In a landmark development for the U.S. energy sector, Pacifico Energy has secured approval for its GW Ranch project in Pecos County, West Texas. This 7.65 gigawatt (GW) gas-fired power campus, combined with 1.8 GW of battery storage and 750 MW of solar capacity, has been hailed as the largest permitted power project in the nation.

The Texas Commission on Environmental Quality (TCEQ) granted the air permit, paving the way for a private-grid facility designed specifically to support hyperscale AI data centers. Construction is set to begin in the first quarter of 2026, with initial power delivery expected in early 2027 and the first full GW online by 2028.

This approval comes amid a broader surge in natural gas infrastructure across Texas, where the state is effectively planning to double its natural gas electric generation capacity over the next decade. The push is fueled by unprecedented electricity demand growth, particularly from data centers powering AI advancements. Below, we explore the reasons behind this expansion, how it’s unfolding, what it means for everyday consumers, and key companies poised for investment opportunities.

Why Texas Is Doubling Down on Natural Gas Generation

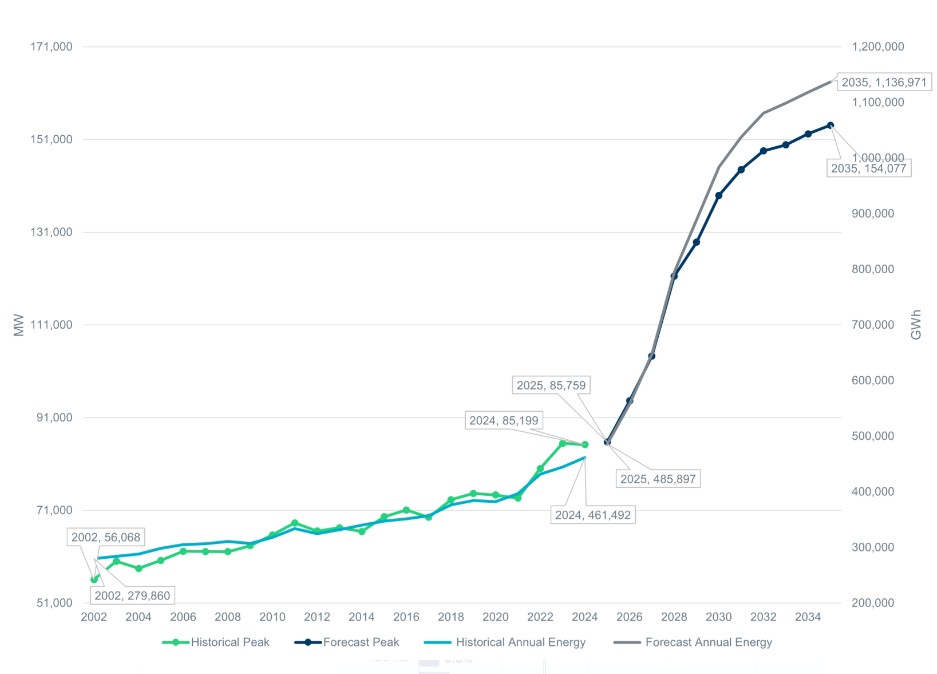

Texas already leads the U.S. in natural gas production and power generation, with gas accounting for nearly half of the state’s electricity mix. However, recent forecasts indicate a dramatic shift: the Electric Reliability Council of Texas (ERCOT), which manages the state’s grid, projects peak electricity demand could nearly double from current levels to around 150 GW by 2030.

This growth is driven by several interconnected factors:

Exploding Data Center Demand: AI and cloud computing are energy-intensive, and Texas has become a hotspot for data center development due to its abundant natural gas, business-friendly policies, and available land. By 2028, Texas could host over 40 GW of data center capacity—nearly 30% of the U.S. total—representing a 142% increase in market share.

In 2025 alone, data centers in Texas had a maximum power demand of about 8 GW, but projections show them accounting for over 10% of total electricity consumption by 2030, with total demand potentially reaching 78 GW.

Population and Economic Growth: Texas’ population is booming, adding millions of residents and supporting industries like manufacturing and electrification in the oil and gas sector. For instance, Permian Basin operators are shifting from diesel to electricity, further straining the grid.

Renewable Energy Limitations: While wind and solar have grown significantly in Texas, their intermittent nature requires reliable baseload power like natural gas to maintain grid stability, especially during extreme weather events.

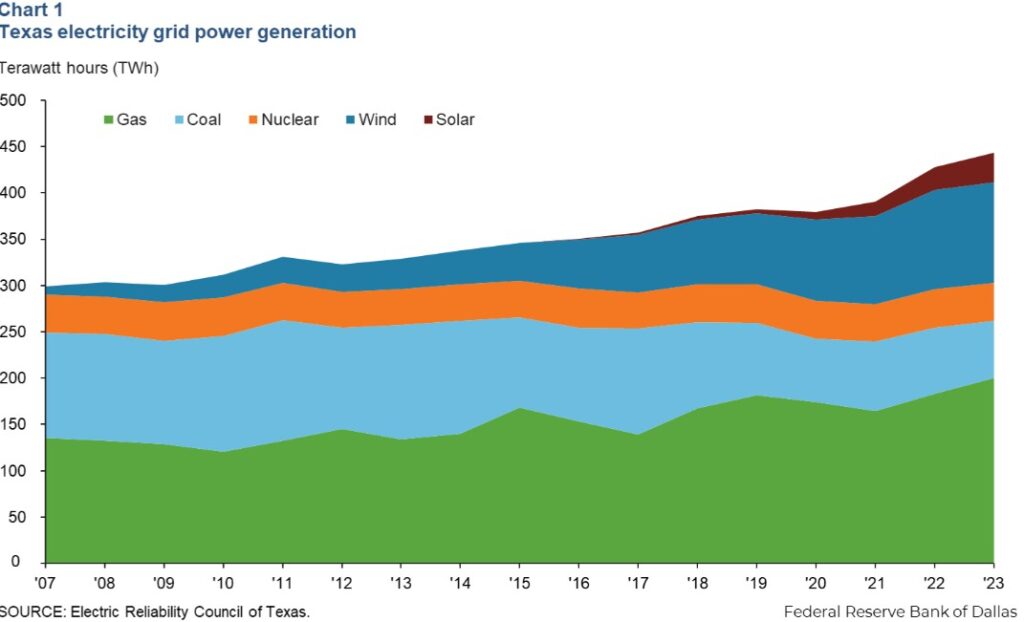

To illustrate the historical shift in Texas’ energy mix, consider this chart showing electricity generation by source from 2007 to 2023. Natural gas (green) has remained dominant, while wind (blue) has expanded rapidly, and coal (light blue) has declined.

How Texas Plans to Achieve This Expansion

The path to doubling natural gas generation involves a mix of public incentives, private investments, and innovative project designs:State Incentives: The Texas Energy Fund, established in 2023 with $7.2 billion in low-interest loans and grants, aims to spur new gas-fired plants. However, progress has been slow—only two projects have been approved in two years due to market challenges like low energy prices and high construction costs.

Despite this, over 130 new gas plants or expansions are proposed, totaling 58 GW—enough to power 48 million homes.

Private and Off-Grid Developments: Many data centers are bypassing the public grid entirely by building on-site gas plants. The GW Ranch exemplifies this trend, using a private grid to ensure reliable power without relying on ERCOT. Similar projects include Chevron’s 2.5 GW (expandable to 5 GW) facility in the Permian Basin, set for operation in 2027, and others like the Hays Energy Project (990 MW) and Sandow Lakes (1,200 MW).

These off-grid setups reduce interconnection delays and leverage West Texas’s shale gas resources.

Timeline and Scale: Global Energy Monitor reports that Texas added nearly 58 GW of gas power projects to its pipeline in 2025 alone, with about 40 GW dedicated to data centers.

If realized, this could effectively double current gas capacity (around 60 GW) by the early 2030s.

ERCOT’s forecast highlights the urgency: annual energy demand is projected to surge from about 485,000 GWh in 2025 to over 1.1 million GWh by 2035.

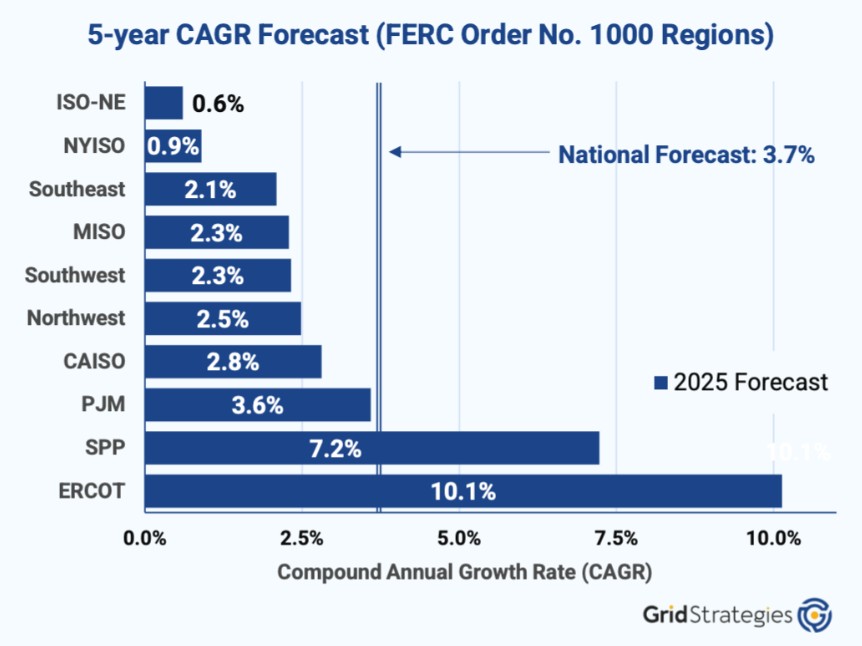

This chart compares Texas’ projected 5-year compound annual growth rate (CAGR) in demand to other regions, underscoring its outlier status at 10.1%.

What This Means for Consumers

For Texas residents, the gas buildout promises more reliable electricity amid rising demand, potentially averting blackouts like those during Winter Storm Uri in 2021. However, it comes with trade-offs:Higher Bills: Increased demand could drive up wholesale prices, with data centers contributing to nearly half of the growth. The Electric Power Research Institute estimates data centers will push overall consumption higher, leading to potential rate hikes for households.

Environmental Impact: More gas plants mean higher emissions—up to millions of tons of greenhouse gases annually from new facilities. While gas burns cleaner than coal, the scale of expansion raises air quality concerns in areas like the Permian Basin.

Grid Stability vs. Costs: Off-grid projects like GW Ranch may ease pressure on ERCOT, but if supply lags demand, consumers could face brownouts or higher costs for grid upgrades.

Overall, consumers benefit from economic growth—data centers create jobs and boost tax revenue—but they shouldn’t bear the full cost. Tech giants profiting from AI should fund infrastructure, as some advocates argue.

Companies to Watch for Investing

The Texas energy boom offers opportunities in natural gas production, power generation, and data center infrastructure. Here are key players:

|

Company

|

Role

|

Why Invest?

|

|---|---|---|

|

Chevron (CVX)

|

Oil & Gas Major

|

Building a 2.5-5 GW gas plant in the Permian for data centers; leverages existing assets for direct power sales.

enr.com

|

|

Vistra (VST)

|

Power Generator

|

One of Texas’ largest dispatchable power operators; positioned to benefit from Texas Energy Fund and demand growth.

corporateknights.com

|

|

NRG Energy (NRG)

|

Utility & Generator

|

Major player in Texas gas plants; expanding amid data center surge.

|

|

ExxonMobil (XOM)

|

Oil & Gas Major

|

Dominant in Permian gas; supplies fuel for new plants and explores power generation tie-ins.

|

|

Microsoft (MSFT) / Amazon (AMZN)

|

Data Center Operators

|

Driving demand with massive Texas facilities; their AI growth could boost energy partners.

|

|

Kinder Morgan (KMI)

|

Pipeline Operator

|

Transports gas to new plants; benefits from increased volumes in West Texas.

|

These companies are well-substantiated for growth, given Texas’s projected dominance in data centers and gas power. Investors should monitor regulatory approvals and natural gas prices for risks.

Sources: theenergynewsbeat.substack.com, ercot.com, insideclimatenews.org, energy.policyplatform.news, environmentenergyleader.com

Get your CEO on the podcast: https://sandstoneassetmgmt.com/media/

Is oil and gas right for your portfolio? https://sandstoneassetmgmt.com/invest-in-oil-and-gas/

Be the first to comment