As we kick off 2026, the commodities market is heating up with oil, gold, and silver all posting gains amid a cocktail of geopolitical risks, supply constraints, and economic uncertainties. I do not think this will end up being a new Christmas Carol, “Silver, Oil and Gold”, but rather the return to comedies is a trend we are seeing across the news cycles.

Brent crude has hovered around $60-63 per barrel, while WTI sits near $55-60, buoyed by a risk premium despite structural oversupply projections of 2-3.8 million barrels per day (bpd) for the year.

Gold has shattered records, climbing above $4,600 per ounce, and silver has surged past $80, driven by safe-haven demand and industrial tailwinds.

For energy watchers, this trifecta signals volatility ahead, but also opportunities in a world where traditional assets are under pressure from fiscal deficits and global fragmentation.

Geopolitical Headwinds Pushing Oil Higher

Oil prices opened 2026 on a firmer note, supported by escalating tensions in key producing regions that have injected a short-term risk premium into the market.

While ample global supply—led by record U.S. output and non-OPEC growth from Brazil and Guyana—limits prolonged spikes, structural factors like OPEC+ unwinding cuts and weak demand growth keep prices capped.

Analysts forecast Brent averaging $59 per barrel this year, down from 2025, but with upside risks from disruptions.

Key drivers include unrest in Iran, where protests have raised fears of U.S. intervention, adding $3-4 per barrel to the geopolitical premium.

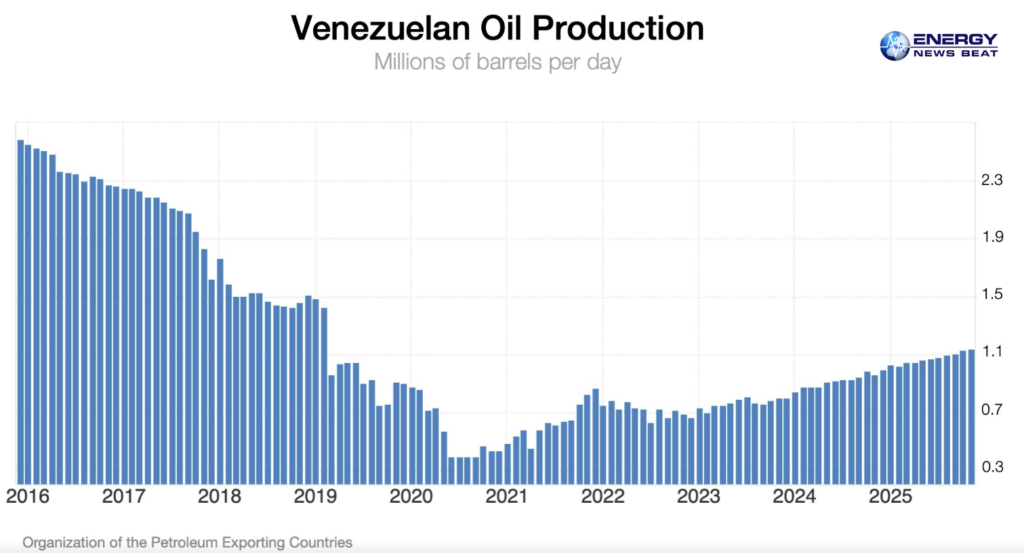

The U.S. capture of Venezuelan President Nicolás Maduro on January 3 has jolted markets, threatening the country’s 1.1 million bpd exports amid civil unrest and infrastructure woes.

Ongoing Russia-Ukraine conflicts, including drone strikes on energy facilities, add to the mix, though peace talks could ease pressures.

These events underscore a fragmented global order, where trade polarizes into U.S.- and China-led blocs, injecting volatility into supply chains.

Iran’s Oil Output and Key Buyers Under Scrutiny

Iran remains a linchpin in the oil market, producing around 3.3-4.1 million bpd despite sanctions, accounting for about 3% of global supply.

Output has rebounded to near pre-sanctions levels through discounted exports, but record floating storage—equivalent to 50 days of production—signals buyer caution amid U.S. threats.

Protests and potential regime change risks could disrupt this, adding $3-4 per barrel to prices if escalation occurs.

China dominates as Iran’s top buyer, taking over 80% of exports (around 1.38 million bpd in 2025), drawn by discounts of $7-8 per barrel below benchmarks.

Independent “teapot” refiners in Shandong province handle most volumes, while state firms avoid sanctions risks.

Other partners include Iraq, UAE, Turkey, and Germany, with fuels making up half of exports to China.

U.S. tariffs on Iran trade partners could escalate tensions, potentially forcing Beijing to seek alternatives amid a trade truce.

Venezuela’s Limited Market RippleVenezuela’s turmoil adds noise but minimal structural impact, with production at around 900,000-1 million bpd—less than 1% of global supply—despite holding the world’s largest reserves (303 billion barrels).

U.S. intervention aims to redirect exports to American refiners, but degraded infrastructure and sanctions limit quick ramps.

Optimistic forecasts see output rising to 1.3-1.4 million bpd in two years with investments, but $183 billion is needed for 3 million bpd by 2040.

Exports currently flow 60-80% to China and 10-20% to the U.S., but U.S. control could shift this, adding short-term chaos without offsetting the 1.5-2 million bpd surplus.

Prices may see brief spikes, but oversupply dominates, with Brent/WTI forecasts at $56/$52 for 2026.

Gold’s Rally: Central Banks Stockpile Reserves

Gold’s ascent to fresh records stems from fiscal uncertainty, inflation concerns, and central bank diversification away from the dollar.

Prices could hit $5,000 by Q4 2026, with $6,000 longer-term, fueled by U.S. deficits, geopolitical risks, and ETF inflows.

Emerging markets like China, India, Poland, and Turkey are key buyers, with reserves still below those of developed nations.

For the first time since 1996, foreign banks hold more gold than U.S. Treasuries ($4 trillion vs. $3.9 trillion).

A weaker dollar and lower rates enhance appeal, with 95% of central banks planning increases.

Silver’s Speed: Industrial Demand Meets Supply Squeeze

Silver has outpaced gold, surging to multi-month highs on industrial demand from EVs, solar, and AI data centers—up 170% since early 2025.

Drivers include China’s export curbs, creating regional surpluses and price volatility, plus thin London inventories prone to squeezes.

Structural deficits, photovoltaic growth (demand inelastic up to $125/oz), and safe-haven flows amid geopolitics push targets to $100-150.

Unlike gold, silver’s dual role amplifies gains, with AI and electrification as key catalysts.

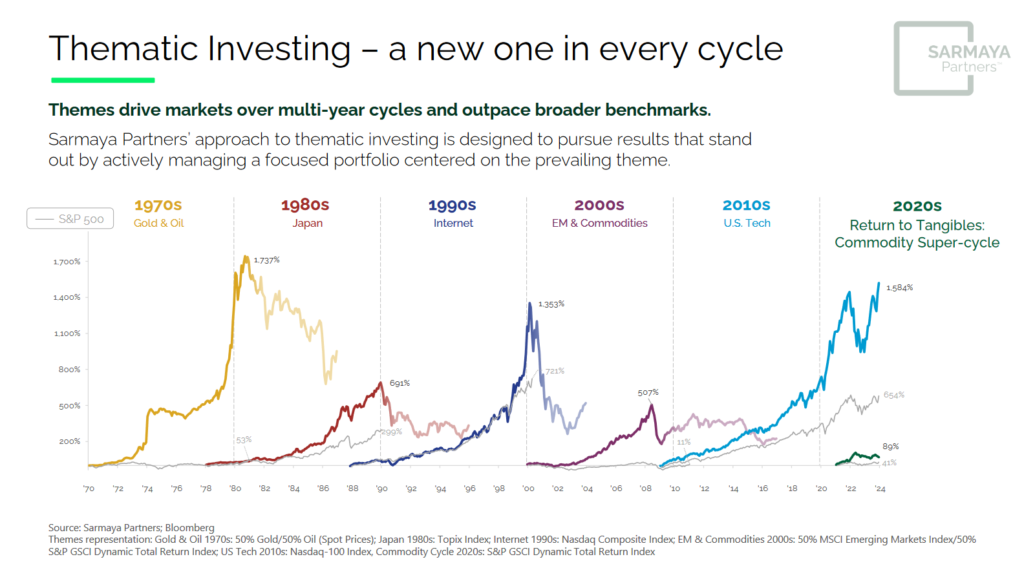

At Energy News Beat, we rely on industry leaders, and one of our Podcast Guests has been at the forefront of this news cycle, calling for the “Return to Tangibles”. Here is the latest podcast with Wasif Latif, “The Oil and Gas Global Markets Update with Wasif Latif, Co-Founder, President and CFO of Sarmaya Partners”.

Drone Strike in the Black Sea: Escalating Energy Risks

Tensions escalated on January 13 when unidentified drones struck three Greek-managed tankers in the Black Sea near Russia’s Novorossiysk port, en route to load Kazakh crude via the Caspian Pipeline Consortium terminal.

The vessels—Delta Harmony and Matilda—suffered fires, highlighting vulnerabilities in Black Sea shipping amid Russia-Ukraine hostilities.

This follows a pattern of strikes, including a Russia-bound tanker hit off Turkey on January 8, threatening the grain corridor and adding to oil’s risk premium.

Ukrainian drones have targeted over half of Russia’s refineries, slashing output by 20% and costing $75 million daily.

In summary, 2026’s commodities landscape is defined by geopolitics overriding fundamentals, with oil volatile but capped, and metals riding safe-haven and industrial waves. For energy investors, diversification into precious metals could hedge risks—stay tuned as these trends unfold.

Sources: goldsilver.com, @Defence_Index, greekreporter.com, reuters.com, seekingalpha.com, jpmorgan.com

Check out the Energy News Beat Substack article with the Chris Wright interview on Fox Business.

Be the first to comment