ENB Pub Note: This is from David Blackmon’s Substack, and I will be talking with him about this and his projections for 2026 next week. We will be interviewing Doomberg on January 6th. As he lists the five most impactful energy events, we will add to this list and cover all of them on Wednesday’s Energy News Beat Stand-Up. We are going to cover Venezuela, Ukraine, Russia, California, and several other issues to round out the top 10. We can’t leave out the closure of California’s refineries and their impact, Spain’s blackout, and the restarting of several key nuclear plants. We highly recommend subscribing to David’s Substack.

Every year is filled with impactful changes in the global energy space and 2025 was no exception. In fact, due to the advent of Donald Trump’s second term in the White House and an array of geopolitical and international trade developments, 2025 could well come to be remembered as one of the most impactful on record.

[Note: This piece is also published at Forbes.]

The AI Datacenter Rush – It’s the gold rush of the 21st century. This frenzied sprint by tech companies and power providers to capitalize on the global competition to win the AI race became the key driver of rising electricity demand in the U.S. and other developed nations. The simultaneous buildout of hundreds of these major power hogs in the U.S. and other countries created visible significant impacts, including rising power bills, strained capacity on regional grids, tightening markets for raw materials and exploding demand for natural gas, which emerged as the dominant power generation fuel of choice.

The major impacts which arose in 2025 raised concerns among policymakers at all levels, meaning 2026 could bring a policy boomerang onto an industry which has to this far operated in almost a wild, wild west scenario. More than any other single factor or event, 2025 seems destined to be remembered as the year in which the rise of AI forced major new investments and a rapid rebalancing of energy priorities in the U.S. and other OECD countries.

China’s Crackdown On Rare Earth Exports – Intentionally or not, China’s government set off panic alarms inside the U.S. and other western governments to onshore or “friend shore” supply chains for rare earth minerals with its series of crackdowns on exports during the past 14 months. With its incremental moves starting in October 2024 and culminating on October 9 of this year, the Xi government set off efforts from Washington, DC to London to Brussels to Tokyo to Sydney designed to secure supplies of these and other critical energy minerals without which real energy security is impossible.

One positive development out of this new energy crisis is the reminder it has sent to western political leaders that rare earth minerals are not in fact rare – they exist in great volumes in widely disparate parts of the world – and that the maintenance of a healthy domestic mining industry is a key driver of national energy security. China’s government no doubt invoked its restrictions in an attempt to protect its dominant position in the market. Instead, it set in motion events across much of the rest of the world which could have the opposite effect.

OPEC+ Invokes Another Oil Price Crash – Speaking of protecting market positions, OPEC and its successor, OPEC+ have made a habit of intentional flooding of oil markets over the last half century as a strategy to protect market share. OPEC took this action in 2014 in what became a failed effort to kill or severely damage the U.S. shale industry. The price crash that folly caused proved so deep and intractable that OPEC worked in concert with Russia, Mexico and other big non-OPEC oil producing countries to create OPEC+ in late 2016 to exert more comprehensive control over crude markets.

Aside from the COVID-caused crash of 2020, OPEC+ has had significant success in supporting global crude prices at more robust levels. But member countries were consistently forced to cut back on their own export volumes in recent years as the U.S. shale industry’s incessant growth cut steadily into market share.

To reverse this trend, OPEC+ embarked on a program early in the year to add significant volumes back onto the market, in the process causing oil prices to fall by almost 30%. But the U.S. shale Atlas responded with a big shrug, continuing to set new overall production records during several months in 2025.

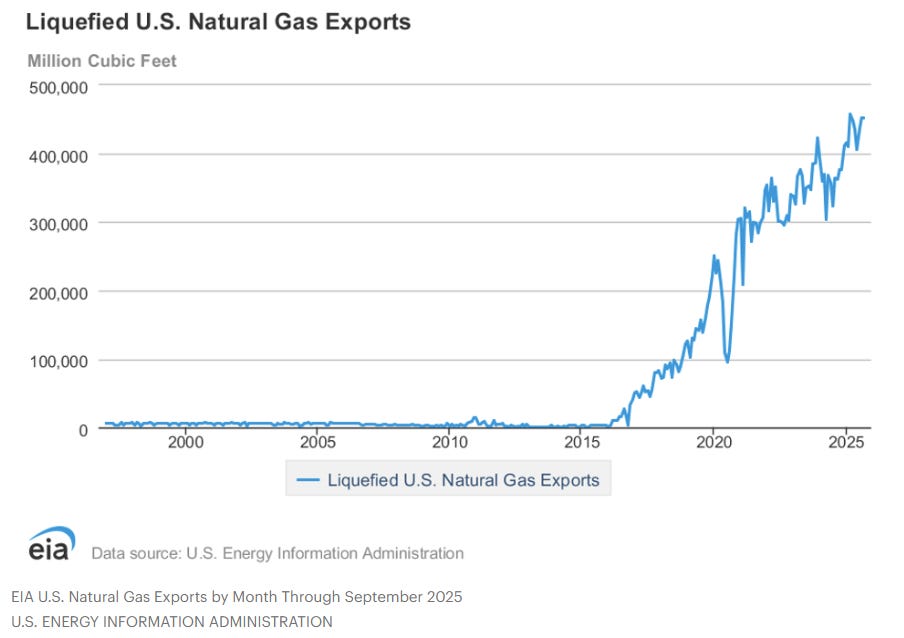

America Becomes the World’s Dominant LNG Supplier – The United States had already moved into the position as the #1 exporter of liquefied natural gas (LNG) on earth in 2024, thanks mainly to explosive European demand brought on by Russia’s war on Ukraine. The fact the domestic industry was able to achieve that position in the face of a year-long federal permitting pause and other efforts to restrict its growth during the Biden years was a testament to its resilience and innovative nature.

President Trump moved on Day 1 of his second presidency to end Biden’s permitting blockade and spent the rest of the year invoking a series of policy changes designed to spur the industry’s growth. Through September 2025, the result has been a 25% year-over-year uptick in exports volumes, cementing U.S. LNG’s position ahead of other big exporters like Australia and Qatar.

IRA Green Energy Subsidies Disappear – What the Inflation Reduction Act (IRA) gaveth to green energy in 2022, the One Big Beautiful Bill Act (OBBBA) took away in 2025. The September 30 end of the IRA’s $7,500 electric vehicles subsidy resulted in an immediate crash in new EV sales in October and November. Ford followed in early December with its announcement of a $19.5 billion write down of EV investments and major model reorganization.

Subsidies for wind and solar projects are being phased out over time, but projects must be under construction by July 2026 to benefit from the federal rents through the end of 2027. It all proves yet again that energy markets are a far more reliable driver of rational corporate capital investments than feeding at the federal trough can ever hope to be.

Fossil Fuel Demand Defies Peak Predictions, Again – Demand for fossil fuels – oil, natural gas, and coal – proved to be stickier in 2025 than many experts had predicted, continuing an annual trend which has stood in the face of global government efforts to force an energy transition via government policy choices and subsidies.

In its annual World Energy Outlook released in November, the International Energy Agency (IEA) was left with no choice but to admit that global consumption of all three major fossil fuels will achieve new record levels this year. Worse for the IEA’s current leadership, the agency was forced to abandon its recent prediction that crude oil demand would peak before 2030 in a revised base case forecast predicting rising crude demand for years to come.

An Energy Secretary Willing To Use The Office As A Bully Pulpit – Men and women of all types of backgrounds have served in the office of U.S. Secretary of Energy. Some, like Biden appointee Jennifer Granholm, George W. Bush appointee Spencer Abraham, and first Trump pick Rick Perry, sported political pedigrees and little energy experience. Others, like Barack Obama picks Stephen Chu and Ernesto Muniz, were academics with strong scientific research backgrounds. Still others were chosen for reasons known only to the presidents who appointed them.

Current Energy Secretary Chris Wright brings a unique combination of experience to the post: A strong, relevant academic background (degrees in engineering from both MIT and Cal Berkeley) and experience creating and running significant businesses in both the nuclear and oilfield service industries. Perhaps more than any of his predecessors, Wright has used his perch atop the DOE as a sort of bully pulpit that has enabled him to become a major driver of key elements of Trump’s energy policy revolution.

With the possible exception of Secretary of State Marco Rubio, no cabinet official has been a more constant presence in the media advocating for the White House’s policy initiatives. Wright has leveraged his position to advocate for reforms like housing new nuclear plants on federal installations; delaying retirements of 15 GW of coal power plants; reallocating green subsidy dollars to bolster DOE research and development; pressuring the European Commission to reform planned methane and corporate reporting regulations, and much more.

Few if any industries are more deeply impacted by government policy actions than energy. That reality is clearly at play in every one of the seven impactful events detailed here. Wright seems to understand that dynamic more clearly and acts on it more decisively than any of his predecessors in the DOE post. Agree with him or not, it is impossible to deny the impact he’s had on the national and international scene.

Please join me here next week with my predictions of the major energy events we can expect to witness in 2026. David Blackmon Substack