ENB Pub Note: This article is from The Merchants News Substack by Giacomo Prandelli, and I had an outstanding conversation with him while he was in Switzerland. I love talking to people from around the world about energy. We recommend subscribing to his Substack, and I have scheduled an interview with him on the Energy News Beat podcast.

The sanctions aren’t working. At least, not the way you think.

Right now, half of Russia’s oil tankers are sailing without declared destinations. Indian refiners just slashed their Russian crude imports by 2/3. Chinese state giants paused direct purchases from Rosneft and Lukoil. Every headline screams “sanctions are biting”…

But the oil is still moving(differently)

And if you’re betting on Russian barrels disappearing, you’re about to lose money on the wrong trade entirely. Because the real story is about what’s being built in plain sight while everyone watches the tanker data.

Let me show you what’s actually happening, why Washington knows exactly what’s going on, and where the money is about to flow for the next decade.

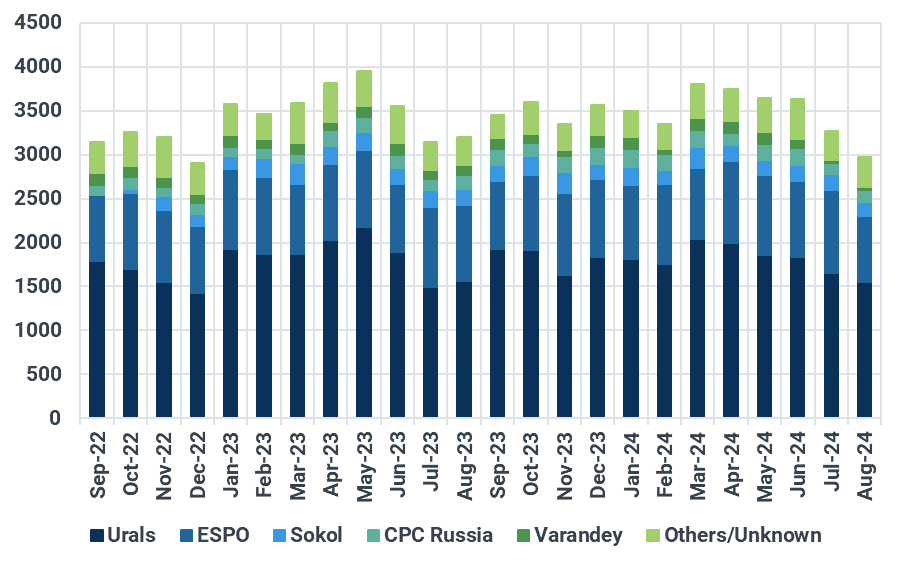

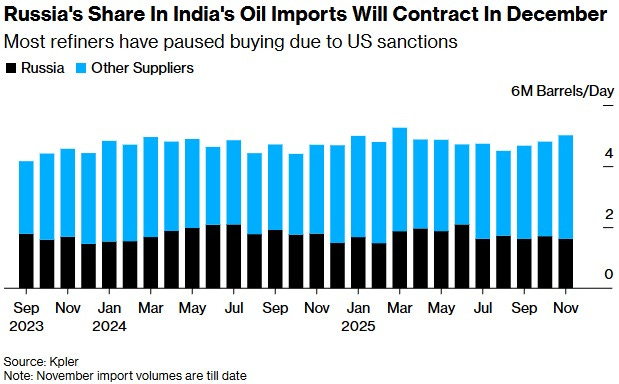

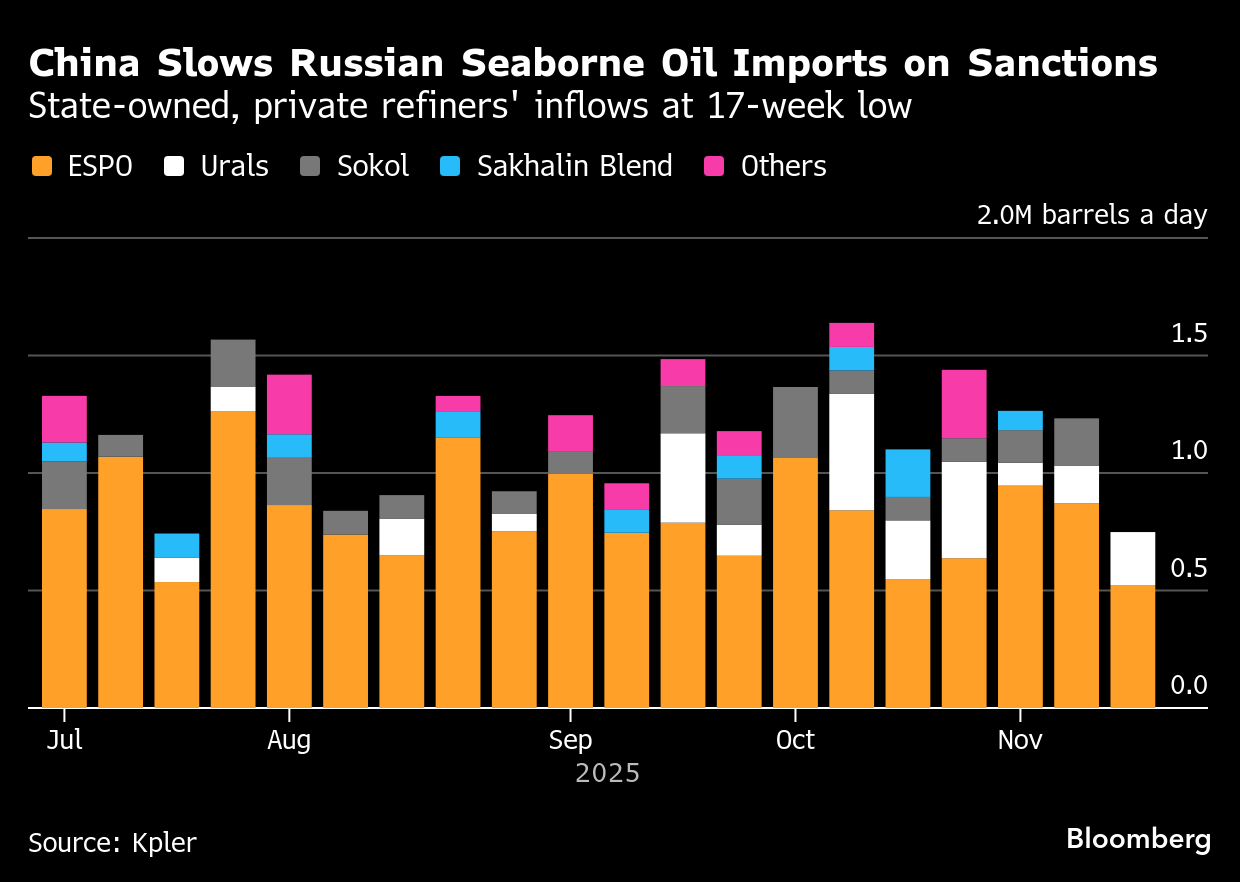

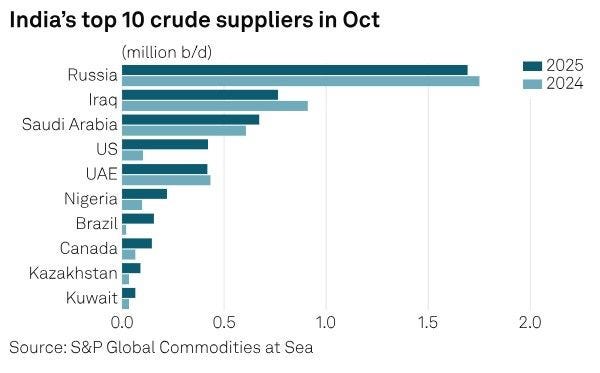

In early November 2025, Russian seaborne crude exports dropped from 3.6 million barrels per day to 2.8 million. India went from importing 1.9 million barrels per day in October to just 670,000 in the first half of November. China’s state refiners cut their direct Russian liftings in half.

On paper, it looks like textbook sanctions success.

Then you look at the tanker data, and everything changes.

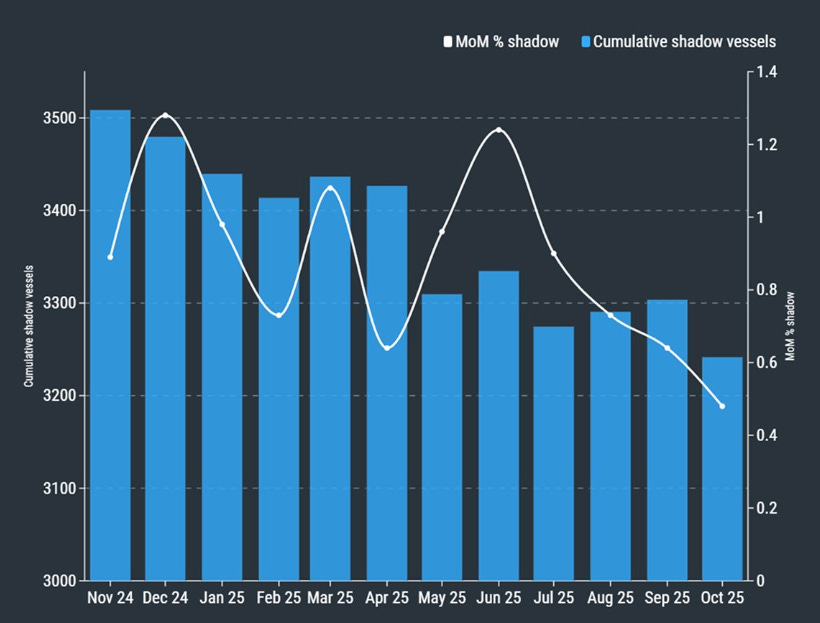

Half of Russia’s crude tankers are now sailing “dark” no declared destination, ship to ship transfers in international waters, rerouting through intermediaries you’ve never heard of.

India and China aren’t walking away from Russian barrels. They have no choice, because the math doesn’t give them one.

India is the center of gravity for future oil demand. Between now and 2035, India’s oil consumption will jump from 5.5 million barrels per day to about 8 million. That’s the single largest increase of any country on Earth.

This isn’t a forecast. It’s physics.

Car ownership is set to triple by 2035. India’s government is targeting 6% GDP growth as baseline, which means more diesel, more petrochemical feedstock, more jet fuel for a rising middle class that wants to fly. Meanwhile, India’s domestic crude production is stuck around 600,000 barrels per day. The country imports nearly 90% of its oil today.

Do the math, India needs an extra 2 million barrels per day of imported crude over the next decade just to keep the lights on and the trucks moving.

Now here’s where Russian oil becomes impossible to ignore.

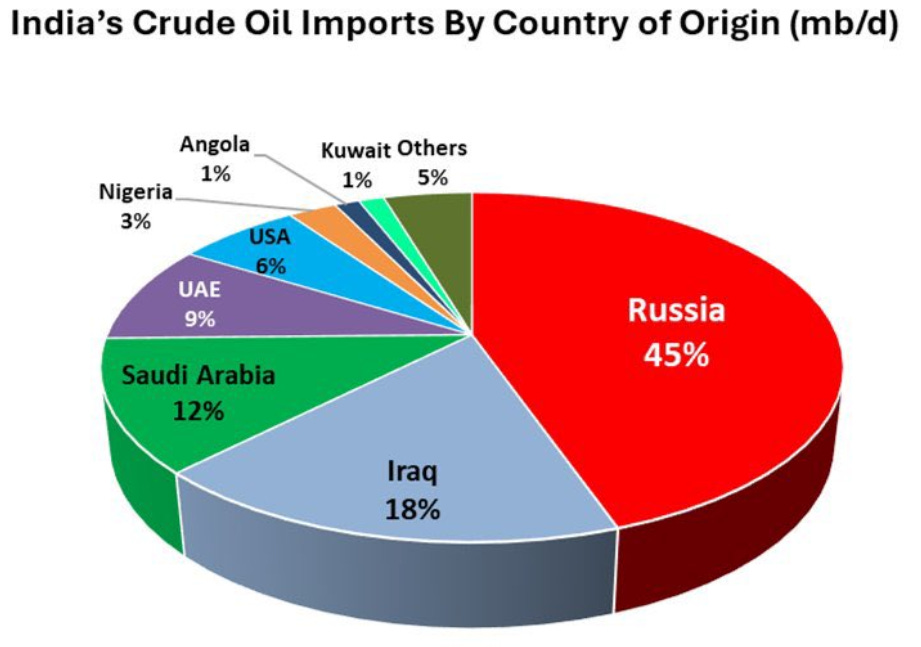

Russian Urals crude trades at steep discounts to Brent. India’s complex refineries are built to process heavy, sour grades exactly what Russia produces. When you’re refining for 1.4 billion people and trying to keep pump prices politically tolerable, a $10 per barrel discount is a strategic imperative.

That’s why Russian crude went from almost nothing in India before 2022 to peaks above 2 million barrels per day in 2023 at times approaching 45% of India’s total imports. The November pullback isn’t a divorce. It’s Indian refiners and traders pausing to rebuild compliant routes while lawyers figure out how to keep the barrels flowing without triggering secondary sanctions.

It’s a legal problem, not an economic one. And legal problems have workarounds.

China plays a different game, but the logic is identical.

China imported about 11.1 million barrels per day of crude in 2024 3 times India’s volume. Russian crude supplies roughly 20% of those imports, making Moscow one of Beijing’s top suppliers. But China has built something India hasn’t…strategic depth.

China now has crude storage capacity exceeding 1.8 billion barrels. Strategic reserves alone sit around 290 million barrels, with total stocks likely well above 1 billion barrels when you include commercial tanks. In October 2025, China added 690,000 barrels per day to stockpiles. Over the first 10 months of the year, the average stockbuild ran around 900,000 barrels per day.

This isn’t speculation. This is Beijing accumulating a 90-day buffer while the world watches tanker routes and writes headlines about sanctions.

When US sanctions hit Rosneft and Lukoil in November, China’s response was textbook. State refiners paused direct liftings to avoid secondary sanctions risk. Smaller, private refiners stepped in through intermediaries. And those massive stockpiles gave Beijing the luxury of time to let the market adjust, time to let traders build new routes, time to keep domestic refineries supplied without any visible disruption.

China’s crude demand growth has slowed, but from a very high base. Even if annual growth is now only 250,000 barrels per day, the absolute import requirement keeps China locked in as the world’s largest crude buyer for years to come.

Russia can’t replace China. And China won’t completely replace Russia. Sanctions change the paperwork. They don’t change the barrels.

Here’s the REAL truth, Washington understands all of this.

The Biden administration sanctioned Gazprom Neft and Surgutneftegaz in early 2025. Trump followed with October 2025 measures against Rosneft and Lukoil. The pattern is clear tighten the screws on Russian revenues, but leave enough room for India and China to keep their systems supplied.

President Trump said it out loud in November. He acknowledged that India has “very substantially” reduced Russian oil purchases, then tied his 50% tariff threat on Indian goods to those previous imports. The message couldn’t be clearer sanctions are leverage, not moral policy. And relief is available if you tilt your future energy buying toward the United States.

Indian refiners process large volumes of Russian crude.

In November, India shipped its first jet fuel cargo to the US West Coast 473,000 barrels from Reliance to Chevron after a California refinery fire. US imports of refined products from Indian refineries that run Russian crude are up 17% mom. Australia’s imports jumped over 100%.

So here’s the circle: discounted Russian crude flows into Indian refineries, gets processed into gasoline, diesel, and jet fuel, and ends up in US and allied markets as clean products.

Washington condemns the crude. It buys the jet fuel.

This is a conscious trade-off between economic needs, alliance politics, and the desire to bleed Russian fiscal capacity without destabilizing global oil markets. The US can’t replace 3 million barrels per day of Russian exports overnight without spiking oil to $120 and triggering a recession. So it doesn’t try.

Washington’s actually playing the long game here, and the real secret weapon?

I’ll show you how this one thing is quietly about to flip the whole board.

Got Questions on investing in oil and gas?

Request Media Kit

If you would like to advertise on Energy News Beat, we offer ad programs starting at $500 per month, and we use a program that gets around ad blockers. When you go to Energynewsbeat.co on your phone, or even on Brave, our ads are still seen. The traffic ranges from 50K to 210K daily visitors, and 5 to 7K or more pull the RSS feeds daily.

https://energynewsbeat.co/request-media-kit/