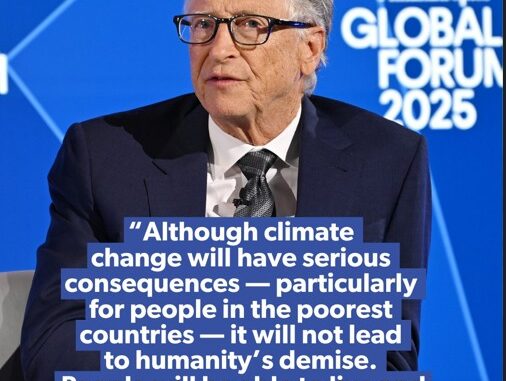

In a surprising pivot that has sent ripples through the environmental and energy sectors, Microsoft co-founder Bill Gates recently declared that climate change, while a real issue, is not an “existential threat” to humanity.

In a memo released just days before the United Nations’ COP30 climate summit, Gates emphasized that poverty and disease remain the primary threats to human welfare, particularly in developing nations, and urged a shift in focus from aggressive emissions reductions to practical innovations that improve lives without crippling economies.

This marks a stark departure from his earlier doomsday rhetoric, where he warned of catastrophic consequences from global warming in books like How to Avoid a Climate Disaster and through his massive investments in green technologies.

For over a decade, Gates has been a towering figure in the climate movement, leveraging his wealth and influence to shape global policies on energy, carbon capture, net zero goals, and carbon taxes. His Breakthrough Energy Ventures has raised over $3.5 billion across its funds, with Gates personally committing around $4 billion to climate initiatives.

But now, as Gates calls for a “more reasonable” approach, the question arises: How much has his leadership—and the policies it inspired—cost the global markets in terms of direct expenditures, economic drag, and opportunity losses? Estimating this is complex, but by examining key areas like carbon capture investments, carbon taxes, and policy-driven transitions, we can piece together a picture of trillions in spending that may have been misallocated.

Charles Payne on the Gutfield Show Hits It Out of the Park!

Key Points:

- War on oil and gas

- Shut down the Nuclear power plant

- Overreach by governments

- Damage socially to our kids through false education

I absolutely love @cvpayne, and he hit it out of the park. pic.twitter.com/ar8GprTk6E

— STUART TURLEY – Energy Podcast Host (@STUARTTURLEY16) November 1, 2025

Gates’s Global Influence on Climate Policies

Gates’s advocacy has directly influenced major institutions. Through Breakthrough Energy and partnerships, he has pushed for aggressive net zero targets at the United Nations, where his funding supports climate innovation hubs and influences COP agendas.

In the European Union, his emphasis on carbon pricing and clean tech aligns with the EU Green Deal, which mandates emissions reductions and has imposed stringent rules on industries. The UK, under its Net Zero by 2050 strategy, has echoed Gates’s calls for carbon capture and storage (CCS) and renewable subsidies, often citing his work as a blueprint. California, a U.S. leader in climate policy, has adopted similar measures, including carbon taxes and disclosure mandates, with Gates’s TerraPower and other ventures receiving state support for nuclear and CCS projects.

This influence has driven a global rush toward policies that prioritize emissions cuts over economic pragmatism. But Gates’s recent admission—that climate change is a “chronic problem” rather than apocalyptic—raises doubts about the necessity of these trillions in investments.

Critics argue these efforts have inflated energy costs, stifled growth in fossil fuel sectors, and diverted resources from more pressing issues like healthcare and poverty alleviation.

The High Cost of Carbon Capture: Occidental Petroleum as a Case Study

One of Gates’s key pushes has been for CCS technologies, which he has funded heavily through Breakthrough Energy. Occidental Petroleum (Oxy), a major player in this space, exemplifies the financial toll. Oxy has invested billions in CCS, including its Stratos direct air capture (DAC) plant, projected to capture 500,000 metric tons of CO2 annually at costs exceeding $1,000 per ton initially.

The company acquired Carbon Engineering for $1.1 billion in 2023 and plans to scale DAC globally, with estimates suggesting the market could reach $150 billion annually by 2050.

However, outcomes have been mixed. Oxy quietly abandoned its Century plant, once the world’s largest CCS facility, due to high costs and inefficiencies.

Federal subsidies, including $8.2 billion from the U.S. government under the Biden administration, have propped up these efforts, but critics point to opportunity costs: Funds tied up in CCS could have supported more reliable energy sources like natural gas, potentially lowering global energy prices and boosting GDP.

Oxy’s debt reduction of $7.5 billion in recent months reflects broader financial strains in the sector, where CCS remains uneconomical without massive taxpayer support.

Policy Overreach: Exxon vs. California and EU Backlash

Recent events highlight growing resistance to Gates-inspired mandates. Energy News Beat recently covered Exxon Mobil’s lawsuit against California, filed on October 25, 2025, challenging new climate disclosure laws (SB 253 and SB 261) that require companies to report emissions and risks.

Exxon argues these infringe on free speech and represent regulatory overreach, potentially costing billions in compliance while stifling innovation. The suit seeks to block enforcement, echoing broader industry frustration with California’s aggressive policies.

Across the Atlantic, the EU is facing backlash over its Corporate Sustainability Due Diligence Directive (CSDDD), which imposes human rights and environmental standards on supply chains. The U.S. and Qatar have jointly warned that these rules threaten LNG supplies, posing an “existential threat” to Europe’s energy security.

In a letter from U.S. Energy Secretary Chris Wright and Qatari Energy Minister Saad Sherida al-Kaabi, they urged amendments, citing risks to trade and energy imports at a time of geopolitical tensions.

These cases underscore how climate policies, amplified by Gates’s advocacy, are now clashing with economic realities, leading to legal battles and diplomatic strains.

Calculating Opportunity Losses: Trillions in Misallocated Capital

This includes $60 trillion in clean energy opportunities but offsets against $25 trillion in avoided climate damages—figures that assume catastrophic scenarios Gates now downplays.

Opportunity losses arise from diverted funds: Instead of investing in health (e.g., vaccines, where Gates has succeeded) or poverty reduction, trillions have flowed to subsidies for renewables and CCS, often with low returns. For instance, global renewable subsidies exceed $500 billion yearly, contributing to higher energy bills and grid instability. If even a fraction of this—say, 20%—stems from Gates’s influence, the tally runs into hundreds of billions annually.

More broadly, policies have suppressed fossil fuel development, potentially forgoing cheaper energy that could lift billions out of poverty. With Gates’s pivot, these costs appear increasingly unjustified, representing a massive wealth transfer from consumers and taxpayers to green tech ventures—many backed by Gates himself.

A Call for Reassessment

What do you think about the social overreach and climate fear-mongering damage they have done to our society? Head to the Energy News Beat Substack and leave your comments there.