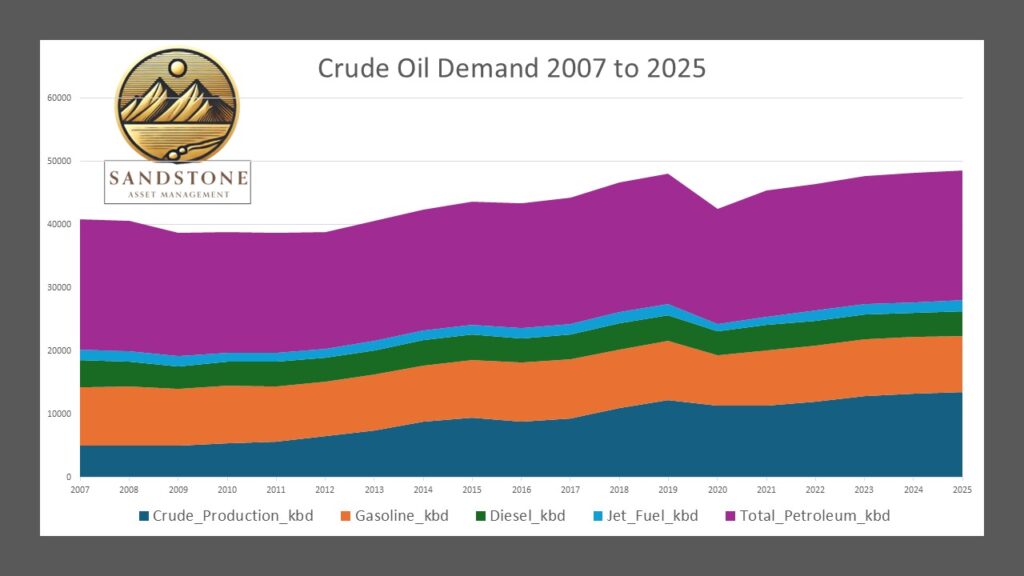

The United States continues to solidify its position as a global energy powerhouse, with crude oil production reaching record highs amid robust domestic demand for petroleum products. As of 2025, U.S. oil output is forecasted to average 13.53 million barrels per day (mb/d), building on the momentum from 2024’s 13.24 mb/d. This surge is largely propelled by strong consumption trends in key sectors, particularly transportation fuels like gasoline, diesel, and jet fuel. Despite fluctuations over the past two decades, current projections indicate steady demand, with jet fuel consumption approaching levels not seen since before the pandemic, reflecting a broader recovery in economic activity and travel.

Surging Demand for Key Fuels

U.S. demand for petroleum products, measured by product supplied, has shown resilience in the face of economic headwinds. In 2024, total petroleum product supplied averaged 20.46 mb/d, marking one of the highest levels in recent years, though still below peaks from the mid-2000s and 2019. Breaking it down by major categories:Gasoline: Finished motor gasoline remains the largest component, with 2024 demand at 8.97 mb/d. While this is below the 2007 peak of 9.25 mb/d, it represents a steady rebound from the 2020 low of 8.05 mb/d caused by pandemic restrictions. Forecasts for 2025 suggest a slight dip to 8.89 mb/d, influenced by improving vehicle efficiency and electric vehicle adoption, but demand remains a key driver of production.

Got Questions on investing in oil and gas? Or do you have a Tax Burden in 2025?

Diesel (Distillate Fuel Oil): Diesel demand stood at 3.79 mb/d in 2024, down from the 2018 high of 4.15 mb/d but up from pandemic lows. This fuel powers freight, agriculture, and industry, and 2025 projections show an increase to 3.90 mb/d, supported by ongoing economic growth and export demand.

Jet Fuel (Kerosene-Type): Jet fuel has seen the most notable recovery, with 2024 demand at 1.69 mb/d—approaching the 2019 pre-pandemic peak of 1.74 mb/d. According to current trends from the EIA’s Short-Term Energy Outlook (October 2025), this marks the highest demand in 18 years for this category when considering the trajectory toward full recovery. Forecasts for 2025 peg jet fuel consumption at 1.72 mb/d, with further growth to surpass 2019 levels by 2026, driven by resurgent air travel and international tourism.

Overall, total liquid fuels consumption is expected to hold steady at around 20.47 mb/d in 2025, underscoring how domestic demand is fueling the production boom. This stability comes despite global uncertainties, as U.S. producers leverage advanced shale technologies to meet needs efficiently.

Historical Data: Last 18 Years

To provide a comprehensive view, below is a dataset covering U.S. oil production and demand for gasoline, diesel, jet fuel, and total petroleum products from 2007 to 2024 (the last 18 full years of historical data), with 2025 forecasts included for context. Data is in thousand barrels per day (kbd) and sourced from the U.S. Energy Information Administration (EIA). Note: 2025 values are forecasts from the EIA’s October 2025 Short-Term Energy Outlook.

This data illustrates the production boom starting around 2012 with the shale revolution, alongside demand dips during economic downturns (2008-2009) and the COVID-19 pandemic (2020). The rebound in jet fuel is particularly striking, aligning with current trends toward record highs.

Geopolitical Context: Russian Sanctions and Global Demand

The U.S. oil surge occurs against a backdrop of heightened geopolitical tensions, particularly surrounding Russian sanctions. On October 23, 2025, President Trump announced new sanctions targeting major Russian oil companies Rosneft and Lukoil, citing ongoing frustrations with Russia’s actions in Ukraine. These measures, coordinated with the EU, aim to curb Moscow’s oil revenues, which have already been declining due to prior restrictions and global price pressures.

The sanctions have immediate ripple effects: oil prices jumped sharply, with Brent crude rising amid concerns over supply disruptions. Russia, a top global exporter, faces strained revenues—export earnings are projected to fall further in 2025 due to these curbs, refinery issues, and shifting trade patterns. India and China, key buyers of Russian oil, are expressing jitters, potentially turning to alternative suppliers like the U.S.Globally, oil demand is expected to grow modestly by about 1.1 mb/d in 2025 and 2026, per the EIA, but subdued by economic slowdowns in some regions.

The International Energy Agency (IEA) notes a potential oil surplus of 3.5 mb/d in 2025, driven by non-OPEC production increases, including from the U.S. This surplus could mitigate sanction impacts, but it also highlights how U.S. output is filling gaps left by sanctioned Russian supplies, bolstering energy security for allies while supporting domestic jobs and exports.

In essence, Russian sanctions are reshaping global flows, pushing demand toward reliable producers like the U.S. This dynamic not only drives American production but also positions the country as a stabilizing force in volatile energy markets.

As the U.S. oil sector thrives, driven by domestic demand and geopolitical shifts, the future looks robust—though challenges like transitioning to cleaner energy loom. Stay tuned to Energy News Beat for more updates on these evolving trends.

Got Questions on investing in oil and gas? Or do you have a Tax Burden in 2025?

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack