Near-term recession concerns and oil price weakness should not obscure a tight oil supply outlook that should spark $100/bbl oil in 2023. NYMEX natural gas meanwhile should dip into the $3.50s next summer.

Calgary, Alberta (December 6, 2022) — Enverus Intelligence Research (EIR), a subsidiary of Enverus, the most trusted energy-dedicated SaaS platform, has released its latest Macro Forecaster, a report that looks at near-term oil and gas balances, recession risks, Russian-Ukraine war impacts, COVID-19 demand impacts in China and OPEC’s decisions on oil supply.

“U.S. oil supply has disappointed this year, forcing us to downgrade our growth expectations significantly. We now forecast U.S. supply growth of 560 Mbbl/d E/E in 2023,” said Bill Farren-Price, report author and a director at EIR.

“We forecast U.S. gas demand growth of 2 Bcf/d in 2023, down 2 Bcf/d versus 2022. Demand gains into 2023 will be limited after a record 32.9 Bcf/d of gas consumption for power in 2022,” Farren-Price said.

Key takeaways the report:

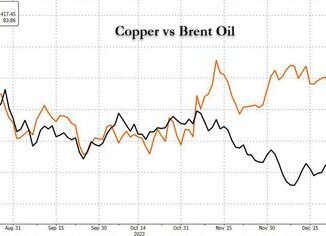

EIR expects near-term recession concerns and oil price weakness to not obscure a tight supply outlook for 2023, when we forecast Brent pinned above $100/bbl on the back of OPEC supply management and EU sanctions on Russian exports.

EIR forecasts NYMEX gas prices of $5.10/MMBtu this winter, falling to $3.50/MMBtu in summer 2023.

A full removal of COVID-19 restrictions in China is not expected. Measures may be relaxed, but the threat of fresh shutdowns will undermine Chinese business confidence and oil demand.

Haynesville gas production is expected to grow 1.5 Bcf/d E/E in 2022 and 0.2 Bcf/d E/E in 2023. The slowdown next year reflects limited takeaway capacity with the Gulf Run pipeline limited to 0.5 Bcf/d until Golden Pass starts up in 2Q24.

Members of the media should contact Jon Haubert to schedule an interview with one of Enverus’ expert analysts.

About Enverus

Enverus is the most trusted, energy-dedicated SaaS platform, offering real-time access to analytics, insights and benchmark cost and revenue data sourced from our partnerships to 98% of U.S. energy producers, and more than 35,000 suppliers. Our platform, with intelligent connections, drives more efficient production and distribution, capital allocation, renewable energy development, investment and sourcing, and our experienced industry experts support our customers through thought leadership, consulting and technology innovations. We provide intelligence across the energy ecosystem: renewables, oil and gas, financial institutions, and power and utilities, with more than 6,000 customers in 50 countries. Learn more at Enverus.com.

About Enverus Intelligence Research

Enverus Intelligence Research, Inc. is a subsidiary of Enverus and publishes energy-sector research that focuses on the oil and natural gas industries and broader energy topics including publicly traded and privately held oil, gas, midstream and other energy industry companies, basin studies (including characteristics, activity, infrastructure, etc.), commodity pricing forecasts, global macroeconomics and geopolitical matters. Enverus Intelligence Research, Inc. is registered with the U.S. Securities and Exchange Commission as an investment adviser.

The post 2023 Outlook: Oil to Rise, Gas to Drop first appeared on Enverus.