In a move that has sent shockwaves through the renewable energy sector, the Trump administration announced on December 22, 2025, the immediate suspension of leases for five major offshore wind projects under construction along the U.S. East Coast, citing classified national security concerns raised by the Pentagon.

This includes Dominion Energy’s flagship Coastal Virginia Offshore Wind (CVOW) project, the largest offshore wind farm in the U.S., which was poised to generate 2.6 gigawatts of clean energy—enough to power up to 660,000 homes by late 2026.

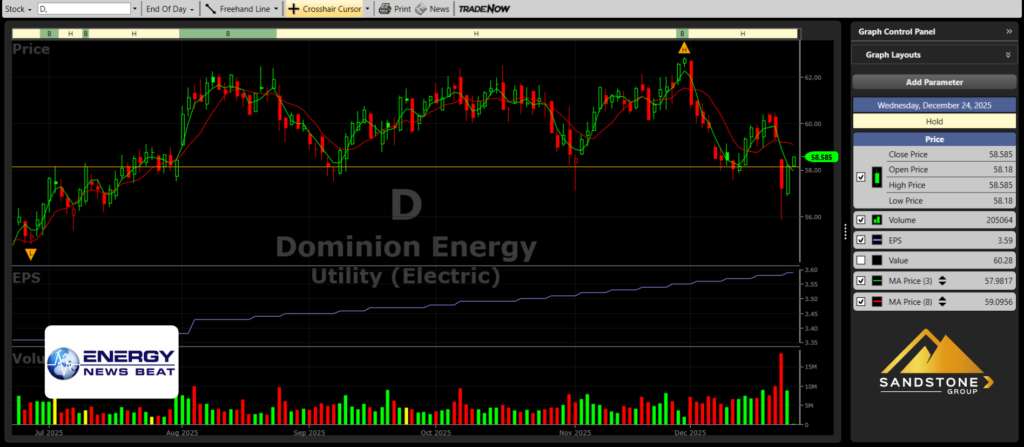

The 90-day pause, effective immediately, has sparked immediate market reactions, with Dominion Energy’s stock plunging between 4% and 8.4% in a single trading session, reflecting investor unease over potential delays, cost overruns, and broader implications for the utility’s bottom line.

As Virginia’s dominant utility provider, Dominion now faces scrutiny from investors, ratepayers, and regulators alike, with ripple effects that could extend to higher energy costs and job losses in the region.

A Look Back: Dominion Energy’s Earnings Over the Last Five Years

To understand the potential fallout, it’s essential to contextualize Dominion’s financial trajectory. Over the past five years (2020–2024), the company has navigated a mix of challenges and recoveries, including asset divestitures, regulatory pressures, and heavy investments in renewables like offshore wind. Here’s a summary of key metrics based on annual reports and financial summaries:

|

Year

|

Revenue (in billions)

|

Net Income (in billions)

|

Earnings Per Share (EPS)

|

Key Notes

|

|---|---|---|---|---|

|

2024

|

~$17.01

|

$2.61

|

$2.44

|

Strong recovery with operating earnings of $2.77 per share (non-GAAP); investments in CVOW contributed to capital expenditures but supported long-term growth targets.

investors.dominionenergy.com

Total shareholder return reached 20.4% for the year. s2.q4cdn.com

|

|

2023

|

~$16.5 (estimated from trends)

|

$1.99

|

$2.33

|

A 75% increase in EPS from 2022, driven by operational efficiencies and renewable expansions; however, net income reflected ongoing costs from infrastructure projects.

macrotrends.net

|

|

2022

|

~$15.2

|

$1.09

|

$1.33

|

Lower earnings due to divestitures and market volatility; early CVOW investments began impacting capital outlays.

|

|

2021

|

~$14.0

|

-$0.40 (loss)

|

-$0.49

|

Significant losses from asset sales and restructuring; focus shifted toward regulated utilities and renewables.

|

|

2020

|

~$14.2

|

$1.40

|

$1.68

|

Stable amid pandemic, with emphasis on core utility operations; initial planning for offshore wind added to long-term debt considerations.

simplywall.st

|

Dominion’s earnings have shown a rebound since 2022, with EPS growing from $1.33 to $2.44 by 2024, largely fueled by regulated rate recoveries and renewable energy initiatives. However, the company’s debt levels have hovered around $40–45 billion, partly due to capital-intensive projects like CVOW, which have required billions in upfront investment. These figures highlight Dominion’s vulnerability: while renewables have been a growth driver, any disruption could erode recent gains and pressure future profitability.

The Trump Administration’s Announcement and Its Immediate Ripples

The suspension order, issued by Interior Secretary Doug Burgum, halts construction on projects including Vineyard Wind (Massachusetts), Revolution Wind (Rhode Island and Connecticut), and Dominion’s CVOW, totaling around 6.9 GW of capacity.

The administration cited risks to military radar and operations, rebranding the Pentagon as the “Department of War” in the process—a nod to Trump’s campaign rhetoric.

For Dominion, this directly targets CVOW, a $10.7 billion endeavor already midway through construction, with two pilot turbines operational since 2020.

The project was expected to offset up to 5 million tons of CO2 emissions annually and create over 1,100 jobs in Virginia.

Investor sentiment has turned bearish, as evidenced by social media discussions and market data. On X (formerly Twitter), users highlighted stock drops of up to 8.4%, with short interest rising in anticipation of policy shifts.

One analyst noted, “Trump’s admin just killed 3,600 VA wind jobs, crashing Dominion stock 8.4% today.”

Broader market reactions included an 11% drop in Ørsted shares, a key partner in offshore wind.

If the pause extends beyond 90 days or leads to outright cancellation, Dominion could face write-downs on sunk costs, potentially denting its bottom line by hundreds of millions and delaying revenue streams from the project.

Federal Incentives: A Double-Edged Sword

Dominion has benefited significantly from federal support under the Inflation Reduction Act (IRA) of 2022, which provided a 30% investment tax credit (ITC) for offshore wind projects commencing construction before 2026.

For CVOW, this translates to credits on approximately 83% of the project’s capital costs, potentially amounting to over $2.5–3 billion based on the $9.8–10.7 billion total price tag.

Additional incentives include production tax credits and grants aimed at domestic manufacturing, with the IRA extending these benefits for a decade to bolster U.S. offshore wind development.

However, the Trump administration’s broader agenda, including proposed cuts to clean energy tax credits in a “megabill,” could claw back or phase out these incentives.

Projects not operational by 2027 risk losing eligibility, and the current halt raises questions about repayment obligations if CVOW is scrapped.

Dominion has already factored these credits into its financial planning, reducing effective project costs and supporting rate stability. Losing them could force the company to absorb higher expenses, impacting profitability.

Ratepayers in the Crosshairs

Virginia’s ratepayers, residential and commercial customers served by Dominion, stand to feel the pinch most acutely. The CVOW project was designed to deliver affordable, reliable, clean energy, with costs approved by the State Corporation Commission to be recovered through customer bills over time. A prolonged halt could lead to stranded assets, where billions in investments yield no returns, potentially hiking rates by 12% or more to cover losses, as speculated in investor circles.

Delays might also exacerbate reliance on fossil fuels, exposing consumers to volatile natural gas prices amid growing demand from data centers and electrification. Critics argue the move undermines energy security and job creation, with over 3,600 Virginia jobs at risk.

Dominion issued a statement expressing disappointment and warning of economic fallout, while environmental groups like the Environmental Defense Fund called the action “unlawful.”

Proponents of the pause, however, cite reduced taxpayer burdens on “inefficient” renewables.

Outlook: Uncertainty Ahead for Dominion and the Sector

As the 90-day review unfolds, Dominion’s fate hinges on whether the administration deems offshore wind compatible with national security. The utility has pledged to work with regulators and stakeholders, but the episode underscores the policy risks in energy transitions. Investors are watching closely, with some seeing short-term pain but long-term opportunities if fossil fuels regain favor under Trump. For ratepayers, the calculus is simpler: higher costs, no federal subsidies, and delayed clean energy projects could redefine Virginia’s energy landscape for years to come. We do not offer investment advice, but there is a reason that Warren Buffett said there is no reason to invest in a wind farm without tax credits or subsidies.

Sources: reuters.com, @JCDeardeuff on X, edf.org, cnn.com, @xray_media, pilotonline.com, martenlaw.com, dominionenergy.com