ENB Pub Note: This article is from the Bison Insights with Josh Young. Stu Turley, David Blacmon, Josh Young, and Wasif Latif will be live next week, and this article will be one of the key talking points. We highly recommend subscribing to the Bison Interests Substack.

Here is the live link to watch the podcast: On Dec 12 at 10:00 Central

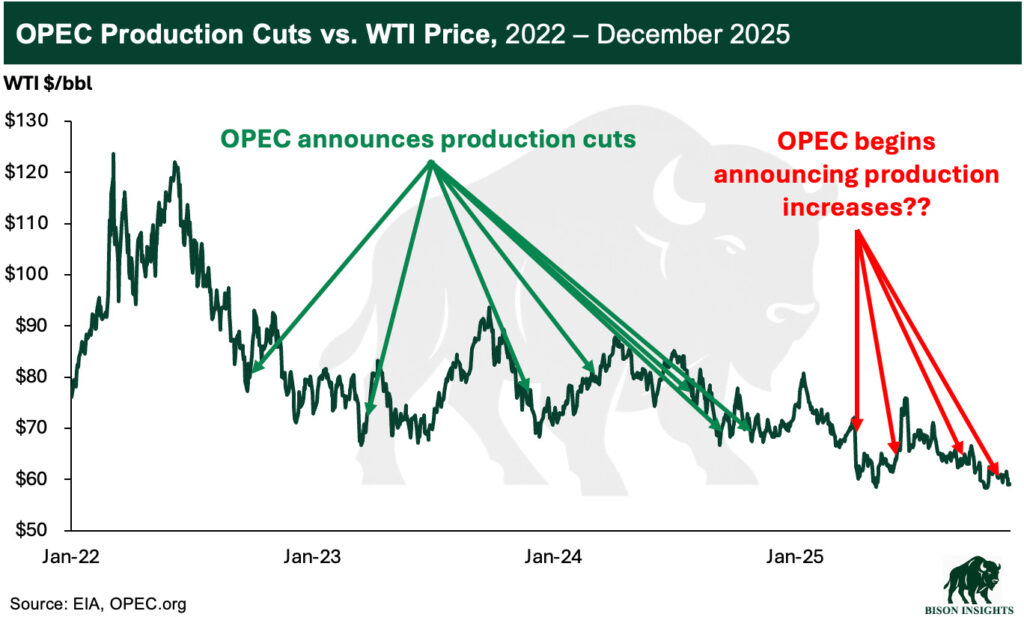

One of the more puzzling developments in oil markets this year has been OPEC+’s rapid unwinding of production cuts at a time when oil prices are at their lowest levels in nearly five years.

The group clearly benefits from higher prices, and its stated purpose is to “stabilize” oil markets. So why would OPEC+ keep production constrained for several years when prices were much higher, only to increase supply now, when prices are lower?

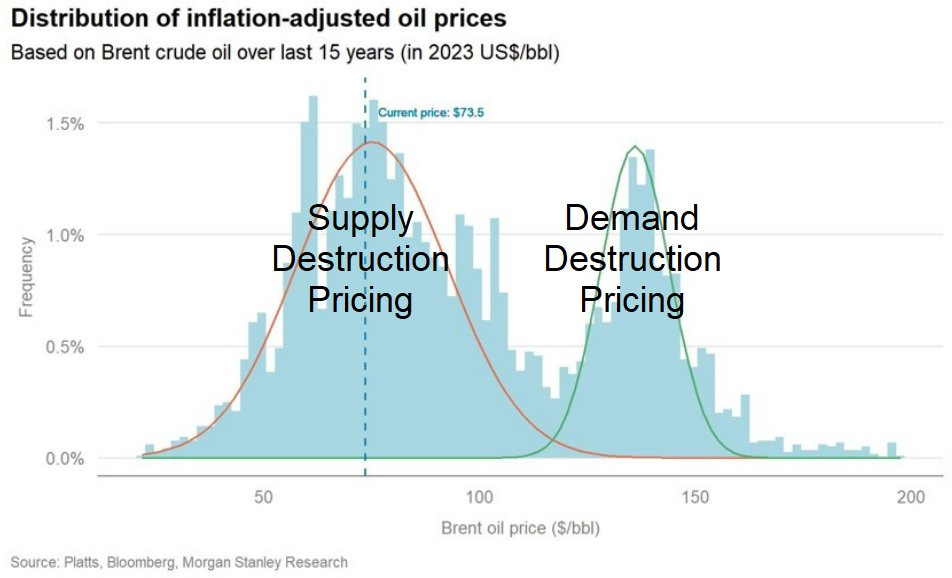

In oil markets, as in all commodity markets, it’s important to skate to where the puck is going, not where it is today. Prices are currently low, but OPEC is signaling that they see robust demand ahead, and that they are increasing production now to try to ensure stable, modestly high prices in the future. Oil prices tend to be bimodal, and OPEC’s long-term interests are best served when prices sit between the extreme end ranges of supply-destruction pricing and demand-destruction pricing, or over $100 per barrel:

While extremely high prices obviously benefit OPEC+ member countries in the short term, the ensuing demand destruction and supply builds that follow are damaging to the group over the long run. Their recent actions and statements suggest they are trying to avoid that extreme scenario by adding supply now, into the wave of demand that is now starting to show up in the data – indicating that we’re in the early stages of the next up-cycle in oil. This broader context helps frame a special OPEC briefing I attended on Sunday.

I joined a small group invited by OPEC+ leadership to hear their presentation on a new study they’re performing to assess the Maximum Sustainable Capacity (MSC) of member countries that will serve as a reference for establishing 2027 production quota baselines. HRH Prince Abdulaziz bin Salman opened the session, and OPEC Secretary General Haitham Al Ghais outlined how the organization plans to evaluate sustainable production levels across member countries.

It was an unusual, fascinating conversation that gave me a clearer view of where OPEC policy is heading and sharpened my thesis on why they unwound production cuts so quickly this year, as well as what that means for the oil market over the next several years.

My Key Insight: 2025 Production is the New Baseline

They need this assessment because the quota system only works if allocations reflect genuine production capability and are adhered to. If quotas are set above real capacity, countries can’t meet them. If they’re set too low, members argue they’re being unfairly restricted. Establishing a credible sense of spare capacity makes the entire framework more enforceable and coherent.

To get that clarity, OPEC wants to observe production behavior in an unconstrained environment. By rapidly loosening quotas, they can see which countries actually increase output and which ones don’t.

This is the message that OPEC shared during the meeting and in a subsequent presentation sent to the participants, where they made clear that 2025 production will serve as the baseline for future quotas:

“1st Milestone: Establish 2025 as the baseline year to identify reference crude oil production and projects.”

Put simply, the recent quota relaxation is an attempt to anchor future allocations by understanding what countries can actually produce today.

Where OPEC Production and Quotas Stand Now

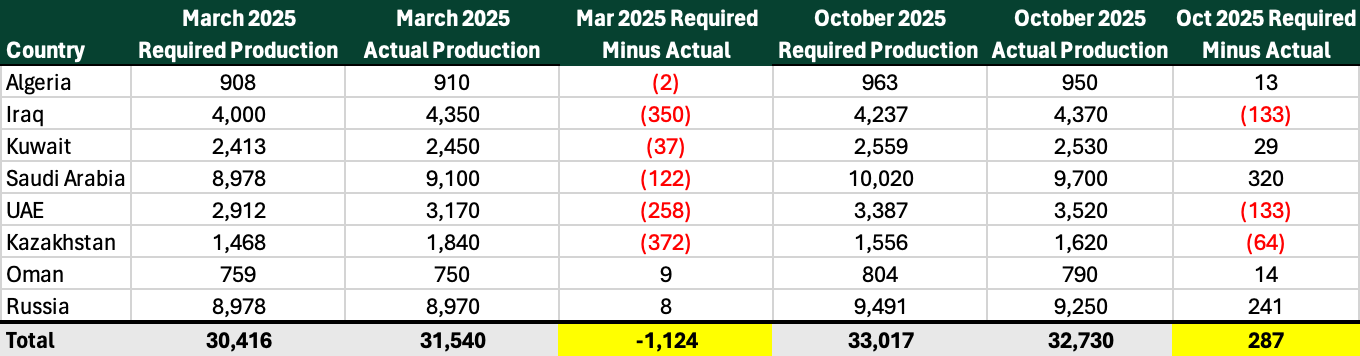

Today, the situation has flipped. OPEC+ has raised quotas so quickly that member countries can’t keep up. In October, the group as a whole produced 287 mboe/d below its required production level:

Since March, production quotas have increased by 2,601 mboe/d, but actual production has only increased by 1,190 mboe/d.

By highlighting this gap between actual production and stated production quotas, I think OPEC leadership is achieving three key goals:

- By “loosening the reins” and setting quotas above what countries can realistically produce, OPEC leadership can observe how members respond and determine their true spare capacity. This gives them a much clearer picture of sustainable production levels, which helps calibrate future quotas and informs longer-term capital allocation decisions, particularly for Saudi Arabia.

- By revealing that many member countries cannot reach their stated quotas, OPEC is effectively puncturing the long-held narrative that the group has several million barrels per day of spare capacity. That perception has been a major headwind for oil prices. Demonstrating that this spare capacity doesn’t actually exist removes a psychological and structural barrier to higher prices, and higher prices ultimately aligns with the interests of OPEC leadership.

- By rapidly unwinding its production cuts, OPEC leadership is also currying favor with the Trump administration, which helps reinforce Saudi Arabia’s newly upgraded status as a major non-NATO ally and supports the recent Strategic Defense Agreement between the U.S. and Saudi Arabia that provides important military and economic benefits to the Kingdom.

What This Means for Future Production

My view is that the most likely outcome is that the core OPEC+ countries continue to fall short of their rising quotas. As that happens, the market will be forced to confront the reality that OPEC does not have the multi-million-barrel spare capacity buffer it has long assumed. With U.S. oil production expected to decline over the next year, this realization could drive a sharp upward repricing of oil as investors recognize how tight the physical market actually is and the market starts to price that in.

The less likely scenario is that member countries do manage to meet the higher quotas. If that occurs, Saudi Arabia gains exactly what it wants: a clear view of each country’s Maximum Sustainable Capacity, allowing them to recalibrate future quotas with far greater precision. But even in this case, the implications are still bullish, albeit with some delay. If members are already producing at or near their sustainable maximums during this test period, it suggests we are very close to — if not already at — maximum production levels for most or all OPEC+ countries. That would imply that once quotas are reset using this new information, future adjustments are more likely to be cuts, not increases.

Either path points to the same structural conclusion: the narrative of meaningful OPEC+ spare capacity is ending just as global demand continues to rise. The market has not yet priced in the implications.

Disclaimer: This is for informational and educational purposes only. This is not an offer, solicitation, or investment recommendation. Please consult an advisor and do your own diligence. Past performance may not repeat itself. These are the personal views of Josh Young’s alone, and do not represent any other individual or organization.

Got Questions on investing in oil and gas?

If you would like to advertise on Energy News Beat, we offer ad programs starting at $500 per month, and we use a program that gets around ad blockers. When you go to Energynewsbeat.co on your phone, or even on Brave, our ads are still seen. The traffic ranges from 50K to 210K daily visitors, and 5 to 7K or more pull the RSS feeds daily.