After the collapse of Silicon Valley Bank and Signature Bank, U.S. clean energy start-ups and companies could face growing difficulties in accessing finance, which could slow the effect of a rapid renewable energy rollout intended by the Inflation Reduction Act, analysts and investment firms have told the Financial Times.

The Inflation Reduction Act (IRA) has around $370 billion in climate and clean energy provisions, including investment and production credits for solar and wind power generation, storage, critical minerals, funding for energy research, and credits for clean energy technology manufacturing such as wind turbines and solar panels.

After the collapse of Silicon Valley Bank, which triggered a banking sector scare for regional U.S. banks and spread to Europe with the near-collapse of Credit Suisse, regulators in the U.S. stepped up to guarantee the deposits of clean energy start-ups in SVB. However, renewable energy firms are now assessing their vulnerability and exposure to the banking sector. Some of those firms may find it harder to access funding, and it’s not only the high-interest rates that will be the hindrance according to investment managers.

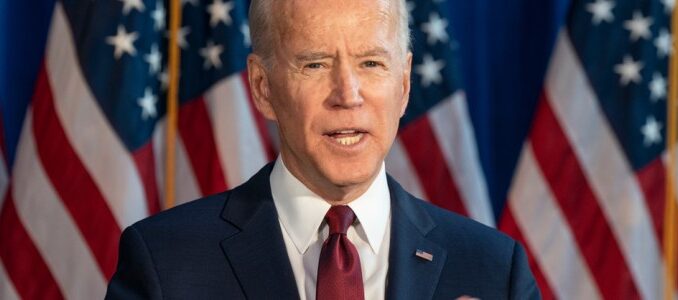

Concerns about smaller regional banks in the U.S. have increased significantly since the SVB collapse and the banking sector turmoil could slow the rollout of renewable energy as Biden’s IRA had expected.

A large part of the Act was intended to bring clean energy to low-income communities, Afsaneh Beschloss, founder and CEO at investment firm RockCreek, told FT.

“One of the biggest places that was supposed to happen was through local community banks . . . That is going to be hugely impacted,” Beschloss added.

SVB had more than 1,550 clean technology firms as clients and had extended billions of U.S. dollars in loans to them, The New York Times reported earlier this month.

“If the flywheel of financing for early-stage climate innovation stops during these critical years, that’s going to be a big problem,” Daniel Firger, founder of Great Circle Capital Advisors, told NYT.