The silver market’s dramatic plunge on January 30, 2026, has left investors reeling, wiping out trillions in market value and sparking widespread debate about manipulation, market fundamentals, and broader economic implications.

Spot silver prices collapsed 37% in a single session, marking the worst day on record, while futures plummeted 31.4% to settle at $78.53—an unprecedented drop not seen since March 1980.

This followed a parabolic rally that saw silver surge past $120 per ounce earlier in the week, driven by industrial demand and supply constraints, only to erase weeks of gains in hours.

As the dust settles ahead of Monday’s trading on February 2, questions abound: Was this a natural correction or orchestrated manipulation?

What does it mean for banks and the broader markets? And with silver’s critical role in AI and tech hardware, could this volatility spill over?

A Turbulent Update on the Silver Market

Silver entered 2026 on a tear, having soared 144% in 2025 and another 54% in January alone, peaking at $121 before the crash.

The rally was fueled by structural supply deficits—now in their fifth year—and exploding industrial demand from sectors like solar panels, electric vehicles (EVs), semiconductors, 5G infrastructure, and AI data centers.

China’s export restrictions on silver, effective January 1, 2026, exacerbated shortages, pushing prices higher as global mining supply remains stagnant, largely as a byproduct of other metals extraction.

The January 30 crash was triggered by President Trump’s nomination of Kevin Warsh as Federal Reserve chair, a hawkish pick that strengthened the U.S. dollar and reduced the appeal of non-yielding assets like precious metals.

Margin hikes by the CME Group in mid-January—from 9% to 11%—forced leveraged traders into liquidations, amplifying the sell-off.

By session’s end, silver had shed 31%, with spot prices dipping to $83.45 before stabilizing around $78-85 in Western markets.

However, physical markets told a different story: Shanghai silver traded at $122 per ounce on February 1, a $37 premium over Western prices, highlighting a massive East-West dislocation and potential arbitrage draining Western supplies to Asia.

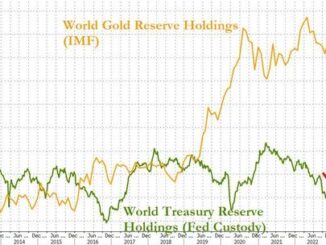

Looking ahead, silver’s outlook remains volatile but fundamentally bullish for many analysts. Supply deficits are projected through 2030, with industrial demand—now 59% of total usage—dominating.

U.S. and Chinese data centers alone consumed 350 million ounces in 2025, over half of global mining output.

Forecasts vary: UBS sees silver averaging $56 in 2026, potentially hitting $58 by Q4, while others predict a rebound to $150 or even $200 by May after a February consolidation above $78.50 support.

Bearish voices, like former JPMorgan strategist Marko Kolanovic, warn of a drop back to $50 if speculative froth unwinds.

🚨 SILVER RIGGED: THE PROOF

Silver crashed 28% on friday, wiping out trillions.

And guess what?

JP closed their short positions at the absolute exact second it hit the bottom.

Between 2008-2016, 5 major banks were caught criminally rigging these markets.

The charges were:… pic.twitter.com/dVaHPagk12

— NoLimit (@NoLimitGains) February 1, 2026

This video and post on X is worth watching. All 5 stages of the last crashes are flashing warning signs.

4 of the 5 are Red. The last one is the trigger.

In 1929, a man named Roger Babson predicted the crash that would destroy the American economy.

Wall Street laughed at him. 47 days later, they lost everything.

Babson wasn’t lucky. He identified a 5-stage pattern that appears before every major financial collapse.

The same… pic.twitter.com/jyB8xxAz7D

— Crypto Fergani (@cryptofergani) January 31, 2026

History of Bank Fines for Market Manipulation

The silver market has long been plagued by allegations of manipulation, with major banks paying billions in fines over the past decade. In 2020, JPMorgan Chase & Co. agreed to a record $920 million penalty from the U.S. Department of Justice, CFTC, and SEC for spoofing—placing fake orders to manipulate prices—in precious metals and U.S. Treasuries markets.

The scheme spanned eight years and involved deceptive trading to benefit the bank’s positions.

Deutsche Bank settled a $38 million lawsuit in 2016 for rigging silver prices, providing documents and recordings that exposed collusion with UBS and others via the flawed London Silver Fix benchmark.

In 2014, five banks—including Citibank, HSBC, JPMorgan, RBS, and UBS—were fined over $1.4 billion by the CFTC for attempting to manipulate foreign exchange benchmarks, which often intertwined with metals trading.

The Bank of Nova Scotia paid $60.4 million in 2020 for commodities price manipulation.

These cases highlight a pattern of banks abusing their market-making roles to distort prices, often through spoofing or benchmark rigging, to the detriment of investors.JPMorgan’s Timely Short Closure: Coincidence or Manipulation?

Amid the chaos, JPMorgan’s actions have fueled suspicion. COMEX data reveals the bank closed 3.17 million ounces of silver shorts exactly at the crash’s nadir, issuing all 633 delivery notices at $78.29—the settlement price.

This precise timing allowed JPMorgan to unwind positions profitably as panicked longs liquidated, with the price rebounding shortly after.

Analysts and social media users, including on X, argue this wasn’t luck: “This isn’t coincidence… This is the proof the whole Friday crash was planned.”

The setup was months in the making. CME’s margin hikes forced liquidations, and JPMorgan’s own forecast of a 50% drop preceded the event.

A $20 discount to NAV in the iShares Silver Trust (SLV) ETF allowed banks to buy shares cheaply, redeem for physical silver at higher LBMA prices ($103.19 vs. COMEX $78.29), and pocket up to $1.5 billion in profits.

Combined with COMEX open interest drops, banks may have extracted $5 billion overall from the orchestrated drop.

While JPMorgan has faced past fines for similar tactics, this event raises fresh questions about regulatory oversight in a market where paper contracts vastly outnumber physical supply (490 million ounces in open interest vs. 105 million registered).

What Analysts Expect on Monday: Banks, Closures, and Silver’s Path Forward

Monday’s reopen could be explosive. Physical premiums in Asia remain sky-high, with Shanghai at $122 signaling strong demand from China and India amid industrial shortages.

This East-West gap could accelerate silver flows eastward, pressuring Western inventories and potentially igniting another squeeze.

Analysts like those at FXEmpire see a February pause above $78.50 as healthy, setting up a surge to $200 by May.

Others warn of deeper plunges to $68 if overbought signals persist or if retail panic sells.

Volatility is assured, with some forecasting $70 as the “new normal” base.

Banking stress adds intrigue. Metropolitan Capital Bank & Trust in Chicago ($261 million in assets) failed on January 30—the first U.S. closure of 2026—amid “unsafe conditions.”

The FDIC’s swift intervention contained it, but the timing with the silver crash and $60 billion in Fed liquidity injections raises eyebrows about hidden exposures.

Experts monitor for more failures if metals volatility exposes short positions or liquidity crunches, especially with $13.7 billion in estimated JPMorgan silver exposure pre-crash.

Broader Implications for Energy Markets

Silver’s scarcity could ripple through the energy transition. Rising costs might make solar less accessible in developing regions, delaying global decarbonization efforts.

Conversely, it presents opportunities for investors in silver mining or related ETFs, as prices are expected to climb amid persistent deficits.

For the solar industry, innovation is key. Advances in perovskite or thin-film technologies could reduce silver dependency, but c-Si remains dominant for now.

As Elon Musk recently tweeted, solar will dominate future power generation, but supply chain vulnerabilities like silver could test that vision.

Silver’s Tech Ties: Will the Crash Spill Over?

Silver’s industrial footprint—essential for conductive inks in AI chips, data center wiring, EVs, and solar panels—means volatility could ripple into tech and energy sectors.

AI and data centers drive surging demand, with projections for continued growth tying silver prices to tech innovation.

A prolonged crash might hike costs for solar (key to energy transitions) and AI hardware, potentially slowing deployments if shortages worsen.

However, the isolated nature of Friday’s drop—sparing stocks, bonds, and other commodities—suggests limited immediate spillover.

Retail fervor around silver, now rivaling AI stocks like Nvidia, could indirectly pressure tech if investor rotation accelerates.

Long-term, deficits ensure upward pressure, but short-term crashes like this expose vulnerabilities in supply chains reliant on stable pricing.

They Crashed Silver on Purpose… Here’s The Real Plan pic.twitter.com/5devFOVq9d

— Felix Prehn 🐶 (@felixprehn) February 1, 2026

As markets gear up for Monday, the silver saga underscores deeper questions about financial integrity. For energy stakeholders, silver’s role in renewables like solar amplifies the stakes—will this plunge be a buying opportunity, or the start of broader instability?

As Stu Turley, Podcast Host for the Energy News Beat channel, has said, we don’t provide investment advice; rather, we provide tools for your research and ask your CPA and other certified investment professionals the right questions. Regarding the silver crash of 2026, Stu Turley advises taking profits as you go and not letting them run. If it is a true run, it will pull back; then you can enter. Much like a pilot trusts his instruments, trust your charts. Charts, patterns, and profits all work together. Right now, we have more questions than answers.

Sources: Grok on X, investing.com, finance.yahoo.com, cnbctv18.com, cnbc.com, wsj.com, @DarioCpx, @silvertrade

Get your CEO on the podcast: https://sandstoneassetmgmt.com/media/

Is oil and gas right for your portfolio? https://sandstoneassetmgmt.com/invest-in-oil-and-gas/