By Wolf Richter for WOLF STREET.

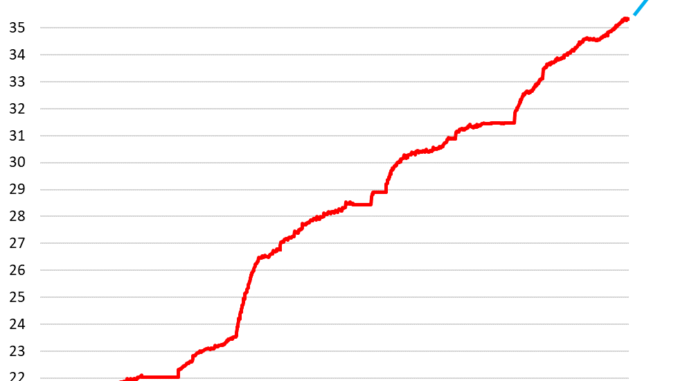

The US national debt has ballooned so fast to $35.3 trillion – by $12.0 trillion since January 2020 – that it’s mindboggling, especially in a growing economy. And every single one of the Treasury securities that form this colossal debt was bought and is held by some investor, and we’re going to look at those entities that hold this Treasury debt.

Who holds this $35.3 trillion in Treasury debt?

US Government funds: $7.11 trillion. This “debt held internally” are Treasury securities held by various US government pension funds and by the Social Security Trust Fund (here’s the SS Trust Fund holdings, income, and outgo). These Treasury securities are not traded in the market, but the government funds purchase them directly from the Treasury Department, and at maturity are redeemed at face value. They don’t involve Wall Street fees and profits, and they’re not subject to the whims of the markets.

The remaining $28.2 trillion in Treasury securities are “held by the public.” At the end of Q2, the time frame we’re going to look at now, $27.6 trillion were held by the public. A small portion of these Treasuries “held by the public” cannot be traded, such as the popular inflation-protected I bonds, and some other bond issues.

The rest – $27.05 trillion – were Treasury bills, notes, and bonds, TIPS (Treasury Inflation Protected Securities), and FRNs (Floating Rate Notes) that were traded and were therefore “marketable.” They’re by far the largest class of US fixed income securities, far ahead of corporate bonds ($11 trillion).

Who holds the $27.05 trillion in “marketable” Treasury securities?

The Securities Industry and Financial Markets Association (SIFMA) just released its Quarterly Fixed Income Report for Q2, which spells out, among other things, who held these $27.05 trillion of marketable Treasury securities at the end of Q2:

Foreign holders: 33.5% of marketable securities. This includes private sector holdings and official holdings, such as by central banks.

Overall foreign holdings have continued to rise from record to record. The big financial centers, European countries, Canada, India, and other countries have increased their holdings to new records. China, Brazil, and some other countries have reduced their holdings for years (we discussed the details of those foreign holders here).

The US entities that hold the remaining 66.5%.

US mutual funds: 17.7% of marketable Treasury securities (about $4.8 trillion), such as bond mutual funds and money market mutual funds. They decreased their share from Q1 (18.0%).

Federal Reserve: 16.1% of marketable Treasury securities. Under its QT program, the Fed has already shed $1.38 trillion of Treasury securities since the peak in June 2022 and as of early September has brought its holdings down to $4.4 trillion (our latest update on the Fed’s balance sheet).

US Individuals: 11.1% of marketable Treasury securities (about $3.0 trillion). These are investors who hold them in their accounts in the US. They increased their holdings since Q1 (from a share of 9.8% or about $2.7 trillion).

Banks: 8.1% of marketable Treasury securities outstanding (about $2.2 trillion), roughly unchanged since Q1.

State and local governments: 6.2% of marketable Treasury securities (about $1.7 trillion), a slight decrease in share since Q1 (6.3%).

Pension funds: 3.7% of marketable Treasury securities (about $1.0 trillion), a decrease of their holdings since Q1 (4.3% and $1.7 trillion).

Insurance companies: 2.2% of marketable Treasury securities (about $600 billion), an increase of their holdings since Q1 (1.9%), reflecting Warren Buffett’s conglomerate, Berkshire Hathaway, which includes GEICO, which has loaded up on T-bills over the past two years through Q2.

Other: 1.4% of marketable Treasury securities (about $400 billion).

The burden of the US debt: These interest-bearing assets held by investors are costly liabilities for the government. Here’s our discussion on the burden of the national debt and what portion of the tax receipts are eaten up by interest payments and how that evolved over the decades: Spiking Interest Payments on the Ballooning US Government Debt v. Tax Receipts, GDP, and Inflation

Take the Survey at https://survey.energynewsbeat.com/