In the volatile world of energy markets, where geopolitical tensions and supply chain dynamics can swing prices overnight, the latest data from the U.S. Energy Information Administration (EIA) offers a mixed bag for oil investors. U.S. crude oil inventories have ticked upward in recent weeks, signaling a slight easing of supply tightness—but they’re still lagging behind historical norms. Meanwhile, demand indicators paint a picture of steady, if unremarkable, consumption. Add to this the fresh diplomatic overtures from Russia on ending its war in Ukraine, and investors are left pondering:

Is this the calm before a supply surge, or a fleeting bullish blip? Let’s break it down.EIA Data: A Climb, But No Peak Yet

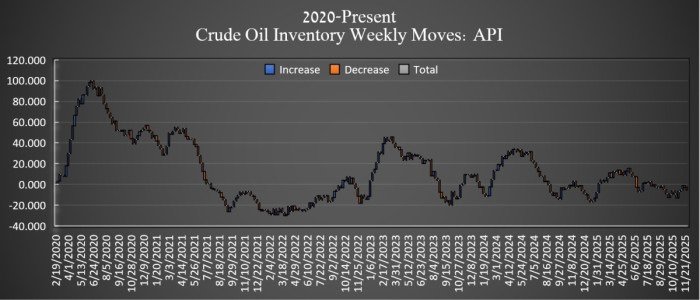

The EIA’s Weekly Petroleum Status Report, released today, covering the week ending November 28, 2025, shows U.S. commercial crude oil inventories (excluding the Strategic Petroleum Reserve) rising modestly to 427.5 million barrels.

That’s an increase of approximately 11.5 million barrels from the prior week’s level of 416.0 million barrels, marking a reversal from the draws seen in earlier reports.

However, context is key: At current levels, inventories remain about 3% below the five-year seasonal average for this time of year. This deficit underscores ongoing tightness in the global oil market, driven by robust U.S. production, steady exports, and recovering demand post-pandemic. For comparison, inventories were a whopping 10-15% below average earlier in 2025, so this uptick could signal seasonal replenishment as refiners gear up for winter heating needs.

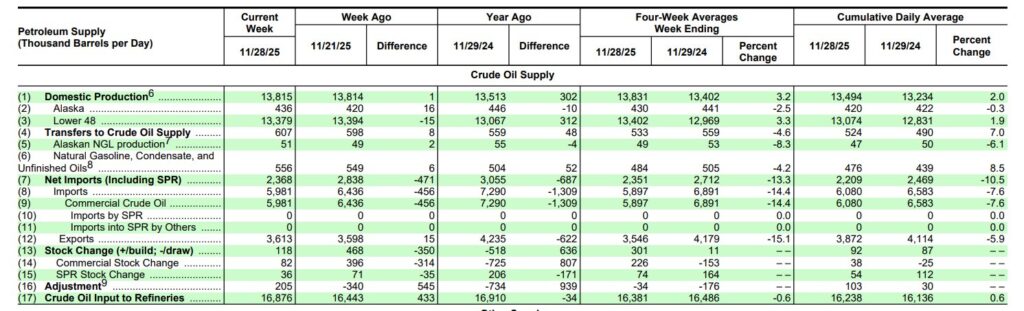

On the demand side, refinery inputs—a key proxy for domestic consumption—averaged 16.9 million barrels per day (bpd) last week, up slightly from 16.5 million bpd the prior week but still below the 2024 peak. Over the past four weeks, product supplied (a broader measure of demand) has averaged 20.1 million bpd, flat year-over-year but down 2% from pre-pandemic levels. Gasoline demand, in particular, held at 8.7 million bpd, while distillates (including diesel and heating oil) ticked up to 3.9 million bpd amid cooler weather forecasts.

Imports tell a similar story of balance: Crude oil imports fell to 6.0 million bpd last week, down 456,000 bpd from the previous period, while exports remained strong at around 4.1 million bpd. Total motor gasoline inventories, meanwhile, climbed 4.5 million barrels to levels 2% below the five-year average, suggesting ample fuel for holiday travel without immediate price spikes.

|

Key EIA Metrics (Week Ending Nov. 28, 2025)

|

Value

|

Change from Prior Week

|

vs. 5-Year Avg.

|

|---|---|---|---|

|

Crude Oil Inventories

|

427.5 Mb

|

+11.5 Mb

|

-3%

|

|

Refinery Inputs (Demand Proxy)

|

16.9 Mbpd

|

+0.4 Mbpd

|

N/A

|

|

Product Supplied (4-Week Avg.)

|

20.1 Mbpd

|

Flat YoY

|

-2%

|

|

Gasoline Inventories

|

~245 Mb

|

+4.5 Mb

|

-2%

|

|

Distillate Inventories

|

~120 Mb

|

+2.1 Mb

|

-7%

|

Mb = million barrels; Mbpd = million barrels per day; YoY = year-over-year

What Does This Mean for Investors?

For oil traders and long-term investors, the data is cautiously bullish in the short term but warrants vigilance on global factors. The inventory build, while reversing recent draws, doesn’t erase the below-average baseline— a dynamic that has kept West Texas Intermediate (WTI) crude hovering around $72 per barrel and Brent at $75 this week. Lower-than-average stocks typically exert upward pressure on prices, supporting majors like ExxonMobil (XOM) and Chevron (CVX), whose refining margins benefit from tighter supply.

Demand stability is another green light: With U.S. refinery utilization at 91%, there’s little risk of oversupply flooding the market. Holiday travel and industrial rebound could push product supplied higher into Q1 2026, potentially lifting prices another $2-3 per barrel if weather disruptions hit. However, the modest import dip hints at softening external pull, and any escalation in electric vehicle adoption or economic headwinds could cap gains.

Bottom line?

This isn’t a bearish pivot. Investors in energy ETFs like the United States Oil Fund (USO) or producer stocks might see this as a “buy the dip” moment, especially with OPEC+ reportedly holding production cuts steady. But with inventories still lean, a surprise demand surge could ignite a rally—keep an eye on next week’s report for confirmation.

Putin’s Remarks: A Geopolitical Wild Card for Oil Markets

No oil story in 2025 would be complete without the shadow of the Russia-Ukraine war, which has reshaped global energy flows since 2022. Russian exports—once a staple for Europe—now flow primarily to Asia, but sanctions and rerouting have crimped supply by up to 2 million bpd at peaks. Recent comments from President Vladimir Putin, however, inject fresh uncertainty (or hope?) into the equation.

In marathon talks yesterday at the Kremlin with U.S. President Donald Trump’s special envoy Steve Witkoff and son-in-law/adviser Jared Kushner, Putin described the discussions on ending the war as “necessary and useful,” but also “difficult work.” The Kremlin confirmed Putin accepted “some” U.S. proposals for a peace framework, including potential compromises on sanctions relief and territorial lines, and expressed readiness to continue negotiations.

Trump, briefing from the Oval Office, called the session “reasonably good” and noted Putin’s apparent desire to “make a deal,” though he cautioned that “it takes two to tango.”

Yet, the tone wasn’t all olive branches. Putin lambasted European counter-proposals as “absolutely unacceptable,” accusing Brussels of sabotaging Trump’s efforts to broker peace.

He also issued stark warnings, stating Russia was “ready for war” if Europe escalated, a hawkish flex amid stalled progress on key issues like Ukrainian territory control.

Ukrainian Foreign Minister Andrii Sybiha shot back, interpreting the remarks as evidence that Putin “does not want the war to end.”

For oil investors, this diplomatic dance is high-stakes poker. A genuine ceasefire could unlock 1-2 million bpd of Russian crude back into Western markets, pressuring prices downward and squeezing U.S. producers’ margins. Conversely, prolonged stalemate—or worse, escalation—would sustain the Urals discount and keep Brent elevated, benefiting shale drillers and LNG exporters.

With Witkoff and Kushner slated for follow-up talks in Miami today with Ukraine’s Rustem Umerov, markets are pricing in a 40% chance of de-escalation by Q2 2026, per Bloomberg futures.

Navigating the Uncertainty: Investor Takeaways

The EIA’s inventory climb tempers immediate supply fears, but sub-five-year-average levels keep the market on a bullish tilt—ideal for positioning in quality energy names before winter demand peaks. Layer on Putin’s guarded optimism, and the risk-reward skews toward caution: Peace could flood supply, but rhetoric suggests it’s no sure bet.

Investors should monitor:

Next EIA Release (Dec. 11): Watch for continued builds or demand upticks.

OPEC+ Meeting (Dec. 10): Any output hikes could amplify bearish pressures.

Ukraine Talks: Breakthroughs in Miami could send oil futures sliding 5-10%.

In energy, as in geopolitics, timing is everything. With inventories tight and tensions simmering, now’s the time to diversify—perhaps blending U.S. upstream plays with downstream refiners for balanced exposure.

Stay tuned to Energy News Beat for updates as this story evolves. Views are for informational purposes only and not investment advice.