January saw the return of the “QE trade”… or more appropriately, a de-hawking of The Fed as the narrative rapidly shifted from hyped-inflation and growth scares to ‘soft landing’ and Fed-Pause/Pivot… and everything’s awesome.

Overall January saw macro surprise data flat in January as ‘soft’ survey data tumbled (along with weaker ‘hard’ industrial data) but offset by a number of questionably strong labor market indications…

Source: Bloomberg

However, despite the narrative shift, January saw rate expectations barely budge… terminal rate dropped around 4bps while rate-cut exp fell 3bps…

Source: Bloomberg

The market is locked-and-loaded for a 25bps hike tomorrow by The Fed, it also prices an 83% chance of a 25bps hike in March and 42% odds of a 25bps hike in April…

Source: Bloomberg

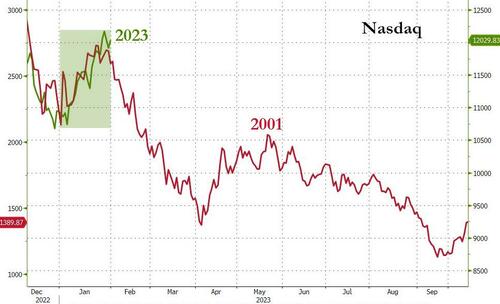

But that never stopped stocks from fully embracing the dovish hope, with Nasdaq soaring over 10% in January. The Dow lagged with a meager 2.4% return…

Source: Bloomberg

Stocks melted up into today’s month-end close (on a massive MOC buy), erasing all of yesterday’s selling pressure from the open…

Nasdaq soared to its best January since 2001…

Source: Bloomberg

Who could have seen that coming!!??

The January shift in the growth and inflation outlooks have helped support a laggards-to-leaders (dash for trash) trade within the S&P 500…

At the stock level, 9 of the 10 best performing stocks in January also underperformed the S&P 500 over the last 12 months – also highlighting a laggard-to-leaders trade.

And if you needed more evidence of the ‘quality’ of the rally, “most shorted” stocks soared 19% in January – the biggest monthly short squeeze since January 2021 – which marked the record high in stocks…

Source: Bloomberg

And all that exuberance pushed financial conditions to their loosest since June (when Fed Funds were 350bps lower)…

Source: Bloomberg

That is the 3rd month of ‘easing’ financial conditions in the last four, after financial conditions reached their tightest since 2016…

Source: Bloomberg

Is that the “unwarranted easing” that The Fed warned about in its latest Minutes?

Treasury yields ended the month of January significantly lower with the short-end lagging (2Y -22bps) and the belly outperforming (5Y -37bps)…

Source: Bloomberg

That is the second biggest monthly drop in the 5Y yield since March 2020 (the peak of Fed intervention amid the COVID lockdowns)…

Source: Bloomberg

The yield curve collapsed further in January with Fed Chair Powell’s favorite signals (3m spot – 18m fwd 3m bill yield spread) crashing to its most inverted ever right as the dot-com boom busted…

Source: Bloomberg

The dollar fell for the 4th straight month in January, with the greenback sparking a ‘death cross’…

Source: Bloomberg

…with one of the largest 3mo declines in the world’s reserve currency in history…

Source: Bloomberg

Gold surged for the 3rd straight month in a row, back above $1900 (to its highest since April 2022 and notably above the 2011 highs)…

Source: Bloomberg

…up 18%, its best such move since August 2011…

Source: Bloomberg

Bear in mind that gold has dramatically decoupled from the resurgence in real yields…

Source: Bloomberg

Bitcoin saw its best start to a year since 2013, up almost 40% in January…

Source: Bloomberg

Bitcoin is back above $23,000, erasing all the losses from the FTX FUD, now testing back to the Terra-LUNA / 3AC / Voyager collapse chaos…

Source: Bloomberg

Solana (hammered hard during the FTX debacle) was the massive outperformer though in crypto and we note that Bitcoin outperformed Ethereum (which still had a stellar 33% gain on the month)…

Source: Bloomberg

Oil prices had a quiet January ending marginally lower (WTI rangebound between $78 and $82), which followed a quiet December (which ended practically unchanged in a narrow range)…

January saw the biggest drop in NatGas prices since January 2001, with Henry Hub crashing to its lowest since April 2021, back below $3.00

Source: Bloomberg

Finally, circling back to the start, the last time the Nasdaq soared as much as this in January, it didn’t end well…

Source: Bloomberg

This time is obviously different though… because inflation remains extremely high, govt debt is exponentially higher, and The Fed balance sheet remains ridiculously high.

Loading…