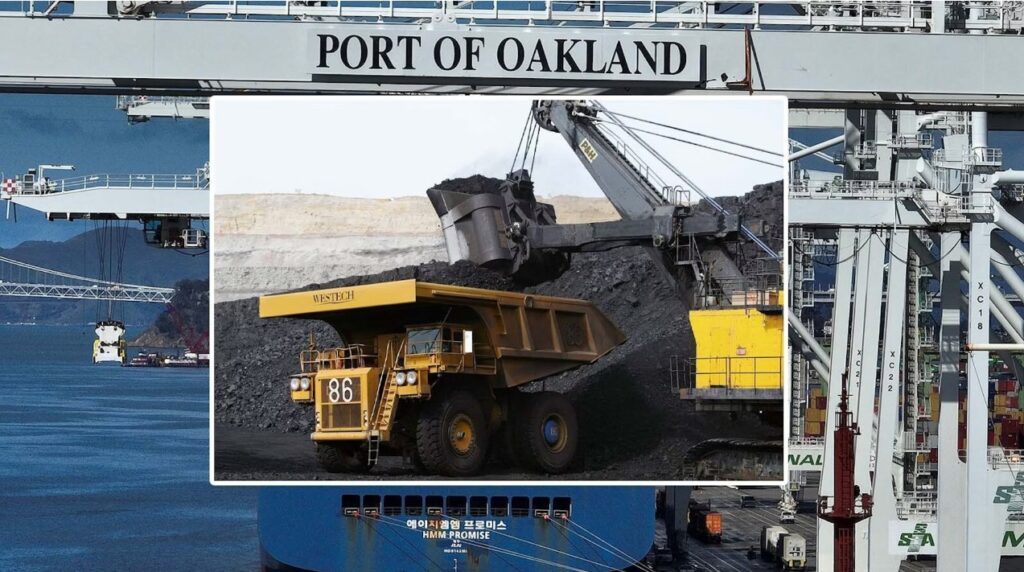

In a landmark decision that could revitalize the struggling U.S. coal industry, the California Supreme Court has effectively greenlit the development of a bulk terminal in Oakland, paving the way for Wyoming coal to reach international markets via the West Coast. On September 18, 2025, the court denied the city of Oakland’s petition for review, ending a protracted legal saga that spanned nearly a decade and involved environmental concerns, economic stakes, and interstate commerce.

This ruling upholds prior court decisions favoring the project, allowing the Oakland Bulk and Oversized Terminal (OBOT) to proceed with plans to handle up to 10 million tons of commodities annually, including coal from Wyoming’s Powder River Basin.

Background on the Legal Battle

The dispute originated in the mid-2010s when developer Phil Tagami proposed redeveloping the former Oakland Army Base into a modern bulk terminal. The project faced fierce opposition from environmental groups and local officials, who argued that coal shipments would pose significant health and pollution risks to the surrounding community.

In 2016, Oakland passed an ordinance banning coal handling at the port, citing “significant and unavoidable” impacts.

Are you Paying High Taxes in New Jersey, New York, or California?

However, federal and state courts repeatedly sided with the developers, ruling that the ban violated development agreements and discriminated against interstate commerce.

The case escalated through appeals, with interior coal-producing states like Wyoming and Utah lobbying for access to West Coast ports to counter declining domestic demand.

Opponents, including the group No Coal In Oakland, vowed to shift focus from litigation to deterring investors by highlighting climate risks and community backlash.

Despite these efforts, the Supreme Court’s refusal to intervene marks a decisive win for export proponents, with construction potentially starting soon and the first shipments eyed for 2028.

Companies Impacted by the DecisionThis ruling has ripple effects across the coal supply chain, benefiting producers, transporters, and developers while challenging environmental advocates and local governments.

Wyoming Coal Producers:

Major players in the state’s Powder River Basin stand to gain the most. Arch Resources (NYSE: ARCH), operator of the massive Black Thunder Mine, and Peabody Energy (NYSE: BTU), which runs the North Antelope Rochelle Mine, could see expanded export channels to offset shrinking U.S. utility demand.

Other firms like Navajo Transitional Energy Company (NTEC) and smaller operators represented by the Wyoming Mining Association may also benefit, as the terminal connects directly to Wyoming’s rail networks.

Terminal Developers and Operators: Phil Tagami and Mark McClure, the lead developers of OBOT, have invested heavily in the project, now estimated at $350-400 million due to delays.

Insight Terminal Solutions (ITS), previously involved under John Siegel (who reportedly lost $27 million), could re-enter as an operator.

The terminal’s design for oversized bulk cargo positions it as a versatile hub beyond just coal.

Rail and Logistics Firms: Union Pacific (NYSE: UNP) and BNSF Railway (a subsidiary of Berkshire Hathaway, NYSE: BRK.B) are key beneficiaries, as they control the rail lines from Wyoming to Oakland.

Increased shipments could boost freight volumes, especially with the terminal’s capacity for 8-10 million tons per year initially.

Opponents and Indirect Impacts: Environmental organizations like No Coal In Oakland and Sierra Club affiliates face setbacks, potentially shifting to political or investor pressure campaigns.

The city of Oakland may incur ongoing costs from related disputes, while West Coast ports in Washington and Oregon could see competitive pressure if Oakland becomes a coal export gateway.

Potential Coal Export Customers

With domestic coal use waning due to renewables and natural gas, exports offer a lifeline for Wyoming’s low-sulfur thermal coal. The Oakland terminal’s Pacific access targets high-demand Asian markets, where energy needs remain robust despite global decarbonization trends.Japan and Taiwan: These nations have shown strong interest, with Wyoming Governor Mark Gordon highlighting potential deals during recent trade missions. Taiwan, importing over 97% of its energy, views Wyoming coal as a reliable source for power generation.

Japan, a traditional buyer, could increase imports to meet industrial demands.

South Korea and India: South Korea’s steel and power sectors are prime candidates, while India accounted for 57% of U.S. thermal coal exports to Asia in 2023 and continues to seek affordable supplies.

India’s growing economy could absorb millions of tons annually.

Other Asian Markets: Broader opportunities exist in China and Southeast Asia, where Wyoming and Montana coal could compete if port access expands.

Demand projections suggest Asian coal imports could double or triple for Western U.S. suppliers.

Africa also emerges as a secondary market, with surging U.S. thermal coal exports noted in recent years.

Potential Investment Opportunities

The decision injects optimism into coal-related investments, though risks from environmental regulations, market volatility, and shifting energy policies remain. Analysts warn that coal is a “risky investment” with uncertain long-term yields, as seen in past terminal failures.

Still, for contrarian investors, this could signal a rebound.

Coal Mining Stocks: Arch Resources (ARCH) and Peabody Energy (BTU) are direct plays, with potential upside from export volumes. Recent mine expansions, like the Antelope Mine’s approval for 14.5 million additional tons, bolster their prospects.

Smaller firms or ETFs tracking coal (e.g., VanEck Coal ETF, KOL) may see gains if shipments ramp up.

Rail and Infrastructure: Union Pacific (UNP) and Berkshire Hathaway (BRK.B) could benefit from higher rail traffic. Infrastructure funds focused on ports and logistics might also capitalize on OBOT’s development.

Broader Energy Plays: Investors eyeing diversification could look at funds with exposure to Asian energy importers or commodities. However, community opposition and climate litigation pose headwinds, as evidenced by Utah counties’ $53 million investment in similar projects yielding mixed results.

In summary, this court victory could unlock billions in revenue for Wyoming’s coal sector by facilitating exports to eager Asian buyers.

While challenges persist, it represents a rare positive development in an industry facing existential threats. Energy New Beat will continue monitoring as permitting advances and markets respond.

Avoid Paying Taxes in 2025

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack