HOUSTON, Nov. 14, 2022 (GLOBE NEWSWIRE) — Battalion Oil Corporation (NYSE American: BATL, “Battalion” or the “Company”) today announced financial and operating results for the third quarter 2022.

Key Highlights

- New volumes from 2022 capital program driving production growth ~8% increase in average daily production over second quarter 2022

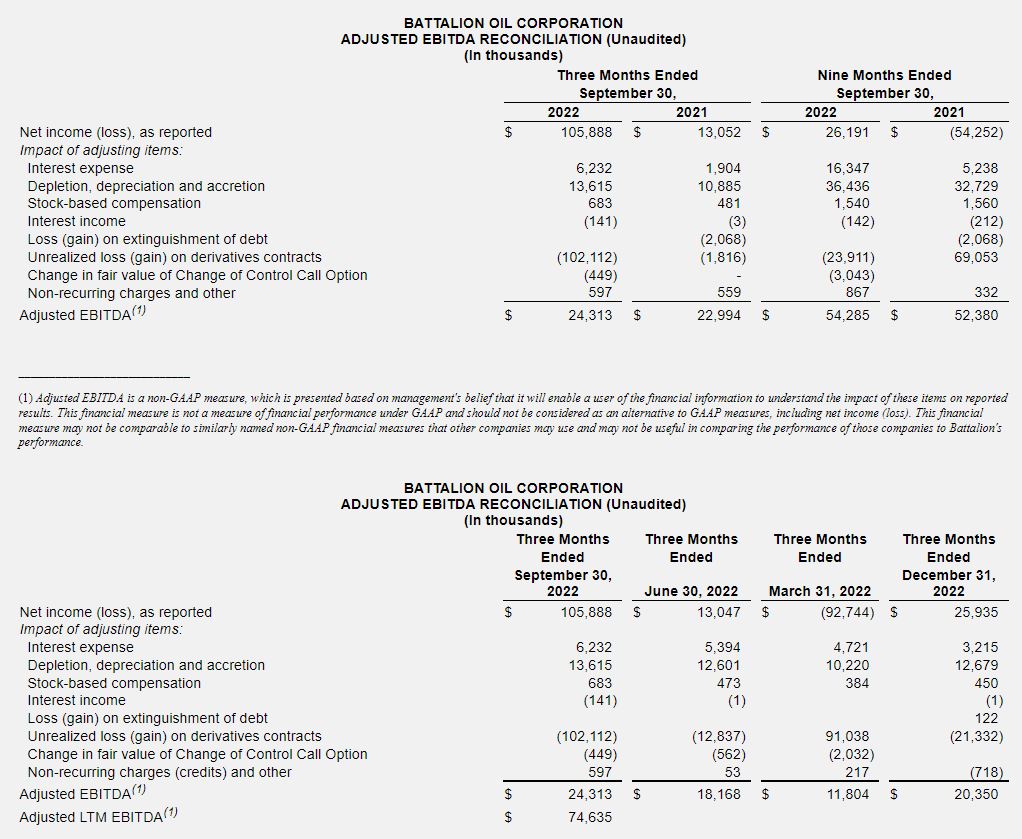

- Approximately 34% increase in Adjusted EBITDA over second quarter 2022

- Improved realized pricing ~11% increase in realized crude oil prices despite ~15% decline in average crude oil prices over second quarter 2022

- Most recent three well pad began flowing back during second week of October, raising total to 8 wells put online in 2022

- Completed Third Bone Spring test with promising early results production in line with Wolfcamp well performance

- Construction of acid gas treating facility on track with an expected facility in-service date during 1Q23

- Revised FY 2022 guidance for oil production; reiterating guidance on total production, total capital expenditures, and wells put online

Management Comments

Richard Little, the Company’s CEO, commented, “As we continue to build on our strong drilling and completion performance in 2022, our third quarter results begin to reflect the benefits of our return to development. With our capital program driving production growth and realized pricing improving as we outproduce our legacy hedges, Battalion delivered an approximate 34% increase in Adjusted EBITDA over second quarter despite an overall decline in benchmark prices. This is a significant achievement for Battalion as we continue to build momentum towards 2023.”

“We are also excited to announce that we recently completed a test of the Third Bone Spring at Monument Draw, and early results are promising with production in line with our Wolfcamp well performance. With several producing Bone Spring wells around our acreage, a successful test would significantly de-risk that zone across our footprint and could unlock the potential for multi-zone development. We will continue to closely monitor these results and expect to provide a more complete update at year end.”

“With much of our capital program behind us, we also want to take this opportunity to provide revised guidance expectations for 2022. While we are reiterating our original guidance for capital activity, capex and total production, we do anticipate a slight reduction to our oil cut and, as such, have reduced estimates for total oil production.”

“As we move into the fourth quarter, we remain focused on efficient and disciplined operations as we close out our 2022 capital program. With new wells continuing to come online, a Bone Spring test underway, and growing cash flows, we feel well positioned for success in the fourth quarter and beyond.”

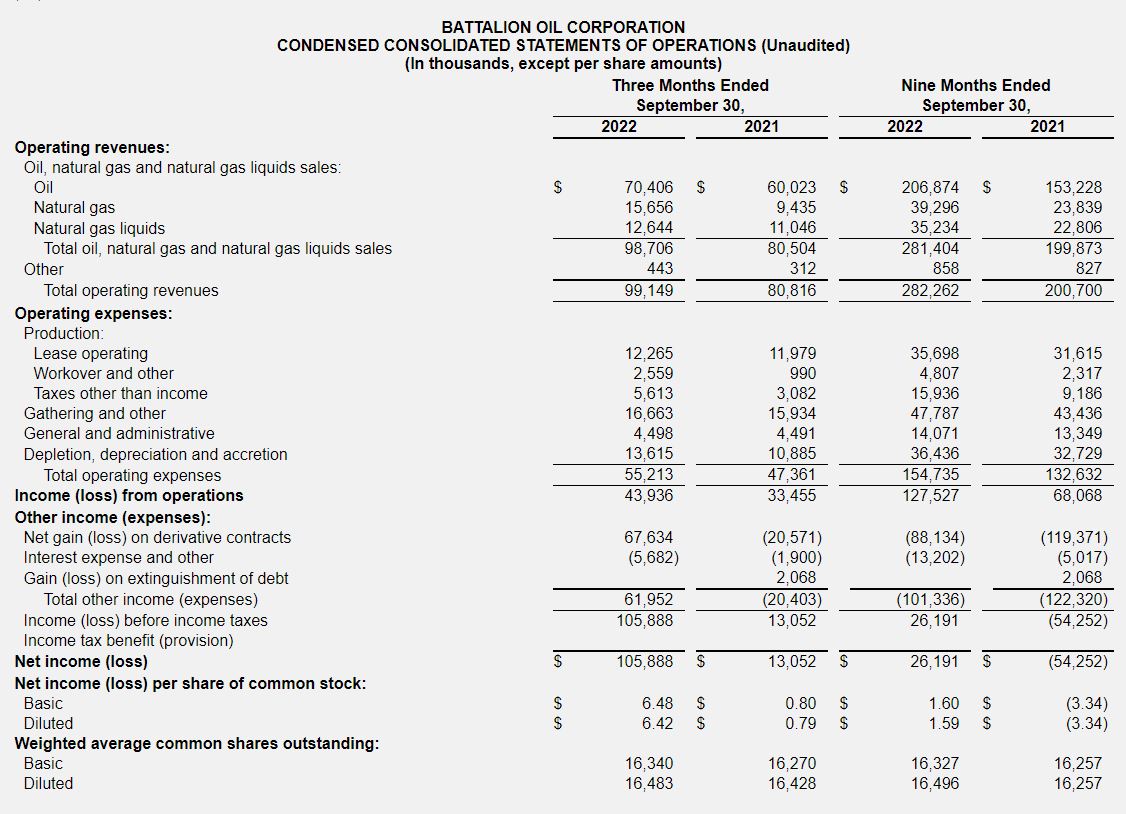

Results of Operations

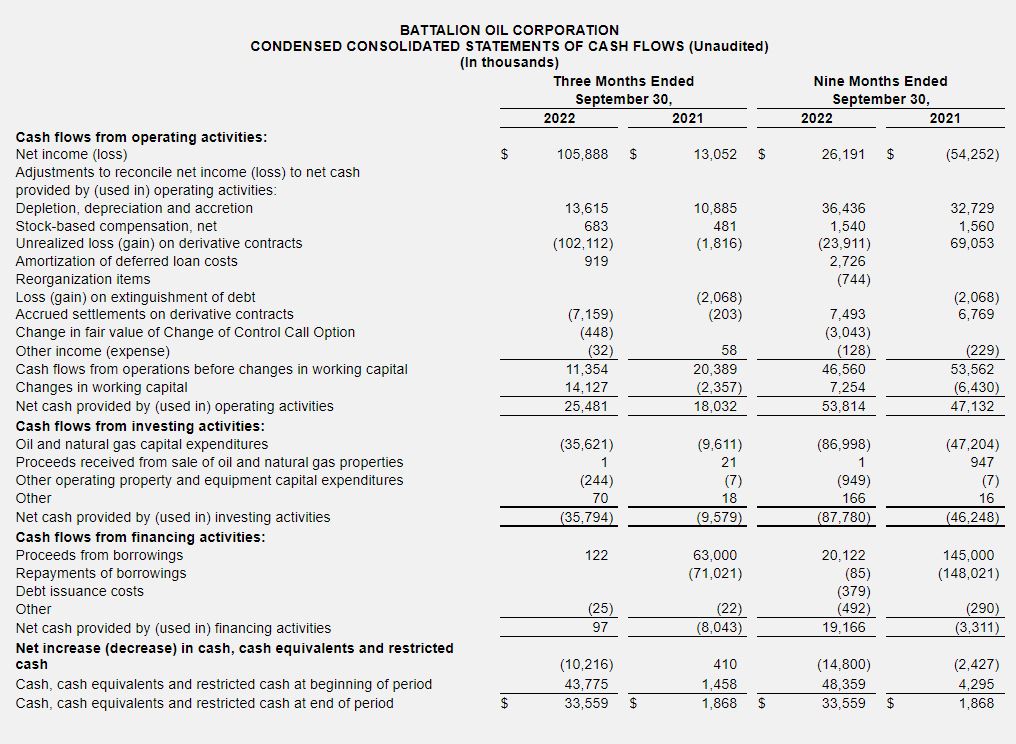

Average daily net production and total operating revenue during the third quarter 2022 were 16,228 barrels of oil equivalent per day (“Boepd”) (50% oil) and $99.1 million, respectively, as compared to production and revenue of 17,728 Boepd (53% oil) and $80.8 million, respectively, during the third quarter 2021. The increase in revenues year-over-year is primarily attributable to an approximate $16.75 per Boe increase in average prices (excluding the impact of hedges). Excluding the impact of hedges, Battalion realized 102% of the average NYMEX oil price during the third quarter of 2022. Realized hedge losses totaled approximately $34.5 million during the third quarter 2022.

Lease operating and workover expense was $9.93 per Boe in the third quarter of 2022 and $7.95 per Boe in the third quarter of 2021. Adjusted G&A was $2.11 per Boe in the third quarter of 2022 compared to $2.11 per Boe in the third quarter of 2021 (see Selected Operating Data table for additional information).

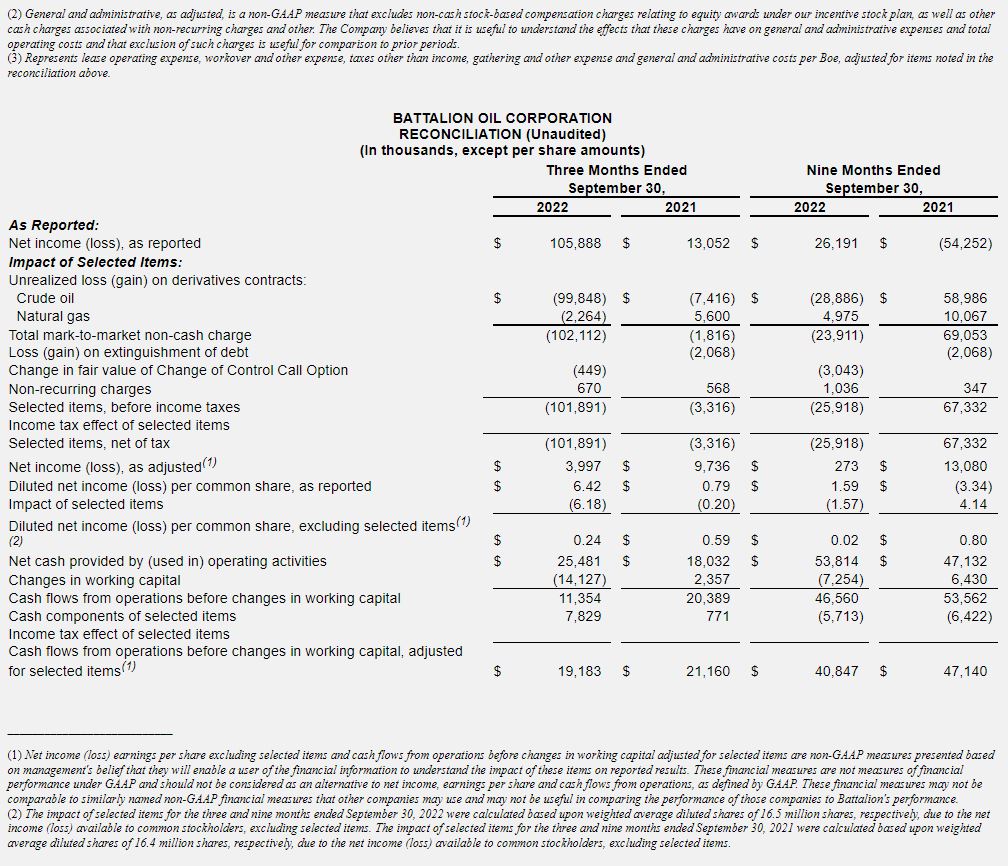

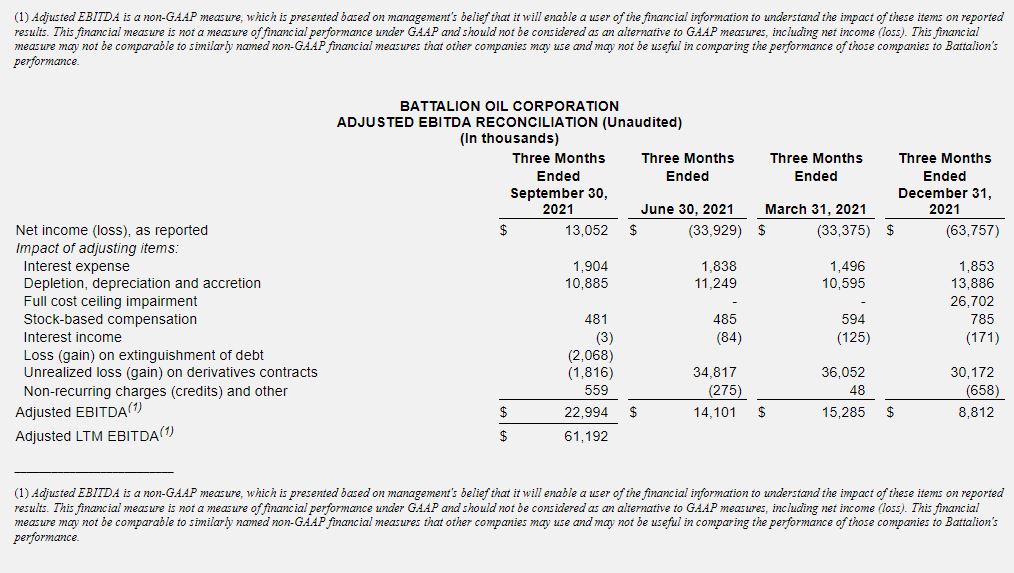

The Company reported net income to common stockholders for the third quarter of 2022 of $105.9 million and net income per diluted share of $6.42. After adjusting for selected items, the Company reported adjusted net income to common stockholders for the third quarter of 2022 of $4.0 million, or adjusted net income of $0.24 per diluted share (see Selected Item Review and Reconciliation for additional information). Adjusted EBITDA during the quarter ended September 30, 2022 was $24.3 million as compared to $23.0 million during the quarter ended September 30, 2021 (see Adjusted EBITDA Reconciliation table for additional information).

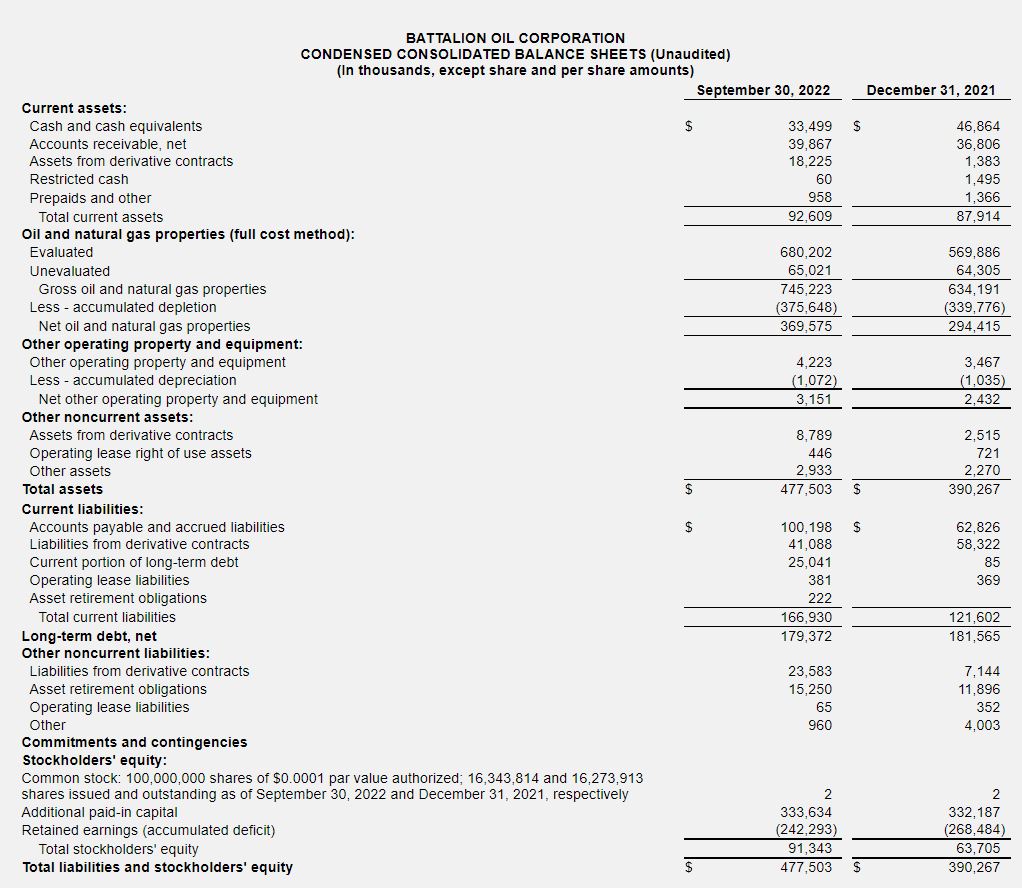

Liquidity and Balance Sheet

As of September 30, 2022, the Company had $220.1 million of indebtedness outstanding, approximately $1.3 million of letters of credit outstanding and up to $15.0 million in delayed draw term loans available to be drawn under our Term Loan Agreement. Total liquidity on September 30, 2022, inclusive of $33.5 million of cash and cash equivalents, was $48.5 million.

At September 30, 2022, the Company was not in compliance with Current Ratio requirements under the Term Loan Agreement. On November 10, 2022, the Term Loan Agreement was amended to modify certain provisions including, but not limited to, decreasing the Current Ratio requirement to 0.9 to 1.00 as of September 30, 2022. As a result of the amendment, we were in compliance with the amended Current Ratio covenant for the quarter ended September 30, 2022. A further explanation of the revisions to the term loan credit facility can be found in Note 5 of the Company’s Form 10-Q.

Revised 2022 Guidance

The Company is providing updated FY 2022 guidance for oil production, which has been reduced to a range of 7.5 8.5 MBopd. The Company is maintaining all other FY 2022 Guidance.

| Revised FY 2022 Guidance | ||||||

| Low | High | |||||

| Oil Production, MBopd | 7.5 | 8.5 | ||||

| Total Production, MBoepd | 14.0 | 17.0 | ||||

| Wells POL | 8 | 12 | ||||

| Total Capex, $MM | $ | 130 | $ | 150 | ||

Conference Call Information

Battalion Oil Corporation has scheduled a conference call for Wednesday, November 16, 2022, at 10:00 a.m. Central Time. To access the live conference call, local participants may dial +1 646-828-8193. All other participants may dial 888-394-8218 for toll free. The confirmation code for the live conference call is 5533000. The live conference call will also be available through the Company’s website at www.battalionoil.com on the Events and Presentations page under the Investors tab. The replay for the event will be available on the Company’s website at www.battalionoil.com on the Events and Presentations page under the Investors tab.

Forward Looking Statements

This release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements that are not strictly historical statements constitute forward-looking statements. Forward-looking statements include, among others, statements about anticipated production, liquidity, capital spending, drilling and completion plans, and forward guidance. Forward-looking statements may often, but not always, be identified by the use of such words such as “expects”, “believes”, “intends”, “anticipates”, “plans”, “estimates”, “projects,” “potential”, “possible”, or “probable” or statements that certain actions, events or results “may”, “will”, “should”, or “could” be taken, occur or be achieved. Forward-looking statements are based on current beliefs and expectations and involve certain assumptions or estimates that involve various risks and uncertainties that could cause actual results to differ materially from those reflected in the statements. These risks include, but are not limited to, those set forth in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021, and other filings submitted by the Company to the U.S. Securities and Exchange Commission (“SEC”), copies of which may be obtained from the SEC’s website at www.sec.gov or through the Company’s website at www.battalionoil.com. Readers should not place undue reliance on any such forward-looking statements, which are made only as of the date hereof. The Company has no duty, and assumes no obligation, to update forward-looking statements as a result of new information, future events or changes in the Company’s expectations.

About Battalion

Battalion Oil Corporation is an independent energy company engaged in the acquisition, production, exploration and development of onshore oil and natural gas properties in the United States.

Contact

Chris Lang

Director, Finance & Investor Relations

(832) 538-0551