The days of vertically integrated utilities such as South Africa’s Eskom are numbered and — particularly in a post-pandemic world — such companies will be unable to effectively tackle the challenge of providing Africa’s people access to electricity and clean fuel.

“We need to attack it in a different way,” said Louis van Pletsen, founder of energy investment company InAfrica Holdings, on last month’s Africa Energy Indaba webinar.

“Post-Covid, all 54 African countries… are technically insolvent and the burden on society has increased. If your model is a power purchase agreement with a utility support structure and a government guarantee, that’s a dilemma.”

Given the dire financial state of African governments — excluding South Africa — adding only 50 to 100 megawatts of power would likely take up any one country’s entire debt and credit capacity and max out its funding ability, he said.

Even if governments opt to pursue projects of this size, Van Pletsen said, “15MW, 20MW and 35MW solar farms” will not solve Africa’s electricity and clean fuel problem.

He is a strong advocate of micro-generation as the best way to tackle this continent-wide challenge.

“We need distributed generation,” he said, specifically citing rooftop solar as a solution.

“Let utilities focus on the big customers. The hut on the hill does not need to get electricity from a coal-fired plant.”

At the same time, he called for pragmatism, and argued that coal still has a future if it is combined with carbon capture and storage (CCS).

“There is nothing wrong with coal. We need to remove from our thoughts that we must close assets with a remaining life. CCS is at a price point that makes it very economic. The issue is what to do with the carbon dioxide once it has been captured. “

He also said he has no problem with development agencies financing diesel power plants if it stops diesel having to be trucked long distances to market.

“All this leads to a balanced fuel mix that leans towards renewables but uses existing assets, optimally, for their remaining lifetimes.”

Van Pletsen said utilities should sell off their power grids to overseas investors and instead focus on off-grid solutions to rapidly improve people’s lives and reduce environmental impacts.

Andre de Ruyter, chief executive of South African state-owned utility Eskom, agreed that rooftop solar is the best at-hand solution and has the added benefit of creating jobs.

“It creates jobs, leverages the existing grid in a smarter way and therefore lowers the cost of access to electricity,” De Ruyter said.

“It’s an economic-growth catalyst that we underestimate.”

Daniel Schroth, director of renewable energy at the African Development Bank, talked in a similar vein about the benefits of “prosumers”, energy consumers who also generate power that can be fed back into a grid.

De Ruyter bemoaned the lack of political nous in South Africa to fully open up the power market to private interests, pointing out how Vietnam added 7.52 gigawatts to its grid in one year by doing just that.

Van Pletsen agreed: “If you want to scale this up, you need to let it loose. It’ll happen. You don’t need huge bureaucracy to implement this. If you start now, you’d have 10GW by Christmas.”

But if cash-strapped Africa cannot afford to roll out distributed power, then who will pay for it? The answer would appear to be a mix of agencies, the private sector and governments.

Schroth told the Africa Energy Indaba that concessional financing can de-risk investments and also highlighted the ADB’s sustainable energy fund.

But South Africa-educated Van Pletsen reckoned that, while development agencies still offer good political connections, their cost of funding “has drifted up to almost commercial levels”.

The other problem with Africa, he remarked, is that overseas investors see more attractive opportunities elsewhere.

“We need to dress ourselves up to be the attractive partner to dance with,” he said.

If Sub-Saharan Africa can get things right, Van Pletsen said, it will see “battery and mobile power leapfrogging conventional generation — off-grid leapfrogging grid — while micro-mobility will see a continent full of battery-powered motorbikes and tuk tuks”.

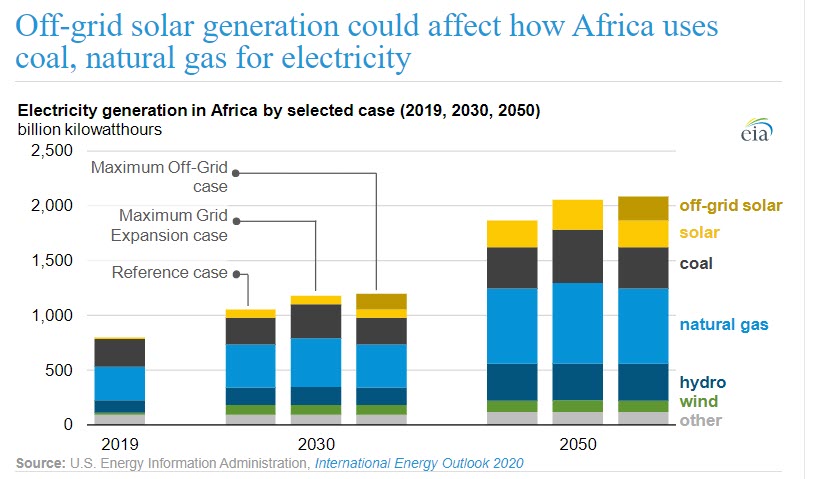

Nevertheless, despite all the promise of renewables, Andy Calitz, secretary general of the International Gas Union, noted that they currently only supply 2% of Africa’s power market and that when it comes to electricity provision, gas has a major role to play.

Calitz, a South African who held top positions in Shell’s liquefied natural gas business before joining the IGU, said gas-to-power will be vital for electricity provision in Africa’s fast-growing megacities.

To meet power demand, he said, the continent’s coastal nations need to find ways to make it commercially viable to import 1 million to 2 million tonnes per annum of LNG, far smaller than the volumes bought by countries such as Japan.

Source: Upstream