As global oil markets navigate a complex landscape of supply increases, geopolitical tensions, and economic uncertainties, a notable shift has emerged in the futures curve for 2026. West Texas Intermediate (WTI) crude timespreads for several months in 2026 have slipped into contango, reflecting growing concerns over potential oversupply. This development comes amid OPEC+’s efforts to ramp up production and escalating trade frictions that are dampening demand outlooks. In this article, we explore the buildup and definition of oil contango, its implications for investors, and contrasting views on OPEC+’s ability to deliver on new quotas.

Understanding Oil Contango: Definition and Build-Up

Oil contango is a market condition in the futures curve where the price of oil for future delivery is higher than the current spot price. This structure typically arises when there is an expectation of abundant supply in the near term, leading to higher storage costs and incentives for producers or traders to hold onto inventory rather than sell immediately. In contrast to backwardation—where spot prices exceed futures, signaling tight supplies—contango often indicates bearish sentiment, such as fears of a supply glut.

The buildup to contango can stem from various factors, including increased production announcements, weakening demand signals, or external shocks like trade disputes. Historically, contango has deepened during periods of oversupply, such as the 2014-2016 oil price crash when shale production surged. In the current context, the shift into contango for 2026 contracts began late last week, with WTI benchmark contracts for the entire year trading below $60 per barrel.

This repricing has been driven by rising crude output from both OPEC+ and non-OPEC sources, coupled with trade tensions that are eroding confidence in global demand.

The Current Market Situation: Glut Worries and Trade Frictions

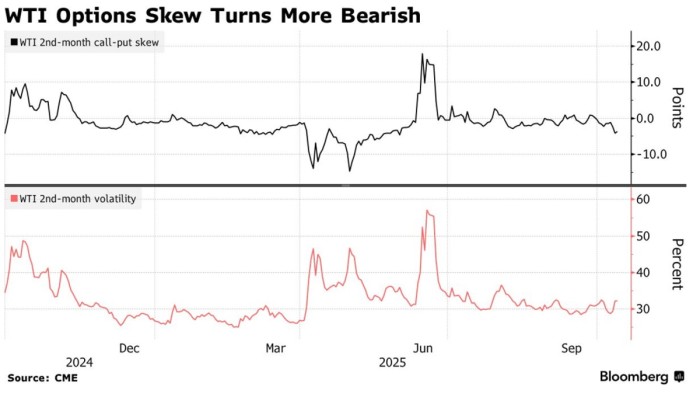

Recent market data underscores these concerns. The December-December spread in WTI futures has weakened to its lowest since June, while sentiment in second-month options is nearing its most bearish in four months.

Traders are increasingly betting on near-term futures declining more sharply than longer-dated ones, a classic sign of oversupply fears. Although the nearest portion of the curve remains in backwardation due to ongoing geopolitical risks—like drone strikes on Russian assets and potential U.S. sanctions on Iran—the broader 2026 outlook has turned pessimistic.Glut worries are primarily fueled by OPEC+’s decision in early October to raise production quotas in a bid to reclaim market share.

This move, combined with robust non-OPEC growth from countries like the U.S., Brazil, and Canada, could add significant volumes to the global supply. Adding to the pressure, U.S. President Donald Trump’s tariff threats against China have battered the demand outlook for the world’s top crude importers, the U.S. and China, exacerbating bearish repricing.

Banks such as Goldman Sachs and Morgan Stanley have slashed their oil-price forecasts, warning that sustained low prices could strain U.S. shale producers, who need prices above $60 to drill profitably.

The Energy Information Administration anticipates a slight decline in U.S. crude production next year, the first annual drop since 2021.

What Does This Mean for Investors?

For investors, a contango market presents a mixed bag of opportunities and risks. On the positive side, it can create arbitrage plays for those with access to storage: buy cheap spot oil, store it, and sell higher-priced futures contracts to lock in profits. This “carry trade” becomes attractive when the futures premium covers storage and financing costs.

However, contango poses challenges for passive investors in oil-linked exchange-traded funds (ETFs) or futures-based strategies. Rolling over contracts in a contango environment incurs “roll yield” losses, as expiring near-term contracts are sold low and replaced with more expensive longer-dated ones, eroding returns over time. In a broader sense, the shift signals a bearish long-term outlook, potentially discouraging investment in oil exploration and production. Analysts suggest this could pressure U.S. shale, leading to reduced drilling and a possible supply squeeze later in 2026, which might ultimately support prices.

For diversified portfolios, contango may prompt a pivot toward downstream sectors like refining, which could benefit from lower input costs, or alternatives like renewables amid volatile fossil fuel markets.The OPEC+ Perspective: Struggles to Meet New QuotasWhile OPEC+’s quota hikes contribute to glut fears, a closer look reveals significant challenges in actually delivering the promised output, which could mitigate some oversupply risks. Historical data shows that the alliance has repeatedly fallen short of quota increases; for instance, in previous hikes, actual production lagged due to compliance issues and technical constraints.

In May 2025, OPEC’s output rose by only 150,000 barrels per day (bpd) against a planned 310,000 bpd, and similar shortfalls occurred in prior months.

Capacity constraints are a key hurdle. Many members, including Iraq, Kazakhstan, and Nigeria, face aging infrastructure, underinvestment, and operational bottlenecks that limit ramp-ups.

Spare capacity is dwindling and concentrated in a few countries like Saudi Arabia (3.1 million bpd) and the UAE (1 million bpd), leaving the group vulnerable to disruptions.

Geopolitical factors, such as Ukraine’s strikes on Russian facilities and U.S. sanctions, further erode flexibility.

Analysts note that while OPEC+ aims to add nearly 2 million bpd cumulatively through August 2025, real increases have been modest, and markets haven’t panicked because actual supply growth is below announcements.

This inability to fully meet quotas could paradoxically support prices by preventing a full-blown glut. If production constraints persist, it might lead to tighter markets and potential price spikes from any supply shock, as spare capacity shrinks to precarious levels.

However, persistent overproduction by some members risks internal discord and could prompt a market share battle, echoing past price wars.

The Bottom Line

The emergence of contango in 2026 oil futures highlights deepening worries over supply gluts and demand headwinds from trade frictions. While this bearish signal challenges investors with roll costs and signals caution for upstream plays, it also underscores opportunities in storage and potential future squeezes if U.S. production declines. On the OPEC+ front, ambitions to boost output are tempered by real-world constraints, suggesting the glut may not materialize as feared. As markets evolve, stakeholders will closely watch upcoming OPEC+ meetings and geopolitical developments for clues on the path ahead. Stay tuned to Energy News Beat for the latest updates on global energy dynamics.

Got Questions on investing in oil and gas? Or do you have a Tax Burden in 2025?

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack