In a highly anticipated release on November 19, 2025, Nvidia Corporation unveiled its third-quarter fiscal 2026 earnings, delivering results that surpassed Wall Street expectations and provided a much-needed boost to the AI sector. The chip giant reported record-breaking revenue of $57.0 billion, marking a 62% increase year-over-year and a 22% rise from the previous quarter.

This performance, driven primarily by surging demand for its data center products, has helped alleviate growing concerns about an impending AI tech bubble, as investors grapple with the sustainability of the rapid AI infrastructure buildup.

Key Highlights from the Earnings Report

Nvidia’s data center segment, which accounts for the lion’s share of its business, generated $51.2 billion in revenue—a staggering 66% jump from the same quarter last year and 25% sequential growth.

GAAP net income reached $31.9 billion, up 65% year-over-year, while diluted earnings per share (EPS) came in at $1.30, exceeding analyst estimates of $1.26.

These figures underscore the company’s dominance in supplying GPUs essential for AI training and inference workloads.

Looking ahead, Nvidia provided optimistic guidance for the fourth quarter, projecting revenue of $65.0 billion (±2%), which tops consensus estimates of around $62.4 billion.

Gross margins are expected to improve slightly to about 75% on a non-GAAP basis, reflecting efficient operations amid high demand.

The company also highlighted its Blackwell AI chip platform, noting that production is ramping up to meet “off the charts” demand, with cloud GPUs already sold out.

CEO Insights and Forward-Looking Statements

Nvidia’s founder and CEO, Jensen Huang, struck a bullish tone during the earnings call, emphasizing the exponential growth in AI adoption. “We’ve entered the virtuous cycle of AI,” Huang stated. “The AI ecosystem is scaling fast—with more new foundation model makers, more AI startups, across more industries, and in more countries. AI is going everywhere, doing everything, all at once.”

This commentary reinforces Nvidia’s view that AI demand is not only sustained but accelerating, with both training and inference applications driving compute needs.

Analysts echoed this sentiment, with many viewing the results as a “validation moment” for the AI boom.

CFO Colette Kress added that the company remains on track for $500 billion in AI chip orders over the 2025-2026 period, signaling robust pipeline strength despite recent market jitters.

After-Market Response and Market Sentiment

The market reacted positively, with Nvidia shares surging sharply in after-hours trading, climbing as much as 5-7% immediately following the release.

This rebound comes after a volatile period where the stock had dipped about 10% from its recent highs, fueled by fears of AI overinvestment.

Broader tech indices also ticked higher, reflecting relief across the sector.

Is This Truly Positive for AI, and Does It Lift Bubble Fears?

Yes, these results appear genuinely positive for the AI industry and help dispel notions of an imminent tech bubble—at least in the short term. Prior to the report, concerns had mounted about potential overbuilding in AI infrastructure, with some analysts warning of a “risk-off” attitude among investors.

However, Nvidia’s beat-and-raise performance, coupled with strong guidance, demonstrates sustained demand from hyperscalers and enterprises. The company’s emphasis on a “virtuous cycle” where AI advancements fuel further investments suggests the sector is far from peaking.

That said, bubble fears aren’t entirely erased. Some observers note that while Nvidia’s numbers are impressive, the broader AI ecosystem— including startups and applications—must show profitability to justify the trillions in projected infrastructure spending.

AI’s energy-intensive nature adds another layer: Data centers powered by Nvidia’s chips are projected to consume a significant portion of global capacity, potentially straining power grids and driving up energy costs.

For the energy sector, this translates to booming demand, with AI expected to contribute to a $3-4 trillion infrastructure opportunity over the next five years.

What Should Investors Look For?

Investors eyeing the AI space should monitor several key indicators moving forward:

Blackwell Adoption: Watch for updates on production ramp-up and customer deployments, as delays could reignite concerns.

Hyperscaler Spending: Commitments from major cloud providers like Microsoft, Amazon, and Google will signal ongoing AI investment.

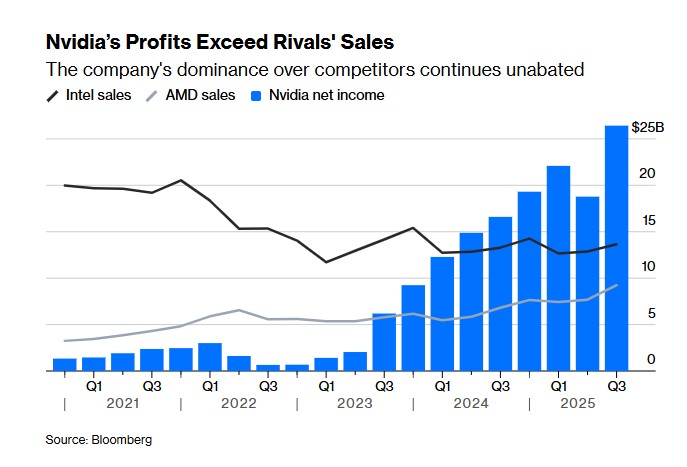

Margins and Competition: Sustained high gross margins (around 73-75%) amid rising competition from AMD and Intel.

Energy and Regulatory Risks: Increasing scrutiny on AI’s power consumption could impact data center expansions; look for partnerships in efficient cooling or renewable energy integration.

Macro Factors: Broader economic conditions, including interest rates and geopolitical tensions affecting supply chains.

Other Companies Poised to BenefitNvidia’s success ripples across the ecosystem. Taiwan Semiconductor Manufacturing Company (TSMC), Nvidia’s primary chip fabricator, stands to gain from increased orders for advanced nodes.

Competitors like AMD could see a sector-wide lift, as strong AI demand validates the market for all players.On the customer side, cloud giants such as Microsoft (Azure), Amazon (AWS), and Alphabet (Google Cloud) benefit from enhanced AI capabilities, potentially boosting their revenues through higher cloud usage.

In the energy realm—relevant to Energy News Beat readers—utilities and renewable providers like NextEra Energy or nuclear operators like Constellation Energy may see upside from the exploding power needs of AI data centers.

Memory suppliers like Micron and server makers such as Dell or Super Micro Computer also ride the wave of data center expansions.

In summary, Nvidia’s Q3 earnings not only affirm its leadership in AI but also inject confidence into a sector under bubble scrutiny. For energy stakeholders, the report highlights AI’s role in driving unprecedented power demand, positioning the industry at the intersection of tech innovation and energy transformation. As AI continues to “go everywhere,” the real test will be translating this momentum into long-term, sustainable growth.

Got Questions on investing in oil and gas?

If you would like to advertise on Energy News Beat, we offer ad programs starting at $500 per month, and we use a program that gets around ad blockers. When you go to Energynewsbeat.co on your phone, or even on Brave, our ads are still seen. The traffic ranges from 50K to 210K daily visitors, and 5 to 7K or more pull the RSS feeds daily.

https://energynewsbeat.co/request-media-kit/