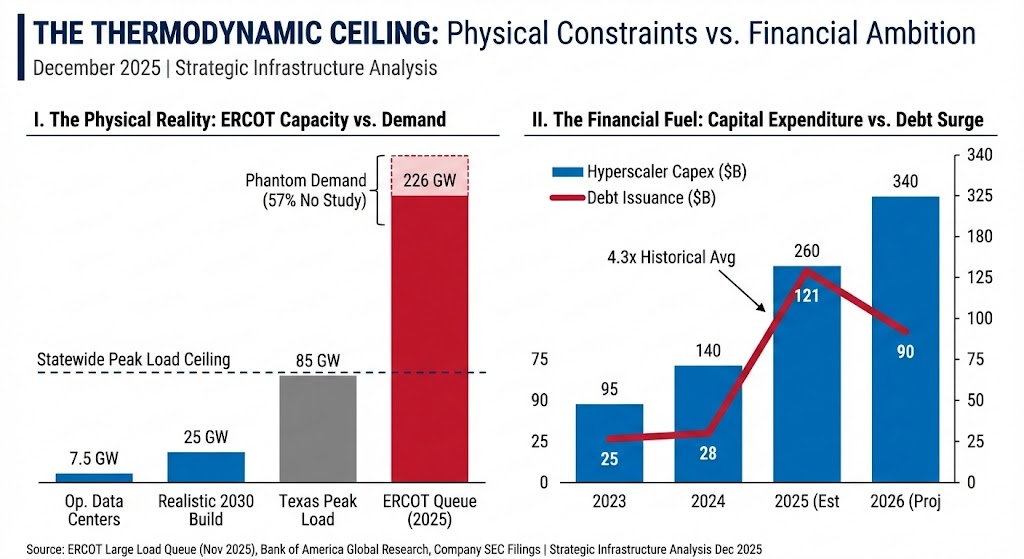

Texas operates its own independent grid managed by the Electric Reliability Council of Texas (ERCOT), which serves about 90% of the state’s electricity needs. As of recent reports, ERCOT’s total available generation capacity stands at approximately 103 GW, encompassing a mix of natural gas, wind, solar, and other sources.

This includes significant renewable additions: In 2025 alone, ERCOT added about 7 GW of new solar photovoltaic capacity and nearly 7.5 GW of battery storage, bolstering reliability during peak periods. The additional costs of adding DC projects to the AC grid are not discussed, and balancing the 60Hz grid is another cost consumers face, such as the billions of dollars consumers paid to get wind from West Texas to the grid.

On the demand side, Texas has seen record-breaking usage. The all-time peak demand hit around 85 GW in the summer of 2023, with similar highs persisting into 2025.

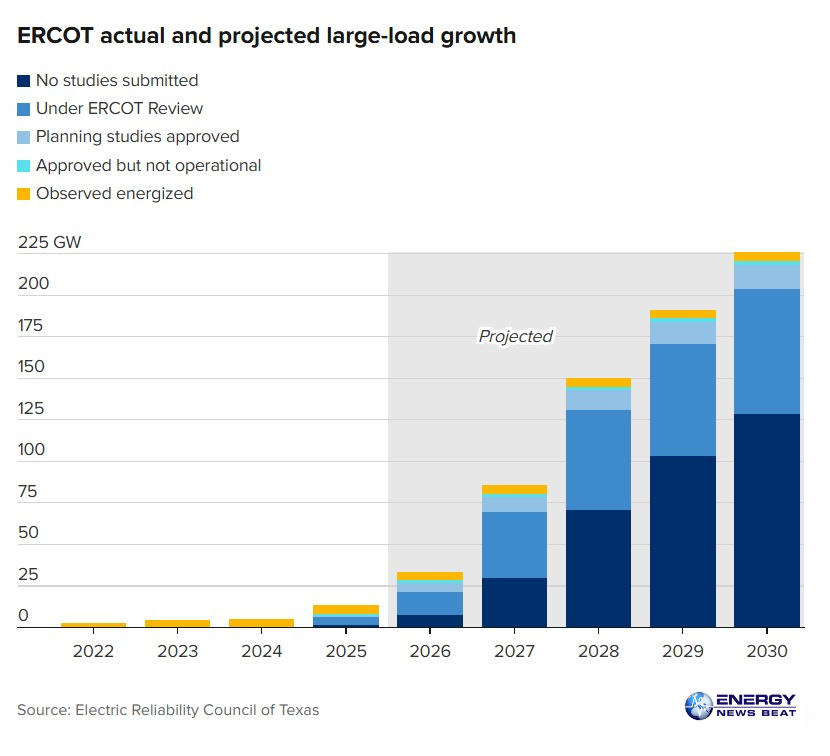

Without major disruptions, baseline projections suggest peak demand could rise to about 119 GW by 2030 due to population growth, electrification, and industrial expansion.

However, these figures don’t account for the explosive growth from data centers. ERCOT’s latest Capacity, Demand, and Reserves (CDR) reports indicate that planning reserve margins could dip significantly from 2025 to 2029 if new loads outpace supply additions, potentially leading to tighter conditions.

Solar power has been a bright spot, setting records with a high of 29.8 GW generated on September 9, 2025, helping stabilize the grid during high-demand periods.

Yet, even with these advancements, ERCOT warns that in worst-case scenarios—such as extreme weather or delayed projects—supply could fall short of peak demand by 2030.

This sets the stage for the AI-driven surge, where data centers could push demand far beyond current forecasts.

The AI Data Center Boom: Scale and Speculation

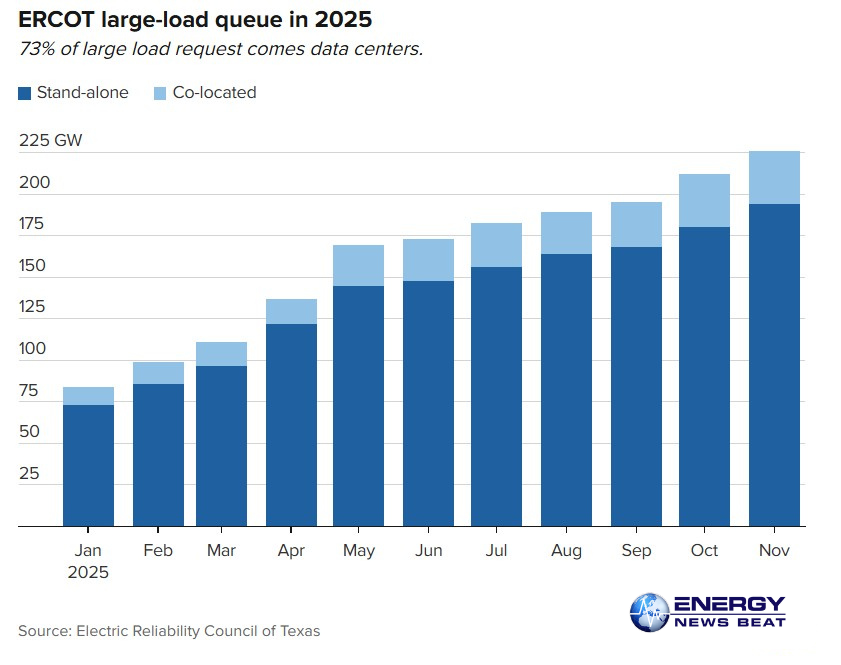

The numbers are staggering. As of August 2025, ERCOT had received requests for 572 GW of new connections from large users, with data centers comprising the lion’s share.

Narrowing to big projects, over 220 GW are queued by 2030, with more than 70% tied to data centers fueled by AI demands.

To put this in perspective, that’s equivalent to adding the energy needs of several major U.S. states combined. Nationally, data centers are projected to consume up to 9% of U.S. electricity by 2030, but Texas is bearing a disproportionate load—potentially half of the country’s industrial electricity demand growth.

A 2023 state law mandating the inclusion of unsigned projects in forecasts has amplified these figures, leading to what some experts call a “bubble.”

Of the 220 GW in requests, about 128 GW haven’t even submitted formal studies, while 90 GW are under review or approved—but only 7.5 GW have actually connected or been greenlit for operation.

This disconnect between potential buildouts and deliverable power highlights the speculative nature: Developers are staking claims without firm commitments, clogging the pipeline and complicating grid planning.

In Texas, data centers already consume at least 8.8% of the state’s power as of 2024, a figure set to balloon.

ERCOT estimates that power demand could nearly double by 2030, with data centers driving nearly half of a 70% increase over the next six years.

While this reshapes energy markets, it also raises alarms about overestimation—some analysts question if ERCOT is inflating load growth projections.

A Home Run for Investors and Consumers?

On the optimistic side, this buildout could be a massive win. For investors, Texas’s deregulated market offers opportunities in renewables, natural gas, and transmission infrastructure. The state’s investor-funded model means private capital shoulders the risks of new builds, potentially yielding high returns if demand materializes.

Economic ripple effects are already visible: Job creation, tax revenues, and tech sector growth could boost the state’s economy. Moreover, integrating data centers with renewables—like solar and batteries—could accelerate clean energy transitions, stabilizing prices long-term.

Consumers might benefit too. Unlike in regulated markets where utilities pass overbuild costs directly to ratepayers (leading to 20% bill hikes in places like Illinois), Texas’s structure keeps consumer impacts modest.

Electricity prices rose just 5% year-over-year in Texas, below the national average of 7%.

If managed well, the influx could fund grid upgrades, enhancing reliability and preventing blackouts like those in 2021.

New regulations are helping: A May 2025 law requires $100,000 study fees and proof of site control, while a proposed rule demands $50,000 per megawatt in security deposits.

These measures aim to weed out speculators, ensuring only viable projects proceed and creating a more predictable environment for serious investors.

Or a Potential Bust?

The risks, however, are substantial. If the AI hype cools or projects underperform, Texas could end up with overbuilt infrastructure—excess power plants and lines that investors are “left on the hook” for.

Equipment costs have skyrocketed; natural gas plant expenses have more than doubled in five years, amplifying financial exposure.

Nationally, inaccurate demand forecasts have led to consumers footing bills for phantom data centers, and Texas isn’t immune if speculation dominates.

For consumers, higher demand could still drive up prices indirectly through market dynamics, especially if grid strain leads to shortages.

electricityplans.com, fortune.com, cnbc.com

ERCOT’s queue is jammed, delaying legitimate projects and risking inefficiencies. Experts estimate the grid can realistically handle only 20-30 GW of new data center load by 2030—far below the 220 GW requested—potentially turning the boom into a bust if most fizzle out.

The Bottom Line: Proceed with Caution

Texas’s AI data center buildout is a double-edged sword. It could supercharge the economy, attract investment, and modernize the grid, delivering wins for investors through high-reward opportunities and for consumers via stable, upgraded energy systems. But the massive gap between requests and reality screams caution—speculation could lead to wasted resources, financial losses, and grid vulnerabilities, marking it as a potential bust.

Ultimately, success hinges on smart regulation, accurate forecasting, and the sustained AI demand. As ERCOT refines its projections and weeds out weak projects, Texas may yet hit a home run. But for now, it’s a high-risk play in a volatile energy game. Stakeholders should watch closely as 2030 approaches.

Sources: ERCOT, electricityplans.com, fortune.com, cnbc.com, ascendanalytics.com, fortune.com

Be the first to comment