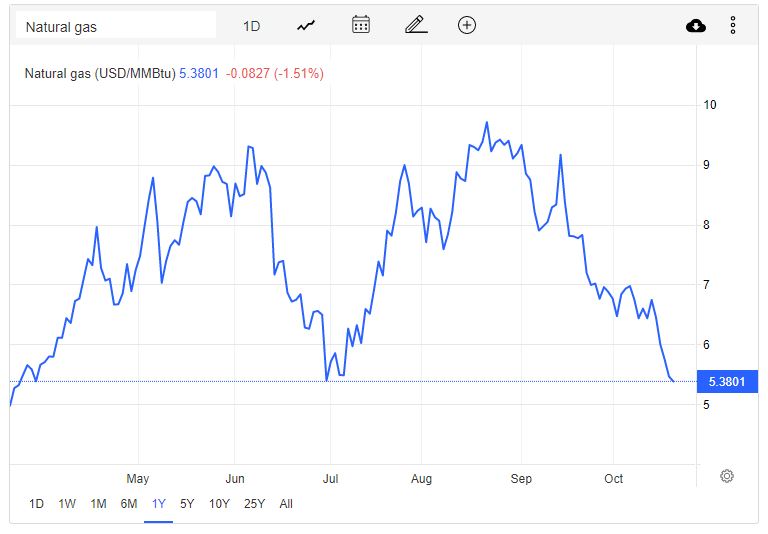

US natural gas futures dropped for the fifth straight session to $5.3/MMBtu, the lowest in seven months, after the latest EIA report showed another larger-than-usual storage build. US utilities added a more than expected 111 billion cubic feet (bcf) of natural gas to storage last week, well above a build of 91 bcf during the same week a year ago and a five-year (2017-2021) average increase of 73 bcf. Natural gas prices have been under pressure amid forecasts of lower weather-driven demand, record domestic production levels and reduced liquefied natural gas (LNG) exports, allowing utilities to inject more gas into storage. Average US gas demand, including exports, is expected to fall to 94.9 bcfd next week from 100.3 bcfd this week.

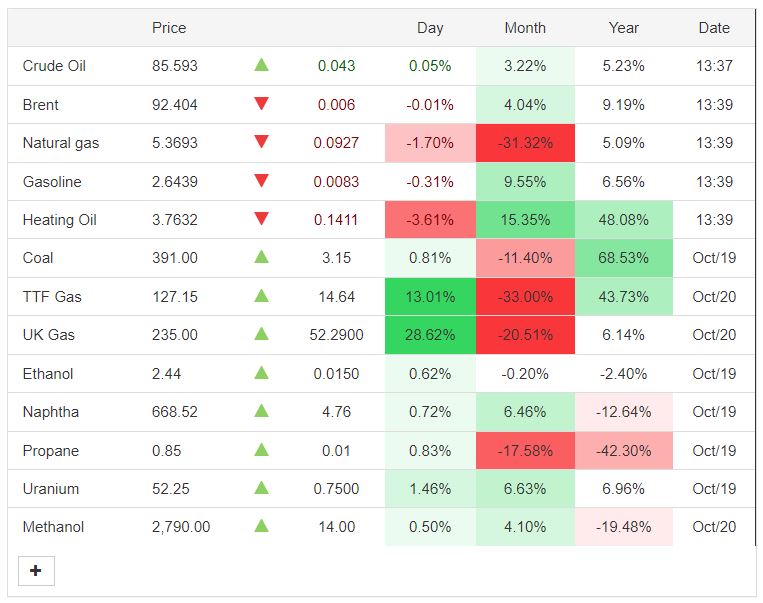

| Actual | Previous | Highest | Lowest | Dates | Unit | Frequency | ||

|---|---|---|---|---|---|---|---|---|

| 5.35 | 5.46 | 15.78 | 1.04 | 1990 – 2022 | USD/MMBtu | Daily |