In a move that reignites one of the most contentious debates in American energy policy, the Trump administration has flung open the doors to oil and gas leasing in Alaska’s Arctic National Wildlife Refuge (ANWR). On October 23, 2025, U.S. Interior Secretary Doug Burgum announced the completion of a plan to make the refuge’s entire 1.5 million-acre coastal plain available for exploration and development.

This paves the way for lease sales as early as this winter, reversing environmental protections and restoring previously issued leases to the Alaska Industrial Development and Export Authority (AIDEA), the state’s development arm.

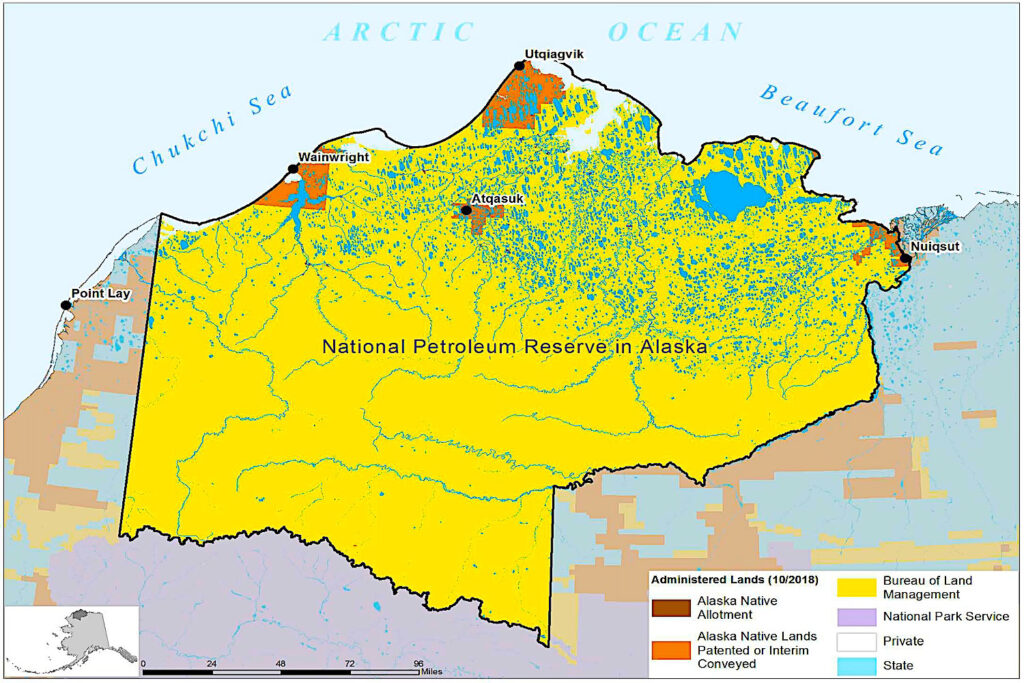

It’s a bold step aimed at bolstering domestic energy security, but it raises a pivotal question: With the gates unlocked, who will actually step up to drill—and at what cost?ANWR, often called America’s last great wilderness, has been a political football for decades. The coastal plain—home to polar bears, caribou, and indigenous communities—holds an estimated 4.3 to 11.8 billion barrels of technically recoverable oil, according to U.S. Geological Survey data.

Proponents tout it as a jackpot for jobs and revenue; critics decry the ecological risks. The latest opening follows two prior lease sales under the 2017 Tax Cuts and Jobs Act: one in January 2021 that drew tepid bids from small players, and another in January 2025 that attracted zero offers from major oil companies.

Those flops underscore a harsh reality: Even with federal green lights, the Arctic’s brutal logistics, regulatory hurdles, and market volatility have kept Big Oil on the sidelines.Who Might Bid? The Usual Suspects (and Skeptics)History suggests enthusiasm will be muted. In past rounds, giants like ExxonMobil, Chevron, and BP showed fleeting interest before bowing out—Exxon in 2021, Chevron and Hilcorp the same year—citing insufficient data and high risks.

Today’s landscape looks similar: No major announcements have surfaced in the days since Burgum’s reveal, and industry insiders whisper that the 2025 no-bid fiasco still stings.

That said, a few players could nibble. AIDEA, which scooped up leases in prior sales, is positioned to lead again, backed by state coffers and a mandate to juice Alaska’s economy.

ConocoPhillips Alaska, with its deep North Slope roots and recent wins like the $8 billion Willow project, might eye ANWR for synergies—though executives have been cagey, prioritizing “capital discipline” over bold Arctic bets.

Hilcorp Energy, a private mid-tier operator with Arctic experience, could return after its 2021 exit, drawn by tax credits and infrastructure ties.Smaller independents like SAExploration or Regulate Alaska’s Drilling may test the waters with lowball bids, but majors? Analysts doubt it. “Big Oil isn’t interested in the refuge—and in fact, most aren’t keen on Arctic drilling at all,” notes one environmental assessment of the 2025 sale.

The calculus: Why sink billions into unproven reserves when Permian Basin wells gush cheaper crude?

The Sticker Shock: Capital Expenditures in the Frozen North

Developing ANWR isn’t for the faint of wallet. Arctic operations demand ice roads, heated pipelines, and spill-proof tech—costs that dwarf conventional U.S. plays. Economists peg economically recoverable reserves at around 7 billion barrels, but unlocking them could require $10–20 billion in upfront capital for a single large-scale project, per older Yale models adjusted for inflation and logistics.

Look to Willow as a proxy: Conoco’s $6–8 billion North Slope behemoth, approved in 2023, promises 180,000 barrels per day but has faced ballooning costs from supply chain snarls and permitting delays. ANWR’s isolation amps that up—think $100–150 per barrel breakeven, versus $40–50 in Texas.

Operating expenses? Another $2–3 billion annually once flowing, factoring in extreme weather and environmental compliance.

For context, global upstream CapEx dipped $85 billion in 2020 alone amid price crashes; today’s majors are loath to repeat that.

Budgeting here means multi-year commitments: $5–10 billion for seismic surveys and initial wells, scaling to $50 billion+ for full infrastructure over a decade. Tax breaks from the 2017 law help, but they’re no panacea in a net-zero world.The Trillion-Dollar Elephant: Why Drill When the Market’s Starved for Cash?

Zoom out, and ANWR’s plight mirrors a broader oil and gas paradox:

The world is trillions short on investment, yet companies clutch their wallets. OPEC warns of an $18.2 trillion gap through 2050 to meet demand and avert supply crunches—enough to spike prices to $100+ per barrel.

The IEA echoes this, forecasting $1.1 trillion in fossil fuel spending for 2025, but upstream budgets lag at $570 billion—$70 billion shy of what’s needed to sustain output.

Cumulative? A $3.5 trillion annual shortfall through mid-century for net-zero transitions alone.

Why the drought? Post-2014 oil busts, ESG pressures, and stranded-asset fears have slashed CapEx by half since 2014 peaks. Investors demand returns over growth—dividends and buybacks trump drilling rigs.

Yet demand roars: Global oil use hit records in 2024, with trade wars and AI-driven power needs portending more.

On LinkedIn, Chris Hedge has some outstanding points in his post.

Underinvestment in U.S. oil production is already reshaping both energy prices and global geopolitical dynamics in 2025. Here’s how:

Impact on Energy Prices

- Short-Term Stability, Long-Term Risk: Despite record U.S. output of 13.5 million barrels/day, the Energy Information Administration (EIA) forecasts Brent crude prices will drop to $69/barrel in 2025, then $52/barrel in 2026, due to oversupply and slowing demand.

- Gasoline Prices: Retail gas is expected to average $3.10/gallon in 2025, down from $3.30 in 2024.

- Natural Gas Volatility: Prices at Henry Hub are projected to rise from $2.20 to $3.40 per MMBtu, reflecting tighter supply and export growth.

However, if underinvestment continues, future supply constraints could reverse this trend, causing price spikes and market instability.

Geopolitical Consequences

- Reduced U.S. Leverage: Slower growth in U.S. oil output weakens its influence in global markets, especially against OPEC+ and major producers like Russia and Saudi Arabia.

- Strategic Vulnerability: The U.S. may become more reliant on imports or less able to buffer global supply shocks, such as Middle East conflicts or sanctions on Russia/Iran.

- Trade Tensions: Fears of a trade war and regulatory uncertainty are already discouraging investment, which could further destabilize energy diplomacy.

In short, while prices are soft now, underinvestment could sow the seeds for future volatility, both economically and geopolitically.

Why Step Up Now? Policy Tailwinds and Price Perks

So why might firms commit? Timing. Brent crude hovers at $70–80 per barrel in 2025 forecasts, with geopolitics (hello, Middle East) adding a $10 premium risk.

Trump’s “drill baby drill” redux—surging permits 30% since January—slashes red tape, while AIDEA’s infrastructure push eases logistics.

Long-term, IEA scenarios show oil demand peaking post-2030, but not vanishing; ANWR could hedge against OPEC cuts.Still, caution reigns. “Wall Street expects U.S. producers to keep a lid on spending,” per Reuters, focusing on “shareholder returns” over expansion.

A government shutdown earlier this month already slowed permitting, hinting at bureaucratic bumps.

For ANWR to pop, prices must kiss $90, and lawsuits—from Earthjustice and tribes—must fizzle.

What Should Investors Watch For?

If you’re eyeing energy stocks, ANWR isn’t a slam-dunk bet—it’s a high-stakes poker hand. Key signals:

|

Watch For

|

Why It Matters

|

Red Flags

|

|---|---|---|

|

Lease Sale Bids (Winter 2025)

|

Tallies interest; >$100M in offers signals momentum. AIDEA bids alone? Snoozer.

|

Zero or token bids, echoing 2025 flop.

eos.org

|

|

CapEx Guidance (Q4 Earnings)

|

Conoco/Hilcorp hikes? Bullish. Flat budgets? Pass.

|

Delays from Willow-like overruns ($6B+).

alaskabeacon.com

|

|

Oil Prices & Geopolitics

|

$80+ Brent greenlights Arctic; watch OPEC+.

|

Sub-$60 crash kills margins.

|

|

Legal/Regulatory Wins

|

Fast-tracked EIS or quashed suits = go-time.

|

Earthjustice injunctions stall everything.

earthjustice.org

|

|

Production Milestones

|

First wells by 2027? Payoff.

|

Endless “studies” = vaporware.

|

Bottom line: ANWR’s opening is red meat for politicians, but developers need sustained $80 oil and ironclad policy to bite. For now, it’s more sizzle than steak—watch the bids, not the hype. In a market starved for supply, the real winners might be those who wait.

Drill baby Drill sounds good till you have to pay the bills, and $60 oil is the old $40 oil due to inflation. As Stu Turley and Michael Tanner have talked about on the Energy News Beat Podcast and on their deal evaluations, it is about the returns to investors and being fiscally responsible. But like a puppy with a rolled-up newspaper, if you beat the puppy too much, you lose the puppy’s affection.

Investors will need to look at investing in private companies as close to the wellbore as possible, or in the midstream space, for returns. Picking those companies is the key issue.

Got Questions on investing in oil and gas? Or do you have a Tax Burden in 2025?

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack

Be the first to comment