ENB Pub Note: Robert Bryce writes a fantastic article on the SMR stocks getting hammered on his Substack today. Looking at them from an investment perspective, you have to ask, How is the cash flow looking. Robert has been on the Energy News Beat podcast several times, and we highly recommend following and subscribing to his Substack.

I have been following Nano Nuclear Energy, and believe that they are on the right track, getting their mass production, fuel, and reactors all being approved at the same time. This is a recipe for success. We will be watching their stock in our Energy News Beat Energy Portfolio.

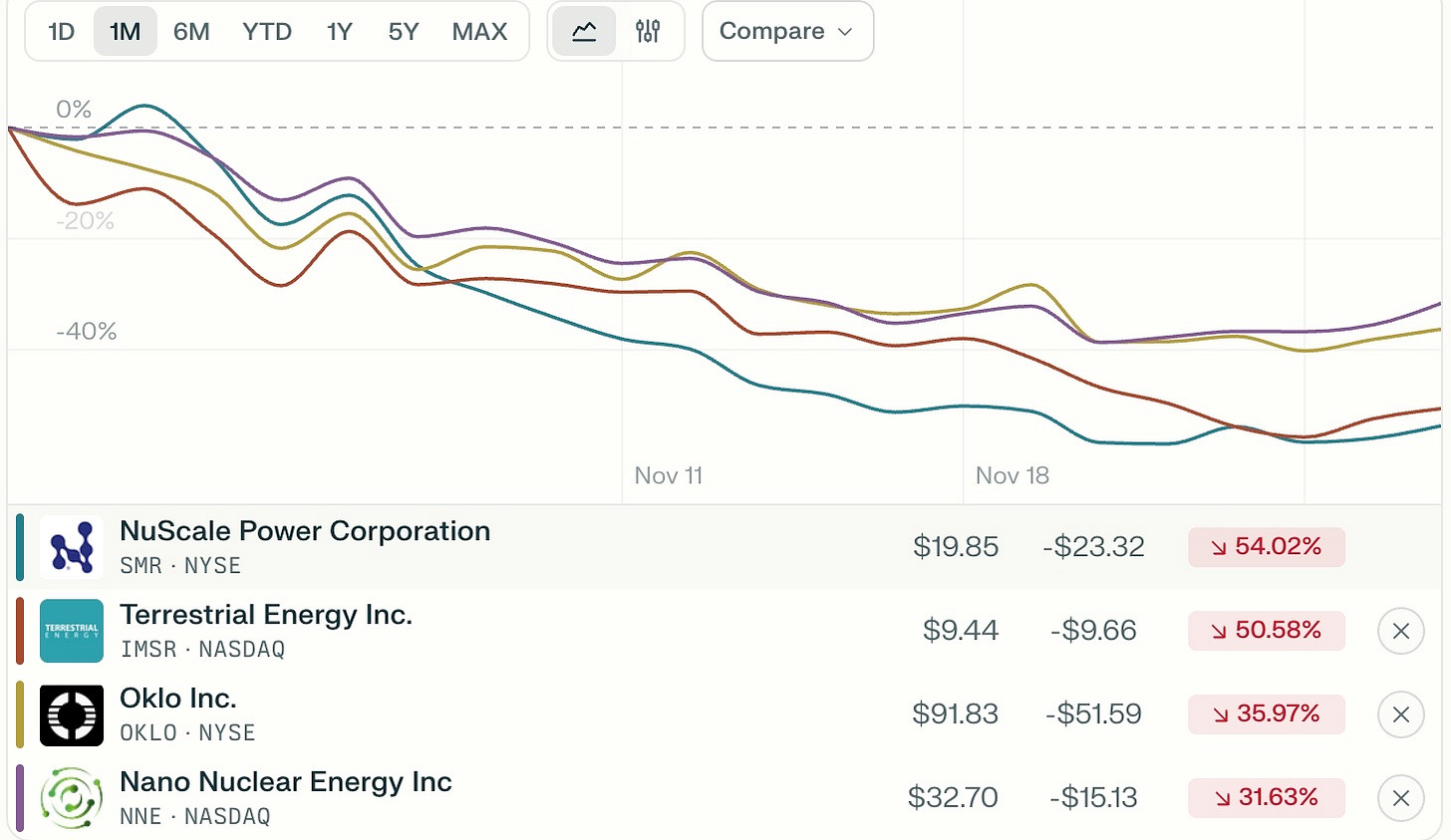

The hype over SMRs is colliding with the realities of the marketplace. Last month, all four of the publicly traded pure-play SMR companies got shellacked. Of the four, NuScale took the biggest beating, and rightly so.

As seen above, NuScale’s shares plummeted by 54% last month. Why the collapse? The company keeps reporting terrible numbers. On November 6, the company reported a third-quarter operating loss of $538 million, compared with a $41 million operating loss in the year-ago quarter. A day later, NuScale announced a $750 million equity offering. In other words, NuScale is losing increasing amounts of cash, and it is funding its operations by issuing additional stock, which will further dilute the equity of existing shareholders. I have been writing about NuScale since 2008. And despite years of promises and countless press releases, the company still hasn’t built a reactor. Since 2020, NuScale has reported operating losses of about $1.4 billion.

Terrestrial Energy, the latest pure-play SMR company to go public, also saw its shares plummet. Since going public on October 29, the company’s shares have fallen by about 50%.

Oklo, which has had more positive media coverage than any other SMR company, saw the value of its shares fall by 36% last month. In September, the company broke ground at Idaho National Laboratory for its first reactor project. Since then, it has announced several significant contracts. But on November 14, the company announced that it lost $63.3 million during the third quarter. And stock traders are getting leery of considerable insider selling. Over the past six months, Oklo’s co-founders, Jacob DeWitte and Caroline Cochran, each sold 600,000 shares of their company’s stock, worth $67.3 million. As reported by QuiverQuant, three other Oklo insiders have also sold big chunks of stock. In all, Oklo insiders have sold their company’s stock 43 times over the past six months, but have made no purchases. The total value of those insider sales: $171 million.

Meanwhile, Nano Nuclear, which is developing microreactors, saw its share price fall by about 32% last month. The company still sports a market capitalization of $1.6 billion.

The November share-price collapse for the pure-play SMR companies is newsworthy

because several companies are planning IPOs in 2026. As we explained in October,

in the first SMR Intelligence Update, that list including Deep Fission, Hadron Energy, Terra Innovatum, and Holtec International. Since then, One Nuclear Energy has declared its intent to go public in 2026. Whatever the outcome of those deals, it is clear that all of the SMR vendors must navigate a daunting licensing process with the federal government, a process that will likely take years. They will also have to raise hundreds of millions of dollars in new capital to scale up their businesses. In short, all of the SMR companies are years away from generating significant profits. Mr. Market is starting to take that reality into account.

British Government Picks Rolls-Royce

technology provider for the development of small modular reactors. On November 13, the government confirmed that the industrial giant, which also makes jet engines

and other power equipment, will begin development of three reactors at Wylfa in Wales.

The government’s decision to go with Rolls-Royce isn’t surprising. It makes sense

that the Brits would choose a British company for the SMR deployment over a

foreign one. As a government spokesperson explained, “This is our flagship SMR

program, producing homegrown clean power with a British company, and we have

chosen the best site for it.”

A few other points are relevant. First, although it’s labeled a SMR, the Rolls-Royce reactor at 470 MW of capacity, is not, in fact, small. Second, the British government didn’t choose a company developing a reactor that uses an alternativechemistry and special fuel. Instead, it played it safe by selecting the Rolls-Royce reactor, which is a conventional pressurized water reactor that uses low-enriched uranium. Third, the deal shows that the British government and Rolls-Royce are hoping the Wales project will lead to exports of the technology. In August, Rolls-Royce was pickedby Swedish utility Vattenfall as a finalist to become the provider for Sweden’s first new nuclear construction project in over four decades. The other finalist is GE Vernova, which is developing the BWRX-300.

In August, Deep Fission was selected by the Department of Energy to participate in the nuclear reactor pilot program, which aims to have three test reactors achieve criticality by next July. In September, the company filed an S-1 with the Securities and Exchange Commission, signaling its intent to go public. In mid-October, during the Texas Nuclear Summit in Austin, I did a short interview with the company’s CEO, Liz Muller. Here’s a transcript of that interview. It has been edited and condensed for clarity.

Robert Bryce: Tell me why this technology is going to prevail in the market.

Liz Muller: The reason that nuclear power is so expensive has nothing to do with the core. The core of a nuclear reactor is almost stupid simple, right? It’s just, you know, bring uranium-235 atoms together, and they start to react, and that creates heat. So the challenge has been in the containment, in creating the pressure so that you can get high quality steam, and then in all the emergency core cooling systems in case something goes wrong. And that’s 80% of the cost of nuclear power is in all of those things, not the core of the nuclear reactor itself. So the recognition that we had is that if you’re in a bore hole a mile underground, you have excellent containment. That’s why nuclear waste disposal in bore holes is so great. So you don’t have to build the containment. It’s already built in…Final thing is the cooling systems, emergency core cooling systems. You know, we have a column. Our borehole is full of water. It’s a column a mile long, it has all the cooling you could possibly need without needing to build in some additional coolness

RB: So the entire bore hole is filled with water? What are we talking about in mass and volume roughly?

LM: I don’t know them off the top of my head, but you can imagine it. The weight is 160 atmospheres of pressure, right?

RB: So the 160 atmospheres is due to the pressure of the water column. I see. So why go public? You’ve got Hadron Energy planning to go public. Terra Innovatum, Holtec, and Terrestrial is going to go public in the next few days. I mean, frankly, this just smells like a bubble to me, yeah. Do you blame me for saying that?

LM: I do not blame you. I mean, for us, it’s very clear because we need to, we need to build a reactor for the Department of Energy pilot program. So we are actively building a reactor right now, and our target date to have it operational is July 4, 2026 that’s not that far off. So, yes, there may be a bubble right now. I think the real question is going to be, who’s going to actually build a reactor in 2026? I think we have really good reason to believe that we can. I think that those who cannot build a reactor in 2026 or heaven forbid, if they don’t build one in 2027, I think we’re going to start to see that bubble burst. You know, my hope for Deep Vision is to build our reactor. And not only will we build our first reactor, we’re then going to move straight into the commercialization phase. And so we’re going to have real revenue. We’re going to have real profit, you know, starting in the next couple of years, not five to 10 years into the future.

RB: How much money do you think you will raise when the shares start trading?

LM: So we, you know, we’re not talking publicly about exactly how much we need to raise, but we are expecting to raise a pretty significant round in the next I’m going to call it, six months, which is going to cover the cost of building this reactor.

RB: But we can, we can assume several hundred million dollars?

LM: Less than that. So, the cost of our reactor itself, we’re looking at $40 to $50 million.

RB: For 15 megawatts?

LM: For 15 megawatts. Now we are going to need some additional non-recurring engineering expenses, etc, and I’m happy to go into that in a little more detail if you want. But it the biggest expenses are the borehole itself and the balance of plant.

RB: So what can you tell me about the dollars? You have to go a mile deep and 36 inches across? What does that cost to drill that?

LM: I mean, what I can share is that we have shared estimates of cost… that puts us at right about $40 to $50 million per reactor.

RB: To build new combined cycle gas capacity is $2 to $2.5 million per megawatt. So you’re somewhat above that: $3 to $4 million per megawatt?

LM: Yeah, and that ends up being about five to seven cents per kilowatt-hour or so.

RB: And then, if I remember from your colleague yesterday, you don’t refuel? When that fuel is spent, you pull the fuel out and you leave the rest of the stuff underground?

LM: Yeah, we don’t even expect to pull the fuel out. So our on site, temporary storage is going to be on site at the bottom of the bore hole. And so we would seal off the reactor with the fuel inside of it. So no need to pull things out of the reactor. We just seal off the whole thing. Put another reactor on top. When that one’s used, we seal it off. Put another one on top until the bore hole, until we’ve used it for 50 years, 60 years, 100 years, however long we’re using the bore hole for, and then at that point we either my choice, would say, all right, well now nuclear waste disposal and bore holes has become an option because that’s, you know, 50 years into the future. And so we never intend to pull the waste up. We’re just going to certify it now as safe for nuclear waste disposal.

Got Questions on investing in oil and gas?

If you would like to advertise on Energy News Beat, we offer ad programs starting at $500 per month, and we use a program that gets around ad blockers. When you go to Energynewsbeat.co on your phone, or even on Brave, our ads are still seen. The traffic ranges from 50K to 210K daily visitors, and 5 to 7K or more pull the RSS feeds daily.