The momentum for U.S. LNG right now is powerful. With Europe’s efforts to wean itself off Russian natural gas boosting long-term LNG demand and Asian consumption expected to grow even further, there has been a strong push for new LNG projects in North America. So far, that has helped propel two U.S. projects, Venture Global’s Plaquemines LNG and Cheniere’s Corpus Christi Stage III, to reach a final investment decision (FID). With these two projects getting a green light, total export capacity in the U.S. will be at least 130 MMtpa — or 17.3 Bcf/d — by mid-decade. That top-line export capacity could be much higher, however. There are currently eight U.S. Gulf Coast pre-FID projects with binding sales agreements, and a handful of projects that are fully subscribed in credible non-binding deals. If all those projects go forward, it would add a staggering 86 MMtpa (11.4 Bcf/d) of export capacity to the U.S., pushing the total toward 30 Bcf/d, or 225 MMtpa. In today’s RBN blog we look at U.S. LNG under development, how high export capacity could go, and the implications for the U.S. natural gas market.

The U.S. currently has 90.85 MMtpa (12 Bcf/d) of operational capacity at LNG export facilities, including Calcasieu Pass, which is still commissioning its last few trains but is expected to be fully in service soon. Beyond those, there are three projects that have taken FID and are under construction along the U.S. Gulf Coast — Plaquemines (see Jump in the Line) and Corpus Christi Stage III (see Jump in the Line, Part 2) both recently got their final go-aheads, as we mentioned in the intro, and ExxonMobil and QatarEnergy’s Golden Pass, which took FID back in early 2019 and is expected online in 2024. [There are also projects under construction in Canada and Mexico (see our Go West series).] Beyond the Gulf Coast projects that have taken FID, there are several hoping to capitalize on the current market momentum. At RBN, we evaluate prospective LNG export projects based on their commercial, regulatory and infrastructure/feedgas progress and, from there, put them into three categories: probable, possible or speculative. In the possible category we further break this down into three tiers of likelihood based on how close they are to FID. Our full account of all projects and the progress they’ve made toward FID is available in the LNG Voyager Quarterly Report, the latest of which was released earlier this month.

Prior to this year, the lowest tier in the possible category — Tier 3 — was by far the most numerous category. There were plenty of LNG projects announced but very few with a genuine shot at a near-term FID. Most had made just a little progress, usually on the regulatory front, but it didn’t seem likely that many, if any, would ever take FID. Now we have eight land-based U.S. Gulf Coast projects that we categorize as probable (dark orange diamonds and project names in Figure 1) or possible (Tier 1, light orange; Tier 2, yellow), not to mention other offshore projects (the topic of an upcoming blog) and projects in Mexico and Canada. When you evaluate each of these individual projects on its own merits, a strong case for FID can be made for every one. But together, as a big picture, we’re talking about 86.1 MMtpa (11.4 Bcf/d) of new export capacity in a very small geographic footprint. It’s an almost unthinkable amount of LNG. The lines between the categories — differentiating what will be built and what won’t — and even the lines between FID and not — are blurring, but it’s increasingly looking like most of these projects, and potentially others out there, will go forward. And, as we mentioned in the introduction, that will have a significant impact on the U.S. natural gas value chain — from upstream to downstream — particularly on the Gulf Coast.

Figure 1. U.S. Gulf Coast LNG Export Terminals and Select Proposed Terminals. Source: RBN LNG Voyager

With so many strong projects out there, two new factors are becoming increasingly important to LNG development. The first is speed, as there is likely to be a significant early-mover advantage. While the market is showing no signs of slowing, it eventually will with the coming supply-side buildout, and if a project doesn’t move forward in this third wave of LNG development, it might not ever. Speed also applies to how fast a project can come online, which is of particular concern for Europe. This has boosted support for mid-scale modular technology, which is featured in both of the recent FID projects, Plaquemines and Corpus Christi Stage III. These terminals feature smaller trains that can be brought online more quickly than traditional, large-scale trains. Plaquemines began construction this spring and is expected online in 2024, and likewise Corpus Christi in 2025, although Cheniere has a long history of bringing on its trains ahead of schedule. For comparison, Golden Pass, which features traditional LNG trains, began construction in 2019 and is not expected online until 2024.

The second factor is the project developer — more specifically, whether a project is being developed by an experienced major player in U.S. LNG. Everyone was new to this 10 years ago, but now being Cheniere or Venture Global or Sempra counts for something and all of the big players have additional projects that are likely to go ahead. That includes Venture Global’s CP2 (Calcasieu Pass 2) project, which is still under FERC environmental review but has sold nearly 20% of its capacity, and an unnamed, unannounced Cheniere expansion that (despite the lack of project details) has essentially sold 3 MMtpa (0.4 Bcf/d) of export capacity in recent months (sales were made by Cheniere’s marketing arm, CMI, and are tied to additional capacity taking FID). Beyond those developers that already have operating terminals, there also are projects on the list likely to move forward from new-to-U.S. LNG developers that don’t feature modular technology, like NextDecade’s Rio Grande terminal, which has sold out 75% of the first two trains, but those are more the exception than the rule at this point. Most projects on our list are either from a developer with a terminal already in operation or a project that features modular technology, or both.

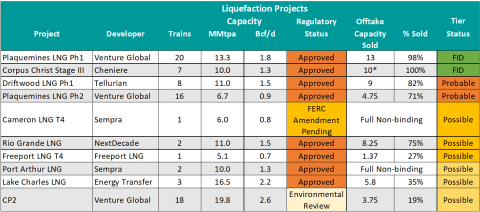

Figure 2 below summarizes these projects and where they stand in regard to regulatory approvals, offtake capacity sold, and their tier status.

Figure 2. Select U.S. LNG Export Projects. Source: RBN LNG Voyager Quarterly Report

* Includes select deals made by Cheniere’s marketing arm, CMI, that are not specifically tied to Corpus Christi Stage III, but were used to support its FID

While the ultimate extent of the U.S.’s LNG export buildout is still unknown, it’s clear that it will be a lot of new capacity coming online, mostly on the Gulf Coast. We’re already at the point where LNG exports have shifted U.S. gas markets and the impact is only going to be magnified from here. So where will the gas come from? U.S. upstream producers are already seeking out deals to supply LNG terminals and give them exposure to the global gas market. With producers increasingly onboard and the demand in place to make these projects happen, more pipeline capacity will be needed to bring additional gas supplies down to the Gulf Coast to serve feedgas demand.

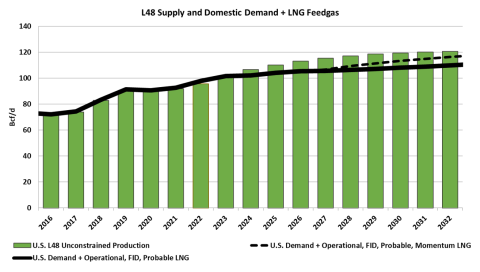

Figure 3 below shows RBN’s unconstrained production forecast (green bars), which assumes that all needed pipeline expansions move forward, and the anticipated LNG buildout (black lines). The U.S. has the gas supply to make this a reality, but we don’t live in an unconstrained world. A huge chunk of the potential production growth is locked away in the Northeast, and pipeline buildout in that area has become incredibly difficult, if not impossible (see our weekly NATGAS Appalachia report for more). Gas originating closer to the Gulf Coast is a possibility but, there too, gas pipeline capacity must increase in tandem with export capacity. Louisiana’s pipeline infrastructure is already constrained. As the gas supply begins to constrain around the pipeline infrastructure, localized gas prices will separate from each other, putting upward pressure on Gulf Coast prices, including Henry Hub, and downward pressure on areas where supply is stuck, like the Northeast.

Figure 3. U.S. Supply vs. Domestic and LNG Feedgas Demand, Source: RBN

Gas is no longer a local commodity; it’s a global product and the U.S. is poised to become the dominant supplier. The Shale Revolution completely changed the landscape of U.S. gas markets, and LNG has the potential to bring that to the rest of the world. The conversation around the shifting role of the U.S. in the rapidly globalizing gas market doesn’t stop here. Come join us at xPortCon 2022 on September 26-27 in downtown Houston to continue the discussion with industry leaders on the U.S.’s expanding role as a major exporter of crude oil, natural gas and NGLs.

“Blurred Lines” was written by Robin Thicke, Pharrell Williams, Clifford Harris Jr. and Marvin Gaye. It appears as the first song on Robin Thicke’s sixth studio album of the same name. Produced by Pharrell Williams, it was released as a single in March 2013. It went to #1 on the Billboard Hot 100 Singles chart and has been certified Diamond (over 10 million sold) by the Recording Industry Association of America, with over 14 million sold in the U.S. Marvin Gaye’s estate sued Thicke and Williams, claiming “Blurred Lines” infringed copyright laws on Marvin Gaye’s 1977 song, “Got to Give it Up.” They won the case and were awarded posthumous songwriting credit and royalties. Personnel on the record were: Robin Thicke (vocals), Pharrell Williams (vocals, sampling, instruments, production), and T.I. (vocals).

The album, Blurred Lines, was produced by KSHMR, Cirkut, Dr. Luke, Jerome “J-Roc” Harmon, Pharrell Williams, ProJay, Robin Thicke, Timbaland, and will.i.am. Released in July 2013, the album went to #1 on the Billboard 200 and Top R&B/Hip-Hop Albums charts. It has been certified Gold by the RIAA, with sales of over 730,000 in the US. Four singles were released from the LP.

Robin Thicke is an American singer, songwriter and record producer. He has released eight studio albums and 40 singles. He continues to record and tour and is currently a judge on the hit television show “The Masked Singer.”