In a surprising turn following the high-stakes Alaska summit between U.S. President Donald Trump and Russian President Vladimir Putin, Trump announced he would delay hiking tariffs on Chinese goods. This decision stems directly from China’s ongoing purchases of Russian oil, which Trump linked to progress made in discussions aimed at ending the war in Ukraine. The move has immediate implications for global energy markets, potentially stabilizing oil and liquefied natural gas (LNG) prices amid ongoing geopolitical tensions.

The announcement came shortly after the summit at Joint Base Elmendorf-Richardson in Anchorage, Alaska, where Trump and Putin met for several hours but failed to secure a formal ceasefire deal.

Both leaders described the talks as productive, with Trump rating the meeting a “10 out of 10” during a subsequent interview on Fox News’ Sean Hannity show.

Trump emphasized that the discussions covered “land swaps” and territorial concessions in Ukraine, claiming they came “very close to a deal” without NATO involvement in security guarantees.

He urged Ukrainian President Volodymyr Zelenskiy to negotiate directly with Putin, warning of “economically severe consequences” if no agreement is reached.

Putin, for his part, reportedly reiterated past statements that he would not have invaded Ukraine had Trump won the 2020 election, attributing the conflict’s escalation to U.S. leadership changes. During Trump’s Hannity appearance, the president referenced Putin’s alleged admission that mail-in voting irregularities “stole” the election, though no direct confirmation from Putin on the show has surfaced.

Today marked a significant day in the new trading blocs, with the next steps focusing on the EU, UK, and Ukraine. How they play it will determine their success or failure.

These claims echo broader narratives around election integrity but remain unsubstantiated in recent public records.

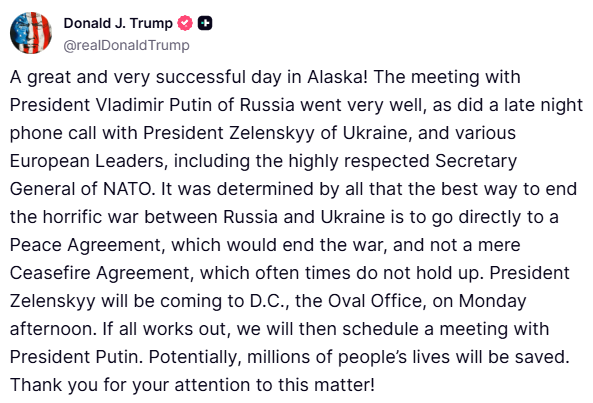

As noted in President Trump’s Truth post, Zelensky should be in the Oval Office on Monday, and they can set the meeting to end the war and peace without a ceasefire.

The following is from RT

❗️Trump: GREAT and VERY SUCCESSFUL day in Alaska

'Determined by all' that best bet is STRAIGHT to peace agreement, skipping ceasefire

Zelensky talks coming up Monday, hopeful for a Putin-Zelensky meet soon after https://t.co/Z1zYdMKhQM pic.twitter.com/0JxrflWpa3

— RT (@RT_com) August 16, 2025

The Tariff Decision and Its Ties to Russian Oil

Trump’s tariff pause on China is explicitly tied to Beijing’s role as a major buyer of Russian oil, which has helped Moscow circumvent Western sanctions since the 2022 invasion. The president had previously threatened secondary tariffs of 25% to 50% on countries purchasing Russian energy to pressure Putin into peace talks.

However, following the summit’s perceived progress, Trump stated, “Because of what happened today, I think I don’t have to think about that,” adding that he might revisit the issue in two to three weeks.

This reprieve aligns with a recent 90-day extension of a U.S.-China trade truce, which lowered duties on bilateral goods to avert market disruptions.

China has defended its Russian oil imports as “lawful and necessary for its energy security,” underscoring the purchases’ role in maintaining affordable energy supplies amid global volatility.

In contrast, Trump has already doubled tariffs on Indian products to 50%, effective August 27, 2025, due to India’s continued buying of discounted Russian crude.

This move is part of a broader strategy to isolate Russia’s energy revenues, which fund its military efforts. However, there is no mention in recent reports of plans to stop or reverse these sanctions on India; instead, speculation suggests the China pause could signal flexibility for India if Ukraine talks advance.

Analysts note that imposing such tariffs on major buyers like India and China could drastically reduce Russian oil flows, potentially raising global prices by disrupting supply chains.

Implications for Oil and LNG Prices

The decision to hold off on China tariffs is poised to have stabilizing effects on oil and LNG markets, avoiding potential price spikes that could arise from escalated trade tensions. By not targeting China—one of the world’s largest oil importers—Trump’s move preserves current supply dynamics, where discounted Russian crude helps keep global benchmarks like Brent crude in check. Oil prices eased recently amid trade war concerns, trading below five-week highs as traders weighed the risks of Russian supply disruptions.

Experts argue that steep tariffs on Russian oil buyers would jeopardize Trump’s domestic goal of lowering energy costs, as they could lead to higher U.S. gasoline prices by tightening global supplies.

For instance, if China faced penalties, it might reduce Russian imports, forcing Moscow to cut production or reroute supplies, which could push oil prices upward by 10-20% in the short term, according to market models. Conversely, the tariff delay supports continued Chinese demand, potentially keeping West Texas Intermediate (WTI) crude around $70-80 per barrel.For LNG, the impact is more indirect but positive for U.S. exporters. The U.S.-China trade truce extension could facilitate increased American LNG shipments to China, which has been a key growth market. Tariffs on China might have deterred such trade, raising LNG spot prices in Asia and Europe. By holding off, Trump avoids this, potentially boosting U.S. LNG exports and stabilizing prices at current levels of $10-12 per million British thermal units (MMBtu) in key hubs. However, ongoing Russia-Ukraine uncertainties could still introduce volatility, with any escalation risking supply disruptions from Russian gas pipelines.

|

Factor

|

Potential Impact on Oil Prices

|

Potential Impact on LNG Prices

|

|---|---|---|

|

Tariff Delay on China

|

Stabilizes supply; prevents spikes from reduced Russian flows

|

Supports U.S. exports to China; keeps Asian prices steady

|

|

Continued Russian Oil Sales

|

Maintains discounted crude availability; downward pressure on benchmarks

|

Minimal direct effect, but aids global energy affordability

|

|

India Tariffs (Ongoing)

|

Could reroute Indian demand to Middle East; slight upward pressure

|

Indirect; may increase competition for U.S. LNG in Asia

|

|

Ukraine Talks Progress

|

Reduces war premium; lowers prices if ceasefire nears

|

Eases European demand for U.S. LNG; potential price drop

|

In summary, Trump’s tariff reprieve on China, framed against the backdrop of the Alaska summit, prioritizes diplomatic progress over immediate economic pressure on Russia. While it offers short-term relief for oil and LNG prices, the energy sector remains watchful for any shifts in U.S.-Russia negotiations or secondary sanctions on buyers like India. As Trump noted, the pause is temporary, leaving markets on edge for the next few weeks.

As they were ending the meeting, President Putin invited President Trump to Moscow while speaking in English. That is significant. The other critical part of the day was the teams at the meetings, which included business people, and the announcement earlier in the day regarding Exxon and the Russian project. I also appreciated the remarkable timing of the B-2 bomber passing right overhead as the two presidents stepped onto the stage. I have not found out if they are not going to follow through with the Indian tariffs on buying oil.

All in all, a great day for the United States. We are done funding the Ukraine war, and it is up to them to sign the deal.

Is Oil & Gas Right for Your Portfolio?

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack