Occidental Petroleum Corporation (NYSE:OXY) released a solid earnings report for FQ1 this week. However, that hasn’t been enough to stem a slide in OXY that started in early April, as the boost from the OPEC+ production cut faltered.

Berkshire Hathaway (BRK.A) (BRK.B) CEO Warren Buffett‘s clarification that he isn’t keen to increase Berkshire‘s stake to take control of OXY removes another critical source of support for OXY holders at a crucial juncture.

Occidental management’s earnings commentary suggests that further weakness in Q2 cannot be ruled out, potentially heaping more pressure on the stock. Accordingly, Occidental guided for Q2 production of 1.17 MBOE/d at the midpoint, markedly lower than Q1’s 1.22 MBOE/d.

However, management assured investors that it expects Q2 to be the “lowest point of the year” while “production and productivity are still improving.” As such, Occidental remains confident of a full-year production outlook of 1.195 MBOE/d at the midpoint, suggesting a strong and sustainable recovery in H2FY2023.

Investors should be assured that management’s focus remains on capital returns and not unsustainable production increases. CEO Vicki Hollub reminded holders that the company’s capital allocation priorities continue to favor shareholders.

Accordingly, she accentuated that over the past year, 57% of the company’s cash allocation went toward debt reduction, with another 17% toward share repurchases.

Moreover, Occidental executed 25% of its $3B share repurchase authorization in Q1, buying back $752M worth of shares. It was also on top of the $647M redemption of its preferred stock, as the company capitalized on its $1.7B in free cash flow or FCF generated in Q1.

Furthermore, Hollub received another stamp of approval from Buffett at Berkshire’s annual meeting. Buffett articulated that Hollub is “an extraordinary manager of Occidental.”

While Buffett was disappointed as Occidental redeemed its preferred, he stressed that Occidental’s decision was “intelligent from their standpoint.”

Occidental also highlighted that it “plans to continue repurchasing common shares to stay above the $4 trigger per share.” Keen investors should know that Occidental’s preferred stock redemption is triggered “when rolling 12-month common shareholder distributions reach a cumulative $4 per share.”

Despite that, management cautioned that it anticipates headwinds in H2FY2023 which could make “staying above the trigger more challenging.” In addition, underlying commodity pricing volatility could also complicate Occidental’s ability to stay above the trigger point.

Management also presented that it “would likely want oil prices in the $75 range to continually stay above the trigger point.”

With WTI crude (CL1:COM) (USO) currently trading below the $75 level, investors must assess whether they think oil prices could be in their favor moving forward.

Morningstar’s assessment suggests an outlook of $78 per barrel and $73 per barrel in 2023 and 2024, respectively. Moreover, it has placed the prognosis of the $100 oil price under threat, suggesting that underlying macroeconomic conditions are now the focus of investors.

As such, it questions whether the impact could have been worse if not for the recent production cuts. Moreover, Russia’s oil exports have remained robust, in conflict with their official updates of cutting production.

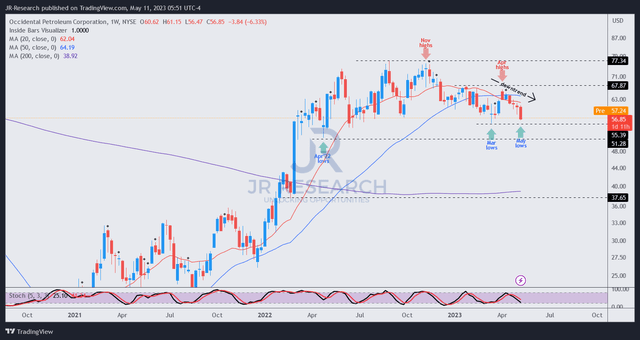

Despite that, the price action in OXY is clear: to the downside.

OXY price chart (weekly) (TradingView)

With the rejection by sellers at its April highs, OXY has moved into a medium-term downtrend, with its March lows looking increasingly likely to be re-tested.

Therefore, we urge investors to remain cautious about buying the current dips, assessing the buying sentiments at its March lows first before committing their capital.

Furthermore, a breakdown below OXY’s April 2022 lows could open up further downside volatility toward the $40 zone, suggesting more attractive opportunities to accumulate if it does get there.

OXY quant factor ratings (Seeking Alpha)

Moreover, Seeking Alpha Quant reflected a “D-” valuation for OXY, suggesting that its valuation isn’t cheap.

Coupled with unconstructive price action, and potentially worse underlying dynamics in the oil market, investors should continue staying on the sidelines and wait for a steeper pullback.

Rating: Hold (Reiterated).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.