In the volatile world of energy markets, oil prices have taken a surprising dip in recent weeks, even as a confluence of bullish factors and escalating geopolitical tensions suggests the potential for a sharp reversal. As of December 2025, Brent crude hovers around $61 per barrel, while West Texas Intermediate (WTI) sits near $57, marking a nearly 2% drop in a single session despite positive signals from major forecasters.

This downward pressure comes amid thin market liquidity and algorithmic selling, but underlying fundamentals paint a more complex picture. With global demand remaining resilient and supply surges showing signs of halting, the question arises: Is the market overreacting to fears of an oil glut, and could undervaluation relative to other commodities set the stage for a significant spike?

The Recent Price Dip and Bullish Backdrop

Oil prices have extended their losing streak through much of December 2025, defying a wave of optimistic news. The Organization of the Petroleum Exporting Countries (OPEC) maintained a firm demand outlook for 2025–2026, emphasizing strong consumption in key regions like China, India, and the Middle East.

Non-OPEC supply growth is expected to moderate after 2025, with OPEC+ positioned to stabilize the market. Adding to the positivity, U.S. inventories showed draws—4.8 million barrels according to the American Petroleum Institute (API) and 1.8 million per the Energy Information Administration (EIA)—indicating robust winter demand.

Yet, prices fell anyway, influenced more by sentiment than fundamentals. Analysts at Citi project Brent could dip to $60 in early 2026, reflecting ongoing bearish pressures.

This disconnect highlights how market psychology can override data in the short term.

Is the Oil Glut an Overreaction?

The International Energy Agency (IEA) recently trimmed its forecast for a 2026 global oil surplus, reducing it from 4.09 million barrels per day (bpd) to 3.84 million bpd—a cut of about 230,000 bpd.

This adjustment stems from a sharp decline in global supply, which dropped by 610,000 bpd in November 2025 from October and 1.5 million bpd from September’s peak.

OPEC+ accounted for 80% of the November drop, driven by outages in Kuwait and Kazakhstan, as well as reduced output from Russia and Venezuela amid sanctions.

Russia’s exports fell by 400,000 bpd to 6.9 million bpd, partly due to buyers shunning cargoes from sanctioned entities like Rosneft and Lukoil.

While the projected glut remains substantial, there’s evidence it may be overstated. Global oil demand hit a record above 103 million bpd in 2025, with emerging markets driving growth.

The IEA notes a mismatch: floating storage is piling up, yet inventories at key pricing hubs are near decade lows, leading to only marginal price easing.

Broader forecasts, including from the EIA, anticipate rising inventories through 2026, exerting downward pressure, but demand growth—estimated at 700,000 bpd in 2025 and 800,000 bpd in 2026—could tighten balances if supply disruptions intensify.

In this context, the glut narrative appears somewhat reactionary, amplified by moderated demand expectations rather than a collapse in fundamentals.

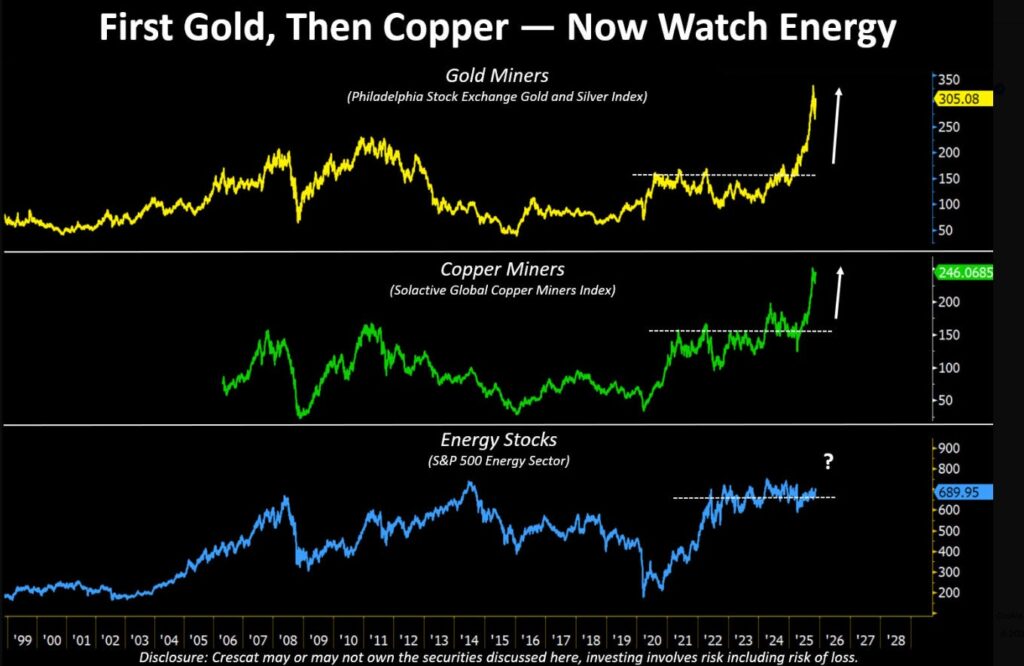

Oil’s Undervaluation: A Comparison to Gold and Commodities

A compelling case for oil’s undervaluation emerges when compared to other commodities, particularly gold. With gold trading above $4,200 per ounce, it currently buys over 65 barrels of crude at around $62 per barrel—a ratio more than three times the historical average of 18-20.

This extreme has historically occurred during crises, but today’s physical oil market is strong, with no recession in sight. Gold’s 50%+ surge in the past year reflects fiscal dominance, central bank interventions, and geopolitical risks—factors that oil prices have yet to fully price in.

Thinning spare capacity, lagging capital expenditures, and eroding buffers further underscore oil’s mispricing in a shifting monetary system.

If the gold-oil ratio reverts to its long-term norm, crude could realistically target $150-$200 per barrel, echoing the 1,400% rise from $15 to $147 between 1998 and 2008.

Compared to other commodities, oil’s lag suggests it’s the outlier in an otherwise inflationary environment, poised for catch-up.

Geopolitical Wildcards: The Spark for a Spike?

Geopolitical tensions are rampant, adding upside risks that could ignite a price surge. Ongoing Russia-Ukraine conflict includes Ukrainian drone strikes on Russian oil infrastructure, such as Lukoil assets in the Caspian Sea.

Sanctions on Russia and Venezuela are curbing supply, with U.S.-India trade talks influencing export flows.

In the Middle East, tensions involving Iran persist, while U.S.-Venezuela frictions and potential Chinese stockpiling amid tariff concerns could disrupt balances.

Recent events, like Iraq restoring production at a key field (0.5% of global supply), have eased immediate pressures, but broader uncertainties— including no peace deal in Ukraine—keep markets on edge.

These factors, combined with OPEC+’s planned capacity reviews in 2026, could flip the script from glut to shortage.

What Should Investors Watch For?

Investors eyeing opportunities in this environment should monitor several key indicators:

Supply Disruptions: Track geopolitical escalations in Russia-Ukraine, the Middle East, and Venezuela for potential outages that could reduce the glut.

Demand Signals: Focus on economic data from China and India, as well as global inventory builds at hubs like Cushing, Oklahoma.

OPEC+ Moves: Upcoming meetings and compliance with quotas will be crucial, especially as non-OPEC growth slows.

Commodity Ratios: Watch the gold-oil ratio for signs of reversion, alongside broader inflation trends.

Macro Factors: U.S. Federal Reserve rate decisions and tariff policies could influence demand and currency strength, impacting oil.

A bearish outlook dominates short-term forecasts, with prices potentially dipping below $60 in 2026, but upside risks from these elements abound.

The Consumer Impact of Higher Oil Prices

Should prices spike to $150-$200 as some analyses suggest, consumers worldwide would feel the pinch. Gasoline prices could surge, adding $1-2 per gallon at the pump in the U.S., inflating transportation and heating costs.

Stu Turley just finished the interview with Giacomo Prandelli, The Merchant’s News, and he confirmed the theories and discussion points. The podcast is sent to production, and should roll out next week.

This would fuel broader inflation, eroding purchasing power and hitting low-income households hardest. In emerging markets, where energy subsidies are common, governments might face fiscal strains, potentially leading to social unrest. Airlines, shipping, and manufacturing sectors would pass on higher costs, raising prices for goods and services. While energy producers benefit, the net effect could slow economic growth if not offset by wage gains or policy interventions.

In summary, while oil’s current downturn reflects glut fears and market sentiment, undervaluation and geopolitical powder kegs position the market for potential volatility. Investors and consumers alike should brace for swings as 2026 approaches— the era of cheap oil may be shorter-lived than it seems.

Source: themerchantsnews.substack.com,

oilprice.com, discoveryalert.com.au, investing.com, reuters.com.

Want to get your story in front of our massive audience? Get a media Kit Here. Please help us help you grow your business in Energy.

Be the first to comment