President Biden banned imported oil and other energy sources from Russia to punish the country as it intensified its military campaign in Ukraine, a move that will add pressure to already record U.S. gasoline prices and the economic recovery.

The U.S. immediately prohibited new Russian shipments of oil, certain petroleum products, liquefied natural gas and coal under an executive order Mr. Biden signed Tuesday. Washington will give companies 45 days to wind down existing contracts for Russian energy supplies, a senior Biden administration official said. The order also bars new U.S. investment in Russia’s energy sector and blocks Americans from financing foreign companies that invest in the sector.

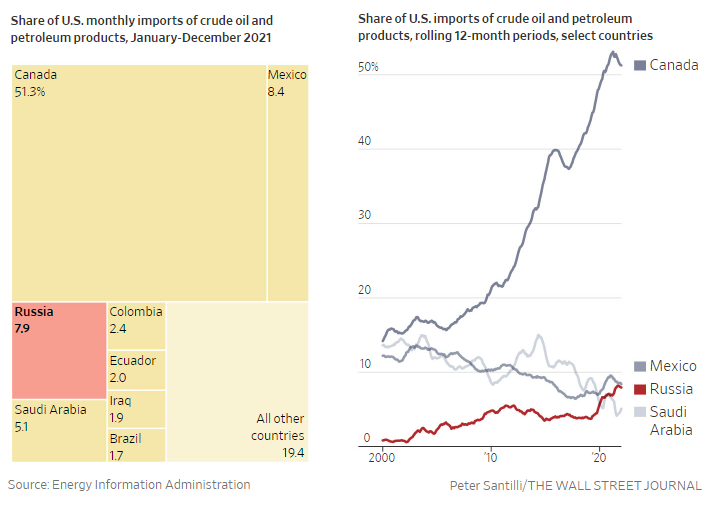

European governments, which are far more reliant on Russian energy, took their own actions on Tuesday, though they weren’t as stringent as what the U.S. imposed. About 8% of U.S. imports of oil and refined products, or about 672,000 barrels a day, came from Russia last year, according to the U.S. Energy Information Administration.

Mr. Biden, who had previously resisted cutting off Russian oil, suggested the ban would likely push up gasoline prices further but said it was an important part of his campaign to pressure Russian President Vladimir Putin to end his assault in Ukraine. Russia is among the world’s biggest energy producers, and the move—on top of a host of other sanctions from the U.S. and other Western nations—is meant to cripple the country’s economy.

“This is a step that we’re taking to inflict further pain on Putin,” Mr. Biden said at the White House. “But there will be costs as well here in the United States.”

The ban primes gasoline prices to soar even higher and will likely pinch American households already being tested by the highest inflation in four decades. Economists estimate the government will on Thursday report a February inflation rate of nearly 8%, an acceleration from the prior month that would only partially capture the recent run-up in energy prices.

A wide majority of Americans, 79%, said they favored a ban on Russian oil imports even if the prohibition increased energy prices in the U.S., according to data from a new Wall Street Journal poll, while 13% said they opposed it. Though the U.S. is the world’s biggest oil producer, it still imports millions of barrels each day from other parts of the world.

Some administration advisers and allies worried privately that gasoline-price increases from the ban could be a political liability, people familiar with the matter said. But the administration began looking at the issue more seriously in recent days, as Russia continued its assault and pressure mounted from senior Ukrainian officials and members of Congress, the people said.

The price for gasoline in the U.S. hit a record high, tracking a surge in global energy markets.

PHOTO: MANUEL BALCE CENETA/ASSOCIATED PRESS

House Speaker Nancy Pelosi (D., Calif.) said she would push forward with a vote on legislation to ban the U.S. import of Russian oil and energy products, review Russia’s access to the World Trade Organization and renew the Global Magnitsky Human Rights Accountability Act so that the U.S. can impose further sanctions on Russia.

Western allies also acted. The European Union said it planned to cut its imports of Russian natural gas by two-thirds by the end of this year, while the U.K. said it would end Russian oil imports, currently 8% of the nation’s demand, by the end of the year. The U.K. government is also exploring options to end Russian gas imports altogether.

The U.S. typically relies on Russia for only a sliver of its energy sources, and American companies had already sharply curtailed imports from the country in recent days. But the prospect of tighter global supplies further drove up prices for crude, extending a monthslong run-up caused by the geopolitical crisis and strengthening demand as countries recover from the pandemic. Brent crude, the global benchmark, rose to nearly $133 a barrel on Tuesday before easing to around $128 a barrel later in the day.

Higher oil prices are already hitting consumers in their pocketbooks, particularly at the pump, as oil is the main ingredient of gasoline. The average price of a gallon of regular gas soared 55 cents over the past week to $4.17 as of Tuesday, a nominal—though not inflation-adjusted—record, AAA announced. That eclipsed the previous high of $4.11 set in summer 2008, during the severe recession caused by the housing crash.

In California, the average price of gasoline rose to $5.44. Prices are particularly high in the state because of higher gasoline taxes and environmental standards that require additional steps in the refining process, said Devin Gladden, an AAA spokesman.

Mr. Gladden said prices are bound to rise further across the U.S.

“Typically it would take a few days to ripple through the gasoline processing and manufacturing supply chain,” Mr. Gladden said. “But given how quickly we’ve seen these price increases happen and that they’ve been so steady in the past few weeks, we could see those price increases much more rapidly.”

Gasoline prices have risen 51% from a year ago, when a gallon cost an average $2.77. Under one estimate, households would spend $850 more this year, on average, compared with last year, if gasoline prices remain above $4 a gallon for most of 2022, according to Diane Swonk, chief economist at the consulting firm Grant Thornton LLP. Last year, such costs rose $940 from 2020, she said.

The higher costs could further embolden the Federal Reserve as it moves to raise interest rates, starting at its policy meeting next week, to tamp down inflation.

The Russia-Ukraine crisis and the related run-up in oil prices will slow the U.S. economic recovery this year, several economists said.

“The risk of a policy error, and therefore a U.S. recession, is rising quickly,” Joseph LaVorgna, chief economist for the Americas at Natixis, said in a note to clients.

Most economists said the economy can withstand the hit of higher energy costs without tipping into a recession.

The world’s largest economy has momentum because households have built up savings during the pandemic, Covid-19 cases have declined sharply since January, businesses are hiring aggressively and families are resuming travel and leisure activities that they had long put off.

Still, the higher energy costs will surely cause pain, particularly for the poorest households and workers that have little access to public transit and must drive to work, economists said.

At the Venice Super Petrol station on Venice Boulevard in Los Angeles, unleaded gasoline cost $5.29 for a gallon on Tuesday, slightly below the $5.51 average for the region. Troy Litke said he paid $60 for about half the gas that his Toyota Tacoma can hold.

“To fill this up would be like $120,” said Mr. Litke, who is trying to manage fuel costs by not filling the truck’s large tank every time he goes to a station.

Luana Zagami also paid for far less than a complete fill-up, spending $25.57 for 4.8 gallons in her Ford Focus.

“I was just complaining about gas prices,” she said. She added that she has to drive 26 miles every day to drop off her son at daycare and then head to the University of Southern California, where she is a Ph.D. candidate.

Lawmakers and advocacy groups in numerous states, including New York, California, Ohio, Illinois and Rhode Island have proposed the suspension of some or all gas taxes or the delay of planned increases. In California, which has the highest gas tax in the nation at about 51 cents a gallon, Republicans have proposed lifting the levy for six months while Democratic Gov. Gavin Newsom in January proposed putting off an increase in the tax planned for July.

President Biden delivered remarks on the crisis in Ukraine at the White House on Tuesday.

PHOTO: KEVIN LAMARQUE/REUTERS

Consumer spending provides roughly two-thirds of economic output in the U.S. Households could cut back on shopping, travel and other discretionary spending as a result, economists said. Ms. Swonk believes output will expand at just a 1% annual rate in the second half of 2022, a sharp slowdown driven by the rise in oil.

U.S. output rose 5.6% in the final quarter of 2022 compared with the same period a year earlier, marking the strongest calendar year of growth since 1984.

Oil analysts have said that sanctions previously imposed on Russia have already discouraged banks and oil companies from buying the country’s crude, and the sharp increase in oil prices in recent days is a sign the market expects further disruptions.

Exxon Mobil Corp. , BP PLC and Shell PLC all announced plans to exit Russian operations last week. Shell went further on Tuesday, saying it would halt all spot purchase of crude from the country and phase out its other trading and business dealings.

—Justin Scheck, Alicia A. Caldwell, Natalie Andrews, Max Colchester and Christine Mai-Duc contributed to this article. – Source WSJ