By Conor Ryder, of Kaiko Research

On Monday, Hong Kong made its intentions clear to open the door to crypto trading for retail. Reports claim that China is quietly encouraging the move, using Hong Kong as a testing ground for what safe crypto trading might look like. The Hong Kong Securities and Futures Commission (SFC) outlined various caveats for retail investing in crypto, namely hinting at only having a small subset of the largest tokens available to trade.

The move from Hong Kong, with China behind the scenes, paints a stark contrast to the enforcement approach we’ve seen from the SEC in the US recently. While the West risks stifling innovation and driving crypto business out of the US, Asia looks to be positioning itself to be at the forefront of the next crypto revolution by welcoming crypto business with open arms.

An enticing East could well be the next catalyst that propels crypto prices upwards, with some proclaiming that this run has already started, propelled by an Asian-linked token rally. However, looking at market dynamics, these claims seem premature. When looking at BTC volume so far in 2023, the majority of high volume hours have been during US trading, indicating that crypto’s flagship asset is in fact driven by the West at present. Interestingly, the trend was less extreme in 2021, as China only outlawed crypto trading towards the end of the year.

BTC hourly volumes can be considered step one in debunking the Asia-led market rally. However, we know that altcoin trading is popular in the region, with South Korea in particular having a reputation for investing in the latest trends. That being said, it’s important to look at the broader market dynamics across all tokens and exchanges. Firstly, using a basket of tokens linked to projects in Asia, we can see that although there is less of an extreme difference between Asian and US hours, the majority of volume still occurs during US hours over the last three years, with not much change year to year. Interestingly, 2023 volumes so far have shown no new trend.

(In this case, we classify “Asia-linked” crypto tokens as those affiliated with a project headquartered in Asia or boasting a dominant regional user-base, such as Axie Infinity or Tron.)

Looking at volumes at the exchange level, we can see that exchanges catering for the Asia region have been losing a significant amount of market share since the start of 2020, with Binance being the main benefactor. As a caveat, our exchange classifications are not exact considering many offer global trading services. As such, our classifications are based on a combination of information on the exchange’s headquarters and historical user base.

A large reason for the rapid decline in Asian exchanges’ share of volume was China’s crypto ban in 2021, outlawing all crypto related transactions. Huobi and others closed all services to Chinese customers by the end of 2021, leaving many Asian exchanges desperate for volumes. Binance benefited from not targeting one specific market, becoming the most global exchange and reaping the rewards in terms of trading volume. Binance market share of all volumes has risen from 15% in January 2020 to 68% as of February 2023, with Asian exchange market share moving in the opposite direction, falling from 78% of volumes to just 22% over the same period.

As a global-serving exchange, I have kept Binance in a category of its own. OKX on the other hand was counted as an Asian exchange despite being headquartered in the Seychelles, as they cannot service US customers and a majority of trade volume was placed during Asian hours. We can see the Binance volumes are more obviously US trading hour biased, with some of its lowest volume hours occurring during Asian trading hours. What is curious about this, though, is that Americans cannot use Binance, only Binance.US. So although trade volume is skewed towards US trading hours, it is likely not coming from within the country but from off-shore entities.

Why Now?

So why are Hong Kong and potentially other jurisdictions in the Asia region loosening the shackles of regulation now, particularly after such a tumultuous few months post FTX collapse? If anything, one would have forgiven Hong Kong for saying I told you so after the last few incidents where investors bore the brunt of devious actors in the space.

Well for one, thanks to a crypto regulatory carpet bomb from the SEC, now looks like the perfect time to strike for Hong Kong. The contrasting regulatory approach of the West may drive many businesses looking for more regulatory clarity towards Asia.

I could see a lot of exchanges, for example, focusing more on Asian markets to avoid the iron fist of Mr. Gensler. Why hang around, losing market share to Binance, unsure what products you can and can’t offer thanks to a lack of regulatory guidance, and potentially be hit with a fine – when you could move operations to Asia, benefit from a friendlier regulatory environment and carve out a chunk of a growing market?

Trade volume since 2020 shows us that Asian exchanges benefitted the most from the bull run of 2021, but since China outlawed crypto towards the end of 2021, Asia has lagged Binance in volumes significantly. Welcoming investors back to Hong Kong and Asia now makes sense for not only Hong Kong, but for the Asian exchanges as well.

From a token standpoint, tokens affiliated with crypto projects in the Asia region have struggled to keep pace with BTC volumes over the last year.

On the left we can see the dwindling volumes of Asia-project linked tokens. On the right we can debunk stories that the market is being driven by these tokens: there was no significant increase in market share of volumes between BTC and the selection of tokens affiliated with projects in Asia since the start of the year.

When looking at trade volume trends, the market appears to not have been driven by activity in the Asian region, meaning the reaction to this regulatory news out of the East has been subdued. The long term market dynamics of this are more interesting and once the friendlier regulation comes into effect, a handful of tokens could see a wave of new money directed their way.

Which tokens stand to benefit will be decided by Hong Kong’s SFC, who hinted at tokens that are included in at least “two approved indices”.

Indices

According to the proposal by the SFC, they will only allow trading for “large-cap virtual assets…that are included in at least two approved indices”. It’s unclear what exactly classifies as large cap, and what the approved indices might be, but the guidance at least helps us narrow down the universe of tokens that could be available. Using some of crypto’s largest indices, @tier10k on Twitter listed the tokens they hold, identifying any potential overlap for tokens that are included in at least two indices.

There’s a couple of things that stand out to me here. Firstly, some of the indices hold relatively illiquid altcoins: Stellar Lumens, Ethereum Classic, EOS and Bitcoin Cash to name a few. Given the conservative nature of the Hong Kong guidance, I highly doubt they will include some of these more speculative tokens.

Secondly, in the list of tokens that are included in at least two indices, Bitcoin Cash, Litecoin and Polkadot interestingly make the cut, included in 3 or 4 out of the 5 indices. Perpetual futures markets reacted well to the realization that these tokens could see renewed flows from Asia, with open interest for all three rising by about 15% in the last week. Funding rates also moved positive and have mostly persisted since the announcement, with BCH being the exception.

There is reason for caution however, as I’m not sure some of these tokens are liquid enough to warrant consideration as large-cap assets. As I’ve written about before, using market cap alone to measure the value of tokens isn’t sufficient and we need to incorporate other metrics, specifically liquidity. It’s commonplace in traditional finance that liquidity is one of the criteria for indices construction, and crypto should be no different. According to Nasdaq, their indices are constructed using “rigorous liquidity standards”. I’m not sure how that justifies holding XLM, ETC or UNI. In December I ranked the top 28 tokens by liquidity: XLM finished dead last, UNI finished 22nd and ETC wasn’t liquid enough to even be included.

The inclusion of Bitcoin Cash, Polkadot and Litecoin has me worried from a liquidity standpoint and I believe if the SFC are to include large-cap assets, they must use more liquid tokens in their selection. For starters, all three tokens rank poorly in 2% market depth, measuring the amount of orders currently sitting on exchanges order books within 2% of current prices.

Tokens like XRP, MATIC and LINK look to be excluded from the SFC’s list by not being included in at least two indices. They miss out while tokens with worse liquidity, particularly BCH, look to be up for consideration. This is more of a qualm with index construction in crypto, as the fact BCH is included in 3 of the top 5 indices in crypto is definitely cause for concern. A more robust approach to index construction is needed that accounts for liquidity alongside market cap.

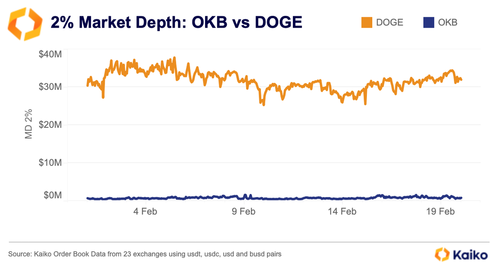

For example, yesterday I noticed that OKB, the exchange token for OKX, was included in the top 10 tokens on CoinGecko and other ranking sites due to an update of their circulating supply figure, apparently increasing from 60m to roughly 250m. This increased its market cap by over $9bn, moving it inside the top 10. If a large cap index was constructed based on market cap, it would potentially have to include OKB now. Using liquidity metrics alongside market cap, however, would rule OKB out of consideration. Comparing OKB’s market depth to DOGE, who lost out on its top 10 spot thanks to OKB, the difference in liquidity is stark.

OKB’s 2% market depth is under $1m, compared to DOGE’s depth of $32m. On that note, and a potentially controversial take, but I believe DOGE warrants more consideration for the SFC than BCH thanks to its vastly superior liquidity.

Takeaways

The news out of Hong Kong, with stories of quiet backing from China, are no doubt positive for crypto longer term. Short-term, we have seen that markets aren’t actually being driven by this narrative, rather investors in the US buying on the assumption that those in Asia are. The timing of the announcement, while the SEC crack down on crypto, looks intentional and may actually drive crypto business out of the US and towards Asia over time.

However, some of the tokens that could be considered under the SFC’s new rules aren’t of the highest caliber, from both a fundamental and a liquidity perspective. This is actually an issue with index construction in crypto, but the SFC needs to properly account for liquidity as they may be excluding some tokens with better fundamentals and liquidity just because they aren’t included in two indices. Any token that is included in the new parameters should see fresh investment and improved sentiment, while Asia may be increasingly well-positioned for a new wave of crypto investment.

Loading…